BLUE PAPER June 2016

... EMs have made strong progress toward the elimination of poverty in recent years. In the 20 years since the Asian currency crises, Brazil, China and Indonesia have all reduced poverty rates, while Argentina and Russia have effectively eliminated it. This does not mean that living standards have equal ...

... EMs have made strong progress toward the elimination of poverty in recent years. In the 20 years since the Asian currency crises, Brazil, China and Indonesia have all reduced poverty rates, while Argentina and Russia have effectively eliminated it. This does not mean that living standards have equal ...

10 - Finance

... Value-Based Management (VBM) VBM is the systematic application of the corporate valuation model to all corporate decisions and ...

... Value-Based Management (VBM) VBM is the systematic application of the corporate valuation model to all corporate decisions and ...

credit application - S. Walter Packaging

... Pending receipt of this information we suggest advance payment on the first order to expedite prompt shipment. Upon receipt we shall immediately process your order for production or shipment. CURRENT FINANCIAL INFORMATION Financial statements will be of great assistance to us in establishing a credi ...

... Pending receipt of this information we suggest advance payment on the first order to expedite prompt shipment. Upon receipt we shall immediately process your order for production or shipment. CURRENT FINANCIAL INFORMATION Financial statements will be of great assistance to us in establishing a credi ...

Valuation of Financial Assets

... of following year’s dividend and price. – As price approaches economic infinity, present value of terminal price (price in final year) becomes zero for valuation purposes. – Any financial asset is equal to present value of future cash flows. – Since stock may exist until economic infinity, only cash ...

... of following year’s dividend and price. – As price approaches economic infinity, present value of terminal price (price in final year) becomes zero for valuation purposes. – Any financial asset is equal to present value of future cash flows. – Since stock may exist until economic infinity, only cash ...

Full Page with Layout Heading - Michigan Department of Education

... Bond rate equals 5.00% and published rate equals 5.25%, issuer pays zero (5.00% - 5.00% = 0.00%) Bond rate equals 5.50% and published rate equals 4.75%, issuer pays 0.75% (5.50% - 4.75% = 0.75%) Current indicative market rate is 6.20% and published rate equals 5.01% for a net rate of 1.19% Abili ...

... Bond rate equals 5.00% and published rate equals 5.25%, issuer pays zero (5.00% - 5.00% = 0.00%) Bond rate equals 5.50% and published rate equals 4.75%, issuer pays 0.75% (5.50% - 4.75% = 0.75%) Current indicative market rate is 6.20% and published rate equals 5.01% for a net rate of 1.19% Abili ...

Issue189 - Bank Windhoek

... transfer payments by government, such as old age pension and grants to vulnerable children are omitted, because the recipients of these grants do not produce goods in return for the transfers. However, if a financial transaction involves a sales commission, the commission is included in GDP, because ...

... transfer payments by government, such as old age pension and grants to vulnerable children are omitted, because the recipients of these grants do not produce goods in return for the transfers. However, if a financial transaction involves a sales commission, the commission is included in GDP, because ...

download soal

... 5. Return investasi bisa berbentuk dua hal yaitu 6. Calculate the expected returns for the stock. Its current price is $ 125. Its next expected dividend is $ 21. And you expect to sell it for $ 137 in one year. 7. An analyst projects that a stock will pay a $ 2 dividend next year and that it will se ...

... 5. Return investasi bisa berbentuk dua hal yaitu 6. Calculate the expected returns for the stock. Its current price is $ 125. Its next expected dividend is $ 21. And you expect to sell it for $ 137 in one year. 7. An analyst projects that a stock will pay a $ 2 dividend next year and that it will se ...

Document

... surplus + Income of self-employed + imputed value of household production + property income (interest, dividend, royalties, rent, patents, rights) Value of services by financial institutions included in GDP. – Service charges – Difference between income received on loans and interest/claims paid o ...

... surplus + Income of self-employed + imputed value of household production + property income (interest, dividend, royalties, rent, patents, rights) Value of services by financial institutions included in GDP. – Service charges – Difference between income received on loans and interest/claims paid o ...

Capital components: debt, preferred stock, and common stock

... The flotation costs are highest for common equity. However, since most firms issue equity infrequently, the per-project cost is fairly small. We will frequently ignore flotation costs when calculating the WACC. 5. Weighted Average Cost of Capital (WACC) If all new equity will come from retained ...

... The flotation costs are highest for common equity. However, since most firms issue equity infrequently, the per-project cost is fairly small. We will frequently ignore flotation costs when calculating the WACC. 5. Weighted Average Cost of Capital (WACC) If all new equity will come from retained ...

JP Morgan

... • Central and Eastern Europe operations now report to Vince McLenaghan, MD of Asia-Pacific operations • Benefits will include: – more focussed strategy and management of underwriting – more flexible use of capital – lower maximum event retention – synergies from merging back office functions – plans ...

... • Central and Eastern Europe operations now report to Vince McLenaghan, MD of Asia-Pacific operations • Benefits will include: – more focussed strategy and management of underwriting – more flexible use of capital – lower maximum event retention – synergies from merging back office functions – plans ...

Financial Sector: Saving, Investment and the Financial System

... gathered from many individuals into financial assets. Mutual funds. Creates a stock portfolio by buying and holding shares in companies and then selling shares of the stock portfolio to individual investors. Pension Funds and Life Insurance Companies. Pension funds are non-profit institutions that ...

... gathered from many individuals into financial assets. Mutual funds. Creates a stock portfolio by buying and holding shares in companies and then selling shares of the stock portfolio to individual investors. Pension Funds and Life Insurance Companies. Pension funds are non-profit institutions that ...

11:00 Commercial Banking

... equities, derivative securities, traded debt instruments and commodities. • The Accord was amended in 1996 to require banks to implement internal portfolio models appropriate to the wider array of banking activities to compute capital requirements (e.g., ...

... equities, derivative securities, traded debt instruments and commodities. • The Accord was amended in 1996 to require banks to implement internal portfolio models appropriate to the wider array of banking activities to compute capital requirements (e.g., ...

The Economic Bailout: An Analysis of the Economic

... In addition, the language of Section 3(5) provides that a “financial institution” includes any institution “having significant operations in the United States,” thereby allowing foreign banks to participate in the TARP. There is one qualification to foreign participation in the TARP in that “any cen ...

... In addition, the language of Section 3(5) provides that a “financial institution” includes any institution “having significant operations in the United States,” thereby allowing foreign banks to participate in the TARP. There is one qualification to foreign participation in the TARP in that “any cen ...

BRIEFING PAPER FOR THE MONETARY DIALOGUE FIRST

... year and falling gradually over the next few years. These findings are broadly consistent with results achieved by similar empirical tests in the other comparative large currency area, namely the US. They find as well that in the Euro Area (EA) investment is highly responsive in driving output chang ...

... year and falling gradually over the next few years. These findings are broadly consistent with results achieved by similar empirical tests in the other comparative large currency area, namely the US. They find as well that in the Euro Area (EA) investment is highly responsive in driving output chang ...

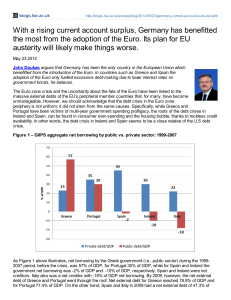

With a rising current account surplus, Germany has benefitted the

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

the time value of money - Pegasus Server

... Check with instructor on your financial institution. Write for or visit the company and obtain: Last annual report and 10K YOU MUST HAVE A PUBLISHED ANNUAL REPORT / 10K You can use the internet to get started but MUST provide instructor with a published report. Last 10Q (quarterly report) and pr ...

... Check with instructor on your financial institution. Write for or visit the company and obtain: Last annual report and 10K YOU MUST HAVE A PUBLISHED ANNUAL REPORT / 10K You can use the internet to get started but MUST provide instructor with a published report. Last 10Q (quarterly report) and pr ...

kuwait

... monetary reserve to finance economic development projects in the kingdom, since the oil revenue covers this projects as Saudi has huge reserves, so the plan to establish these project will not be affected by this crisis and Saudi Arabian Monetary Agency is ready to support liquidity needs. - The Sau ...

... monetary reserve to finance economic development projects in the kingdom, since the oil revenue covers this projects as Saudi has huge reserves, so the plan to establish these project will not be affected by this crisis and Saudi Arabian Monetary Agency is ready to support liquidity needs. - The Sau ...

Terry`s Place is currently experiencing a bad debt ratio of 4%. Terry

... If an investment project (normal project) has an IRR equal to the cost of capital, the NPV for that project is: D. Zero In the United States large-value electronic payments are made by: (I) Fedwire (III) CHIPS D. I and III only Earnings before interest and taxes is calculated as: B. Total revenues - ...

... If an investment project (normal project) has an IRR equal to the cost of capital, the NPV for that project is: D. Zero In the United States large-value electronic payments are made by: (I) Fedwire (III) CHIPS D. I and III only Earnings before interest and taxes is calculated as: B. Total revenues - ...

Document

... premium, especially prior to the Bear Stearns rescue. 2. Association with the state of the real economy (previously evident before the crisis) was reduced. 1. Investors were actually not yet concerned with the prospect of a global recession in which would impact the bank’s loan portfolios as with ot ...

... premium, especially prior to the Bear Stearns rescue. 2. Association with the state of the real economy (previously evident before the crisis) was reduced. 1. Investors were actually not yet concerned with the prospect of a global recession in which would impact the bank’s loan portfolios as with ot ...

GEBA MAX - at www.GEBA.com.

... You may elect to have your initial interest rate, excluding the first-year bonus, guaranteed for 1, 3, or 5 years.2 After that, the interest rate is guaranteed to never fall below the contract’s declared guaranteed minimum interest rate. If you elect the 3-year or 5-year guarantee period, the rate c ...

... You may elect to have your initial interest rate, excluding the first-year bonus, guaranteed for 1, 3, or 5 years.2 After that, the interest rate is guaranteed to never fall below the contract’s declared guaranteed minimum interest rate. If you elect the 3-year or 5-year guarantee period, the rate c ...

cost of capital

... we want one-third (or $60,000) to be debt ($180,000*1/3 = $60,000) and the other $120,000 to be common equity ($180,000*2/3=$120,000). Of the $120,000 of equity, only $20,000 of new common stock needs to be sold since we will have $100,000 available in the form of retained earnings. These amounts re ...

... we want one-third (or $60,000) to be debt ($180,000*1/3 = $60,000) and the other $120,000 to be common equity ($180,000*2/3=$120,000). Of the $120,000 of equity, only $20,000 of new common stock needs to be sold since we will have $100,000 available in the form of retained earnings. These amounts re ...

Bank-Based or Market-Based Financial Systems: Which

... they form long-run relationships with firms and do not reveal information immediately in public markets [Boot, Greenbaum, and Thakor 1993]. Proponents of the bank-based view also stress that liquid markets create a myopic investor climate [Bhide 1993]. In liquid markets, investors can inexpensively ...

... they form long-run relationships with firms and do not reveal information immediately in public markets [Boot, Greenbaum, and Thakor 1993]. Proponents of the bank-based view also stress that liquid markets create a myopic investor climate [Bhide 1993]. In liquid markets, investors can inexpensively ...

Euro Currency Risk in Global Equities

... The third reason to be concerned about euro exposure is that the nominal and real value of the US Dollar is at a historic low on a trade-weighted basis. Currency cycles tend to last from 5 to 15 years, and over the past decade the dollar’s weakening has contributed positive returns to unhedged inter ...

... The third reason to be concerned about euro exposure is that the nominal and real value of the US Dollar is at a historic low on a trade-weighted basis. Currency cycles tend to last from 5 to 15 years, and over the past decade the dollar’s weakening has contributed positive returns to unhedged inter ...

Progress Report on Programme for Government 2007

... people and from €16,000 to €20,000 for couples or widowed persons. As income tax rates are reduced, we will keep the rate of mortgage interest relief at 20% for all home owners. ...

... people and from €16,000 to €20,000 for couples or widowed persons. As income tax rates are reduced, we will keep the rate of mortgage interest relief at 20% for all home owners. ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.