Growth in the Shadow of Expropriation ∗ Mark Aguiar and Manuel Amador

... In this paper we present a tractable growth model that highlights the interaction of political economy frictions, tax policy, and capital flows in a small open economy. We augment the standard neoclassical growth model with two frictions. First, there is limited commitment on the part of the domesti ...

... In this paper we present a tractable growth model that highlights the interaction of political economy frictions, tax policy, and capital flows in a small open economy. We augment the standard neoclassical growth model with two frictions. First, there is limited commitment on the part of the domesti ...

Asset Valuation in Workably Competitive Markets

... incumbent supplier can be conceptualised as a holder of a portfolio of long term contracts for the supply of services from assets of different vintages, and attention can be focused on whether or not the forms of contract that are, in effect, determined by regulation are broadly consistent with what ...

... incumbent supplier can be conceptualised as a holder of a portfolio of long term contracts for the supply of services from assets of different vintages, and attention can be focused on whether or not the forms of contract that are, in effect, determined by regulation are broadly consistent with what ...

James Stokes (Spring `10, file)

... from the loans that were given out to everyone. Once people began defaulting on their loans, the assets became illiquid assets. Now that most of Lehman Brothers’ holdings are illiquid assets, they do not want this information on the shareholders’ financial reports. Lehman Brothers began using an acc ...

... from the loans that were given out to everyone. Once people began defaulting on their loans, the assets became illiquid assets. Now that most of Lehman Brothers’ holdings are illiquid assets, they do not want this information on the shareholders’ financial reports. Lehman Brothers began using an acc ...

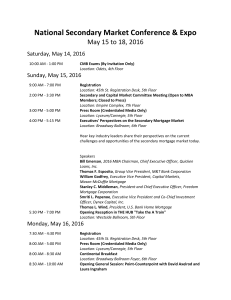

Editable Agenda - Mortgage Bankers Association

... New Member Lunch (By Invitation Only) Location: Astor Ballroom, 7th Floor Press Lunch (Credentialed Media Only) Location: Music Box/Winter Garden, 6th Floor General Session: Update on the Single Security & Common Securitization Platform Location: Broadway Ballroom, 6th Floor The common securitizatio ...

... New Member Lunch (By Invitation Only) Location: Astor Ballroom, 7th Floor Press Lunch (Credentialed Media Only) Location: Music Box/Winter Garden, 6th Floor General Session: Update on the Single Security & Common Securitization Platform Location: Broadway Ballroom, 6th Floor The common securitizatio ...

Annual Report 2016 Pico Far East Holdings Limited

... Our global strength is inspired by the diversity of our professionals working in nearly 40 cities worldwide. Their keen understanding of different cultures and industry practices is underpinned by some 70,000 square metres of modern production facilities. Together, they give us the capability to ach ...

... Our global strength is inspired by the diversity of our professionals working in nearly 40 cities worldwide. Their keen understanding of different cultures and industry practices is underpinned by some 70,000 square metres of modern production facilities. Together, they give us the capability to ach ...

Trends in and structure of the overall capital stock

... where K Bt represents the stock of gross fixed assets at the beginning of year t, It-s the gross fixed capital formation in the year t±s and g (t,t±s) a survival function which shows what proportion of the investment of the year t±s is still being used in the production process at time t. T is the m ...

... where K Bt represents the stock of gross fixed assets at the beginning of year t, It-s the gross fixed capital formation in the year t±s and g (t,t±s) a survival function which shows what proportion of the investment of the year t±s is still being used in the production process at time t. T is the m ...

Whither growth in central and eastern Europe? Policy lessons

... Torbjörn Becker has been Director of the Stockholm Institute of Transition Economics at the Stockholm School of Economics since August 2006. He is also a board member of the Swedish International Development Cooperation Agency, chairman of the board of the Kyiv Economics Institute (Ukraine) and CenE ...

... Torbjörn Becker has been Director of the Stockholm Institute of Transition Economics at the Stockholm School of Economics since August 2006. He is also a board member of the Swedish International Development Cooperation Agency, chairman of the board of the Kyiv Economics Institute (Ukraine) and CenE ...

EGESIF_15-0021-00 GN on CPR42 Managememt costs and fees

... costs and fees, introducing a requirement for their performance orientation and new calculation of thresholds as further stipulated in Articles 12, 13 and 14 CDR. The purpose of the guidance is to clarify how to apply the new approach to management costs and fees of bodies implementing financial ins ...

... costs and fees, introducing a requirement for their performance orientation and new calculation of thresholds as further stipulated in Articles 12, 13 and 14 CDR. The purpose of the guidance is to clarify how to apply the new approach to management costs and fees of bodies implementing financial ins ...

Slowdown of Credit Flows in Jordan in the Wake of the Global

... banks and show that these were modest in Thailand. If the slowdown in credit was caused by a reduction in demand for loans, then there would have been involuntary accumulation of excess reserves by banks, which was proven not to be the case in Thailand. The above discussion suggests that the evidenc ...

... banks and show that these were modest in Thailand. If the slowdown in credit was caused by a reduction in demand for loans, then there would have been involuntary accumulation of excess reserves by banks, which was proven not to be the case in Thailand. The above discussion suggests that the evidenc ...

INTERNATIONAL Route des Morillons 15 Tel: (41 22) 929 88 88 CO

... - to allow financial instruments that are redeemable at book value to be accounted for as equity when they represent the most subordinate interest of an entity, even if they don’t give an individual right on the remaining net assets in case of liquidation ...

... - to allow financial instruments that are redeemable at book value to be accounted for as equity when they represent the most subordinate interest of an entity, even if they don’t give an individual right on the remaining net assets in case of liquidation ...

oecd economic outlook

... lower export market growth and market share losses. Growth gradually recovers as these factors fade, though falling housing investment remains a drag throughout. Despite currency appreciation inflationary pressures are strong and, with capacity use moving just slightly below its normal level, it is ...

... lower export market growth and market share losses. Growth gradually recovers as these factors fade, though falling housing investment remains a drag throughout. Despite currency appreciation inflationary pressures are strong and, with capacity use moving just slightly below its normal level, it is ...

The Equity Premium: Why Is It a Puzzle? Rajnish Mehra

... The feature that makes Equation 2 the “preference function of choice” in much of the literature on growth and in Real Business Cycle theory is that it is scale invariant. Although the levels of aggregate variables, such as capital stock, have increased over time, the equilibrium return process is st ...

... The feature that makes Equation 2 the “preference function of choice” in much of the literature on growth and in Real Business Cycle theory is that it is scale invariant. Although the levels of aggregate variables, such as capital stock, have increased over time, the equilibrium return process is st ...

The Negative Growth-Volatility Relationship and the Gains from

... a number of country-specific factors.1 We revisit this relationship and find that it continues to hold – average per-capita GDP growth is significantly lower in countries that have high average GDP volatility over the period 1962 − 2011, using data from the Penn World Tables 9.0 (see Figures 1 and 2 ...

... a number of country-specific factors.1 We revisit this relationship and find that it continues to hold – average per-capita GDP growth is significantly lower in countries that have high average GDP volatility over the period 1962 − 2011, using data from the Penn World Tables 9.0 (see Figures 1 and 2 ...

EUROPEAN COMMISSION Brussels, 22.2.2017 SWD(2017) 84 final

... been made in increasing public and private R&D expenditure. Regarding CSR 2, the Netherlands has made no progress in facilitating the transition to permanent employment contracts. While no specific measures were taken to reduce distortive tax incentives favouring self-employment or to increase the s ...

... been made in increasing public and private R&D expenditure. Regarding CSR 2, the Netherlands has made no progress in facilitating the transition to permanent employment contracts. While no specific measures were taken to reduce distortive tax incentives favouring self-employment or to increase the s ...

Insolvencies in Central and Eastern Europe

... spending habits as, in many cases, they had been affected by the challenging times in the labour market during 2012 and 2013. Despite this, households did become more inclined to purchase durable goods in 2015, rather than being focused on daily necessities. CEE economies are highly exposed to expor ...

... spending habits as, in many cases, they had been affected by the challenging times in the labour market during 2012 and 2013. Despite this, households did become more inclined to purchase durable goods in 2015, rather than being focused on daily necessities. CEE economies are highly exposed to expor ...

NBIM DIscussIoN NoTE Momentum in Futures Market

... manifest momentum. Hong and Stein (2007) further extend this framework such that information diffusion, limited attention and heterogeneous priors can be combined to understand a broad range of stylised facts such as return continuation up to 12 months and return reversals thereafter. Vayanos and Wo ...

... manifest momentum. Hong and Stein (2007) further extend this framework such that information diffusion, limited attention and heterogeneous priors can be combined to understand a broad range of stylised facts such as return continuation up to 12 months and return reversals thereafter. Vayanos and Wo ...

annual report 2016 - Asseco Central Europe

... willingness to present new ideas and solutions, we rank among top providers of IT services in the region of Central Europe. Last but not least, I would like to thank, on behalf of the company, to our shareholders for the coordination support at the business and management levels. The group´s activit ...

... willingness to present new ideas and solutions, we rank among top providers of IT services in the region of Central Europe. Last but not least, I would like to thank, on behalf of the company, to our shareholders for the coordination support at the business and management levels. The group´s activit ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.