The Transmission Mechanism for Monetary Policy

... therefore reduce consumption (although this effect may be partially or fully offset by the increased income for savings). Furthermore, they reduce the value of assets, which impacts negatively on wealth and therefore consumption. Lower asset prices also reduce the value of collateral and therefore r ...

... therefore reduce consumption (although this effect may be partially or fully offset by the increased income for savings). Furthermore, they reduce the value of assets, which impacts negatively on wealth and therefore consumption. Lower asset prices also reduce the value of collateral and therefore r ...

FridayJanuary31stMeeting - Sites at Lafayette

... • ECB President Mario Draghi pledged “further decisive action” as necessary • Interest rates at .25% • Avoid deflation, which hurts consumer spending, prices, and investment ...

... • ECB President Mario Draghi pledged “further decisive action” as necessary • Interest rates at .25% • Avoid deflation, which hurts consumer spending, prices, and investment ...

Budget and Cash Flow Projections

... these tools essential to creating a profitable business as they require the business owner to think ahead and make changes before it’s too late. ...

... these tools essential to creating a profitable business as they require the business owner to think ahead and make changes before it’s too late. ...

Discussion of Diewert-Fox: Money and the Measurement of Total

... • Consider liquid assets from the perspective of productivity analysis • High cash balances were noted as a policy concern during the financial crisis, i.e., that firms were holding cash rather than undertaking new investment • Authors suggest high cash holdings means . . . “the economy is not using ...

... • Consider liquid assets from the perspective of productivity analysis • High cash balances were noted as a policy concern during the financial crisis, i.e., that firms were holding cash rather than undertaking new investment • Authors suggest high cash holdings means . . . “the economy is not using ...

Turmoil in Global Economy: The Indian Perspective

... Risk of government spending in US abruptly falling on inability of US Congress to pass budget Could cause substantial decline in growth as government spending is keeping economy in positive territory US Debt ceiling needs to be revised higher amid plans to return to long term fiscal prudence. ...

... Risk of government spending in US abruptly falling on inability of US Congress to pass budget Could cause substantial decline in growth as government spending is keeping economy in positive territory US Debt ceiling needs to be revised higher amid plans to return to long term fiscal prudence. ...

smarterinsightTM - Donald Wealth Management

... strongly, even if at a lower pace than the express rates previously exhibited in countries such as China and India - estimated, in aggregate at around 6% for 2012, by the IMF. It is interesting to note too, that for the first time in many years the UK's exports to non-EU countries have exceeded thos ...

... strongly, even if at a lower pace than the express rates previously exhibited in countries such as China and India - estimated, in aggregate at around 6% for 2012, by the IMF. It is interesting to note too, that for the first time in many years the UK's exports to non-EU countries have exceeded thos ...

Where Macro is, and Where it`s Going

... Keynesian economics and a specific limited interpretation of Keynesian economics Keynesian economic theory was soon sidetracked into simple equilibrium models that didn’t capture possible dynamic instability. ...

... Keynesian economics and a specific limited interpretation of Keynesian economics Keynesian economic theory was soon sidetracked into simple equilibrium models that didn’t capture possible dynamic instability. ...

Save

... Risk of government spending in US abruptly falling on inability of US Congress to pass budget Could cause substantial decline in growth as government spending is keeping economy in positive territory US Debt ceiling needs to be revised higher amid plans to return to long term fiscal prudence. ...

... Risk of government spending in US abruptly falling on inability of US Congress to pass budget Could cause substantial decline in growth as government spending is keeping economy in positive territory US Debt ceiling needs to be revised higher amid plans to return to long term fiscal prudence. ...

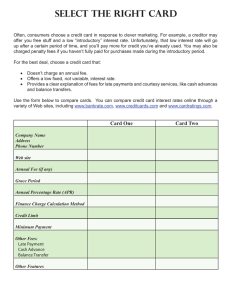

Select the Right Card

... offer you free stuff and a low “introductory” interest rate. Unfortunately, that low interest rate will go up after a certain period of time, and you’ll pay more for credit you’ve already used. You may also be charged penalty fees if you haven’t fully paid for purchases made during the introductory ...

... offer you free stuff and a low “introductory” interest rate. Unfortunately, that low interest rate will go up after a certain period of time, and you’ll pay more for credit you’ve already used. You may also be charged penalty fees if you haven’t fully paid for purchases made during the introductory ...

Developing a Financial Planning Model

... Required External Financing Required New Investment Spontaneous Financing Internal Equity Financing • See Logic for Debt as Secondary Plug Excel file ...

... Required External Financing Required New Investment Spontaneous Financing Internal Equity Financing • See Logic for Debt as Secondary Plug Excel file ...

Chapter 7 - McGraw Hill Higher Education

... Foreign direct investment (FDI) occurs when a company, individual, or fund invests money in another country, for example, by buying shares of stock in or loaning money to a foreign firm In 2010, FDI was $1.24 trillion ...

... Foreign direct investment (FDI) occurs when a company, individual, or fund invests money in another country, for example, by buying shares of stock in or loaning money to a foreign firm In 2010, FDI was $1.24 trillion ...

Address by the Governor of the Bank of Italy

... hesitation, giving the lie to the sceptics. Their shareholders, including leading institutional investors, understood the need for this step. ...

... hesitation, giving the lie to the sceptics. Their shareholders, including leading institutional investors, understood the need for this step. ...

The Global Economy and Southeast Asia

... there is an emergence of a “new international division of labor” • Basically a change in geographical pattern of specialization at the global scaleconstantly changing and very dynamic • Example: movement of textile and shoe production from Indonesia to China ...

... there is an emergence of a “new international division of labor” • Basically a change in geographical pattern of specialization at the global scaleconstantly changing and very dynamic • Example: movement of textile and shoe production from Indonesia to China ...

Lesson 11-1 Guided Reading Activity

... Directions: Read each main idea and complete the statements below. Refer to your textbook as you write the answers. A. Saving and Economic Growth Main idea: When people save, they make funds available for others to use. Businesses can borrow these savings to produce new goods and services, build new ...

... Directions: Read each main idea and complete the statements below. Refer to your textbook as you write the answers. A. Saving and Economic Growth Main idea: When people save, they make funds available for others to use. Businesses can borrow these savings to produce new goods and services, build new ...

4Q 2012 - Cypress Asset Management

... With this backdrop, and the absence of any meaningful fiscal policy or reform out of Congress, the Fed commenced another round of easing in September 2011. The so called “Operation Twist” was designed to bring down long term treasury rates and ultimately mortgage rates. It proved modestly successful ...

... With this backdrop, and the absence of any meaningful fiscal policy or reform out of Congress, the Fed commenced another round of easing in September 2011. The so called “Operation Twist” was designed to bring down long term treasury rates and ultimately mortgage rates. It proved modestly successful ...

Recent International Financial Markets Turmoil is a Wakeup Call: Dr

... continuous widening of global economic imbalances now for almost five years whereby burgeoning US external current account deficit has also raised several questions. The SBP Governor said that in order to promote global economic stability and an orderly unwinding of these imbalances, the Internation ...

... continuous widening of global economic imbalances now for almost five years whereby burgeoning US external current account deficit has also raised several questions. The SBP Governor said that in order to promote global economic stability and an orderly unwinding of these imbalances, the Internation ...

The U.S. Current Account Balance

... time to stop worrying about the U.S. current account deficit. It is possible that: • If property measured, the true deficits were smaller than has been reported • In some years they were not there at all. ...

... time to stop worrying about the U.S. current account deficit. It is possible that: • If property measured, the true deficits were smaller than has been reported • In some years they were not there at all. ...

Linear Regression 1

... – Why did the credit processing firm “cut off” Frontier? • Answer: The credit crisis is spreading… • Mortgage banks and other lenders got in trouble for lending too much… Now EVERYBODY is lending less… • Since some airlines went bankrupt, credit firms started to worry about Frontier airlines... And ...

... – Why did the credit processing firm “cut off” Frontier? • Answer: The credit crisis is spreading… • Mortgage banks and other lenders got in trouble for lending too much… Now EVERYBODY is lending less… • Since some airlines went bankrupt, credit firms started to worry about Frontier airlines... And ...

Lender of last resort: Put it on the agenda!

... lender of last resort. Without them, financial regulations could even become counterproductive. Moreover, in the short run, large liquidity facilities should be put in place to protect emerging market economies from possible sudden stop episodes associated with the current crisis and consequent dele ...

... lender of last resort. Without them, financial regulations could even become counterproductive. Moreover, in the short run, large liquidity facilities should be put in place to protect emerging market economies from possible sudden stop episodes associated with the current crisis and consequent dele ...

Happy 11th anniversary Vikatan…..

... On the positive side this kind of growth is not unprecedented. In 2000, India’s GDP was 0.5 trillion and now it is 2.3 trillion. In the same time frame China went from 1.2 trillion GDP to 11 trillion. India’s demography, aspirations of the people will be factors that will try and drive the nation to ...

... On the positive side this kind of growth is not unprecedented. In 2000, India’s GDP was 0.5 trillion and now it is 2.3 trillion. In the same time frame China went from 1.2 trillion GDP to 11 trillion. India’s demography, aspirations of the people will be factors that will try and drive the nation to ...

Tutorial 8 - Peter Foldvari

... would reduce the returns from the new investments. If the increase in interest rate is high enough, BP would abandon the project. Yes, since the opportunity costs of using own funds would increase. This is because the own funds could be lent at the higher interest rate in the market for loanable fun ...

... would reduce the returns from the new investments. If the increase in interest rate is high enough, BP would abandon the project. Yes, since the opportunity costs of using own funds would increase. This is because the own funds could be lent at the higher interest rate in the market for loanable fun ...

Natural Selection - Rain Capital Management

... for higher yields as well as the substitutes that are being ...

... for higher yields as well as the substitutes that are being ...

Brazil_en.pdf

... expanded more slowly (4.8%), as did government consumption (2.2%). Investment growth also decelerated over the year (5.7% compared with 21.8% in 2010). Sluggish domestic demand reflected the higher cost of credit, fewer new jobs and the effects of growing global economic uncertainty on domestic econ ...

... expanded more slowly (4.8%), as did government consumption (2.2%). Investment growth also decelerated over the year (5.7% compared with 21.8% in 2010). Sluggish domestic demand reflected the higher cost of credit, fewer new jobs and the effects of growing global economic uncertainty on domestic econ ...