Budgets!

... the end of the month or even worse, left with a deficit at the end of the month. In 2014, statistics showed that people where spending more money on housing (rent or mortgage repayments which have increased from come 12% to 18.2%) instead of food ( which has dropped to 16.2%). Also there has bee ...

... the end of the month or even worse, left with a deficit at the end of the month. In 2014, statistics showed that people where spending more money on housing (rent or mortgage repayments which have increased from come 12% to 18.2%) instead of food ( which has dropped to 16.2%). Also there has bee ...

DEPARTMENT OF LABOR AND EMPLOYMENT

... The purpose of proposed amendments to 1 CCR 210-1 is to define “outstanding debt,” to establish information to be provided to licensees, and to establish guidelines for the Gambling Intercept Cash Fund fee. The statutory basis for proposed amendments to 1 CCR 210-1 is found in section 24-35-601, et ...

... The purpose of proposed amendments to 1 CCR 210-1 is to define “outstanding debt,” to establish information to be provided to licensees, and to establish guidelines for the Gambling Intercept Cash Fund fee. The statutory basis for proposed amendments to 1 CCR 210-1 is found in section 24-35-601, et ...

Current Assets

... Generally listed in the order in which they can be converted into cash Valued at cost or market price (whichever is the lower) Often includes “Provision for loss” (safeguard against unsold goods or bad debts) and Prepayments (items which have been paid for in advance) ...

... Generally listed in the order in which they can be converted into cash Valued at cost or market price (whichever is the lower) Often includes “Provision for loss” (safeguard against unsold goods or bad debts) and Prepayments (items which have been paid for in advance) ...

World economic growth slowing but firm

... Investors appetite towards risk is a dominant driver of the AUD. Interest-rate differentials are also in the AUD’s favour. ...

... Investors appetite towards risk is a dominant driver of the AUD. Interest-rate differentials are also in the AUD’s favour. ...

Document

... and 3.7% in 2008. Global growth of less than 3% implies a world recession, so its latest forecasts would push the world over the edge. Some forecasts by private-sector firms are even gloomier, with several now predicting global GDP growth of no more than 1.5% in 2009. Global GDP has never fallen in ...

... and 3.7% in 2008. Global growth of less than 3% implies a world recession, so its latest forecasts would push the world over the edge. Some forecasts by private-sector firms are even gloomier, with several now predicting global GDP growth of no more than 1.5% in 2009. Global GDP has never fallen in ...

Member Service Representative ProMedica Federal Credit Union

... MSR Position Summary: The primary functions of an MSR are to process member deposits, withdraws, loan and credit card payments, issue cashier’s checks, money orders, and cash advances. MSR’s must balance each day’s transactions and verify cash and check totals. MSR’s also assist members with questio ...

... MSR Position Summary: The primary functions of an MSR are to process member deposits, withdraws, loan and credit card payments, issue cashier’s checks, money orders, and cash advances. MSR’s must balance each day’s transactions and verify cash and check totals. MSR’s also assist members with questio ...

US election outcome favors US credit markets

... production, would likely benefit the energy sector. In particular, we see support for oil exploration activity, which would benefit oil field service providers. Higher oil production may lead to lower sustained oil prices, especially in the face of a stronger US dollar (which is traditionally negati ...

... production, would likely benefit the energy sector. In particular, we see support for oil exploration activity, which would benefit oil field service providers. Higher oil production may lead to lower sustained oil prices, especially in the face of a stronger US dollar (which is traditionally negati ...

Slide 1

... • August 5, 2011: S&P downgraded the US sovereign rating from AAA to AA+ with a negative outlook – Other rating agencies have chosen to maintain the status quo for US ratings – Since January 2011, other countries downgraded by S&P include Japan, Greece, Portugal and Ireland – US Debt ceiling has bee ...

... • August 5, 2011: S&P downgraded the US sovereign rating from AAA to AA+ with a negative outlook – Other rating agencies have chosen to maintain the status quo for US ratings – Since January 2011, other countries downgraded by S&P include Japan, Greece, Portugal and Ireland – US Debt ceiling has bee ...

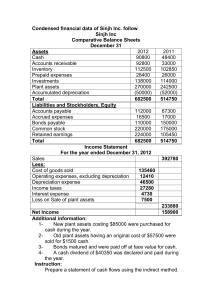

Condensed financial data of Sinjh Inc. follow Sinjh Inc Comparative

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...

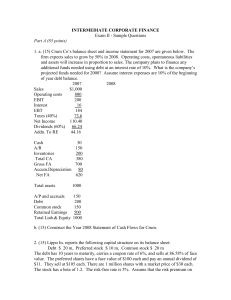

A corporate bond maturing in 5 years carries a 10% coupon rate and

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

Financial and Fiscal Reforms in Support of China’s Rebalancing David Dollar

... GDP. One problem with this system is that much of the borrowing is short-term, to finance long gestation infrastructure projects, putting local finance on a risky foundation. Furthermore, the system is not transparent. There are widely differing estimates of the total local debt. Citizens do not hav ...

... GDP. One problem with this system is that much of the borrowing is short-term, to finance long gestation infrastructure projects, putting local finance on a risky foundation. Furthermore, the system is not transparent. There are widely differing estimates of the total local debt. Citizens do not hav ...

The Road Map - Profit Mastery

... to help identify key causal factors of financial underperformance. If your company has symptoms of Low (or declining) Cash, Low (or declining) Gross Margin, and/or Low (or declining) Net Profit, then begin the analysis process in one of those three shaded boxes. • Move upwards out of the shaded box, ...

... to help identify key causal factors of financial underperformance. If your company has symptoms of Low (or declining) Cash, Low (or declining) Gross Margin, and/or Low (or declining) Net Profit, then begin the analysis process in one of those three shaded boxes. • Move upwards out of the shaded box, ...

Quick Market Update. Six Possible Surprises for 2014

... quarters. Although a quick and significant positive turn in emerging-market equity performance likely would be viewed as a major surprise in 2014. Foreign cash repatriation could push U.S. equity markets higher U.S. companies with significant international operations have huge excess cash balances i ...

... quarters. Although a quick and significant positive turn in emerging-market equity performance likely would be viewed as a major surprise in 2014. Foreign cash repatriation could push U.S. equity markets higher U.S. companies with significant international operations have huge excess cash balances i ...

What businesses need to know about the US current account deficit

... similar external debt relative to GDP. Since debt is denominated in its own currency, repayment will not be all that difficult for the US. The US has historically earned higher returns on its foreign assets than it has paid to overseas investors. Net interest payments may still be less than 1% of GD ...

... similar external debt relative to GDP. Since debt is denominated in its own currency, repayment will not be all that difficult for the US. The US has historically earned higher returns on its foreign assets than it has paid to overseas investors. Net interest payments may still be less than 1% of GD ...

Assessment of alternative international monetary regimes

... The United States is the centre country of the International Monetary System The United States is the world banker: US issues short-term low-risk assets (T-bills) US invests in high risk foreign assets (foreign equity and direct investment) Earns excess returns on its external position: “exorbitant ...

... The United States is the centre country of the International Monetary System The United States is the world banker: US issues short-term low-risk assets (T-bills) US invests in high risk foreign assets (foreign equity and direct investment) Earns excess returns on its external position: “exorbitant ...

The Global Financial Crisis – Implications for Asia Dr Tony Tan Keng

... Increasing signs of stabilization and recovery ...

... Increasing signs of stabilization and recovery ...

Financialization and the crisis

... is positive, meaning that they lend their surpluses to households, with about half of these funds coming from financial corporations. • The net accumulation of financial assets of households is negative, meaning that they borrow from corporations to pay for their consumption, financial and real esta ...

... is positive, meaning that they lend their surpluses to households, with about half of these funds coming from financial corporations. • The net accumulation of financial assets of households is negative, meaning that they borrow from corporations to pay for their consumption, financial and real esta ...

Working Capital Management

... • A business needs to have enough cash (or “cash to come”) to be able to pay its debts • Obviously, a current ratio comfortably in excess of 1 should be expected – but what is comfortable depends on the kind of business • Some businesses find it hard to turn stock and debtors into cash – so ...

... • A business needs to have enough cash (or “cash to come”) to be able to pay its debts • Obviously, a current ratio comfortably in excess of 1 should be expected – but what is comfortable depends on the kind of business • Some businesses find it hard to turn stock and debtors into cash – so ...