2014 Annual Report

... Allstate is a special place. We rally employees and agency teams around the theme of “Be A Force For Good” and live this by striving to do the right thing at the right time, putting people before policies and defying expectations. This is not easy, and we are not always perfect since we are an organ ...

... Allstate is a special place. We rally employees and agency teams around the theme of “Be A Force For Good” and live this by striving to do the right thing at the right time, putting people before policies and defying expectations. This is not easy, and we are not always perfect since we are an organ ...

Credit Suisse Global Investment Returns Yearbook 2013

... It is now over five years since the beginning of the global financial crisis and there is a sense that, following interruptions from the Eurozone crisis and, more recently, the fiscal cliff debate in the USA, the world economy is finally moving towards a meaningful recovery. In this context, the Cre ...

... It is now over five years since the beginning of the global financial crisis and there is a sense that, following interruptions from the Eurozone crisis and, more recently, the fiscal cliff debate in the USA, the world economy is finally moving towards a meaningful recovery. In this context, the Cre ...

2016 Form 10-K - PSEG Investor Relations

... future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forwardlooking statements are subject to risks and uncertain ...

... future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forwardlooking statements are subject to risks and uncertain ...

International Monetary Fund Annual Report 1962

... year, the surplus was no longer sufficient, as imports increased in response to economic recovery, and there was also a larger outflow of capital. Japan's trade position deteriorated sharply from 1960 to 1961, although an inflow of short-term capital kept reserves rising during the first four months ...

... year, the surplus was no longer sufficient, as imports increased in response to economic recovery, and there was also a larger outflow of capital. Japan's trade position deteriorated sharply from 1960 to 1961, although an inflow of short-term capital kept reserves rising during the first four months ...

HP INC (Form: 10-K, Received: 12/15/2016 16:48:55)

... Operations” in Item 7, contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the results of HP Inc. and its consolidated subsidiaries (“HP”) may differ materially from those expressed ...

... Operations” in Item 7, contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the results of HP Inc. and its consolidated subsidiaries (“HP”) may differ materially from those expressed ...

FORM 10-K - Morningstar Document Research

... Orient-Express Hotels Ltd. (the “Company” and, together with its subsidiaries, “OEH”) is incorporated in the Islands of Bermuda and is a “foreign private issuer” as defined in Rule 3b-4 promulgated by the U.S. Securities and Exchange Commission (“SEC”) under the U.S. Securities Exchange Act of 1934 ...

... Orient-Express Hotels Ltd. (the “Company” and, together with its subsidiaries, “OEH”) is incorporated in the Islands of Bermuda and is a “foreign private issuer” as defined in Rule 3b-4 promulgated by the U.S. Securities and Exchange Commission (“SEC”) under the U.S. Securities Exchange Act of 1934 ...

Form: 40-F, Received: 03/30/2017 17:11:38

... Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves , adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Act of 1993, as amended (the “Securities Act”). Under SEC Indu ...

... Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves , adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Act of 1993, as amended (the “Securities Act”). Under SEC Indu ...

Establishing resolution arrangements for investment banks

... These proposals are designed to operate together as part of an integrated package of reforms. They respond to the specific challenges highlighted by the collapse of Lehman, but are also designed to be forward looking, and place the UK on a strong footing to deal with any future ...

... These proposals are designed to operate together as part of an integrated package of reforms. They respond to the specific challenges highlighted by the collapse of Lehman, but are also designed to be forward looking, and place the UK on a strong footing to deal with any future ...

HOW STOCKBROKERS COULD REDUCE THEIR

... values. Given that Broker 88 is allowed no provision to trade on his own account, all scrip, if necessary, and in all events, ultimately is deliverable and delivered to brokers and the Broker 88 overdraft is not at risk. It is additionally assumed that Broker 88's overdraft would be guaranteed colle ...

... values. Given that Broker 88 is allowed no provision to trade on his own account, all scrip, if necessary, and in all events, ultimately is deliverable and delivered to brokers and the Broker 88 overdraft is not at risk. It is additionally assumed that Broker 88's overdraft would be guaranteed colle ...

PRIMERO MINING CORP (Form: 40-F, Received: 03

... loss of equipment, whether as a result of natural occurrences including flooding, political changes, title issues, intervention by local landowners, loss of permits, or environmental concerns or otherwise; ...

... loss of equipment, whether as a result of natural occurrences including flooding, political changes, title issues, intervention by local landowners, loss of permits, or environmental concerns or otherwise; ...

Page 1 of 1 REPL::Annual Reports and Related Documents:: 7/5

... (the “2016 AGM”), Shareholders approved, inter alia, the renewal of a mandate (the “IPT Mandate”) to enable the Company, its subsidiaries and associated companies which are considered to be “entities at risk” (as that term is used in Chapter 9 of the Listing Manual (the “Listing Manual”) of the SGX- ...

... (the “2016 AGM”), Shareholders approved, inter alia, the renewal of a mandate (the “IPT Mandate”) to enable the Company, its subsidiaries and associated companies which are considered to be “entities at risk” (as that term is used in Chapter 9 of the Listing Manual (the “Listing Manual”) of the SGX- ...

barrick gold corporation

... One of the reasons Barrick has been able to advance an ambitious exploration and development program is the financial strength we’ve built over the years, with the industry’s only A-rated balance sheet and nearly $1 billion in cash. We also improved our capital structure and lowered our cost of capi ...

... One of the reasons Barrick has been able to advance an ambitious exploration and development program is the financial strength we’ve built over the years, with the industry’s only A-rated balance sheet and nearly $1 billion in cash. We also improved our capital structure and lowered our cost of capi ...

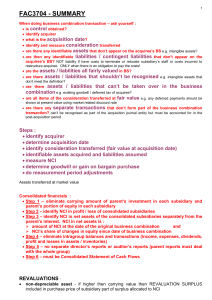

Assignment 1 is compulsory and due

... If eliminate unrealised profit of R 5 000 then subsidiary must value asset at R 40 000 and depreciation @ 20% would be R 8 000 per year So excess depreciation of R 1 000 (R 9 000 – R 8 000) must be written back every year and this is a way of saying that 1/5th of the unrealised profit is being reali ...

... If eliminate unrealised profit of R 5 000 then subsidiary must value asset at R 40 000 and depreciation @ 20% would be R 8 000 per year So excess depreciation of R 1 000 (R 9 000 – R 8 000) must be written back every year and this is a way of saying that 1/5th of the unrealised profit is being reali ...

Effects of Local Director Markets on Corporate Boards

... lowers monitoring costs and find that proximate VCs offer entrepreneurs less harsh incentive contracts, with fewer investor-friendly cash flow contingencies. Masulis et al. (2011) find that foreign independent directors, who are far removed from a firm, are less likely to attend board meetings and ...

... lowers monitoring costs and find that proximate VCs offer entrepreneurs less harsh incentive contracts, with fewer investor-friendly cash flow contingencies. Masulis et al. (2011) find that foreign independent directors, who are far removed from a firm, are less likely to attend board meetings and ...

NBER Reporter Program Report Productivity

... issued since 1978. It also includes searchable indexes to all NBER books and to all current NBER Research Associates and Faculty Research Fellows. In addition, our web site has the NBER Macroeconomic History Database (3500 different time series) and other items. ...

... issued since 1978. It also includes searchable indexes to all NBER books and to all current NBER Research Associates and Faculty Research Fellows. In addition, our web site has the NBER Macroeconomic History Database (3500 different time series) and other items. ...

CollegeChoice CD Disclosure Statement

... If we do not receive instructions at maturity, we will take the following default action: • We will automatically transfer matured funds into an Honors Savings Account until you provide distribution or other investment instructions. Alternatively, you may choose one of the following options at ...

... If we do not receive instructions at maturity, we will take the following default action: • We will automatically transfer matured funds into an Honors Savings Account until you provide distribution or other investment instructions. Alternatively, you may choose one of the following options at ...

Lending-of-last-resort is as lending-of-last-resort does

... in the interbank market. Examining the interplay between central bank liquidity provision and interbank market activity presents a number of empirical challenges. The vast majority of interbank transactions take place in over-the-counter markets. There is no centralized recordkeeping of transactions ...

... in the interbank market. Examining the interplay between central bank liquidity provision and interbank market activity presents a number of empirical challenges. The vast majority of interbank transactions take place in over-the-counter markets. There is no centralized recordkeeping of transactions ...

SKF Half-year results 2013 Tom Johnstone, President and CEO

... Although management believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those implied in the forward-looking statements as a res ...

... Although management believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those implied in the forward-looking statements as a res ...