A Chronicle of the Financial Crisis

... What will fill the gap? Government has been doing this temporarily – But ability and willingness to do this is limited – Growing fiscal pressures are leading to more contractionary policies around the world, especially in Europe after the Greek crisis – In US, states and localities are facing mas ...

... What will fill the gap? Government has been doing this temporarily – But ability and willingness to do this is limited – Growing fiscal pressures are leading to more contractionary policies around the world, especially in Europe after the Greek crisis – In US, states and localities are facing mas ...

STATE BANK KEEPS POLICY RATE UNCHANGED AT 12 PERCENT

... around 1.7 percent of GDP for FY12, which is not large for a developing country like Pakistan. The net flows in the capital and financial account, on the other hand, were only $1.4 billion during the same period. Accounting for repayments of the IMF loans during the year, SBP’s net liquid foreign ex ...

... around 1.7 percent of GDP for FY12, which is not large for a developing country like Pakistan. The net flows in the capital and financial account, on the other hand, were only $1.4 billion during the same period. Accounting for repayments of the IMF loans during the year, SBP’s net liquid foreign ex ...

– 20 No: 2013 Release Date: 16 May 2013

... rate has been kept at 0 percent while lending rate has been cut from 10 percent to 9.5 percent. Recent data suggest that domestic and external demand are evolving in line with expectations. Domestic demand follows a healthy recovery while exports slow down due to weak global economic activity. The c ...

... rate has been kept at 0 percent while lending rate has been cut from 10 percent to 9.5 percent. Recent data suggest that domestic and external demand are evolving in line with expectations. Domestic demand follows a healthy recovery while exports slow down due to weak global economic activity. The c ...

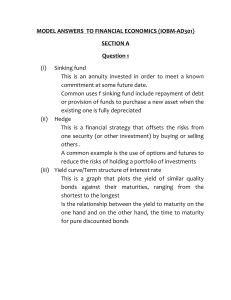

MODEL ANSWERS TO FINANCIAL ECONOMICS (IOBM

... and demand of loanable funds in the economy’s credit market investment and savings on the economy determine the level of long term interest rates while short term interest rates are determined by an economy’s financial and monetary conditions key components of the demand for lonable funds net invest ...

... and demand of loanable funds in the economy’s credit market investment and savings on the economy determine the level of long term interest rates while short term interest rates are determined by an economy’s financial and monetary conditions key components of the demand for lonable funds net invest ...

Presentation by Mr. Christopher Towe, Deputy Director, Monetary

... over mortgage originators to improve underwriting standards Stricter application of consolidated supervision: Basel II reduces the incentives to move off-balance sheet, but vigilance will still be required Fair value accounting: Care is needed to minimize the procyclicality of this system Improve li ...

... over mortgage originators to improve underwriting standards Stricter application of consolidated supervision: Basel II reduces the incentives to move off-balance sheet, but vigilance will still be required Fair value accounting: Care is needed to minimize the procyclicality of this system Improve li ...

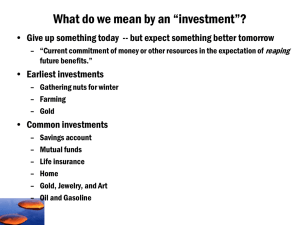

Chap001_overview

... • All financial assets (owner of the claim) are offset by a financial liability (issuer of the claim). • When we aggregate over all balance sheets, only real assets remain. • Hence the net wealth of an economy is the sum of its real assets. ...

... • All financial assets (owner of the claim) are offset by a financial liability (issuer of the claim). • When we aggregate over all balance sheets, only real assets remain. • Hence the net wealth of an economy is the sum of its real assets. ...

GLOBAL ECONOMIC PROSPECTS: The Continuing Crisis

... Source: OECD, Economic Outlook No. 86, 19 November 2009 ...

... Source: OECD, Economic Outlook No. 86, 19 November 2009 ...

Global Perspective - Standard Life Investments

... Indeed, the manufacturing sector is in, or close to, recession in several countries, such as the UK or Taiwan. The main causes are the deceleration in emerging market economies, led by the marked slowdown in China but encompassing the recessions in Brazil and Russia alongside the impact of low oil p ...

... Indeed, the manufacturing sector is in, or close to, recession in several countries, such as the UK or Taiwan. The main causes are the deceleration in emerging market economies, led by the marked slowdown in China but encompassing the recessions in Brazil and Russia alongside the impact of low oil p ...

Real versus Financial Assets

... Informational Role of Financial Markets • If a firm performing well, investors will bid up ,on the other hand, a company’s prospects seem poor, investors will bid down • However, Some companies can be “hot” for a short period of time, attract a large flow of investor capital, and then fail after onl ...

... Informational Role of Financial Markets • If a firm performing well, investors will bid up ,on the other hand, a company’s prospects seem poor, investors will bid down • However, Some companies can be “hot” for a short period of time, attract a large flow of investor capital, and then fail after onl ...

Rappoteur awan santosh by Ram

... Collapse of a ‘Model’: The Mexican Financial Crisis: The Mexican government liberalized the trade sector in 1985, adopted an economic stabilization plan at the end of 1987, and gradually introduced market-oriented institutions. Those reforms led to the resumption of economic growth, which averaged 3 ...

... Collapse of a ‘Model’: The Mexican Financial Crisis: The Mexican government liberalized the trade sector in 1985, adopted an economic stabilization plan at the end of 1987, and gradually introduced market-oriented institutions. Those reforms led to the resumption of economic growth, which averaged 3 ...

Financial Analysis

... Gross National Product (GNP): total value of all final goods and services produced by factors of production owned by citizens of a country regardless of production location Growth rates of both can be used as an initial estimate of a firm’s growth rate ...

... Gross National Product (GNP): total value of all final goods and services produced by factors of production owned by citizens of a country regardless of production location Growth rates of both can be used as an initial estimate of a firm’s growth rate ...

Capital Budgeting Processes And Techniques

... At end of two years assume that Norm receives a salary offer of $90,000, which increases at 8% per year Expected tuition, fees and textbook expenses for next two years while studying in MBA: $35,000 If Norm worked at his current job for two years, his salary ...

... At end of two years assume that Norm receives a salary offer of $90,000, which increases at 8% per year Expected tuition, fees and textbook expenses for next two years while studying in MBA: $35,000 If Norm worked at his current job for two years, his salary ...

Consumption & Investment

... a larger effect on total demand, the larger is the effect of current GDP on consumption of domestic goods. If budget constraints or precautionary savings are important then mpc may be high and mpd high. If economy is very open, like HK mpim may be high and mpd low. ...

... a larger effect on total demand, the larger is the effect of current GDP on consumption of domestic goods. If budget constraints or precautionary savings are important then mpc may be high and mpd high. If economy is very open, like HK mpim may be high and mpd low. ...

SENS 29 - 17 February 2004

... Revenue increased 3% over the comparable period ended 31 December 2002, and 11% over the second half of the 2003 financial year. Revenue growth resulted from increased passenger volumes and improved load factors which, however, were partially offset by lower yields. Yields remain under pressure due ...

... Revenue increased 3% over the comparable period ended 31 December 2002, and 11% over the second half of the 2003 financial year. Revenue growth resulted from increased passenger volumes and improved load factors which, however, were partially offset by lower yields. Yields remain under pressure due ...

07(a).The Development(Eng) - Hong Kong Monetary Authority

... intermediation within the domestic economy. In scope this might include anything or everything from basic deposit-based savings schemes for the s m a l l s ave r, t h ro u g h c o l l e c t i ve i nve s t m e n t instruments, to the development or enhancement of the wholesale stock and bond markets. ...

... intermediation within the domestic economy. In scope this might include anything or everything from basic deposit-based savings schemes for the s m a l l s ave r, t h ro u g h c o l l e c t i ve i nve s t m e n t instruments, to the development or enhancement of the wholesale stock and bond markets. ...

M arket B ulletin - St. James`s Place Wealth Management

... plants. However, it is not all doom and gloom – forward looking surveys such as the Ifo business confidence index suggest the pace at which the economy – the world’s third largest – is contracting has already slowed. Economist Dirk Schumacher of Goldman Sachs said the first quarter “is water under ...

... plants. However, it is not all doom and gloom – forward looking surveys such as the Ifo business confidence index suggest the pace at which the economy – the world’s third largest – is contracting has already slowed. Economist Dirk Schumacher of Goldman Sachs said the first quarter “is water under ...

China – a straggler - o|n MacroIntelligence

... The frailty of the banking system inherent to the Listian model, but becoming exposed to increasingly open exhange regimes, was what triggered the Asian crisis. (It may be of interest that it was triggered by problems in the banking sector, while the crises in countries like Brazil and Turkey origin ...

... The frailty of the banking system inherent to the Listian model, but becoming exposed to increasingly open exhange regimes, was what triggered the Asian crisis. (It may be of interest that it was triggered by problems in the banking sector, while the crises in countries like Brazil and Turkey origin ...