global insight – 2014 outlook

... 2013 looks to have been the “year of the markets”—it featured a powerful advance in equity share prices set beside a painful back-up in bond yields (and corresponding slump in bond prices). We are dubbing 2014 “the year of the investor,” who we expect to spend some considerable time and energy comin ...

... 2013 looks to have been the “year of the markets”—it featured a powerful advance in equity share prices set beside a painful back-up in bond yields (and corresponding slump in bond prices). We are dubbing 2014 “the year of the investor,” who we expect to spend some considerable time and energy comin ...

Monetary Policy during Japan`s Great Recession: From Self

... The paths of the inflation-adjusted policy rates are shown in panel (c).1 The thick line shows that the monetary easing effectively ended in mid-1992, only four quarters after the peak. The real interest rate remained in the 1.5% to 2% range until 1995, a level only modestly below conventional estim ...

... The paths of the inflation-adjusted policy rates are shown in panel (c).1 The thick line shows that the monetary easing effectively ended in mid-1992, only four quarters after the peak. The real interest rate remained in the 1.5% to 2% range until 1995, a level only modestly below conventional estim ...

To view this press release as a file

... The public's financial assets portfolio in the second quarter of 2014 During the second quarter of 2014 the value of the public's financial assets portfolio increased by about NIS 30 billion, an increase of about 0.5 percent in real terms, and reached about NIS 3.05 trillion at the end of June. ...

... The public's financial assets portfolio in the second quarter of 2014 During the second quarter of 2014 the value of the public's financial assets portfolio increased by about NIS 30 billion, an increase of about 0.5 percent in real terms, and reached about NIS 3.05 trillion at the end of June. ...

PDF - Ritholtz Wealth Management

... But more importantly for our purposes today, Michael took a look at the impact of rate movements on the S&P 500, our stand-in for the broader US equity market. There have been 86 past instances during which interest rates changed over the course of a calendar year. The effects of these changes produ ...

... But more importantly for our purposes today, Michael took a look at the impact of rate movements on the S&P 500, our stand-in for the broader US equity market. There have been 86 past instances during which interest rates changed over the course of a calendar year. The effects of these changes produ ...

The_Caribbean_en.pdf

... was another contributing factor, albeit a less significant one. The positive balance in the services account (19.3% of GDP compared with 17.9% in 2004) reflected buoyant tourist activity, yet was only able to partially offset the merchandise trade deficit. The deficit on the income balance narrowed ...

... was another contributing factor, albeit a less significant one. The positive balance in the services account (19.3% of GDP compared with 17.9% in 2004) reflected buoyant tourist activity, yet was only able to partially offset the merchandise trade deficit. The deficit on the income balance narrowed ...

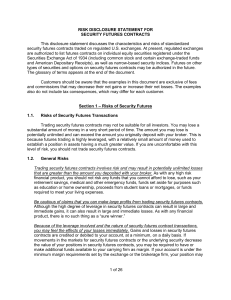

Risk Disclosure Statement for Security Futures Contracts

... be liquidated at a loss, and you will be liable for the deficit, if any, in your account. Margin requirements are addressed in Section 4. Under certain market conditions, it may be difficult or impossible to liquidate a position. Generally, you must enter into an offsetting transaction in order to ...

... be liquidated at a loss, and you will be liable for the deficit, if any, in your account. Margin requirements are addressed in Section 4. Under certain market conditions, it may be difficult or impossible to liquidate a position. Generally, you must enter into an offsetting transaction in order to ...

View/Open

... Improvement and Reform (FAIR) Act included significant changes to U.S. agricultural policy. Prior to this Act, a range of deficiency payment and price support programs protected farmers from price and income shortfalls. The Act, at least in principle, signaled the creation of a new policy environmen ...

... Improvement and Reform (FAIR) Act included significant changes to U.S. agricultural policy. Prior to this Act, a range of deficiency payment and price support programs protected farmers from price and income shortfalls. The Act, at least in principle, signaled the creation of a new policy environmen ...

European Fixed Income: Challenges For Investors In A Low Yield

... APP has raised demand for euro corporate bonds and the result is that switching from the Bloomberg Barclays Euro Treasury Index into the Bloomberg Barclays Euro Corporate Index only provides a paltry yield pick-up of 0.22% for accepting the lower credit quality associated with the corporate universe ...

... APP has raised demand for euro corporate bonds and the result is that switching from the Bloomberg Barclays Euro Treasury Index into the Bloomberg Barclays Euro Corporate Index only provides a paltry yield pick-up of 0.22% for accepting the lower credit quality associated with the corporate universe ...

Trade policies by sector - World Trade Organization

... Prior to independence, the Georgian economy was closely integrated with that of the Soviet Union; trade accounted for an estimated 40% of GDP, and nearly all exports were directed to, and three quarters of imports were from, the Soviet republics. The industrial sector accounted for about one third o ...

... Prior to independence, the Georgian economy was closely integrated with that of the Soviet Union; trade accounted for an estimated 40% of GDP, and nearly all exports were directed to, and three quarters of imports were from, the Soviet republics. The industrial sector accounted for about one third o ...

The Returns and Risks From Investing

... reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United states Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the ...

... reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United states Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the ...

Too Different For Comfort

... and women lived short, painful lives during which they lost an inordinate number of children to early deaths and struggled to accumulate any meaningful capital whatsoever. Most people ‘survived’ rather than ‘lived’. As the US economist Robert Gordon showed in his work, before the industrial revoluti ...

... and women lived short, painful lives during which they lost an inordinate number of children to early deaths and struggled to accumulate any meaningful capital whatsoever. Most people ‘survived’ rather than ‘lived’. As the US economist Robert Gordon showed in his work, before the industrial revoluti ...

The Business of Banking and the Economic Environment (Chapter 1)

... in which banks operate. We will consider what a bank is, what it does, and how it makes money. We will also look at the development of UK banking and the different types of banks and other financial services organisations that operate in the current business environment. We will conclude by consider ...

... in which banks operate. We will consider what a bank is, what it does, and how it makes money. We will also look at the development of UK banking and the different types of banks and other financial services organisations that operate in the current business environment. We will conclude by consider ...

Total liabilities and equity

... • Issuing common stock is expensive, so companies do it infrequently. – The assumption is that Van Leer will not issue common stock. Instead, it will fund its equity needs by retaining its profits rather than paying them out as dividends. ...

... • Issuing common stock is expensive, so companies do it infrequently. – The assumption is that Van Leer will not issue common stock. Instead, it will fund its equity needs by retaining its profits rather than paying them out as dividends. ...

PDF Download

... European Union rose only 11 percent over the period 2000 to 2004, despite a 46 percent appreciation of the euro and a 29 percent appreciation of the British pound against the US dollar over this period, plus some modest inflation in Europe. The US market is sufficiently important to many foreign sup ...

... European Union rose only 11 percent over the period 2000 to 2004, despite a 46 percent appreciation of the euro and a 29 percent appreciation of the British pound against the US dollar over this period, plus some modest inflation in Europe. The US market is sufficiently important to many foreign sup ...

3.6 Ratio Analysis

... Low gearing is a “safe” business strategy, but could indicate that management is not using borrowing as a strategy to expand the business which limits growth. The gearing ratio can be lowered by raising cash in other ways: selling more stock, decreasing the dividend. Result: “pump up” capital withou ...

... Low gearing is a “safe” business strategy, but could indicate that management is not using borrowing as a strategy to expand the business which limits growth. The gearing ratio can be lowered by raising cash in other ways: selling more stock, decreasing the dividend. Result: “pump up” capital withou ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.