FridayMarch28thMeeting - Sites at Lafayette

... • New mortgage securities / lenders take initial losses • Private entities can purchase Gov. guarantees • Attempts to prevent careless lending ...

... • New mortgage securities / lenders take initial losses • Private entities can purchase Gov. guarantees • Attempts to prevent careless lending ...

Global Financial Markets in an Era of Turbulence

... the mindsets, with which to do this effectively and democratically • There is greater need for institutions, like the IMF, to regulate the global international financial ...

... the mindsets, with which to do this effectively and democratically • There is greater need for institutions, like the IMF, to regulate the global international financial ...

Lecture / Chapter 3

... Objective information sources about the Subject are difficult to obtain Comparable property data is limited Reliable price quotations are not available on a frequent basis Typically only a select amount of buyers/sellers in a market Transactions are cumbersome, time-consuming, inefficient, etc. Time ...

... Objective information sources about the Subject are difficult to obtain Comparable property data is limited Reliable price quotations are not available on a frequent basis Typically only a select amount of buyers/sellers in a market Transactions are cumbersome, time-consuming, inefficient, etc. Time ...

Asia and the Emerging Global Economic System

... – New version of Triffin paradox – Economic circumstances in reserve currency country may differ from those of others—conflicts of interests in “supply” of reserves – Money that is put aside in reserves is money not spent—contributing to lack of global aggregate demand – Developing countries lend mo ...

... – New version of Triffin paradox – Economic circumstances in reserve currency country may differ from those of others—conflicts of interests in “supply” of reserves – Money that is put aside in reserves is money not spent—contributing to lack of global aggregate demand – Developing countries lend mo ...

National Finances and MNCs

... Impacts: it is generally good that a state has positive capital flows because such flows tend to stimulate economic activity by making capital available for start ups, expansion, research and development and other uses. However, a large proportion of foreign investment that constitutes a positive ca ...

... Impacts: it is generally good that a state has positive capital flows because such flows tend to stimulate economic activity by making capital available for start ups, expansion, research and development and other uses. However, a large proportion of foreign investment that constitutes a positive ca ...

Slide 1 - World Bank

... How much should we change our economic policy beliefs? • How will Latin American countries fare? ...

... How much should we change our economic policy beliefs? • How will Latin American countries fare? ...

the credit crunch

... a state of shocked disbelief… I made a mistake in presuming that the self-interest of banks and others was such that they were best capable of protecting their own shareholders” Greenspan (23.10.08) ...

... a state of shocked disbelief… I made a mistake in presuming that the self-interest of banks and others was such that they were best capable of protecting their own shareholders” Greenspan (23.10.08) ...

wells fargo investment management

... REVOLUTIONARY * The Dollar Still The Dominant “Key Currency” In World Trade And Finance --Diminishes With U.S. Output Share, Euro Acceptance ...

... REVOLUTIONARY * The Dollar Still The Dominant “Key Currency” In World Trade And Finance --Diminishes With U.S. Output Share, Euro Acceptance ...

Saving and Capital Formation

... remember that interest rates, like prices, are a result of supply and demand, not a cause. Higher investment is a “good thing” from the point of view of economic growth, but it is compatible with either higher or lower interest rates. ...

... remember that interest rates, like prices, are a result of supply and demand, not a cause. Higher investment is a “good thing” from the point of view of economic growth, but it is compatible with either higher or lower interest rates. ...

FedViews

... order to reduce their debt levels and improve their balance sheets has contributed to the global supply of savings. ...

... order to reduce their debt levels and improve their balance sheets has contributed to the global supply of savings. ...

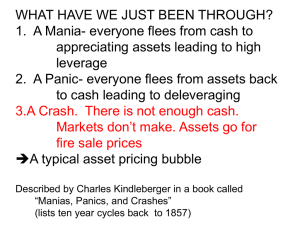

Bubble

... Today’s Dilemmas • Monetary policy doesn’t work • Interest rates can’t be pushed below 0% • But prices are falling ==> real rates are positive ...

... Today’s Dilemmas • Monetary policy doesn’t work • Interest rates can’t be pushed below 0% • But prices are falling ==> real rates are positive ...

Traditional Interest Rate Channels

... Notice that the effect of monetary policy of firms is asymmetric. The greater the dependence on bank loans, ...

... Notice that the effect of monetary policy of firms is asymmetric. The greater the dependence on bank loans, ...

OVERVIEW

... repayment capacity. For that reason, it would be in the households’ interest to use credit cards as a means of payment and to prefer consumer loans for their financing needs. In 2007, the leverage ratios of firms declined and the upward trend in their profitability ratios continued. Despite limited ...

... repayment capacity. For that reason, it would be in the households’ interest to use credit cards as a means of payment and to prefer consumer loans for their financing needs. In 2007, the leverage ratios of firms declined and the upward trend in their profitability ratios continued. Despite limited ...

Balance of Payments Accounts

... Official Reserve Assets It — are assets, other than domestic money or securities, that can used in making international payments ...

... Official Reserve Assets It — are assets, other than domestic money or securities, that can used in making international payments ...

Presentation 04.2017

... price loss to “Captive Investors” – pensions, insurance companies, local governments. * Cash Flow Analysis – higher timely liquidity and increased safety, reduced market risk. Focus – increase income – budget – lesser degree – market price fluctuations. ...

... price loss to “Captive Investors” – pensions, insurance companies, local governments. * Cash Flow Analysis – higher timely liquidity and increased safety, reduced market risk. Focus – increase income – budget – lesser degree – market price fluctuations. ...

Quiz 3

... ECON 203 – Quiz 3 - Key 1. In symbols, the equation of exchange says MsV = PY 2. High interest rates will stimulate investment, for people will want to consume less. False 3. A budget deficit occurs when government expenditures are greater than tax receipts during a year 4. Assume a relatively small ...

... ECON 203 – Quiz 3 - Key 1. In symbols, the equation of exchange says MsV = PY 2. High interest rates will stimulate investment, for people will want to consume less. False 3. A budget deficit occurs when government expenditures are greater than tax receipts during a year 4. Assume a relatively small ...

Shock Therapy Economic Subordination Sham Stablization

... After 1998 foreign investors withdrew assets and capital flight resulted out of fear of default Fiscal deficit forced government to borrow more, while interest rates continued to climb causing them to borrow even more. In 1998 debt servicing by the government increased from 14% to 50% of federal rev ...

... After 1998 foreign investors withdrew assets and capital flight resulted out of fear of default Fiscal deficit forced government to borrow more, while interest rates continued to climb causing them to borrow even more. In 1998 debt servicing by the government increased from 14% to 50% of federal rev ...

Slide 1

... business and household debt amid a global credit crunch. But the lawmakers noted that the facility funded only $1.7 billion in loans in April, "a figure that was dramatically less than that provided by the program when it was first rolled out in March.“ "To what extent has the lack of demand for sec ...

... business and household debt amid a global credit crunch. But the lawmakers noted that the facility funded only $1.7 billion in loans in April, "a figure that was dramatically less than that provided by the program when it was first rolled out in March.“ "To what extent has the lack of demand for sec ...

The Global Financial Crsis and The World Economy

... Capital market liberalisation Global macro imbalances Global savings glut Accomodative monetary policy Strong global growth The ‘end of boom and bust’ The search for yield and underestimation of risk Regulatory vacuums ...

... Capital market liberalisation Global macro imbalances Global savings glut Accomodative monetary policy Strong global growth The ‘end of boom and bust’ The search for yield and underestimation of risk Regulatory vacuums ...

O Why High Yield Corporate Bonds Will Remain Attractive in 2012

... Mexican for example. Other strong currencies are associated with countries that have with either large services exports or large manufacturing exports, like Taiwan and India. ...

... Mexican for example. Other strong currencies are associated with countries that have with either large services exports or large manufacturing exports, like Taiwan and India. ...

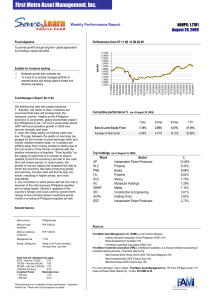

08.20.09-salef - First Metro Asset Management Inc

... money market remains wide, i.e. investors are shifting away from money market to stocks due to the low returns of the former combined with the positive momentum of equities. “Free liquidity” (or the supply of cash that is in excess of what is needed to fund the economy) will add to the cash (that wi ...

... money market remains wide, i.e. investors are shifting away from money market to stocks due to the low returns of the former combined with the positive momentum of equities. “Free liquidity” (or the supply of cash that is in excess of what is needed to fund the economy) will add to the cash (that wi ...

Schroders plc – Statement of financial position

... The distributable profits of Schroders plc are £2.3 billion (2014: £2.1 billion) and comprise retained profits of £2.4 billion (2014: £2.2 billion), included within the ‘Profit and loss reserve’, less amounts held within the own shares reserve. The Group’s ability to pay dividends is however restric ...

... The distributable profits of Schroders plc are £2.3 billion (2014: £2.1 billion) and comprise retained profits of £2.4 billion (2014: £2.2 billion), included within the ‘Profit and loss reserve’, less amounts held within the own shares reserve. The Group’s ability to pay dividends is however restric ...

![Presentation: The Impact of the Financial Crisis on Developing Countries [PDF 378.36KB]](http://s1.studyres.com/store/data/018048683_1-e696bdbdd0ac3e53b85490425f317708-300x300.png)