Introduction to Health care accounting and financial Management

... because the potentially large amounts of cash involved may take a long period to generate. The roots of liquidity crises that put organizations out of business are often buried in inadequate long-term solvency planning in earlier years. So, a good strategy is maximization of your organization’s liqu ...

... because the potentially large amounts of cash involved may take a long period to generate. The roots of liquidity crises that put organizations out of business are often buried in inadequate long-term solvency planning in earlier years. So, a good strategy is maximization of your organization’s liqu ...

UNIVERSITY OF NORTH FLORIDA

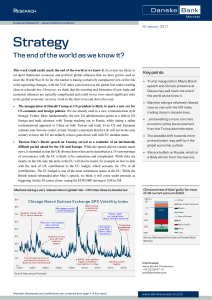

... The equity markets started Q4 on a strong note, achieving new technical levels, and breaking free from the summer’s volatile trading range. In October the DJIA, S&P 500 Index, led the NASDAQ to new highs, and the DJIA successfully rallied above and held the all important 12,000 level. It is hard to ...

... The equity markets started Q4 on a strong note, achieving new technical levels, and breaking free from the summer’s volatile trading range. In October the DJIA, S&P 500 Index, led the NASDAQ to new highs, and the DJIA successfully rallied above and held the all important 12,000 level. It is hard to ...

Endogenous Liquidity Constraints, Financial Deepening and

... Equations (26) and (27) imply that a rise in the rate of money growth increases the financial service-capital ratio ( f / k ) * and the consumption-capital ratio (c / k ) * . The degree of consumer’s financial deepening ( f / y) * thus increases. Equations (28) and (29) tell us that a rise in mone ...

... Equations (26) and (27) imply that a rise in the rate of money growth increases the financial service-capital ratio ( f / k ) * and the consumption-capital ratio (c / k ) * . The degree of consumer’s financial deepening ( f / y) * thus increases. Equations (28) and (29) tell us that a rise in mone ...

Municipal Bond Funds Commentary

... returned 1.45% and 0.20%, respectively. Intermediateand long-maturity bonds outperformed short-maturity bonds due to the more hawkish statements by the Fed that contributed to a flattening of the municipal bond yield curve. The high-yield tax-exempt market outperformed the broader municipal bond mar ...

... returned 1.45% and 0.20%, respectively. Intermediateand long-maturity bonds outperformed short-maturity bonds due to the more hawkish statements by the Fed that contributed to a flattening of the municipal bond yield curve. The high-yield tax-exempt market outperformed the broader municipal bond mar ...

Source Bloomberg Commodity Ex

... Counterparty risk: Through the Fund, investors are exposed to counterparty risk resulting from the use of derivatives to provide exposure to the index. In line with UCITS guidelines and Source policies, the exposure to any derivative counterparty is tightly controlled but the default of a derivative ...

... Counterparty risk: Through the Fund, investors are exposed to counterparty risk resulting from the use of derivatives to provide exposure to the index. In line with UCITS guidelines and Source policies, the exposure to any derivative counterparty is tightly controlled but the default of a derivative ...

FACTSHEET – 05.07.2017 Solactive Panthera World Market

... This info service is offered exclusively by Solactive AG, Guiollettstr. 54, D-60325 Frankfurt am Main, E-Mail [email protected] | Disclaimer: The financial instrument is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or imp ...

... This info service is offered exclusively by Solactive AG, Guiollettstr. 54, D-60325 Frankfurt am Main, E-Mail [email protected] | Disclaimer: The financial instrument is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or imp ...

Spending DA UM7wk - Open Evidence Archive

... necessary to reach a compromise until the last minute. The Republicans are seeking significant spending cuts as a condition of any agreement, while the Democrats are keen to delay fiscal retrenchment until the economy is stronger. The warning from Fitch was echoed by Moritz Kraemer, the head of sove ...

... necessary to reach a compromise until the last minute. The Republicans are seeking significant spending cuts as a condition of any agreement, while the Democrats are keen to delay fiscal retrenchment until the economy is stronger. The warning from Fitch was echoed by Moritz Kraemer, the head of sove ...

MONEY DEMAND SENSITIVITY TO INTEREST RATES: THE CASE

... effect of a zero interest rate on all short-term interest rates is negligible, while we assume that they receive a return at the BoJ call money rate. In other words, the opportunity cost of M1 indicates that such wealth cannot accrue the interest paid on a less liquid long-term asset, such as the 10 ...

... effect of a zero interest rate on all short-term interest rates is negligible, while we assume that they receive a return at the BoJ call money rate. In other words, the opportunity cost of M1 indicates that such wealth cannot accrue the interest paid on a less liquid long-term asset, such as the 10 ...

Devastating impact on South of looming financial crisis

... Devastating Impact on South of Looming Financial Crisis One reflection of the failure of the IMF to discharge its crucial role in maintaining international financial stability is the looming threat of a global financial crisis as a result of a significant decline of the US dollar. Warning of the dev ...

... Devastating Impact on South of Looming Financial Crisis One reflection of the failure of the IMF to discharge its crucial role in maintaining international financial stability is the looming threat of a global financial crisis as a result of a significant decline of the US dollar. Warning of the dev ...

q. please state your name, profession, and occupation.

... Mr. Hill criticizes me for not understanding that the expected rate of return applies to a book value per share whereas the required return applies to a market value per share. What I find interesting is that Mr. Hill can make this statement while at the same time recommending that the required retu ...

... Mr. Hill criticizes me for not understanding that the expected rate of return applies to a book value per share whereas the required return applies to a market value per share. What I find interesting is that Mr. Hill can make this statement while at the same time recommending that the required retu ...

Source Bloomberg Commodity UCITS ETF Factsheet

... as well as up and an investor may not get back the amount invested. Changes in exchange rates between currencies or the conversion from one currency to another may also cause the value of the investments to diminish or increase. An investment in a Fund should not constitute a substantial proportion ...

... as well as up and an investor may not get back the amount invested. Changes in exchange rates between currencies or the conversion from one currency to another may also cause the value of the investments to diminish or increase. An investment in a Fund should not constitute a substantial proportion ...

Vline Sample Page.pmd

... Medical Device businesses helped generate a total of $1.6 billion in annual savings. Due partly to tougher comparisons, management indicated that operating margin improvement over the balance of this year would most likely be far more modest; we estimate an average increase of about onehalf percenta ...

... Medical Device businesses helped generate a total of $1.6 billion in annual savings. Due partly to tougher comparisons, management indicated that operating margin improvement over the balance of this year would most likely be far more modest; we estimate an average increase of about onehalf percenta ...

Nedgroup Investments Positive Return Fund

... The graph above shows the performance of the fund for the year to date (orange dot in graph) as well as the profile for market movements ranging from +30% to -30% going forward. As an example, should the market (as represented by the FTSE/JSE Top 40) deliver a return of -30% going forward, the fund ...

... The graph above shows the performance of the fund for the year to date (orange dot in graph) as well as the profile for market movements ranging from +30% to -30% going forward. As an example, should the market (as represented by the FTSE/JSE Top 40) deliver a return of -30% going forward, the fund ...

Looking Beyond the Fed for Clues on Interest Rates TH E

... the prime rate and rates on CDs and shortterm Treasury securities. Other rates will rise to a lesser extent—such as rates on medium-term Treasury securities and corporate debt. Some rates won’t rise at all, and some may even fall. The prospect of continued tame ...

... the prime rate and rates on CDs and shortterm Treasury securities. Other rates will rise to a lesser extent—such as rates on medium-term Treasury securities and corporate debt. Some rates won’t rise at all, and some may even fall. The prospect of continued tame ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.