Krajowe Stowarzyszenie Funduszy Poręczeniowych

... 1) The funds provide guarantees of micro, small and medium enterprises (definition of the European Commission), doing business and having its registered office in Poland. In the case of funds that have been supported by the RPO (operational programs in the Regions) or the JEREMIE program, guarantee ...

... 1) The funds provide guarantees of micro, small and medium enterprises (definition of the European Commission), doing business and having its registered office in Poland. In the case of funds that have been supported by the RPO (operational programs in the Regions) or the JEREMIE program, guarantee ...

Slide 1

... Abandon the global economy market driven growth strategy because of the advanced countries financial sector failures even though the medium term returns in terms of growth may be lower. Continue with the energy subsidies on the assumption that with the crisis induced decline of commodity price, ...

... Abandon the global economy market driven growth strategy because of the advanced countries financial sector failures even though the medium term returns in terms of growth may be lower. Continue with the energy subsidies on the assumption that with the crisis induced decline of commodity price, ...

here

... across sectors at the regional and country level • Examples: early warning systems, hydro-met program, climate resilient investment facility ...

... across sectors at the regional and country level • Examples: early warning systems, hydro-met program, climate resilient investment facility ...

Comparative Financial Systems: A Survey

... One of the primary purposes of the financial system is to allow savings to be invested in firms. In a series of important papers, Mayer (1988, 1990) documents how firms obtained funds and financed investment in a number of different countries. Table 2 shows the results from the most recent set of stu ...

... One of the primary purposes of the financial system is to allow savings to be invested in firms. In a series of important papers, Mayer (1988, 1990) documents how firms obtained funds and financed investment in a number of different countries. Table 2 shows the results from the most recent set of stu ...

A CREDIT AND BANKING MODEL FOR EMERGING PHILIPPINES

... monetary policy tools. Unlike most models available in the literature, we consider the use of reserve requirements on bank deposits that are frequently used in many emerging Asian economies including the Philippines. Finally, we assess the use of liquidity requirements on banks or equivalently shock ...

... monetary policy tools. Unlike most models available in the literature, we consider the use of reserve requirements on bank deposits that are frequently used in many emerging Asian economies including the Philippines. Finally, we assess the use of liquidity requirements on banks or equivalently shock ...

Are European banks a buy?

... A strong justification for a higher level of banking sector profitability is that all this new capital has to be somehow remunerated. That is, capital providers (shareholders) will require higher compensation to be paid for by bank customers in the form of higher costs of financial intermediation, a ...

... A strong justification for a higher level of banking sector profitability is that all this new capital has to be somehow remunerated. That is, capital providers (shareholders) will require higher compensation to be paid for by bank customers in the form of higher costs of financial intermediation, a ...

Startup Financial Engineering Tutorial

... ◦ Overall, this is much higher than for most industries ◦ However, 15% growth versus 50% growth is consistent with observed 90% public equity decline ◦ Next-generation areas will grow much faster (50%) ...

... ◦ Overall, this is much higher than for most industries ◦ However, 15% growth versus 50% growth is consistent with observed 90% public equity decline ◦ Next-generation areas will grow much faster (50%) ...

Creating value in the semiconductor industry

... Employ strategic sourcing focused on total cost of materials • Optimize consumption to reduce material usage ...

... Employ strategic sourcing focused on total cost of materials • Optimize consumption to reduce material usage ...

Monthly Economic and Financial Developments May 2008 Release Date: 7 July 2008

... (3.95%), and transportation & communication (3.03%). 2. International Developments Indications are that the global economy remained weak during the first five months of the year, amid an environment of economic uncertainty and rising prices, which tempered gains in production and consumer spending. ...

... (3.95%), and transportation & communication (3.03%). 2. International Developments Indications are that the global economy remained weak during the first five months of the year, amid an environment of economic uncertainty and rising prices, which tempered gains in production and consumer spending. ...

Page 1 Important information This information has been provided by

... hand-outs. Housing finance has picked up – particularly for new housing construction – spurred on by extremely low interest rates, and the Government’s grants to first home buyers. However, we have yet to see the full effect of the global recession on exports or business investment. ...

... hand-outs. Housing finance has picked up – particularly for new housing construction – spurred on by extremely low interest rates, and the Government’s grants to first home buyers. However, we have yet to see the full effect of the global recession on exports or business investment. ...

PPT-EN - United Nations Statistics Division

... The Delineation of the Public Sector – Public Control Indicators for Government control of corporations: 1. Ownership of the majority of the voting interest 2. Control of the board or other governing body 3. Control of the appointment and removal of key personnel 4. Control of key committees of the ...

... The Delineation of the Public Sector – Public Control Indicators for Government control of corporations: 1. Ownership of the majority of the voting interest 2. Control of the board or other governing body 3. Control of the appointment and removal of key personnel 4. Control of key committees of the ...

Week ended June 28, 2013 Indian Economic Update

... regarding Fed QE tapering, wide current account deficit too poses a risk to the Rupee. Though the capital flows were relatively benign in FY2013, going forward, CAD financing could pose a challenge in light of tight liquidity scenario in the Global Financial Markets. Therefore, in the medium to long ...

... regarding Fed QE tapering, wide current account deficit too poses a risk to the Rupee. Though the capital flows were relatively benign in FY2013, going forward, CAD financing could pose a challenge in light of tight liquidity scenario in the Global Financial Markets. Therefore, in the medium to long ...

Chapter 2

... Foreign exchange market has two functions: the first is to convert one currency into another (the spot exchange market); the second is to provide insurance against foreign exchange risk (the forward exchange market). ...

... Foreign exchange market has two functions: the first is to convert one currency into another (the spot exchange market); the second is to provide insurance against foreign exchange risk (the forward exchange market). ...

Religion and People`s Choice of Financial Assets

... How to cite this paper: Li, Y. and Zhu, P. (2016) Religion and People’s Choice of Financial Assets: A Research Based on CGSS2010. Open Journal of Social Sciences, 4, 4-12. http://dx.doi.org/10.4236/jss.2016.44002 ...

... How to cite this paper: Li, Y. and Zhu, P. (2016) Religion and People’s Choice of Financial Assets: A Research Based on CGSS2010. Open Journal of Social Sciences, 4, 4-12. http://dx.doi.org/10.4236/jss.2016.44002 ...

Monetary Policy - India schools, colleges, education

... magnitudes or variables such as money supply, interest rates and availability of credit. • Monetary Policy ultimately operates through its influence on expenditure flows in the economy. • In other words affects liquidity and by affecting liquidity, and thus credit, it affects total demand in the eco ...

... magnitudes or variables such as money supply, interest rates and availability of credit. • Monetary Policy ultimately operates through its influence on expenditure flows in the economy. • In other words affects liquidity and by affecting liquidity, and thus credit, it affects total demand in the eco ...

the case of Vietnam

... undergoing rapid transformation. In contrast to earlier literature which tended to paint pictures at relatively aggregate levels, our results have focused on the key individual financial factors which go to building up a profile of enterprise value generation potential. Generally, our analysis shows ...

... undergoing rapid transformation. In contrast to earlier literature which tended to paint pictures at relatively aggregate levels, our results have focused on the key individual financial factors which go to building up a profile of enterprise value generation potential. Generally, our analysis shows ...

Section 3 - State of New Jersey

... analysis involves the evaluation of cost information in order to estimate contract costs to be incurred and reimbursed or prices to be paid. The information evaluated in the cost analysis process includes data concerning the cost of labor, materials, indirect costs and other cost components expected ...

... analysis involves the evaluation of cost information in order to estimate contract costs to be incurred and reimbursed or prices to be paid. The information evaluated in the cost analysis process includes data concerning the cost of labor, materials, indirect costs and other cost components expected ...

FASB Update Name of Event

... • Pushdown accounting is the practice of adjusting the stand-alone financial statements of an acquired entity (the “acquiree”) to reflect the accounting basis of the investor (or “acquirer”). • Such new basis is typically the fair value of the identifiable assets acquired and liabilities assumed. • ...

... • Pushdown accounting is the practice of adjusting the stand-alone financial statements of an acquired entity (the “acquiree”) to reflect the accounting basis of the investor (or “acquirer”). • Such new basis is typically the fair value of the identifiable assets acquired and liabilities assumed. • ...

Bond Interest Payments Mason Company Investors

... (contract) rate is used is for this one calculation (to determine the actual interest to be paid). ALL other calculations use the market rate because we are “tailoring” the bond to the investor’s required rate of return. Face value of bond X Stated rate of interest ...

... (contract) rate is used is for this one calculation (to determine the actual interest to be paid). ALL other calculations use the market rate because we are “tailoring” the bond to the investor’s required rate of return. Face value of bond X Stated rate of interest ...

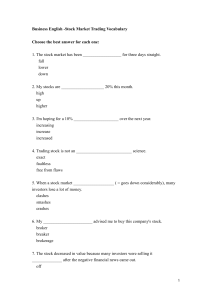

Business English -Stock Market Trading Vocabulary

... Choose the best answer for each one: 1. The stock market has been __________________ for three days straight. fall lower down 2. My stocks are ____________________ 20% this month. high up higher 3. I'm hoping for a 10% _____________________ over the next year. increasing increase increased 4. Tradin ...

... Choose the best answer for each one: 1. The stock market has been __________________ for three days straight. fall lower down 2. My stocks are ____________________ 20% this month. high up higher 3. I'm hoping for a 10% _____________________ over the next year. increasing increase increased 4. Tradin ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.