LEGAL REGULATIONS Accounting in the public sector EV Kalyuha

... Accounting and reporting standards in the public sector in Ukraine devel-blyalysya as separate documents similar package P (S) in the commercial sector. The package, which includes 19 developed by Ukrainian standards of accounting and reporting in general conformity for IPSAS and structure, the use ...

... Accounting and reporting standards in the public sector in Ukraine devel-blyalysya as separate documents similar package P (S) in the commercial sector. The package, which includes 19 developed by Ukrainian standards of accounting and reporting in general conformity for IPSAS and structure, the use ...

Tax Biases to Debt Finance

... economic growth. The main obstacle is probably its cost to public revenues, estimated at around 0.5 percent of GDP for an average developed country. This cost could be reduced in the short run by granting the allowance only to new investment. In the long term, the budgetary cost is expected to be si ...

... economic growth. The main obstacle is probably its cost to public revenues, estimated at around 0.5 percent of GDP for an average developed country. This cost could be reduced in the short run by granting the allowance only to new investment. In the long term, the budgetary cost is expected to be si ...

Deforestation and credit instability in Latin American countries

... freely from one sector to another one with a constant total supply L. Both sectors share a common wage w that induces labour allocation in the economy. Capital use is determined by its opportunity cost r which includes a rental rate and an agency cost. Land is a specific factor of which rental price ...

... freely from one sector to another one with a constant total supply L. Both sectors share a common wage w that induces labour allocation in the economy. Capital use is determined by its opportunity cost r which includes a rental rate and an agency cost. Land is a specific factor of which rental price ...

NBER WORKING PAPER SERIES SUDDEN STOPS, FINANCIAL CRISES AND LEVERAGE:

... leverage ratio of the economy. The emphasis is on studying the quantitative significance of this credit friction, along the lines of the growing literature on the macroeconomic implications of credit constraints (as in Kiyotaki and Moore (1997), Bernanke, Gertler and Gilchrist (1998), Aiyagari and ...

... leverage ratio of the economy. The emphasis is on studying the quantitative significance of this credit friction, along the lines of the growing literature on the macroeconomic implications of credit constraints (as in Kiyotaki and Moore (1997), Bernanke, Gertler and Gilchrist (1998), Aiyagari and ...

Economics Working Paper Weathering the financial storm: The

... Central Bank of Iceland and Aarhus University ...

... Central Bank of Iceland and Aarhus University ...

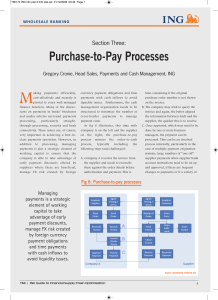

Purchase-to-Pay Processes

... at one of Europe’s largest pension schemes The company had been maintaining a large number of interfaces between proprietary systems at a cost of €30-€40,000 per year. As well as the issue of cost, the firm wanted to achieve greater bank independence, allowing them to decide on our banking relations ...

... at one of Europe’s largest pension schemes The company had been maintaining a large number of interfaces between proprietary systems at a cost of €30-€40,000 per year. As well as the issue of cost, the firm wanted to achieve greater bank independence, allowing them to decide on our banking relations ...

Equilibrium Exchange Rates: a Guidebook for the Euro

... Surprisingly, the buoying literature on global imbalances (e.g. Obstfeld and Rogoff, 2004; Blanchard et al., 2005; Gourinchas and Rey, 2007; Lane and Milesi-Ferretti, 2007) has developed largely aside from that on equilibrium exchange rates, although one outcome of this literature is to provide esti ...

... Surprisingly, the buoying literature on global imbalances (e.g. Obstfeld and Rogoff, 2004; Blanchard et al., 2005; Gourinchas and Rey, 2007; Lane and Milesi-Ferretti, 2007) has developed largely aside from that on equilibrium exchange rates, although one outcome of this literature is to provide esti ...

Inflation and the Price of Real Assets ∗ Monika Piazzesi Martin Schneider

... boomers into asset markets directly lowered the average savings rate. Second, the erosion of bond portfolios by surprise inflation reduced the ratio of financial wealth to human wealth, which also gives rise to lower savings. Since there was only a small reduction in asset supply in the 1970s, the l ...

... boomers into asset markets directly lowered the average savings rate. Second, the erosion of bond portfolios by surprise inflation reduced the ratio of financial wealth to human wealth, which also gives rise to lower savings. Since there was only a small reduction in asset supply in the 1970s, the l ...

cnh industrial nv - corporate

... assumptions and involve known and unknown risks, uncertainties and other factors, many of which are outside the Company’s control and are difficult to predict. If any of these risks and uncertainties materialize or other assumptions underlying any of the forward-looking statements prove to be incorr ...

... assumptions and involve known and unknown risks, uncertainties and other factors, many of which are outside the Company’s control and are difficult to predict. If any of these risks and uncertainties materialize or other assumptions underlying any of the forward-looking statements prove to be incorr ...

rPFM(02-RAR)08

... For the story of the Marconi collapse, see: End of the Line for Marconi Shares ...

... For the story of the Marconi collapse, see: End of the Line for Marconi Shares ...

Incentive Compensation – The White Swan in Risk Management

... Minaz H. Lalani, FCIA, FSA, CERA is a consulting actuary and managing principal at Lalani Consulting Group in Calgary, AB, Canada. He can be reached at [email protected] . ...

... Minaz H. Lalani, FCIA, FSA, CERA is a consulting actuary and managing principal at Lalani Consulting Group in Calgary, AB, Canada. He can be reached at [email protected] . ...

Dreyfus Variable Investment Fund: International Value Portfolio

... The fund seeks long-term capital growth. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in stocks. The fund normally invests substantially all of its assets in the stocks of foreign companies, including those located in emer ...

... The fund seeks long-term capital growth. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in stocks. The fund normally invests substantially all of its assets in the stocks of foreign companies, including those located in emer ...

Fiscal Austerity, Growth Prospects, and Sovereign CDS Spreads

... risk in the CDS market was strongly linked to common factors like investor risk appetite during the period from January 2006 to June 2010. Plank developed a structural model of sovereign credit risk for emerging economies in which the probability of default reflected in the CDS spreads is jointly de ...

... risk in the CDS market was strongly linked to common factors like investor risk appetite during the period from January 2006 to June 2010. Plank developed a structural model of sovereign credit risk for emerging economies in which the probability of default reflected in the CDS spreads is jointly de ...

deposit protection board

... • what is considered a “small depositor” depends on the particular situation of a country and may not be captured by a single parameter such as the level of GDP. • Need for striking a balance between discouraging destabilising bank runs by small depositors, while maintaining market discipline from l ...

... • what is considered a “small depositor” depends on the particular situation of a country and may not be captured by a single parameter such as the level of GDP. • Need for striking a balance between discouraging destabilising bank runs by small depositors, while maintaining market discipline from l ...

the peoples gas light and coke company annual

... a natural gas pipeline system that connects Manlove Field to Chicago with eight major interstate pipelines. These assets are directed primarily to serving rate‐regulated retail customers and are included in our regulatory rate base. We also use a portion of these company‐owned storage and pipeline ...

... a natural gas pipeline system that connects Manlove Field to Chicago with eight major interstate pipelines. These assets are directed primarily to serving rate‐regulated retail customers and are included in our regulatory rate base. We also use a portion of these company‐owned storage and pipeline ...

Armour Residential REIT, Inc.

... We intend to qualify and have elected to be taxed as a REIT for the taxable year ended December 31, 2009 and thereafter upon filing our federal income tax return for that year. Our qualification as a REIT depends on our ability to meet, on a continuing basis, various complex requirements under the I ...

... We intend to qualify and have elected to be taxed as a REIT for the taxable year ended December 31, 2009 and thereafter upon filing our federal income tax return for that year. Our qualification as a REIT depends on our ability to meet, on a continuing basis, various complex requirements under the I ...

Financial Innovation, Collateral and Investment.

... was preceded by years in which leverage, prices and investment increased dramatically in the housing market and all collapsed together after the crisis. Figure 2 shows that CDS was a financial innovation introduced much later than leverage. Figure 3 shows how the peak in CDS volume coincides with th ...

... was preceded by years in which leverage, prices and investment increased dramatically in the housing market and all collapsed together after the crisis. Figure 2 shows that CDS was a financial innovation introduced much later than leverage. Figure 3 shows how the peak in CDS volume coincides with th ...

EUROPEAN COMMISSION Brussels, 26.2.2016 SWD(2016) 90 final

... During the crisis, high fiscal deficits and significant assumption of liabilities of public enterprises have resulted in a sharp increase in public debt. In recent years, fiscal consolidation has been predominantly based on revenueincreasing measures rather than permanent expenditure reductions, als ...

... During the crisis, high fiscal deficits and significant assumption of liabilities of public enterprises have resulted in a sharp increase in public debt. In recent years, fiscal consolidation has been predominantly based on revenueincreasing measures rather than permanent expenditure reductions, als ...

Game Management Annual Report 2015-16

... The Board must consist of not less than five members and not more than nine members appointed by the Minister for Agriculture. Members of the Board are appointed for not more than a period of three years but may be reappointed. As set out in Section 10 of the Act, the Minister must attempt to ensure ...

... The Board must consist of not less than five members and not more than nine members appointed by the Minister for Agriculture. Members of the Board are appointed for not more than a period of three years but may be reappointed. As set out in Section 10 of the Act, the Minister must attempt to ensure ...

The Value-Relevance of Earnings and Book Value

... The first IA factor is the social capital of family firms. This factor is grounded in stewardship theory and the RBV. In line with the first factor, the family has a deep connection with its business (Astrachan & Jaskiewicz, 2008) and family social capital is often intertwined with that of the firm ...

... The first IA factor is the social capital of family firms. This factor is grounded in stewardship theory and the RBV. In line with the first factor, the family has a deep connection with its business (Astrachan & Jaskiewicz, 2008) and family social capital is often intertwined with that of the firm ...

Estimating Firm Value

... estimate that emerges is called a liquidation value. There are two ways in which the liquidation value can be estimated. One is to base it on the book value of the assets, adjusted for any inflation during the period. Thus, if the book value of assets ten years from now is expected to be $ 2 billion ...

... estimate that emerges is called a liquidation value. There are two ways in which the liquidation value can be estimated. One is to base it on the book value of the assets, adjusted for any inflation during the period. Thus, if the book value of assets ten years from now is expected to be $ 2 billion ...

PSX Investor Guide

... Bond as a debt instrument represents the promise of a issuer to pay a fixed sum of money at a specified maturity date and fixed return at regular intervals until then. At Stock Exchange, most of the trades are made in equity instruments, i.e. stocks or shares issued by various companies. ...

... Bond as a debt instrument represents the promise of a issuer to pay a fixed sum of money at a specified maturity date and fixed return at regular intervals until then. At Stock Exchange, most of the trades are made in equity instruments, i.e. stocks or shares issued by various companies. ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.