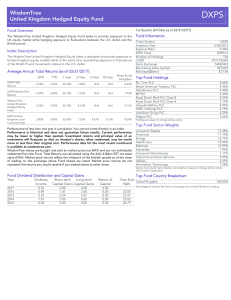

WisdomTree United Kingdom Hedged Equity Fund

... There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors increase their vulnerability to any sing ...

... There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors increase their vulnerability to any sing ...

Review Questions

... A syndicate is a group of investment banks, each of which underwrites a proportion of a new securities offering. In this way, the risk to one investment bank of underwriting an entire issuance is reduced. What is a prospectus? What are the differences between a prospectus, a registration statement, ...

... A syndicate is a group of investment banks, each of which underwrites a proportion of a new securities offering. In this way, the risk to one investment bank of underwriting an entire issuance is reduced. What is a prospectus? What are the differences between a prospectus, a registration statement, ...

Top margin 1

... Belgian KBC Group The European Commission has approved, under EC Treaty state aid rules, an emergency recapitalisation worth €3.5 billion that the Belgian authorities intend to grant to KBC Group N.V. The Commission found the measure to be in line with its Guidance Communications on state aid during ...

... Belgian KBC Group The European Commission has approved, under EC Treaty state aid rules, an emergency recapitalisation worth €3.5 billion that the Belgian authorities intend to grant to KBC Group N.V. The Commission found the measure to be in line with its Guidance Communications on state aid during ...

PCC Financial Ratios for Fiscal Years 2007-2016

... GASB 68 is excluded. Return on Net Assets Ratio Measures total economic return. While an increasing trend reflects strength, a decline may be appropriate and even warranted if it represents a strategy on the part of the institution to fulfill its mission. The numerator for this ratio is change in ne ...

... GASB 68 is excluded. Return on Net Assets Ratio Measures total economic return. While an increasing trend reflects strength, a decline may be appropriate and even warranted if it represents a strategy on the part of the institution to fulfill its mission. The numerator for this ratio is change in ne ...

Preliminary Results Announcement

... Securities Exchange Act of 1934 and Section 27A of the US Securities Act of 1933 with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition and performance and the markets in which it operates. These forward-looking statements can b ...

... Securities Exchange Act of 1934 and Section 27A of the US Securities Act of 1933 with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition and performance and the markets in which it operates. These forward-looking statements can b ...

Essentials of Finance

... coupon rate, a bond will sell at its par value An increase in interest rates will cause the price of an outstanding bond to fall. A decrease in interest rates will cause the price to rise. The market value of a bond will always approach its par value as its maturity date approaches, provided the fir ...

... coupon rate, a bond will sell at its par value An increase in interest rates will cause the price of an outstanding bond to fall. A decrease in interest rates will cause the price to rise. The market value of a bond will always approach its par value as its maturity date approaches, provided the fir ...

Geoff Bertram`s comments - Victoria University of Wellington

... correct, then the only flow we have to estimate is consumption (plus, I suppose, depreciation whatever that means!) – the rest falls into place by arithmetic. All the complicated procedures of SNA accounting, with its attempts to estimate flows directly, are ultimately no more than an operational al ...

... correct, then the only flow we have to estimate is consumption (plus, I suppose, depreciation whatever that means!) – the rest falls into place by arithmetic. All the complicated procedures of SNA accounting, with its attempts to estimate flows directly, are ultimately no more than an operational al ...

The purpose of this presentation is trace some of the key

... attempts to explain and respond to the current financial crisis. Many commentators have asked why so many economists failed to foresee the current financial crisis and we argue that part of the explanation lies in that discipline’s failure to understand institutions and, by implication, the evolutio ...

... attempts to explain and respond to the current financial crisis. Many commentators have asked why so many economists failed to foresee the current financial crisis and we argue that part of the explanation lies in that discipline’s failure to understand institutions and, by implication, the evolutio ...

05RISKS FROM LOW INTEREST RATES – OPPORTUNITIES FROM

... other indicators, could signal heightened risks of a financial crisis (Borio and Drehmann, 2009; GCEE Annual Economic Report 2014 box 14). If one additionally takes into account corporate profits, signs are mixed with regard to potential exaggerations. Profits of major euro area companies (Euro Stox ...

... other indicators, could signal heightened risks of a financial crisis (Borio and Drehmann, 2009; GCEE Annual Economic Report 2014 box 14). If one additionally takes into account corporate profits, signs are mixed with regard to potential exaggerations. Profits of major euro area companies (Euro Stox ...

economic and market outlook 2016 and beyond

... Inflation is likely to rise sharply early in the year, following the same pattern as in the US, because of the significant drop in prices, which creates the possibility for a strong rebound. Figure 9 shows that the BoE expects to see inflation rise back to its 2% per annum target over the next two t ...

... Inflation is likely to rise sharply early in the year, following the same pattern as in the US, because of the significant drop in prices, which creates the possibility for a strong rebound. Figure 9 shows that the BoE expects to see inflation rise back to its 2% per annum target over the next two t ...

Price Dispersion in OTC Markets: A New

... bond (Treasury and corporate), most new derivative markets etc. • Microstructure of OTC markets is different from exchangetraded (ET) markets. • Lack of a centralized trading platform: Trades are result of bilateral negotiations → Trades can take place at different prices at the same time. • Search ...

... bond (Treasury and corporate), most new derivative markets etc. • Microstructure of OTC markets is different from exchangetraded (ET) markets. • Lack of a centralized trading platform: Trades are result of bilateral negotiations → Trades can take place at different prices at the same time. • Search ...

World Bank Document

... Fannie Mae was chartered originally as a government enterprise to add liquidity to the mortgage market and hopefully to lower the costs of borrowing for mortgages. Fannie borrowed money cheaply on capital markets because it was a government entity and used it to buy mortgages. Fannie Mae was privati ...

... Fannie Mae was chartered originally as a government enterprise to add liquidity to the mortgage market and hopefully to lower the costs of borrowing for mortgages. Fannie borrowed money cheaply on capital markets because it was a government entity and used it to buy mortgages. Fannie Mae was privati ...

SKS Consulting - Company Rescue

... Former CEO hired 5 finance directors in 18 months 3. Company overpaid for bad acquisitions 4. Revenues decreased 19% from prior year 5. Acquired company shut down after 6 months 6. Parent company treating newly acquired company poorly, creating un-repairable damage with clients and vendors 7. Client ...

... Former CEO hired 5 finance directors in 18 months 3. Company overpaid for bad acquisitions 4. Revenues decreased 19% from prior year 5. Acquired company shut down after 6 months 6. Parent company treating newly acquired company poorly, creating un-repairable damage with clients and vendors 7. Client ...

chapter06 - IIS-RU

... Permits the bondholder to convert the bond into shares of common stock at a fixed price Investors cannot convert the stocks back to bonds ...

... Permits the bondholder to convert the bond into shares of common stock at a fixed price Investors cannot convert the stocks back to bonds ...

baker sample chapter

... Virtually every decision that a business makes has financial implications. Thus, financial decisions are not limited to the chief executive officer (CEO) and a handful of finance specialists. Managers involved in many areas within an organization such as production, marketing, engineering, and human ...

... Virtually every decision that a business makes has financial implications. Thus, financial decisions are not limited to the chief executive officer (CEO) and a handful of finance specialists. Managers involved in many areas within an organization such as production, marketing, engineering, and human ...

Criteria for an appropriate countercyclical capital buffer

... by deposits from households and firms, but deposits are limited by households’ financial savings and firms’ accumulation of liquid assets. In periods where banks’ lending growth exceeds deposit growth, banks must raise a larger share of their funding directly in the financial market. A high and risi ...

... by deposits from households and firms, but deposits are limited by households’ financial savings and firms’ accumulation of liquid assets. In periods where banks’ lending growth exceeds deposit growth, banks must raise a larger share of their funding directly in the financial market. A high and risi ...

2nd ed Chapter 8

... order to exchange something they have to get something different in return. Free trade refers to trade that is unregulated by the government and free of restrictions and taxes. ...

... order to exchange something they have to get something different in return. Free trade refers to trade that is unregulated by the government and free of restrictions and taxes. ...

The Economy and Financial Markets November 15, 2007

... High yield/junk bonds are not investment grade securities, involve substantial risks and generally should be part of the diversified portfolio of sophisticated investors. Small cap stocks may be subject to a higher degree of risk than more established companies’ securities. The illiquidity of the sm ...

... High yield/junk bonds are not investment grade securities, involve substantial risks and generally should be part of the diversified portfolio of sophisticated investors. Small cap stocks may be subject to a higher degree of risk than more established companies’ securities. The illiquidity of the sm ...

NBER WORKING PAPER SERIES IS FINANCIAL GLOBALIZATION BENEFICIAL? Frederic S. Mishkin

... returns on capital are similar.2 The amount of capital flowing to emerging market countries, which increased dramatically in the 1990s, and is now over $300 billion at an annual rate may sound like a lot, but it is only onefifth of total international capital flows. When governments are added into t ...

... returns on capital are similar.2 The amount of capital flowing to emerging market countries, which increased dramatically in the 1990s, and is now over $300 billion at an annual rate may sound like a lot, but it is only onefifth of total international capital flows. When governments are added into t ...

Macro 4.1- Intro to Money

... “E Pluribus Unum” 5. Lincoln means…. 6. Jefferson “Out of Many, One” 7. JFK 8. FDR 9. Cleveland 10. Wilson ...

... “E Pluribus Unum” 5. Lincoln means…. 6. Jefferson “Out of Many, One” 7. JFK 8. FDR 9. Cleveland 10. Wilson ...

glossary and abbreviations - ACT Treasury

... Includes general revenue in the form of Goods and Services Tax (GST) grants from the Commonwealth Government for the purpose of contributing to the financing of the current operations of the recipient. This is in addition to monies received for specific purposes, where the Commonwealth Government wi ...

... Includes general revenue in the form of Goods and Services Tax (GST) grants from the Commonwealth Government for the purpose of contributing to the financing of the current operations of the recipient. This is in addition to monies received for specific purposes, where the Commonwealth Government wi ...

Financial Intermediation and Endogenous Growth

... economize on liquid reserve holdings that do not contribute to capital accumulation. Or, more specifically, banks reduce investment in liquid assets relative to the situation in an economy lacking intermediaries where each individual must self-insure against unpredictable liquidity needs. And finall ...

... economize on liquid reserve holdings that do not contribute to capital accumulation. Or, more specifically, banks reduce investment in liquid assets relative to the situation in an economy lacking intermediaries where each individual must self-insure against unpredictable liquidity needs. And finall ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.