7 tips to weather market volatility and stay

... Market volatility can cause anxiety for investors—but it also can create opportunity. We took a look back at how the stock market behaved in previous market cycles so investors can compare what’s happening today with past markets. ...

... Market volatility can cause anxiety for investors—but it also can create opportunity. We took a look back at how the stock market behaved in previous market cycles so investors can compare what’s happening today with past markets. ...

mmi13 Caporale 19073238 en

... in all EMU countries. However, the quality of government debt also plays an important role. In particular, increasing debt tends to reduce the yields on euro-denominated government securities if issuances are of high quality (such as the triple-A French or German government securities). By contrast, ...

... in all EMU countries. However, the quality of government debt also plays an important role. In particular, increasing debt tends to reduce the yields on euro-denominated government securities if issuances are of high quality (such as the triple-A French or German government securities). By contrast, ...

Chapter 22: Borrowing Models Simple Interest

... Mathematical Literacy in Today’s World, 7th ed. ...

... Mathematical Literacy in Today’s World, 7th ed. ...

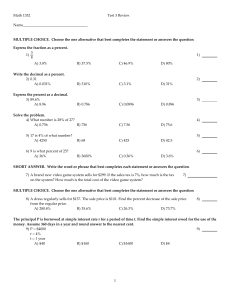

Math 1332 T3Rs11 - HCC Learning Web

... C) a. amount financed: $3800; b. total installment price: $3975; c. finance charge: $175 D) a. amount financed: $3500; b. total installment price: $4010; c. finance charge: $510 Solve the problem. 16) A particular credit card calculates interest using the unpaid balance method. The monthly interest ...

... C) a. amount financed: $3800; b. total installment price: $3975; c. finance charge: $175 D) a. amount financed: $3500; b. total installment price: $4010; c. finance charge: $510 Solve the problem. 16) A particular credit card calculates interest using the unpaid balance method. The monthly interest ...

The Latest Amendments to Japan`s Securities and Exchange Law

... The latest amendments therefore replaced the current 5% limit on shareholdings in a demutualized stock exchange with a limit of 50% (Section 103 of the Securities and Exchange Law). Also, anyone acquiring more than 5% of the shares will be required to declare this, while anyone wishing to become a p ...

... The latest amendments therefore replaced the current 5% limit on shareholdings in a demutualized stock exchange with a limit of 50% (Section 103 of the Securities and Exchange Law). Also, anyone acquiring more than 5% of the shares will be required to declare this, while anyone wishing to become a p ...

banking customer perception about interest rate spread

... consumers, which are beyond the scope of this study, and it is limited to the consumers perception only. This study objective is to conduct the study about banking interest rate paid on savings (profit) and charge on Loans (Mark Up) and limited only to existing depositors and borrower of the banking ...

... consumers, which are beyond the scope of this study, and it is limited to the consumers perception only. This study objective is to conduct the study about banking interest rate paid on savings (profit) and charge on Loans (Mark Up) and limited only to existing depositors and borrower of the banking ...

Chapter 7

... Current account of balance of payments • If current account is in deficit (i.e. total international payments exceed total international receipts) then – Some export income is diverted to service debt – Need to borrow foreign currency to service debt ...

... Current account of balance of payments • If current account is in deficit (i.e. total international payments exceed total international receipts) then – Some export income is diverted to service debt – Need to borrow foreign currency to service debt ...

Changing Times for Financial Institutions Chapter 1

... Notes: The quality of loans refers to one-year default probabilities corresponding to the historical average for a given credit rating, in this case an unsecured credit with an assumed loss given a default (LGD) of 45 percent. The one-year probability of default used is 0.03 percent for AAA, 0.35 pe ...

... Notes: The quality of loans refers to one-year default probabilities corresponding to the historical average for a given credit rating, in this case an unsecured credit with an assumed loss given a default (LGD) of 45 percent. The one-year probability of default used is 0.03 percent for AAA, 0.35 pe ...

words - Investor Relations Solutions

... Certain statements contained in this quarterly report, including those within the forward-looking perspective section within this Management's Discussion and Analysis, and other written and oral statements made from time to time by us or on our behalf do not relate strictly to historical or current ...

... Certain statements contained in this quarterly report, including those within the forward-looking perspective section within this Management's Discussion and Analysis, and other written and oral statements made from time to time by us or on our behalf do not relate strictly to historical or current ...

MetWest Total Return Bond Fund

... advice before making any financial decisions. ©2017 Bloomberg Finance L.P. All rights reserved. Investment Risks It is important to note that the Fund is not guaranteed by the U.S. Government. Fixed income investments entail interest rate risk, the risk of issuer default, issuer credit risk, and pri ...

... advice before making any financial decisions. ©2017 Bloomberg Finance L.P. All rights reserved. Investment Risks It is important to note that the Fund is not guaranteed by the U.S. Government. Fixed income investments entail interest rate risk, the risk of issuer default, issuer credit risk, and pri ...

SECURITIZATION IN INDIA

... Pay Through – Where the payment to the investors are routed through SPV who does not strictly pay the investors only when the receivables are collected by it, but keeps paying on the stipulated dates irrespective of the collection dates. In order to allow for smoothed payment to investors by removin ...

... Pay Through – Where the payment to the investors are routed through SPV who does not strictly pay the investors only when the receivables are collected by it, but keeps paying on the stipulated dates irrespective of the collection dates. In order to allow for smoothed payment to investors by removin ...

homework 3

... A. demand for real money balances. B. ex post real interest rate. C. nominal interest rate. D. current price level. Answer: B 18. An increase in the expected rate of inflation will: A. lower the demand for real balances because the real interest rate will rise. B. lower demand for real balances beca ...

... A. demand for real money balances. B. ex post real interest rate. C. nominal interest rate. D. current price level. Answer: B 18. An increase in the expected rate of inflation will: A. lower the demand for real balances because the real interest rate will rise. B. lower demand for real balances beca ...

міністерство освіти і науки україни державний економіко

... and sociology. It is the study of human efforts to satisfy what seems like unlimited and competing wants through the careful use of relatively scarce resources. Economists study what is or tends to be and how it came to be. They oughtto be. People must make up their own minds about that. Economics i ...

... and sociology. It is the study of human efforts to satisfy what seems like unlimited and competing wants through the careful use of relatively scarce resources. Economists study what is or tends to be and how it came to be. They oughtto be. People must make up their own minds about that. Economics i ...

Measuring Systematic Risk for Crop and Livestock Producers

... recession periods, defined as a reduction in the United States gross domestic product (GDP) for at least two consecutive quarters. Vertical lines indicate farm bill legislation. The vertical dashed line represents the end of the Bretton Woods Accord in 1973. At that time currencies of many of the wo ...

... recession periods, defined as a reduction in the United States gross domestic product (GDP) for at least two consecutive quarters. Vertical lines indicate farm bill legislation. The vertical dashed line represents the end of the Bretton Woods Accord in 1973. At that time currencies of many of the wo ...

Top 10 regulatory challenges for banking and capital markets

... coming year. Financial institutions (FIs) in Australia and internationally will continue to see a focus on governance and conduct, while the implementation of new capital requirements and technology will provide both challenge and opportunity. Political changes in the United States and Europe have i ...

... coming year. Financial institutions (FIs) in Australia and internationally will continue to see a focus on governance and conduct, while the implementation of new capital requirements and technology will provide both challenge and opportunity. Political changes in the United States and Europe have i ...

(MP) and Phillips Curve

... The MP Curve: Monetary Policy and the Interest Rates Banks and financial institutions borrow from each other from one business day to the next on the interbank federal funds market. Large banks that are willing to take risks tend to borrow from risk averse small banks Banks borrow and lend th ...

... The MP Curve: Monetary Policy and the Interest Rates Banks and financial institutions borrow from each other from one business day to the next on the interbank federal funds market. Large banks that are willing to take risks tend to borrow from risk averse small banks Banks borrow and lend th ...

Incorporation of financial ratios into prudential definition of assets

... credit risk characteristics. The prudent segregation of assets by credit quality is vital for estimating related expected and unexpected credit losses and assessing if a bank’s capital level adequately reflects the risks of underlying assets. The segregation also allows for benchmarking the bank aga ...

... credit risk characteristics. The prudent segregation of assets by credit quality is vital for estimating related expected and unexpected credit losses and assessing if a bank’s capital level adequately reflects the risks of underlying assets. The segregation also allows for benchmarking the bank aga ...

PRESSRELEASE Downgraded to A4 , Brazilian economy gears

... the level of investments in the country remains very low, representing only 18.4% of the GDP in 2013. For many years the country’s growth was driven by household consumption, which surpassed GDP on many occasions in the past decade. An emerging middle class and easier credit access contributed to th ...

... the level of investments in the country remains very low, representing only 18.4% of the GDP in 2013. For many years the country’s growth was driven by household consumption, which surpassed GDP on many occasions in the past decade. An emerging middle class and easier credit access contributed to th ...

Session 18: Post Class tests 1. The objective in corporate finance is

... cash flow of the firm will have to remain fixed (or unchanged) as the debt ratio changes. For operating cash flow to not change, operating income has to be fixed as the debt ratio changes. 2. ...

... cash flow of the firm will have to remain fixed (or unchanged) as the debt ratio changes. For operating cash flow to not change, operating income has to be fixed as the debt ratio changes. 2. ...

To view this press release as a file

... direct investments in share capital abroad totaling about $7.6 billion, and an increase in the prices of financial shares abroad held by Israeli residents totaling about $3.1 billion. The value of the financial investments portfolio increased by $4.6 billion (4.1 percent) in the third quarter. An in ...

... direct investments in share capital abroad totaling about $7.6 billion, and an increase in the prices of financial shares abroad held by Israeli residents totaling about $3.1 billion. The value of the financial investments portfolio increased by $4.6 billion (4.1 percent) in the third quarter. An in ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.