Speech to the First Annual Conference of the Risk Management... Singapore via video-conference

... The low long-term rates and low risk premiums that have prevailed in financial markets over the last several years mean that overall financial conditions have been notably more accommodative than suggested by the current level of the real federal funds rate. Given that, a shift in risk perceptions w ...

... The low long-term rates and low risk premiums that have prevailed in financial markets over the last several years mean that overall financial conditions have been notably more accommodative than suggested by the current level of the real federal funds rate. Given that, a shift in risk perceptions w ...

money notes

... *High-quality corporate bonds are classified as investment grade. The ratings on these bonds range from AAA to BBB. Stocks: Historically the Highest Returns *securities that represent ownership in a business *As part owners of a company, shareholders have the right to receive a portion of the firm ...

... *High-quality corporate bonds are classified as investment grade. The ratings on these bonds range from AAA to BBB. Stocks: Historically the Highest Returns *securities that represent ownership in a business *As part owners of a company, shareholders have the right to receive a portion of the firm ...

Workshop on Financial Stability, Systemic Risk Assessment and

... a) Order the financial institution to submit to the Central Bank a capital restoration plan to restore the financial institution to capital adequacy b) Enter into an agreement with the board of directors of the financial institution requiring the financial institution to rectify its significant unde ...

... a) Order the financial institution to submit to the Central Bank a capital restoration plan to restore the financial institution to capital adequacy b) Enter into an agreement with the board of directors of the financial institution requiring the financial institution to rectify its significant unde ...

what have we learned from recent financial crises and policy

... It might also be added that the Mexican crisis of 1995 had its roots in domestic overconsumption whereas the Asian crisis was in part the product of extremely high levels of domestic investment. This fact would seem likely to have an important effect on the recovery path. This is not equivalent to a ...

... It might also be added that the Mexican crisis of 1995 had its roots in domestic overconsumption whereas the Asian crisis was in part the product of extremely high levels of domestic investment. This fact would seem likely to have an important effect on the recovery path. This is not equivalent to a ...

Is Inflation Around the Corner?

... then velocity has increased. Conversely, if the number of transactions for the same dollar declines, then so does velocity. Velocity slowed during this credit crunch as financial institutions, corporations, and individuals hoarded cash. Slowing velocity combined with less credit indicates that the b ...

... then velocity has increased. Conversely, if the number of transactions for the same dollar declines, then so does velocity. Velocity slowed during this credit crunch as financial institutions, corporations, and individuals hoarded cash. Slowing velocity combined with less credit indicates that the b ...

US interest rates: how they`ll affect SA

... The role of interest rates If this foreign capital stops flowing into the country (for example the US hikes rates and makes US yielding or debt investments more attractive relative to SA), the South African Reserve Bank will have no choice but to raise interest rates in South Africa. The Reserve Ban ...

... The role of interest rates If this foreign capital stops flowing into the country (for example the US hikes rates and makes US yielding or debt investments more attractive relative to SA), the South African Reserve Bank will have no choice but to raise interest rates in South Africa. The Reserve Ban ...

Money, Banking, and Financial Markets (Econ 353): Section 1

... 7) In which of the following situations would you prefer to be making a loan? A) The interest rate is 9 percent and the expected inflation rate is 7 percent. B) The interest rate is 4 percent and the expected inflation rate is 1 percent. C) The interest rate is 13 percent and the expected inflation ...

... 7) In which of the following situations would you prefer to be making a loan? A) The interest rate is 9 percent and the expected inflation rate is 7 percent. B) The interest rate is 4 percent and the expected inflation rate is 1 percent. C) The interest rate is 13 percent and the expected inflation ...

Ch. 15: Financial Markets

... – lower interest rates. – an increase in future expected dividends. – A lower tax rate on dividends. ...

... – lower interest rates. – an increase in future expected dividends. – A lower tax rate on dividends. ...

Changing patterns of financial intermediation

... As a consequence of the significant economic and financial crisis suffered in 20012002, Argentina has experienced a particular path with respect to patterns of financial intermediation. Following the abandonment of the Convertibility Plan in December 2001, it suffered a huge financial and economic c ...

... As a consequence of the significant economic and financial crisis suffered in 20012002, Argentina has experienced a particular path with respect to patterns of financial intermediation. Following the abandonment of the Convertibility Plan in December 2001, it suffered a huge financial and economic c ...

Lonmin is a primary producer of Platinum Group Metals (PGMs

... Tightly controlled capital expenditure of $136 million – lower than original guidance of $250 million Net debt of $185 million with available committed facilities of $543 million (net debt of $29 million in 2014) Net assets attributable to equity shareholders valued at $1.6 billion after impairment ...

... Tightly controlled capital expenditure of $136 million – lower than original guidance of $250 million Net debt of $185 million with available committed facilities of $543 million (net debt of $29 million in 2014) Net assets attributable to equity shareholders valued at $1.6 billion after impairment ...

Karlstad Business School Kundju Atem, Robert Paper on Financial

... are measured and recognized using the fair value accounting that had been devalued or under estimated in the changing environment. In this current crisis, financial assets have been tested and both Financial Accounting standards Board (FASB) and International Accounting Standard Board (IASB) provide ...

... are measured and recognized using the fair value accounting that had been devalued or under estimated in the changing environment. In this current crisis, financial assets have been tested and both Financial Accounting standards Board (FASB) and International Accounting Standard Board (IASB) provide ...

Exceptionalmeasures: The Shanghai stock market crash

... suffered, and many observers across the globe are now nervously focused on the Asian giant whose economy drove so many other countries' in recent years. Yet the real economic significance of the drama in China may not stem from its bourses' losses; those who lost money on China's stock market are on ...

... suffered, and many observers across the globe are now nervously focused on the Asian giant whose economy drove so many other countries' in recent years. Yet the real economic significance of the drama in China may not stem from its bourses' losses; those who lost money on China's stock market are on ...

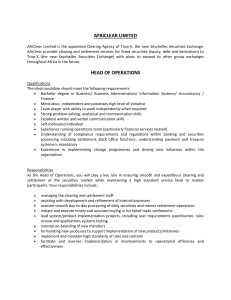

head of operations - Trop-X

... Meticulous, independent and possesses high level of initiative Team player with ability to work independently when required Strong problem-solving, analytical and communication skills Excellent written and verbal communication skills Self-motivated individual Experience running operation ...

... Meticulous, independent and possesses high level of initiative Team player with ability to work independently when required Strong problem-solving, analytical and communication skills Excellent written and verbal communication skills Self-motivated individual Experience running operation ...

Session 051 PD, Market Impact of International Regulation

... activity in last 10 years – Much of this is highly bank-centric and inappropriate to insurance business model Significant effect already on U.S. insurance regulation, especially since 2007-8 financial crisis PCI strongly supports U.S. state-based regulatory system – best for consumers and insurers S ...

... activity in last 10 years – Much of this is highly bank-centric and inappropriate to insurance business model Significant effect already on U.S. insurance regulation, especially since 2007-8 financial crisis PCI strongly supports U.S. state-based regulatory system – best for consumers and insurers S ...

Monthly Emerging Markets Review - Franklin Templeton Investments

... environment, especially as technology is becoming more integral and competitive in emerging markets. Moreover, selected commodity shares remain attractively valued, especially as commodity prices show signs of bottoming out. Oil prices, for example, are currently significantly higher than their rece ...

... environment, especially as technology is becoming more integral and competitive in emerging markets. Moreover, selected commodity shares remain attractively valued, especially as commodity prices show signs of bottoming out. Oil prices, for example, are currently significantly higher than their rece ...

Graphics Induction Presentation

... Pan-African Capital Markets Conference – early 2010 Quantitative classification of countries by level of bond market development Launch of the African Domestic Bond Fund – May 2010 ...

... Pan-African Capital Markets Conference – early 2010 Quantitative classification of countries by level of bond market development Launch of the African Domestic Bond Fund – May 2010 ...

28 March 2017 BCRE – Brack Capital Real Estate Investments N.V.

... additional information regarding the public offering see material events section of the consolidated financial statements. ...

... additional information regarding the public offering see material events section of the consolidated financial statements. ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.