UNITED STATES SECURITIES AND EXCHANGE

... factors that could cause actual results to differ materially from our expectations are contained in cautionary statements in this Annual Report and include, without limitation, the following: • Our business is exposed to risks associated with the volatile global economic environment and political co ...

... factors that could cause actual results to differ materially from our expectations are contained in cautionary statements in this Annual Report and include, without limitation, the following: • Our business is exposed to risks associated with the volatile global economic environment and political co ...

Form 20-F/A - MOL Corporate

... International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our selected consolidated financial data also includes adjusted EBITDA, which is a non-IFRS measure that is not required by, or presented in accordance with, IFRS, but is include ...

... International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our selected consolidated financial data also includes adjusted EBITDA, which is a non-IFRS measure that is not required by, or presented in accordance with, IFRS, but is include ...

FORM 10-K - corporate

... the risk of potential decreases in our reimbursement rates. The foregoing are significant factors we think could cause our actual results to differ materially from expected results. However, there could be additional factors besides those listed herein that also could affect us in an adverse manner. ...

... the risk of potential decreases in our reimbursement rates. The foregoing are significant factors we think could cause our actual results to differ materially from expected results. However, there could be additional factors besides those listed herein that also could affect us in an adverse manner. ...

Drivers for Growth Through 2020

... Exchange-Traded Funds Study to identify five key trends driving global ETF demand. We then built a growth model projecting ETF asset growth over the next five years. Using current asset levels as a starting point, the model examined respondents’ future plans for increasing usage, broadening usage, i ...

... Exchange-Traded Funds Study to identify five key trends driving global ETF demand. We then built a growth model projecting ETF asset growth over the next five years. Using current asset levels as a starting point, the model examined respondents’ future plans for increasing usage, broadening usage, i ...

To Be the World`s Leading Airline Group

... hypotheses of the group’s management based on currently available information. Air transportation, the group’s core business, involves government-mandated costs that are beyond the company’s control, such as airport utilization fees and fuel taxes. In addition, conditions in the markets served by ...

... hypotheses of the group’s management based on currently available information. Air transportation, the group’s core business, involves government-mandated costs that are beyond the company’s control, such as airport utilization fees and fuel taxes. In addition, conditions in the markets served by ...

Project on Financial Statement Analysis of the Textile Industry Of

... Its cffecti ve ness is limited by the distortions which arise in financial statements due to such thin gs as Historical Cost Accounting and inflation . Therefore, Ratio Analysis should only be used as a tirst step in financial analysis, to obtain a quick indication of a firm's perfo rman ce and to i ...

... Its cffecti ve ness is limited by the distortions which arise in financial statements due to such thin gs as Historical Cost Accounting and inflation . Therefore, Ratio Analysis should only be used as a tirst step in financial analysis, to obtain a quick indication of a firm's perfo rman ce and to i ...

SOTHEBYS

... Under Sotheby’s standard payment terms, payments from buyers are due no more than 30 days from the sale date and consignor payments are made 35 days from the sale date. However, for specific collecting categories, extended payment terms are provided to buyers who are well-known to Sotheby’s in order ...

... Under Sotheby’s standard payment terms, payments from buyers are due no more than 30 days from the sale date and consignor payments are made 35 days from the sale date. However, for specific collecting categories, extended payment terms are provided to buyers who are well-known to Sotheby’s in order ...

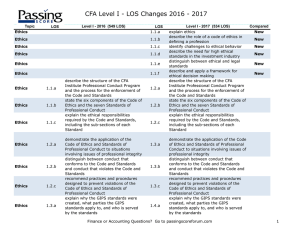

CFA Level I - LOS Changes 2016 - 2017

... describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS standards and l ...

... describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS standards and l ...

World Investment Report 2006 FDI from Developing and

... overseas investment and on the characteristics of the home economy. Any analysis of the impact of outward FDI on home developing economies faces several problems. First and foremost, there are significant data limitations and few research results. Given that the expansion of FDI from developing coun ...

... overseas investment and on the characteristics of the home economy. Any analysis of the impact of outward FDI on home developing economies faces several problems. First and foremost, there are significant data limitations and few research results. Given that the expansion of FDI from developing coun ...

united states securities and exchange commission

... cause our actual results, performance or achievements, or industry results to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Some of these risks, uncertainties and other factors are as follows: our level of indebt ...

... cause our actual results, performance or achievements, or industry results to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Some of these risks, uncertainties and other factors are as follows: our level of indebt ...

Conservatism in Accounting

... Contractual use of accounting measures. Many contracts between parties to the firm use accounting numbers to reduce agency costs associated with the firm (see Watts and Zimmerman, 1986). Those contracts include contracts between the firm and holders of the firm’s debt (debt contracts), management c ...

... Contractual use of accounting measures. Many contracts between parties to the firm use accounting numbers to reduce agency costs associated with the firm (see Watts and Zimmerman, 1986). Those contracts include contracts between the firm and holders of the firm’s debt (debt contracts), management c ...

The ECB`s securities markets programme

... Of particular relevance here is the analytical distinction between disturbance and malfunctioning. The author defines the two concepts as follows: Disturbance and malfunction differ in that a disturbance means that the monetary policy impulse is not transmitted through the different channels to the ...

... Of particular relevance here is the analytical distinction between disturbance and malfunctioning. The author defines the two concepts as follows: Disturbance and malfunction differ in that a disturbance means that the monetary policy impulse is not transmitted through the different channels to the ...

inland western - AnnualReports.com

... This Annual Report and the Letter to Stockholders contain “forward-looking statements”. Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, representations, plans or predictions of the future and are typica ...

... This Annual Report and the Letter to Stockholders contain “forward-looking statements”. Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, representations, plans or predictions of the future and are typica ...

- Covenant University Repository

... among other things, to assist the establishment of new, viable SMI projects; thereby stimulating economic growth, and development of local technology, promoting indigenous entrepreneurship and generating employment. Timing of investment exit was fixed at minimum of three years, that is, banks shall ...

... among other things, to assist the establishment of new, viable SMI projects; thereby stimulating economic growth, and development of local technology, promoting indigenous entrepreneurship and generating employment. Timing of investment exit was fixed at minimum of three years, that is, banks shall ...

How Do Mergers Create Value? A Comparison of Taxes, Market

... benchmarked to industry performance) to infer efficiency improvements after mergers.2 As pointed out in the literature (e.g., Harford, 2005), the fact that mergers are clustered in industries experiencing severe economic, technological, and/or regulatory shocks makes it difficult to draw inferences fr ...

... benchmarked to industry performance) to infer efficiency improvements after mergers.2 As pointed out in the literature (e.g., Harford, 2005), the fact that mergers are clustered in industries experiencing severe economic, technological, and/or regulatory shocks makes it difficult to draw inferences fr ...

- Zodiac Aerospace

... continued investing to develop new designs for seats, IFE (in-flight entertainment) and galley equipment. Changes in the scope of consolidation contributed €24.0 million to the COI surge (Excluding IFRS 3), while the effects of foreign exchange had an overall positive impact of €19.1 million (which ...

... continued investing to develop new designs for seats, IFE (in-flight entertainment) and galley equipment. Changes in the scope of consolidation contributed €24.0 million to the COI surge (Excluding IFRS 3), while the effects of foreign exchange had an overall positive impact of €19.1 million (which ...

FORM 10-Q - 10K Wizard

... normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three months ended March 29, 2013, are not necessarily indicative of the results that may be expected for the year ending December 31, 2013. Sales of our nonalcoholic ready-to-drink ...

... normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three months ended March 29, 2013, are not necessarily indicative of the results that may be expected for the year ending December 31, 2013. Sales of our nonalcoholic ready-to-drink ...

YAHOO INC (Form: 10-Q, Received: 11/12/2013 15:50:48)

... results of operations of acquired companies from the date of the acquisition. The accompanying unaudited condensed consolidated interim financial statements reflect all adjustments, consisting of only normal recurring items, which, in the opinion of management, are necessary for a fair statement of ...

... results of operations of acquired companies from the date of the acquisition. The accompanying unaudited condensed consolidated interim financial statements reflect all adjustments, consisting of only normal recurring items, which, in the opinion of management, are necessary for a fair statement of ...