The Objective

... Reflecting on progress of past ten years and acknowledging there are challenges ahead, the review prepares for IFRS as the global standard. • Independence must be maintained –Monitoring Board, Trustees, IASB structure is appropriate • Global adoption, and not convergence, is the goal • IFRSs should ...

... Reflecting on progress of past ten years and acknowledging there are challenges ahead, the review prepares for IFRS as the global standard. • Independence must be maintained –Monitoring Board, Trustees, IASB structure is appropriate • Global adoption, and not convergence, is the goal • IFRSs should ...

words - Investor Relations Solutions

... had no effect on total assets, total liabilities, shareholders’ equity or net income (loss). Use of Estimates The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount ...

... had no effect on total assets, total liabilities, shareholders’ equity or net income (loss). Use of Estimates The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount ...

M07_ABEL4987_7E_IM_C07

... b. Money allows people to trade their labor for money, then use the money to buy goods and services in separate transactions c. Money thus permits people to trade with less cost in time and effort d. Money also allows specialization, since trading is much easier, so people don’t have to produce thei ...

... b. Money allows people to trade their labor for money, then use the money to buy goods and services in separate transactions c. Money thus permits people to trade with less cost in time and effort d. Money also allows specialization, since trading is much easier, so people don’t have to produce thei ...

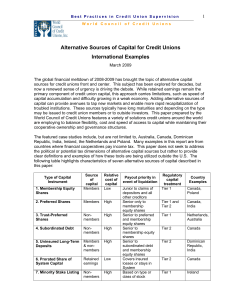

Alternative Sources of Capital for Credit Unions

... Although U.S. credit unions have separate statutory capital requirements per the Federal Credit Union Act, U.S. banks and credit unions in many countries are influenced by the Basel Accord on Capital Adequacy. Therefore, as a starting point we define what is meant by the terms Tier 1 and Tier 2 capi ...

... Although U.S. credit unions have separate statutory capital requirements per the Federal Credit Union Act, U.S. banks and credit unions in many countries are influenced by the Basel Accord on Capital Adequacy. Therefore, as a starting point we define what is meant by the terms Tier 1 and Tier 2 capi ...

Tax Deduction at Source 2015-2016

... making payment The Government or any other authority, corporation or body, company, any NGO, or any school or any college or any university or any hospital or any clinic or any diagnostic ...

... making payment The Government or any other authority, corporation or body, company, any NGO, or any school or any college or any university or any hospital or any clinic or any diagnostic ...

The effect of Foreign Direct Investment on economic growth in OPEC

... The influence of Foreign Direct Investment (FDI) on economic growth is a frequently studied subject, because people believe attracting FDI could lead to several beneficial effects that lead to economic growth. FDI is defined as ‘an investment involving a long-term relationship and reflecting a lasti ...

... The influence of Foreign Direct Investment (FDI) on economic growth is a frequently studied subject, because people believe attracting FDI could lead to several beneficial effects that lead to economic growth. FDI is defined as ‘an investment involving a long-term relationship and reflecting a lasti ...

Pillar 3 Disclosures Quantitative Disclosures As at 31

... taken for accounts defaulting during the year and includes write-offs during the year. The two measures of losses are hence not directly comparable and it is not appropriate to use Actual Loss data to assess the performance of internal rating process or to undertake comparative trend analysis. ...

... taken for accounts defaulting during the year and includes write-offs during the year. The two measures of losses are hence not directly comparable and it is not appropriate to use Actual Loss data to assess the performance of internal rating process or to undertake comparative trend analysis. ...

Kenon Holdings Ltd.

... Shareholders of Record : A shareholder of record (member) entitled to attend and vote at the AGM is entitled to appoint a proxy, or proxies, to attend and vote on his or her behalf. A proxy need not be a shareholder of record (member). To vote by proxy, you should complete, sign and date the enclose ...

... Shareholders of Record : A shareholder of record (member) entitled to attend and vote at the AGM is entitled to appoint a proxy, or proxies, to attend and vote on his or her behalf. A proxy need not be a shareholder of record (member). To vote by proxy, you should complete, sign and date the enclose ...

Firm Productivity as an Engine of Saving

... Following Acemoglu (2009), neoclassical growth theory refers to the Ramsey–Cass–Koopmans tradition. ...

... Following Acemoglu (2009), neoclassical growth theory refers to the Ramsey–Cass–Koopmans tradition. ...

Chapter 02 - Test bank

... 29. The audit of the financial reports of Matilda Ltd had been completed except for the outcome of a material contingent liability that is still subject to the outcome of a court decision. The case is still ongoing but it is expected that a decision will be made after three months. The deadline for ...

... 29. The audit of the financial reports of Matilda Ltd had been completed except for the outcome of a material contingent liability that is still subject to the outcome of a court decision. The case is still ongoing but it is expected that a decision will be made after three months. The deadline for ...

capital - International Actuarial Association

... (only estimated) in advance. Historically, liability requirements were set in many accounting paradigms at a level to provide for reasonable/plausible deviations due to uncertain assumptions. Capital requirements were then set to address very unlikely, but possible outcomes. Since outcomes are uncer ...

... (only estimated) in advance. Historically, liability requirements were set in many accounting paradigms at a level to provide for reasonable/plausible deviations due to uncertain assumptions. Capital requirements were then set to address very unlikely, but possible outcomes. Since outcomes are uncer ...

Asia-Pacific Development Journal

... and for maintaining a given level of population. However, when population increases, there is an impact on the natural resources themselves, due to increasing demand. In 1798, Thomas Malthus, discussed the effect of population increase on land in his famous book An Essay on the Principle of Populati ...

... and for maintaining a given level of population. However, when population increases, there is an impact on the natural resources themselves, due to increasing demand. In 1798, Thomas Malthus, discussed the effect of population increase on land in his famous book An Essay on the Principle of Populati ...

Portfolio Funding Profile

... • A Funding Profile reflects the number of retirement years that a particular portfolio might be expected to support expenses in retirement as a function of inflation-adjusted withdrawal rates • Consistent with Fidelity’s retirement approach, the number of funding years are indicated at the 50% and ...

... • A Funding Profile reflects the number of retirement years that a particular portfolio might be expected to support expenses in retirement as a function of inflation-adjusted withdrawal rates • Consistent with Fidelity’s retirement approach, the number of funding years are indicated at the 50% and ...

comparatible analysys of the capital structure

... As for the valuation of debt, the available data do not allow calculating the market value of a firm's debt. Provided that the cross-sectional correlation between the book value and the market value of debt is large, the misspecification caused by using the book values to compute leverage is not sev ...

... As for the valuation of debt, the available data do not allow calculating the market value of a firm's debt. Provided that the cross-sectional correlation between the book value and the market value of debt is large, the misspecification caused by using the book values to compute leverage is not sev ...

understanding monetary policy series no 26 causes of banking crises

... Conventionally, a bank is a financial institution that serves as an intermediary that accepts deposits from economic units with surplus, and channels these deposits through lending activities to units with deficits, such as individuals, corporate organization and government. This important function ...

... Conventionally, a bank is a financial institution that serves as an intermediary that accepts deposits from economic units with surplus, and channels these deposits through lending activities to units with deficits, such as individuals, corporate organization and government. This important function ...

IOSR Journal of Mathematics (IOSR-JM)

... IV. iv. Results of Factor Analysis The naming of factors comes from the meanings associated with the set of variables grouped together for each factor. In the present study, factor loading of variables clustered are ascended from the top with the largest loading and so on in each column against thei ...

... IV. iv. Results of Factor Analysis The naming of factors comes from the meanings associated with the set of variables grouped together for each factor. In the present study, factor loading of variables clustered are ascended from the top with the largest loading and so on in each column against thei ...

Determinants of capital structure

... the static trade-off theory attempt to overcome one of the biggest weaknesses of the MM propositions – the ignoring of the inevitable consequences of overleveraging. Jensen and Meckling (1976), claim that the benefits of the debt tax shield at some point become offset by the direct and indirect cost ...

... the static trade-off theory attempt to overcome one of the biggest weaknesses of the MM propositions – the ignoring of the inevitable consequences of overleveraging. Jensen and Meckling (1976), claim that the benefits of the debt tax shield at some point become offset by the direct and indirect cost ...

download

... widely documented, secondary market trading was especially intensive for Internet and high-tech stocks during the Internet boom. To return to our favorite example, Palm, its stock turned over at the astonishing rate of once every week!17 In fact, researchers have found that stock valuations are posi ...

... widely documented, secondary market trading was especially intensive for Internet and high-tech stocks during the Internet boom. To return to our favorite example, Palm, its stock turned over at the astonishing rate of once every week!17 In fact, researchers have found that stock valuations are posi ...

Free Full text

... rebound. Unemployment declined to 4.4 percent in Q4 2016 and wage increases have picked up. Nonetheless, inflation remained below the 1–3 percent target range of the Bank of Israel (BOI), reflecting external factors and government measures to reduce the cost of living. The BOI has held the policy ra ...

... rebound. Unemployment declined to 4.4 percent in Q4 2016 and wage increases have picked up. Nonetheless, inflation remained below the 1–3 percent target range of the Bank of Israel (BOI), reflecting external factors and government measures to reduce the cost of living. The BOI has held the policy ra ...

Macroeconomic Policies: New Issues of Interdependence

... turning to hedge funds, searching for uncorrelated asset classes with a focus on absolute (rather than benchmark‐oriented) returns. These new actors may require policy attention as they have probably introduced amplifiers to global credit cycles, with potentially harmful effe ...

... turning to hedge funds, searching for uncorrelated asset classes with a focus on absolute (rather than benchmark‐oriented) returns. These new actors may require policy attention as they have probably introduced amplifiers to global credit cycles, with potentially harmful effe ...

Can Risk Aversion Explain The Demand for Dividends?

... same amount of cash by repurchasing shares) generates an added tax bill of $30 billion annually. Many efforts have been made to explain this dividend puzzle, and considerable progress has been made in understanding the decisions of companies to distribute cash. In general, models have focused on the ...

... same amount of cash by repurchasing shares) generates an added tax bill of $30 billion annually. Many efforts have been made to explain this dividend puzzle, and considerable progress has been made in understanding the decisions of companies to distribute cash. In general, models have focused on the ...

Thesis final structure.docx - Lund University Publications

... the search for yield has driven the demand for these instruments. However, from the issuers’ side the incentive to issue these instruments is closely linked to a more demanding regulatory framework implemented as a consequence of the recent problems in the financial sector. Several articles in the F ...

... the search for yield has driven the demand for these instruments. However, from the issuers’ side the incentive to issue these instruments is closely linked to a more demanding regulatory framework implemented as a consequence of the recent problems in the financial sector. Several articles in the F ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.