PowerPoint

... To survive in the long run, a firm must be able to meet its long-term liabilities; otherwise it is in danger or collapse or takeover. • To measure this risk, long-term solvency ratios are used, the most common being the debt-to-owners’ equity ratio or leverage, which compares the amount of debt to t ...

... To survive in the long run, a firm must be able to meet its long-term liabilities; otherwise it is in danger or collapse or takeover. • To measure this risk, long-term solvency ratios are used, the most common being the debt-to-owners’ equity ratio or leverage, which compares the amount of debt to t ...

Investment Research Strategy How a Trump Presidency will Impact

... The Federal Reserve was already on track to raise short-term interest rates in December. Reflationary pressures from wage growth, higher commodity prices and the federal deficit suggest an eventual end to the ultra low interest rate environment, which led to the abrupt retreat in bond yields across ...

... The Federal Reserve was already on track to raise short-term interest rates in December. Reflationary pressures from wage growth, higher commodity prices and the federal deficit suggest an eventual end to the ultra low interest rate environment, which led to the abrupt retreat in bond yields across ...

Report on the analysis of municipal budgets for the 2004/2005

... of expenditure - norms for salary cost to be reviewed • General expenses increased below inflation – controllable costs such as telephone, transport and subsistence, stationary and printing still require good financial management • Repairs and maintenance in general still well below the norm – impor ...

... of expenditure - norms for salary cost to be reviewed • General expenses increased below inflation – controllable costs such as telephone, transport and subsistence, stationary and printing still require good financial management • Repairs and maintenance in general still well below the norm – impor ...

http://www.econstor.eu/bitstream/10419/89039/1/IDB-WP-276.pdf

... possibility of failure of individual institutions is a necessary part of a healthy financial sector. 2 It is often commented that the Basel standards have stressed microeconomic or individual institution risks. The standards neither consider how risks might develop within financial institutions nor ...

... possibility of failure of individual institutions is a necessary part of a healthy financial sector. 2 It is often commented that the Basel standards have stressed microeconomic or individual institution risks. The standards neither consider how risks might develop within financial institutions nor ...

Nonmonetary Effects of the Financial Crisis in the Propagation of the

... of runs. The result of this was that the behavior of almost the entire system was adversely affected, not just that of marginal banks. The bankers' fear of runs, as I shall argue below, had important macroeconomic effects. B. Defaults and Bankruptcies The second major aspect of the financial crisis ...

... of runs. The result of this was that the behavior of almost the entire system was adversely affected, not just that of marginal banks. The bankers' fear of runs, as I shall argue below, had important macroeconomic effects. B. Defaults and Bankruptcies The second major aspect of the financial crisis ...

1 Introduction 2 Analytical Framework

... zero, in order to concentrate on the firm’s investment decisions. The firm in this setup is competitive (that is, a price-taker) only with respect to r∗ , the international risk-free rate of return. This r∗ cannot be influenced by the firm’s actions. However, rj , K j and ε̄j are firm-specific and m ...

... zero, in order to concentrate on the firm’s investment decisions. The firm in this setup is competitive (that is, a price-taker) only with respect to r∗ , the international risk-free rate of return. This r∗ cannot be influenced by the firm’s actions. However, rj , K j and ε̄j are firm-specific and m ...

Finance 301 Chapter 6: Problems 10/16/08 30 day T

... Usually, if the bonds is called early, the issuer has to pay a call premium that awards the bond holder with more money than par. (example a 10% premium on a 100 dollar bond would give the holder 110 dollars if it were called early.) There is also something called “call protection” that prohibits th ...

... Usually, if the bonds is called early, the issuer has to pay a call premium that awards the bond holder with more money than par. (example a 10% premium on a 100 dollar bond would give the holder 110 dollars if it were called early.) There is also something called “call protection” that prohibits th ...

The Ralston Company/The Balboa Company

... conditions, and unfortunately nobody expects the stock market to improve significantly over the next year or two. Consequently, we do not anticipate being able to sell new equity in the market at a reasonable price for quite awhile, and floating an equity issue now is totally unacceptable to everyon ...

... conditions, and unfortunately nobody expects the stock market to improve significantly over the next year or two. Consequently, we do not anticipate being able to sell new equity in the market at a reasonable price for quite awhile, and floating an equity issue now is totally unacceptable to everyon ...

Financial Innovations and Macroeconomic Volatility

... Giorgio Primiceri Northwestern University ...

... Giorgio Primiceri Northwestern University ...

Farm and Ranch Business Management Functions

... What financial and production measures do you use? What measures do other successful businesses use? Does your present accounting or record system provide you this information? What benchmarks can you compare your measures with to help set your goals? ...

... What financial and production measures do you use? What measures do other successful businesses use? Does your present accounting or record system provide you this information? What benchmarks can you compare your measures with to help set your goals? ...

Financial Liberalisation and Crises

... depth of financial crises have been exacerbated; Laeven and Valencia (2012) record 346 financial crises in the period 1970 to 2011, of which 99 were banking crises, 18 sovereign debt crises and 153 currency crises, 11 banking and debt crises, 28 banking and currency crises, 29 debt and currency cr ...

... depth of financial crises have been exacerbated; Laeven and Valencia (2012) record 346 financial crises in the period 1970 to 2011, of which 99 were banking crises, 18 sovereign debt crises and 153 currency crises, 11 banking and debt crises, 28 banking and currency crises, 29 debt and currency cr ...

Menendez FY 14 Appropriations Request Letter

... distressed urban and rural communities by investing in and growing Community Development Financial Institutions (CDFIs) across the country. CDFIs, are community-based, mission-driven financial institutions that specialize in delivering affordable credit, capital, and financial services to residents ...

... distressed urban and rural communities by investing in and growing Community Development Financial Institutions (CDFIs) across the country. CDFIs, are community-based, mission-driven financial institutions that specialize in delivering affordable credit, capital, and financial services to residents ...

The Interconnected Economy

... eople don’t produce most of what they consume. They don’t grow most of their own food, make their own clothes, build their own houses, or provide their own health care and education. Instead, people mainly consume goods and services that others have produced, and in turn, what most people produce is ...

... eople don’t produce most of what they consume. They don’t grow most of their own food, make their own clothes, build their own houses, or provide their own health care and education. Instead, people mainly consume goods and services that others have produced, and in turn, what most people produce is ...

Harbor Mid Cap Value Fund

... effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may ...

... effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may ...

Phd Economics, Siena - Finance – Final exam (16 April 2014

... 3. A restaurant chain wants to open a new restaurant in Siena, and it has two options: 1) a restaurant in Piazza del Campo, initial cost 2.5mln, expected cash-flows of 200,000 Euros per year; 2) a restaurant at Fontebecci, initial cost of 0.5mln with expected cash-flows 200,000 Euros per year (with ...

... 3. A restaurant chain wants to open a new restaurant in Siena, and it has two options: 1) a restaurant in Piazza del Campo, initial cost 2.5mln, expected cash-flows of 200,000 Euros per year; 2) a restaurant at Fontebecci, initial cost of 0.5mln with expected cash-flows 200,000 Euros per year (with ...

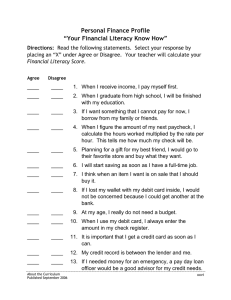

Introduction - Missouri Center for Career Education

... 3. If I want something that I cannot pay for now, I borrow from my family or friends. Good financial planning would suggest one should not make a purchase that cannot be paid for in cash or be able to pay the entire balance each month on a credit card. ...

... 3. If I want something that I cannot pay for now, I borrow from my family or friends. Good financial planning would suggest one should not make a purchase that cannot be paid for in cash or be able to pay the entire balance each month on a credit card. ...

Read Article - Longwave Group

... Front Page Headline, Wall Street Journal – “ECB’s Bond Purchase Plan in Germany’s Interest: Draghi. In an address to the annual meeting of the Federation of Germany Industry in Berlin, European Central Bank President Mario Draghi launches a robust defense of the ECB’s unlimited bond purchase program ...

... Front Page Headline, Wall Street Journal – “ECB’s Bond Purchase Plan in Germany’s Interest: Draghi. In an address to the annual meeting of the Federation of Germany Industry in Berlin, European Central Bank President Mario Draghi launches a robust defense of the ECB’s unlimited bond purchase program ...

Interest-Free Treasury Bonds (IFTB)

... Monetary effect of issuing Foreign Exchange IFTB is similar to issuing IFTBs in domestic money and in addition, it has stabilizing effect on supply and demand of foreign exchange. Central bank can use this issue to manage exchange rate and by changing supply of various foreign exchanges in short ter ...

... Monetary effect of issuing Foreign Exchange IFTB is similar to issuing IFTBs in domestic money and in addition, it has stabilizing effect on supply and demand of foreign exchange. Central bank can use this issue to manage exchange rate and by changing supply of various foreign exchanges in short ter ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.