UK Financial Ombudsman Service

... 2001. But it brought together a number of existing financial services ombudsman schemes. An ombudsman has been an important feature of alternative dispute resolution in financial services for many years. The first scheme, the Insurance Ombudsman Bureau, was set up in 1981. So for 30 years or so, con ...

... 2001. But it brought together a number of existing financial services ombudsman schemes. An ombudsman has been an important feature of alternative dispute resolution in financial services for many years. The first scheme, the Insurance Ombudsman Bureau, was set up in 1981. So for 30 years or so, con ...

8. Non-current liabilities- bonds

... rates, whereas their market values are based on current rates, book values and market values will differ subsequent to issuance. As we will see, this creates the potential for income management by retiring bonds before their ultimate principal is due. Retirement can be by redemption (for cash) or by ...

... rates, whereas their market values are based on current rates, book values and market values will differ subsequent to issuance. As we will see, this creates the potential for income management by retiring bonds before their ultimate principal is due. Retirement can be by redemption (for cash) or by ...

Capital Reduction

... capital so that its capital level truly reflects the past loss. Thus, new investors will be able to inject funds at a price that properly reflects the firm’s value. ...

... capital so that its capital level truly reflects the past loss. Thus, new investors will be able to inject funds at a price that properly reflects the firm’s value. ...

DIGITAL CURRENCIES AND P2P BLOCKCHAIN LEDGERS (1) By

... In the case of cash, that would be the federal government, that sets the parameters of the money supply, the actual production of the bank notes and coins, sets interest rates (through the Bank of Canada), and the like. As for the other forms of payment noted above, credit card systems typically hav ...

... In the case of cash, that would be the federal government, that sets the parameters of the money supply, the actual production of the bank notes and coins, sets interest rates (through the Bank of Canada), and the like. As for the other forms of payment noted above, credit card systems typically hav ...

cross-country correlation: case of the baltic states

... can point to Estonia’s potential lead role. When it comes to external factors, one potential explanation could be linked to Estonia’s geographical proximity and deeper interlinkages with more advanced Northern European economies (of course, assuming that these connections play a role in economic con ...

... can point to Estonia’s potential lead role. When it comes to external factors, one potential explanation could be linked to Estonia’s geographical proximity and deeper interlinkages with more advanced Northern European economies (of course, assuming that these connections play a role in economic con ...

Official Information of 27 June 2012

... calculate the capital requirement for credit risk. 2. Pursuant to Article 8b(1)(b) and Article 8b(2) of the Act on Banks, respectively Article 7a(1)(b) and Article 7a(2) of the Act on Credit Unions in connection with Article 24(1) and (4) and Article 29(1) of Decree No. 123/2007 Coll., stipulating t ...

... calculate the capital requirement for credit risk. 2. Pursuant to Article 8b(1)(b) and Article 8b(2) of the Act on Banks, respectively Article 7a(1)(b) and Article 7a(2) of the Act on Credit Unions in connection with Article 24(1) and (4) and Article 29(1) of Decree No. 123/2007 Coll., stipulating t ...

Advanced Accounting by Hoyle et al, 6th Edition

... Contractual arrangements limit returns to equity holders yet participation rights provide increased profit potential and risks to sponsor. Risks and rewards are not distributed according to stock ownership but by other variable interests. Sponsor’s economic interest vary depending on the VIE’s succe ...

... Contractual arrangements limit returns to equity holders yet participation rights provide increased profit potential and risks to sponsor. Risks and rewards are not distributed according to stock ownership but by other variable interests. Sponsor’s economic interest vary depending on the VIE’s succe ...

Wells Real Estate Investment Trust, Inc.

... illiquid because there is no current public market for the shares and, therefore, it can be difficult to sell the shares. In addition, the price received for any shares sold would likely be less than this estimated share value. Further, real estate markets fluctuate, and real estate values can decli ...

... illiquid because there is no current public market for the shares and, therefore, it can be difficult to sell the shares. In addition, the price received for any shares sold would likely be less than this estimated share value. Further, real estate markets fluctuate, and real estate values can decli ...

In the following paper, I will explore one vector of the financialization

... firms for servicing financial obligations and fueling future capital accumulation. Overindebtedness could arise within one particular segment of a sector, but very little in the way of a build up in financial obligations between sectors would arise. The more households increases their proclivity to ...

... firms for servicing financial obligations and fueling future capital accumulation. Overindebtedness could arise within one particular segment of a sector, but very little in the way of a build up in financial obligations between sectors would arise. The more households increases their proclivity to ...

Euromoney Institutional Investor PLC acquires Arete Consulting

... was founded in 2001 by its managing director and principal shareholder, Robert Benson, formerly Global Head of Structured Products at HSBC. Arete’s proprietary Structured Retail Products database – www.StructuredRetailProducts.com - contains information on over 1.3 million products with significant ...

... was founded in 2001 by its managing director and principal shareholder, Robert Benson, formerly Global Head of Structured Products at HSBC. Arete’s proprietary Structured Retail Products database – www.StructuredRetailProducts.com - contains information on over 1.3 million products with significant ...

Net Noninterest Income

... • Stock Values and Profitability Ratios • Measuring Credit, Liquidity, and Other Risks • The UBPR and Comparing Performance McGraw-Hill/Irwin Bank Management and Financial Services, 7/e ...

... • Stock Values and Profitability Ratios • Measuring Credit, Liquidity, and Other Risks • The UBPR and Comparing Performance McGraw-Hill/Irwin Bank Management and Financial Services, 7/e ...

Our Banking practice – at the heart of the world`s financial markets

... cross-border nature of many of the transactions we act on means that there is also a great deal of collaboration between groups. For example, we have developed cross-practice teams to advise on key issues for our clients such as Britain’s proposed exit from the EU and the increased importance of fin ...

... cross-border nature of many of the transactions we act on means that there is also a great deal of collaboration between groups. For example, we have developed cross-practice teams to advise on key issues for our clients such as Britain’s proposed exit from the EU and the increased importance of fin ...

U.S. Growth, the Housing Market and the Distribution of Income 1

... related to stock market movements (figure 2). Consumption theories can hardly be reconciled with these two concurrent phenomena. A standard hypothesis, laid down in the Post-Keynesian theories of consumption, is that the propensity to consume out of wages is low, while the propensity to spend out o ...

... related to stock market movements (figure 2). Consumption theories can hardly be reconciled with these two concurrent phenomena. A standard hypothesis, laid down in the Post-Keynesian theories of consumption, is that the propensity to consume out of wages is low, while the propensity to spend out o ...

cbm 2003 Version of Trade Cycle

... actually take the form of lending through banking institutions, it can also take the form of retained earnings or the buying of bonds or equity shares. The demand price is similarly interpreted to include the various ways that the business community can take command of unconsumed output—which consti ...

... actually take the form of lending through banking institutions, it can also take the form of retained earnings or the buying of bonds or equity shares. The demand price is similarly interpreted to include the various ways that the business community can take command of unconsumed output—which consti ...

Investment risk, return and volatility

... investment managers are reviewed on a regular basis. The Fund’s investment advisers in conjunction with the Fund develop the investment strategy for each of the investment options. All investment options are actively managed and take a long-term investment approach to delivering the targeted return ...

... investment managers are reviewed on a regular basis. The Fund’s investment advisers in conjunction with the Fund develop the investment strategy for each of the investment options. All investment options are actively managed and take a long-term investment approach to delivering the targeted return ...

Higher mortgage rates, lower housing affordability

... Mortgage rates have continued to follow U.S. Treasury yields higher in the wake of the U.S. presidential election, eliciting questions about the future course of interest rates in the year ahead and, if sustained, the subsequent effect on housing affordability. According to Freddie Mac, the 30-year ...

... Mortgage rates have continued to follow U.S. Treasury yields higher in the wake of the U.S. presidential election, eliciting questions about the future course of interest rates in the year ahead and, if sustained, the subsequent effect on housing affordability. According to Freddie Mac, the 30-year ...

Financial distress and firm performance: Evidence from the Asian

... assets of the firm. Leverage is calculated as the book value of the firm’s long-term debt divided by total assets. I obtain eight years of financial information from each firm. The final sample consists of 277 firms from the eight countries/economies, for a total of 2,216 firm-years. In general, the ...

... assets of the firm. Leverage is calculated as the book value of the firm’s long-term debt divided by total assets. I obtain eight years of financial information from each firm. The final sample consists of 277 firms from the eight countries/economies, for a total of 2,216 firm-years. In general, the ...

2017 Global Market Outlook — Q2 update

... Our investment process is based on the building blocks of business cycle, value and sentiment, and here’s how we see it at the beginning of the second quarter of 2017: ›› Business cycle: It’s a mixed cycle outlook for global equities, and tailwinds for equities in our view appear strongest in Europe ...

... Our investment process is based on the building blocks of business cycle, value and sentiment, and here’s how we see it at the beginning of the second quarter of 2017: ›› Business cycle: It’s a mixed cycle outlook for global equities, and tailwinds for equities in our view appear strongest in Europe ...

I 1) Which of the following is NOT an example of a

... 4) If someone is bearish in the market? a) He expects the market to rise. b) He expects the market to fall. c) He expects the market to move sideways. d) He expects the market to close. 5) A rice exporter will be purchasing rice soon. He is afraid that higher prices could wipe out his potential prof ...

... 4) If someone is bearish in the market? a) He expects the market to rise. b) He expects the market to fall. c) He expects the market to move sideways. d) He expects the market to close. 5) A rice exporter will be purchasing rice soon. He is afraid that higher prices could wipe out his potential prof ...

rlp/blackrock aquila over 5 years index linked gilt

... RLP/BLACKROCK AQUILA OVER 5 YEARS INDEX LINKED GILT INDEX ...

... RLP/BLACKROCK AQUILA OVER 5 YEARS INDEX LINKED GILT INDEX ...

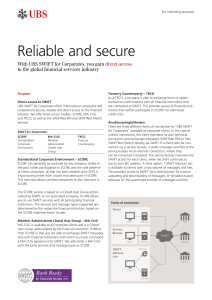

factsheet SWIFT for Corporates

... Member Administered Closed User Group – MA-CUG MA-CUG is available to all corporate clients and is a Closed User Group administered by the financial institution. It differs from SCORE in that you are able to exchange SWIFT messages only with financial institutions with which you have concluded a MA- ...

... Member Administered Closed User Group – MA-CUG MA-CUG is available to all corporate clients and is a Closed User Group administered by the financial institution. It differs from SCORE in that you are able to exchange SWIFT messages only with financial institutions with which you have concluded a MA- ...

Analysis of the Effect of Inflation, Interest Rates, and Exchange

... Proceedings of the International Conference on Global Business, Economics, Finance and Social Sciences (GB15_Thai Conference) ISBN: 978-1-941505-22-9 Bangkok, Thailand, 20-22 February 2015 Paper ID: T507 ...

... Proceedings of the International Conference on Global Business, Economics, Finance and Social Sciences (GB15_Thai Conference) ISBN: 978-1-941505-22-9 Bangkok, Thailand, 20-22 February 2015 Paper ID: T507 ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.