* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The Global Financial Crsis and The World Economy

Survey

Document related concepts

Debt collection wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Financial economics wikipedia , lookup

Debtors Anonymous wikipedia , lookup

Systemic risk wikipedia , lookup

United States housing bubble wikipedia , lookup

Government debt wikipedia , lookup

Global financial system wikipedia , lookup

International monetary systems wikipedia , lookup

Financialization wikipedia , lookup

Household debt wikipedia , lookup

Public finance wikipedia , lookup

Transcript

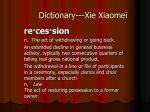

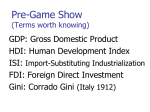

Leverhulme Centre 6th Form Conference, June 26th 2012 The Global Financial Crisis and the World Economy Professor David Greenaway And some films……. Context and Origins Origins • • • • • • • • Capital market liberalisation Global macro imbalances Global savings glut Accomodative monetary policy Strong global growth The ‘end of boom and bust’ The search for yield and underestimation of risk Regulatory vacuums From Sub-Prime Crisis to Credit Crunch What is Sub-Prime Lending? Sub-prime borrowers typically have weakened credit histories that include payment delinquencies, and possibly more severe problems such as charge-offs, judgements and bankruptcies. They also display reduced repayment capacity as measured by credit scores, debt to income ratios, or other criteria that may encompass borrowers with incomplete credit histories. US Treasury Department guidelines, issued in……. 2001 Why Did We Have a Sub-Prime Crisis? • • • • An international savings glut Low interest rates and liquid financial markets Search for yield Ever more sophisticated, but ever more opaque, financial engineering • Underestimation of risk • Inflation in asset values, especially real estate / housing • Housing price slowdown and contagion in 2007 / 2008 Why Do We Have a Credit Crunch? • Information ‘black holes’ – uncertainty over the magnitude of toxic debt – uncertainty over the location of toxic debt • Banks stopped lending to each other – uncertainty over the location of toxic debt – uncertainty over their own exposure • Banks cut back on retail lending – provision for write-offs – need to rebuild balance sheets Policy Responses Government Intervention • Interest rate cuts: – United States (5.25 to 0.3%) – Eurozone (4.25 to 1.0%) – United Kingdom (5.75 to 0.5%) • Support for the financial system: – US, UK and Eurozone: $8,995 billion (and rising) • Liquidity support: $1,950 billion • Asset purchases: $2,525 billion • Guarantees: $4,480 billion ‘The Aftermath of Bankning Crises’ ‘The Aftermath of Financial Crises’ • Reinhart and Rogoff anatomy of aftermath of financial crises in industrialised and emerging economies • Headlines: – “...asset market collapses are deep and prolonged....” – “...profound declines in output and employment...” – “...real value of government debt tends to explode...” Asset Market Collapses • Real estate / housing – Average peak to trough decline of 35.5% – Average decline duration of 6 years – Extremes: declines of 50-60% (Finland, Philippines, Colombia, Hong Kong); duration, 17 years (Japan) • Equity markets – Average peak to trough decline of 55.9% – Average decline duration of 3.4 years – Extremes: decline of 90% (Iceland); duration, 5 years (Malaysia, Thailand, Spain) Unemployment and Output • Unemployment – Average increase of 7 percentage points over 4.8 years – Extremes: 20 percentage points (US); duration, 12 years (Japan) • Output – Average decline, 9.3% over 1.9 years – Extremes: 29% (US); duration, 4 years (US, Finland, Argentina) Real Government Debt • Average increase in government debt 3 years after crisis (excluding current crisis) of 86.3% • Extremes: 280% (Finland, Colombia) UK NET PUBLIC DEBT OVER GDP 300 REVOLUTIONARY AND NAPOLEONIC WARS 250 SECOND WORLD WAR AMERICAN REVOLUTIONAR 200 SEVEN YEARS WAR FIRST WORLD WAR 150 WAR OF AUSTRIAN "GREAT RECESSIO 100 GREAT DEPRESSION 50 2012 2002 1992 1982 1972 1962 1952 1942 1932 1922 1912 1902 1892 1882 1872 1862 1852 1842 1832 1822 1812 1802 1792 1782 1772 1762 1752 1742 1732 1722 1712 1702 1692 0 WAR OF SPANISH SUCCESSION 2014 2008 2002 1996 1990 1984 SECOND WORLD WAR 1978 1972 FIRST WORLD WAR 1966 1960 20 1954 1948 1942 1936 1930 1924 1918 1912 1906 1900 1894 1888 1882 1876 1870 1864 1858 1852 1846 1840 1834 1828 1822 1816 1810 1804 1798 1792 US GROSS PUBLIC DEBT OVER GDP 140 120 "GREAT RECESSION" 100 80 "SUPPLY SIDE" DEFICITS 60 CIVIL WAR 40 GREAT DEPRESSION 0 Global Recession Global Recession • The global financial crisis has pushed all major OECD economies into recession • Many emerging economies have slower or negative growth due to a collapse in export markets • There is uncertainty regarding the depth and duration of recession • There is a possibility of deflation in some economies Globalisation of Recession • Transmission across borders – Integrated capital markets – Lower capital flows – Banking failures – Fall in export demand – High import content of exports Impact on World Trade • World trade only recorded negative growth in one year between 1950 and 2008 • World trade slowed sharply in the final quarter of 2008 • World trade declined by 12% in 2009, due to: – decline in capital flows (credit crunch) – decline in demand (recession) – High import content of exports (globalisation) The Future? Key Risk Factors • Unexpected ‘bad news’ (scale of losses / capacity to finance debt) • Increased protectionism • Slow recovery • Recession becomes deflation • Disorderly break-up of Eurozone Resilience Of Global Systems • Major ‘shocks’ of last 30 years of twentieth century: – Oil shocks of 1973-74 and 1980-81 – Collapse of Bretton Woods system – Debt crisis of mid 1970’s – High (and hyper) inflation – Collapse of the European Monetary System – Collapse of Soviet bloc in Europe – Asian crisis Some Longer-term Implications • Low and stable inflation not sufficient to avoid cycles • Globalisation of financial system has added to risks • Financial system can be a powerful driver of economic fluctuations • Regulatory frameworks need to be reformed to limit this source of volatility • Greater international surveillance of imbalances may be necessary • Economic modellers and policy-makers need to improve understanding of feedbacks from financial system to economic activity