* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

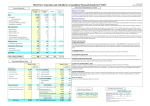

Download Winning Strategy Delivering Value

Financial economics wikipedia , lookup

Pensions crisis wikipedia , lookup

Business valuation wikipedia , lookup

Stock selection criterion wikipedia , lookup

Stock valuation wikipedia , lookup

Global saving glut wikipedia , lookup

Mark-to-market accounting wikipedia , lookup