Banks and Interest

... increasing the economy’s ability to produce in the future Production depends on saving because production of both consumer goods and capital goods takes time ...

... increasing the economy’s ability to produce in the future Production depends on saving because production of both consumer goods and capital goods takes time ...

Personal Finance Economics

... – Saving • The absence of spending • For investment to occur, people must save – Investing » The act of redirecting resources from being consumed today so that they may create benefits in the future. » Saving = Investing ...

... – Saving • The absence of spending • For investment to occur, people must save – Investing » The act of redirecting resources from being consumed today so that they may create benefits in the future. » Saving = Investing ...

Chapter 9: Sources of Capital

... health of the economy. The SAVINGS RATE is the percentage of people’s disposable income that is not spent. Tells about wages Tells about economic slowdowns ...

... health of the economy. The SAVINGS RATE is the percentage of people’s disposable income that is not spent. Tells about wages Tells about economic slowdowns ...

Curriculum at a Glance Personal Finance Grade 9

... Explore how spending, saving and values impact your finances. Set financial goals that are specific and measurable. Apply strategies to be mindful about spending decisions. Create a spending plan to reach your goals. Figure out ways to maintain a positive cash flow ...

... Explore how spending, saving and values impact your finances. Set financial goals that are specific and measurable. Apply strategies to be mindful about spending decisions. Create a spending plan to reach your goals. Figure out ways to maintain a positive cash flow ...

Should the Riksbank issue e-krona?

... Should the Riksbank issue e-krona? • The printing press made it possible to print banknotes in its time – our current technology enables electronic payments • E-krona – a complement to banknotes and coins – not intended to replace them ...

... Should the Riksbank issue e-krona? • The printing press made it possible to print banknotes in its time – our current technology enables electronic payments • E-krona – a complement to banknotes and coins – not intended to replace them ...

Transmission mechanism of monetary policy

... Affects saving and investment decisions Changes in interest rates affect saving and investment decisions of households and firms. For example, everything else being equal, higher interest rates make it less attractive to take out loans for financing consumption or investment. In addition, consumptio ...

... Affects saving and investment decisions Changes in interest rates affect saving and investment decisions of households and firms. For example, everything else being equal, higher interest rates make it less attractive to take out loans for financing consumption or investment. In addition, consumptio ...

STATEMENT TO PARLIAMENTARY COMMITTEE

... in international credit markets in coming to our decision. Here, Mr Chairman, it is worth taking a few moments to set out some history. For some years now, many long-term observers, market participants and officials have been troubled by very narrow pricing for risk. In other words, it has been easi ...

... in international credit markets in coming to our decision. Here, Mr Chairman, it is worth taking a few moments to set out some history. For some years now, many long-term observers, market participants and officials have been troubled by very narrow pricing for risk. In other words, it has been easi ...

Global

... » Tail risk of break-up/FRAGEMTATION appears very low » Euro zone recovery VERY SLOW in light of persistently high unemployment and structural imbalances » Greece is moving into recovery, encouraging market optimism and foreign investment CONSOLIDATED PRIVATE DEBT, % OF GDP EUROSTAT MACROECONOMICS I ...

... » Tail risk of break-up/FRAGEMTATION appears very low » Euro zone recovery VERY SLOW in light of persistently high unemployment and structural imbalances » Greece is moving into recovery, encouraging market optimism and foreign investment CONSOLIDATED PRIVATE DEBT, % OF GDP EUROSTAT MACROECONOMICS I ...

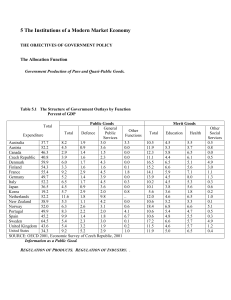

In chapter 1 we discussed in broad outline some of the institutions

... penalty of law, for the correctness of the accounting statements. More reform is possible including the structure that accounting firms should not act both as consultants and auditor. The real consequences of the crisis for the US economy are at the present hard to fathom. The flight of investors fr ...

... penalty of law, for the correctness of the accounting statements. More reform is possible including the structure that accounting firms should not act both as consultants and auditor. The real consequences of the crisis for the US economy are at the present hard to fathom. The flight of investors fr ...

Chapter 8 - FIU Faculty Websites

... running a budget deficit, the interest rate rises, and investment falls. This is called crowding out. ...

... running a budget deficit, the interest rate rises, and investment falls. This is called crowding out. ...

New Financial Intermediaries: Private Equity and the Corporation

... Assets as collateral High free cash flow to repay debt Debt disciplines managers; requires shareholder focus LBO movement ended in scandal, replaced in 1990s by PE ...

... Assets as collateral High free cash flow to repay debt Debt disciplines managers; requires shareholder focus LBO movement ended in scandal, replaced in 1990s by PE ...

499Beaty10Presentation

... • 2004 home ownership rate peaked an all time high of 70% • Individuals began using homes as an investment • Federal Reserve Interest rate increase offset by countries like Germany, Japan and China ...

... • 2004 home ownership rate peaked an all time high of 70% • Individuals began using homes as an investment • Federal Reserve Interest rate increase offset by countries like Germany, Japan and China ...

Rodrigo de RATO Y FIGAREDO

... neighbors but also beggar their own people. And it is no coincidence that economic depression in the inter-war period both fed and was fueled by a resurgence of nationalism. We live today in an internationally integrated, globalized world, but we are not immune from nationalism. You can see it in so ...

... neighbors but also beggar their own people. And it is no coincidence that economic depression in the inter-war period both fed and was fueled by a resurgence of nationalism. We live today in an internationally integrated, globalized world, but we are not immune from nationalism. You can see it in so ...

How far we`ve come, how little we`ve changed

... We believe the result of the Fed’s action may be higher prices and higher interest rates in the near future. With the money supply and credit having doubled without a commensurate increase in output (gross domestic product) we believe prices will adjust upward due to more dollars chasing the same am ...

... We believe the result of the Fed’s action may be higher prices and higher interest rates in the near future. With the money supply and credit having doubled without a commensurate increase in output (gross domestic product) we believe prices will adjust upward due to more dollars chasing the same am ...

march market commentary

... The risk of a mild recession - especially in the US - early in 2008 has increased but on balance appears unlikely and we expect GDP of around 2% for the industrialised economies. Moderating growth in the developing world means current inflationary pressures should abate. Central banks are primed to ...

... The risk of a mild recession - especially in the US - early in 2008 has increased but on balance appears unlikely and we expect GDP of around 2% for the industrialised economies. Moderating growth in the developing world means current inflationary pressures should abate. Central banks are primed to ...

Long Term Outlook for the Economy

... • Other problems, such as Credit Default Swaps ($62 trillion last year, now $30+ trillion) are much bigger. • The Credit Crisis is a major de-leveraging of the financial excesses that have built up in the last 30 years. It should take at least a decade to fix. ...

... • Other problems, such as Credit Default Swaps ($62 trillion last year, now $30+ trillion) are much bigger. • The Credit Crisis is a major de-leveraging of the financial excesses that have built up in the last 30 years. It should take at least a decade to fix. ...

Ashoka Mody Franziska Ohnsorge Damiano Sandri 22 February 2012

... In doing so, we follow the large consumption and saving literature and interpret our regressors as reasonable determinants of household saving rates. Concerns about endogeneity cannot be dismissed. For example, there might be some reverse causality from savings to unemployment, in so far as an exoge ...

... In doing so, we follow the large consumption and saving literature and interpret our regressors as reasonable determinants of household saving rates. Concerns about endogeneity cannot be dismissed. For example, there might be some reverse causality from savings to unemployment, in so far as an exoge ...

INDONESIA UNDER EMBARGO UNTIL 07.00 GMT, WEDNESDAY, 6 AUGUST 2014

... To restore the current account surplus, the Government provided tax breaks to labour-intensive industries that export at least 30% of their production while increasing taxes on luxury goods imports. The fuel subsidy cut in mid-2013 also constrained the import bill, despite triggering high inflation. ...

... To restore the current account surplus, the Government provided tax breaks to labour-intensive industries that export at least 30% of their production while increasing taxes on luxury goods imports. The fuel subsidy cut in mid-2013 also constrained the import bill, despite triggering high inflation. ...

Final accounts of non trading organisation

... Total subscription received during the year Add=subscription received in advance at the beginning of year Add=subscription outstanding at the end of the year. Less=subscription received in advance at the end of year Less= subscription outstanding at the beginning of the year. ...

... Total subscription received during the year Add=subscription received in advance at the beginning of year Add=subscription outstanding at the end of the year. Less=subscription received in advance at the end of year Less= subscription outstanding at the beginning of the year. ...

Balance of Trade

... however, the country has run large annual trade deficits, peaking at $753 billion — 5.6 percent of GDP — in 2006. Falling imports brought the deficit to a nineyear low of $381 billion during the 2007-09 recession, but the gap widened to $560 billion in 2011. Rising oil prices added about $100 billio ...

... however, the country has run large annual trade deficits, peaking at $753 billion — 5.6 percent of GDP — in 2006. Falling imports brought the deficit to a nineyear low of $381 billion during the 2007-09 recession, but the gap widened to $560 billion in 2011. Rising oil prices added about $100 billio ...