Financial Frictions in Macroeconomic Fluctuations

... Federal Reserve Bank of Richmond Economic Quarterly 1. Real activity causes movements in financial flows. One hypothesis is that investment and employment respond to changes in real factors such as movements in productivity. In this case, borrowers cut their debt simply because they need less funds ...

... Federal Reserve Bank of Richmond Economic Quarterly 1. Real activity causes movements in financial flows. One hypothesis is that investment and employment respond to changes in real factors such as movements in productivity. In this case, borrowers cut their debt simply because they need less funds ...

MR0159 - Loan Value granted to Significant Security Positions Held

... What are the current regulatory requirements with respect to the margining of securities? IDA Regulation 100 sets out the various margin rates for securities. These rates are the minimum regulatory rates that are required to be used for Member firm and customer account positions and they are set bas ...

... What are the current regulatory requirements with respect to the margining of securities? IDA Regulation 100 sets out the various margin rates for securities. These rates are the minimum regulatory rates that are required to be used for Member firm and customer account positions and they are set bas ...

officer`s certificate

... Customer has written policies, procedures, and controls, approved by Customer’s governing body, which provide an appropriate, comprehensive risk management framework that, at a minimum, clearly identifies and documents the range of risks to which Customer is exposed, including, but not limited to (i ...

... Customer has written policies, procedures, and controls, approved by Customer’s governing body, which provide an appropriate, comprehensive risk management framework that, at a minimum, clearly identifies and documents the range of risks to which Customer is exposed, including, but not limited to (i ...

Borghesi-Vita-02142016

... “Value, Survival, and the Evolution of Firm Organizational Structure” (coauthored with Andy Naranjo and Joel Houston), University of Kansas, 2003. “Value, Survival, and the Evolution of Firm Organizational Structure” (coauthored with Andy Naranjo and Joel Houston), Financial Management Associati ...

... “Value, Survival, and the Evolution of Firm Organizational Structure” (coauthored with Andy Naranjo and Joel Houston), University of Kansas, 2003. “Value, Survival, and the Evolution of Firm Organizational Structure” (coauthored with Andy Naranjo and Joel Houston), Financial Management Associati ...

Cash Flow IN Sources of Cash Flow in

... after subtracting CoGS Is the percentage of Sales that contributes to Fixed Expenses and Profit. ...

... after subtracting CoGS Is the percentage of Sales that contributes to Fixed Expenses and Profit. ...

- Roosevelt Institute

... and productive market economy. But after decades of deregulation, the current U.S. financial system has evolved into a highly speculative system that has failed rather spectacularly at performing these critical tasks. What has this flawed financial system cost the U.S. economy? How much have America ...

... and productive market economy. But after decades of deregulation, the current U.S. financial system has evolved into a highly speculative system that has failed rather spectacularly at performing these critical tasks. What has this flawed financial system cost the U.S. economy? How much have America ...

L`essentiel en un clin d`oeil

... the 2nd quarter was more favourable. Bonds, currencies but also equities delivered positive performances in an environment characterized by historically low volatility and interest rates at very low levels in the developed world (optimal conditions for the carry trade). In general, the emerging coun ...

... the 2nd quarter was more favourable. Bonds, currencies but also equities delivered positive performances in an environment characterized by historically low volatility and interest rates at very low levels in the developed world (optimal conditions for the carry trade). In general, the emerging coun ...

`The Alignment of Monetary Policy and Banking Regulations in Belize`

... severity and speed of the crisis came as a surprise to many including central bankers. They claim that the securitization based subprime mortgages in the US was the proximate causes of the crisis and the first major liquidity problem in the banking system was noted in Europe and what followed was a ...

... severity and speed of the crisis came as a surprise to many including central bankers. They claim that the securitization based subprime mortgages in the US was the proximate causes of the crisis and the first major liquidity problem in the banking system was noted in Europe and what followed was a ...

Chapter 6

... based on the past The expected risk-return tradeoff is uncertain and may not occur ...

... based on the past The expected risk-return tradeoff is uncertain and may not occur ...

Mechanics of Trading Securities

... versus the average daily trading volume. This can often be greater than all other costs—Beware! ...

... versus the average daily trading volume. This can often be greater than all other costs—Beware! ...

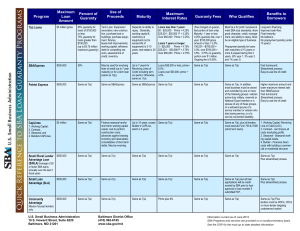

Program Maximum Loan Amount Percent of Guaranty Use of

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of ...

... servicing fee of 0.625%1.5% on unpaid balance Ongoing guaranty fee (FY 2012) is 0.9375% of ...

Black-Markets for Currency, Hoarding Activity and Policy Reforms

... A. Portfolio Demands in the Black Market The consumer/investor chooses an optimal division of his wealth among domestic savings, foreign savings, and hoarding of goods. The investment assets have some trend rates of return, and each of these returns have a stochastic element (represented by a Browni ...

... A. Portfolio Demands in the Black Market The consumer/investor chooses an optimal division of his wealth among domestic savings, foreign savings, and hoarding of goods. The investment assets have some trend rates of return, and each of these returns have a stochastic element (represented by a Browni ...

PR_Well-established cooperation-icubic is the official

... quality and reliability standards. This is especially important for Börse Stuttgart, who understands the daily challenges all too well. "This cooperation significantly reduces the integration effort on the market-maker side”, explains Michael Görgens, Managing Director of ETF and Bond Trading at Bör ...

... quality and reliability standards. This is especially important for Börse Stuttgart, who understands the daily challenges all too well. "This cooperation significantly reduces the integration effort on the market-maker side”, explains Michael Görgens, Managing Director of ETF and Bond Trading at Bör ...

Why Have the Fed`s Polices Failed to Stimulate the Economy?

... policy. (The Board of Governors voted to keep the discount rate unchanged.) A lower natural rate of interest. The natural rate of interest has fallen as expected rates of return have declined and potential growth has been reduced by weak investment and productivity. These trends have heightened pess ...

... policy. (The Board of Governors voted to keep the discount rate unchanged.) A lower natural rate of interest. The natural rate of interest has fallen as expected rates of return have declined and potential growth has been reduced by weak investment and productivity. These trends have heightened pess ...

How to Liberate America from Wall Street Rule

... and the livelihood of the American people. What really matters to the life of our nation is enabling entrepreneurs to build new businesses that create more well-paying jobs, and enabling families to put a roof over their heads and educate their children.” Sheila Bair, FDIC Chair, March 16, 2011 “Fin ...

... and the livelihood of the American people. What really matters to the life of our nation is enabling entrepreneurs to build new businesses that create more well-paying jobs, and enabling families to put a roof over their heads and educate their children.” Sheila Bair, FDIC Chair, March 16, 2011 “Fin ...

External Dependence and Industry Growth Does Financial Structure

... show that industries that depend more on external finance grow relatively faster in economies with a higher level of financial development. This result is robust to the use of alternative measures of financial development and external dependence. Furthermore, Rajan and Zingales show that the effect ...

... show that industries that depend more on external finance grow relatively faster in economies with a higher level of financial development. This result is robust to the use of alternative measures of financial development and external dependence. Furthermore, Rajan and Zingales show that the effect ...

The European Central Bank as Lender of Last Resort

... Emergency Liquidity Assistance (ELA) is still the European Central Bank’s only and most important instrument to provide liquidity for individual banks. The ECB’s role as lender of last resort (LLR) is frequently equated with the ELA.1 In contrast to all other monetary policy operations, the ELA prov ...

... Emergency Liquidity Assistance (ELA) is still the European Central Bank’s only and most important instrument to provide liquidity for individual banks. The ECB’s role as lender of last resort (LLR) is frequently equated with the ELA.1 In contrast to all other monetary policy operations, the ELA prov ...

Advanced Petrochemical Co.

... Gross profit (GP) came in at SAR 202 million in Q3 2016 slumping 18.6% YoY due to lower selling prices. Nonetheless, GP soared 0.36% QoQ driven by the decrease in feedstock prices. Operating income (EBIT) hit SAR 193 million in Q3 2016 shifting down 19.7% YoY while surging 0.75% QoQ. The average pro ...

... Gross profit (GP) came in at SAR 202 million in Q3 2016 slumping 18.6% YoY due to lower selling prices. Nonetheless, GP soared 0.36% QoQ driven by the decrease in feedstock prices. Operating income (EBIT) hit SAR 193 million in Q3 2016 shifting down 19.7% YoY while surging 0.75% QoQ. The average pro ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.