The Subprime Lending Crisis: Causes and Effects of the Mortgage

... $142 per person worldwide and 4 percent of the $23.21-trillion credit market. IMF noted in its report that global banks likely will carry about half of these losses. The report cautioned that the loss estimates are just that, estimates, and the actual numbers may be even higher. In March, Standard & ...

... $142 per person worldwide and 4 percent of the $23.21-trillion credit market. IMF noted in its report that global banks likely will carry about half of these losses. The report cautioned that the loss estimates are just that, estimates, and the actual numbers may be even higher. In March, Standard & ...

PDF Download

... from Asian central banks on US long rates is a matter of dispute. It depends on how readily private foreign investors abroad would step in and make up the gap created by the end of official demand for US Treasuries, as well as the impact central bank intervention is having on a host of other macroec ...

... from Asian central banks on US long rates is a matter of dispute. It depends on how readily private foreign investors abroad would step in and make up the gap created by the end of official demand for US Treasuries, as well as the impact central bank intervention is having on a host of other macroec ...

METLIFE INC (Form: 8-K, Received: 05/21/2013 06

... expectations or forecasts of future events and use words such as “anticipate”, “estimate,” “expect,” “project” and other terms of similar meaning. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward ...

... expectations or forecasts of future events and use words such as “anticipate”, “estimate,” “expect,” “project” and other terms of similar meaning. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... Net income per common share is computed based on the weighted average number of common shares and common share equivalents outstanding during each period after giving retroactive effect to stock dividends. Cash dividends per common share are computed based on declared rates adjusted retroactively fo ...

... Net income per common share is computed based on the weighted average number of common shares and common share equivalents outstanding during each period after giving retroactive effect to stock dividends. Cash dividends per common share are computed based on declared rates adjusted retroactively fo ...

higher audit risk

... the tax benefit reduces Income Taxes Payable on B/S but is credited to APIC (Additional Paid-in Capital) OCF is artificially inflated because most firms report the tax benefit as part of OCF. Unlike other components of OCF, the tax benefit is unlikely to recur (Siegel 2006; Hribar and Nichols 2007) ...

... the tax benefit reduces Income Taxes Payable on B/S but is credited to APIC (Additional Paid-in Capital) OCF is artificially inflated because most firms report the tax benefit as part of OCF. Unlike other components of OCF, the tax benefit is unlikely to recur (Siegel 2006; Hribar and Nichols 2007) ...

chapter 2 2

... much more diverse than this. From the financial year 1998/99 the Australian Bureau of Statistics (ABS) has collected data for ‘small firms’ which it classified as having less than 20 fulltime employees, and ‘medium size firms’ as having 20 to 199 employees. ‘Large firms’ had 200 or more employees. i ...

... much more diverse than this. From the financial year 1998/99 the Australian Bureau of Statistics (ABS) has collected data for ‘small firms’ which it classified as having less than 20 fulltime employees, and ‘medium size firms’ as having 20 to 199 employees. ‘Large firms’ had 200 or more employees. i ...

Technology Industry on Financial Ratios and Stock Returns

... test and Ramsey RESET test were conducted. The White test is used to test Heteroscedasticity which is the variable in error term since an assumption of OLS is that error term must be equal. Results after test show that there was no problem of Heteroscedasticity, The Arch LM and Breusch-Godfrey Seria ...

... test and Ramsey RESET test were conducted. The White test is used to test Heteroscedasticity which is the variable in error term since an assumption of OLS is that error term must be equal. Results after test show that there was no problem of Heteroscedasticity, The Arch LM and Breusch-Godfrey Seria ...

210115 The Dutch Pension System Chris Driessen

... Falling return on government bonds Financial crisis ...

... Falling return on government bonds Financial crisis ...

Fundamentals of Investing Chapter Fifteen

... Make extra effort to save one - two months/year. Take advantage of gifts, inheritances, and windfalls. ...

... Make extra effort to save one - two months/year. Take advantage of gifts, inheritances, and windfalls. ...

Banking Sector Performance in Latin America: Market Power versus

... spurious and no particular sign is expected. One would expect that a positive relationship between GDP growth and ROA since banking profitability is procyclical. Finally, the average annual market interest rate and its relationship with ROA may vary because on one hand higher market interest rates r ...

... spurious and no particular sign is expected. One would expect that a positive relationship between GDP growth and ROA since banking profitability is procyclical. Finally, the average annual market interest rate and its relationship with ROA may vary because on one hand higher market interest rates r ...

2017-18 Budget Paper 1 - Chapter 3 - Fiscal

... STRATEGIC ACTIONS The Government's Fiscal Strategy includes a number of important strategic actions that are aimed at achieving the long-term fiscal principles. Those strategic actions being implemented by the Government to support the fiscal principles are detailed below. 1. Annual growth in Genera ...

... STRATEGIC ACTIONS The Government's Fiscal Strategy includes a number of important strategic actions that are aimed at achieving the long-term fiscal principles. Those strategic actions being implemented by the Government to support the fiscal principles are detailed below. 1. Annual growth in Genera ...

UITF Abstract 26 - Financial Reporting Council

... (Issued 9 November 2000) The issue An entity such as a publisher or broadcaster may agree to provide advertising in exchange for advertising services provided by its customer, rather than for a cash consideration. For example, it has recently become common for companies that provide commercial Websi ...

... (Issued 9 November 2000) The issue An entity such as a publisher or broadcaster may agree to provide advertising in exchange for advertising services provided by its customer, rather than for a cash consideration. For example, it has recently become common for companies that provide commercial Websi ...

Effects of Social Interaction in Financial Markets

... 3.1.1 General Reasons for Participating .................................................................................................................................... 11 3.1.2 Influence of Social Interaction on Participating ..................................................................... ...

... 3.1.1 General Reasons for Participating .................................................................................................................................... 11 3.1.2 Influence of Social Interaction on Participating ..................................................................... ...

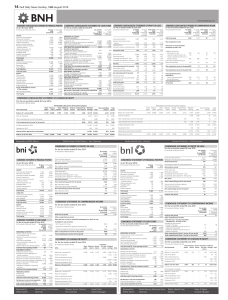

14 Gulf Daily News Sunday, 14th August 2016

... Payments to insurance and reinsurance companies Claims paid to policyholders Claims recovered from reinsurers and salvage recoveries Payment made for other operating expenses ...

... Payments to insurance and reinsurance companies Claims paid to policyholders Claims recovered from reinsurers and salvage recoveries Payment made for other operating expenses ...

The Impact of the Global Financial Crisis on the Chinese Economy

... debt obligations (CDOs). According to the available data, the total direct loss suffered by Chinas four most important commercial banks on these securities amounted to $20 billion. It seems that the underdevelopment of Chinas overseas indirect investment spared China from bigger losses. However, i ...

... debt obligations (CDOs). According to the available data, the total direct loss suffered by Chinas four most important commercial banks on these securities amounted to $20 billion. It seems that the underdevelopment of Chinas overseas indirect investment spared China from bigger losses. However, i ...

Impact of Union elections on the Stock volatility

... is important for several reasons. Firstly, volatility is synonymous with risk and therefore increase in risk associated with a given economic activity should therefore see a reduced level of participation in that activity. In other words, when the Indian stock market exhibits high volatility a reduc ...

... is important for several reasons. Firstly, volatility is synonymous with risk and therefore increase in risk associated with a given economic activity should therefore see a reduced level of participation in that activity. In other words, when the Indian stock market exhibits high volatility a reduc ...

Adrian Lewis - Premier New Home Builder in North and South

... Advertising and marketing for real estate firm. Recruiting and supervision of brokers in the firm. Daily upkeep of records and billing for the NC Real Estate Commission. Evaluating competency of brokers within the firm. Maintaining accurate records of financial reporting and HUD statements. Responsi ...

... Advertising and marketing for real estate firm. Recruiting and supervision of brokers in the firm. Daily upkeep of records and billing for the NC Real Estate Commission. Evaluating competency of brokers within the firm. Maintaining accurate records of financial reporting and HUD statements. Responsi ...

File: ch10 Type: Multiple Choice 1. Which are the two major

... 1. Which are the two major approaches used to value stocks? a) Discounted cash flow techniques and relative valuation techniques. b) Discounted cash flow techniques and absolute valuation techniques. c) Compound cash flow techniques and relative valuation techniques. d) Compound cash flow techniques ...

... 1. Which are the two major approaches used to value stocks? a) Discounted cash flow techniques and relative valuation techniques. b) Discounted cash flow techniques and absolute valuation techniques. c) Compound cash flow techniques and relative valuation techniques. d) Compound cash flow techniques ...

GLOBAL IMBALANCES: PAST, PRESENT, AND FUTURE Olivier

... percent of total inflows and over 40 percent of the U.S. current account deficit. And after peaking in early 2002, the dollar depreciated throughout the period. In several surplus countries (Japan, emerging Asia, but also Central and Northern European countries—particularly Germany) current account ...

... percent of total inflows and over 40 percent of the U.S. current account deficit. And after peaking in early 2002, the dollar depreciated throughout the period. In several surplus countries (Japan, emerging Asia, but also Central and Northern European countries—particularly Germany) current account ...

THE GEORGE WASHINGTON UNIVERSITY

... This question mistakenly left out the value for consumption, thus there is not enough info to calculate domestic spending. However, from the twin-deficit identity we know that (Sp – I) – CA = (G + TR – T). Thus, (300 – 400) –CA = - 200. This implies that CA = 100 and is in surplus. With a CA surplus ...

... This question mistakenly left out the value for consumption, thus there is not enough info to calculate domestic spending. However, from the twin-deficit identity we know that (Sp – I) – CA = (G + TR – T). Thus, (300 – 400) –CA = - 200. This implies that CA = 100 and is in surplus. With a CA surplus ...

Section A

... A fiscal period always ends on December 31. _____ The historical cost principle allows for assets to be recorded at actual cost. _____ Depreciable cost is the amount of depreciation expense recorded for each accounting period. _____ Plant assets provide benefits only in the year of purchase. _____ T ...

... A fiscal period always ends on December 31. _____ The historical cost principle allows for assets to be recorded at actual cost. _____ Depreciable cost is the amount of depreciation expense recorded for each accounting period. _____ Plant assets provide benefits only in the year of purchase. _____ T ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.