INSTITUTO TECNOLOGICO AUTONOMO DE MEXICO

... During the semester we will cover the following topics in detail and discussion in class and exams will be based on them. The instructor may modify and/or add a little more material as the class progresses. DETAILED DESCRIPTION OF THEMES 1. International Trade Theory: Overview of trade theory, Prin ...

... During the semester we will cover the following topics in detail and discussion in class and exams will be based on them. The instructor may modify and/or add a little more material as the class progresses. DETAILED DESCRIPTION OF THEMES 1. International Trade Theory: Overview of trade theory, Prin ...

Exchange rate volatility effects on export competitiveness

... of this currency over the imports and exports of Turkey. First of all, Aydin and al. (2004) have studied the situation from 1987 and 2003 and their conclusion was that the exchange rate doesn’t have any influence over export, but it influences the imports. Secondly, Binatli and Sohrabji (2009) analy ...

... of this currency over the imports and exports of Turkey. First of all, Aydin and al. (2004) have studied the situation from 1987 and 2003 and their conclusion was that the exchange rate doesn’t have any influence over export, but it influences the imports. Secondly, Binatli and Sohrabji (2009) analy ...

'The State of the World Economy' (pdf).

... 1/ In percent of GDP; distance from yellow bar reflects required additional fiscal adjustment relative to 2010-13; adjustment to be sustained between 2020-30 to reduce public debt to prudent levels. 2/ Structural primary balance. 3/ Excluding financial sector support recorded above the line. ...

... 1/ In percent of GDP; distance from yellow bar reflects required additional fiscal adjustment relative to 2010-13; adjustment to be sustained between 2020-30 to reduce public debt to prudent levels. 2/ Structural primary balance. 3/ Excluding financial sector support recorded above the line. ...

2 more things about graphs

... What did Adidas do in 2005? What were the reasons for the deal? How did analysts see this? Why was it unlikely for Nike to take over Reebok? ...

... What did Adidas do in 2005? What were the reasons for the deal? How did analysts see this? Why was it unlikely for Nike to take over Reebok? ...

Presentation

... a new flying geese theory • After World War II, the mutually reinforcing mechanism between productivity growth and demand growth enabled the long-lasting high rate capital accumulation of the 1950s-1960s. • In the USA the locus of dynamism shifted from heavy and chemical industries to machine and el ...

... a new flying geese theory • After World War II, the mutually reinforcing mechanism between productivity growth and demand growth enabled the long-lasting high rate capital accumulation of the 1950s-1960s. • In the USA the locus of dynamism shifted from heavy and chemical industries to machine and el ...

CHAPTER 16 Multinational Financial Management

... to the spot rate? If the U.S. dollar buys fewer units of a foreign currency in the forward than in the spot market, the foreign currency is selling at a premium. In the opposite situation, the foreign currency is selling at a discount. The primary determinant of the spot/forward rate relationship ...

... to the spot rate? If the U.S. dollar buys fewer units of a foreign currency in the forward than in the spot market, the foreign currency is selling at a premium. In the opposite situation, the foreign currency is selling at a discount. The primary determinant of the spot/forward rate relationship ...

Midterm 1 / Questions and Answers

... (a) As the quotas are lifted, imports will increase at any value of the real exchange rate (this is an outward shift in the imports demand curve). As a result of this, net exports will decrease at any value of the real exchange rate (similarly, this is an inward shift in the net exports demand curve ...

... (a) As the quotas are lifted, imports will increase at any value of the real exchange rate (this is an outward shift in the imports demand curve). As a result of this, net exports will decrease at any value of the real exchange rate (similarly, this is an inward shift in the net exports demand curve ...

Institute of Business Management

... Q#2 Explain Inflation and cost of inflation (Expected and unexpected). a. Differentiate Demand pull and cost push inflation with the help of graph which one you suggest for economy and why? b. Define Hyper inflation, stagflation? c. What do you understand by Phillips curve graphically explain short ...

... Q#2 Explain Inflation and cost of inflation (Expected and unexpected). a. Differentiate Demand pull and cost push inflation with the help of graph which one you suggest for economy and why? b. Define Hyper inflation, stagflation? c. What do you understand by Phillips curve graphically explain short ...

ECON 201

... 7. A public official recently argued that our goal as a society should be to eliminate crime, that we should not stop until there is not a single robbery or murder. His assertion is that even one robbery is one too many. Even if a society has enough resources to make it feasible to eliminate crime, ...

... 7. A public official recently argued that our goal as a society should be to eliminate crime, that we should not stop until there is not a single robbery or murder. His assertion is that even one robbery is one too many. Even if a society has enough resources to make it feasible to eliminate crime, ...

News Release 23 September 2003 GOVERNOR’S QUARTERLY PRESS BRIEFING

... support it – both in terms of fiscal policy and reserves. Once that credibility is lost or there is sufficient doubt about its life span, it can be a very expensive system to maintain. We have all seen what speculation can do to even strong economies when their currencies come under attack. The poin ...

... support it – both in terms of fiscal policy and reserves. Once that credibility is lost or there is sufficient doubt about its life span, it can be a very expensive system to maintain. We have all seen what speculation can do to even strong economies when their currencies come under attack. The poin ...

Absolute Advantage, Comparative Advantage

... coordination in these areas. – Multiple objectives within a country may require conflicting policies, so priorities may be critically important. – Independent monetary policies are not possible. – Tax, interest rate, or inflation rate differences will lead to capital flows that will undermine the cu ...

... coordination in these areas. – Multiple objectives within a country may require conflicting policies, so priorities may be critically important. – Independent monetary policies are not possible. – Tax, interest rate, or inflation rate differences will lead to capital flows that will undermine the cu ...

Critical Graphs Required for Success on the AP Macroeconomics

... c. Reserves represent cash and are classified in two ways: i. Required reserves – NOT available for loans ii. Free or excess reserves – AVAILABLE to be loaned out d. Every new loan generates a deposit of equal value, but only a percentage of that new deposit (the amount left after deducting the requ ...

... c. Reserves represent cash and are classified in two ways: i. Required reserves – NOT available for loans ii. Free or excess reserves – AVAILABLE to be loaned out d. Every new loan generates a deposit of equal value, but only a percentage of that new deposit (the amount left after deducting the requ ...

Argentina. Some facts.

... U.S. policies got them into their problem and that the United States then abandoned Argentina because, unlike Turkey, it is not of geopolitical significance. If other emerging market governments misinterpret Argentina's experience, they too might move away from the pro-market policies that can most ...

... U.S. policies got them into their problem and that the United States then abandoned Argentina because, unlike Turkey, it is not of geopolitical significance. If other emerging market governments misinterpret Argentina's experience, they too might move away from the pro-market policies that can most ...

The Renminbi’s Prospects as a Global Reserve Currency

... financial market development, to improve the cost/benefit tradeoff; and (2) financial market development—that is, strengthening the banking system and developing deep and liquid government and corporate bond markets, as well as foreign exchange spot and derivative markets. China’s ability to meet th ...

... financial market development, to improve the cost/benefit tradeoff; and (2) financial market development—that is, strengthening the banking system and developing deep and liquid government and corporate bond markets, as well as foreign exchange spot and derivative markets. China’s ability to meet th ...

National Saving, Domestic Investment, Net Capital Outflow and Net

... LF market: the interest rate adjusts to balance supply for loanable funds (from national saving) and demand for loanable funds (from domestic investment and net capital outflow). In the market for foreign-currency exchange, – the real exchange rate adjusts to balance the supply of dollars (for n ...

... LF market: the interest rate adjusts to balance supply for loanable funds (from national saving) and demand for loanable funds (from domestic investment and net capital outflow). In the market for foreign-currency exchange, – the real exchange rate adjusts to balance the supply of dollars (for n ...

Summary `monetary theory and policy II` Little

... The major central banks seem to have an –perhaps implicit- inflation target over the medium run. In the short run they use an interest rate instrument to react to both output and inflation developments (Taylor rule). 4. Open economy issues In an open economy, the effectiveness of fiscal and monetar ...

... The major central banks seem to have an –perhaps implicit- inflation target over the medium run. In the short run they use an interest rate instrument to react to both output and inflation developments (Taylor rule). 4. Open economy issues In an open economy, the effectiveness of fiscal and monetar ...

DORNBUSCH’S OVERSHOOTING MODEL: A REVIEW

... Views on PPP have changed over time. Before the breakdown of Bretton Woods, economists clung to PPP’s existence (Isard, 1995). In the first phase of research on PPP in the 1970s and 1980s, the emerging consensus was that the real exchange rate followed a random walk, even in the long run, thus denyi ...

... Views on PPP have changed over time. Before the breakdown of Bretton Woods, economists clung to PPP’s existence (Isard, 1995). In the first phase of research on PPP in the 1970s and 1980s, the emerging consensus was that the real exchange rate followed a random walk, even in the long run, thus denyi ...

Solutions to Problems

... interest rates fall. This changes the interest rate differential and the United States sees an increase in its capital outflow and a decrease in its capital inflow. This increases US demand for foreign currencies and reduces world demand for the US dollar. The US dollar depreciates, or other currenc ...

... interest rates fall. This changes the interest rate differential and the United States sees an increase in its capital outflow and a decrease in its capital inflow. This increases US demand for foreign currencies and reduces world demand for the US dollar. The US dollar depreciates, or other currenc ...

PROBLEM SET 6 14.02 Macroeconomics May 3, 2006 Due May 10, 2006

... d. The United States has a large trade deficit. It has a trade deficit with each of its major trading partners, but the deficit is much larger with some countries (e.g., China) than with others. Suppose the United States eliminates its overall trade deficit (with the world as a whole). Do you expect ...

... d. The United States has a large trade deficit. It has a trade deficit with each of its major trading partners, but the deficit is much larger with some countries (e.g., China) than with others. Suppose the United States eliminates its overall trade deficit (with the world as a whole). Do you expect ...

JAPANESE VALUE AT THE FORE (…and the Yen Bond Short)

... deflation, while Asia ex-Japan struggles with inflation. Again, Japan is Asia’s financier, just as the US has been the West’s (Korea is equally influenced). Due to inflation and outstanding current account surpluses, Asian rates need to rise and one factor to help stem that tide will be borrowing fr ...

... deflation, while Asia ex-Japan struggles with inflation. Again, Japan is Asia’s financier, just as the US has been the West’s (Korea is equally influenced). Due to inflation and outstanding current account surpluses, Asian rates need to rise and one factor to help stem that tide will be borrowing fr ...

Monetary Economics and the European Union Lecture: Week 1

... Even with draconian capital controls it might not be possible to maintain a fixed exchange rate (due to balance of payment imbalances and differing inflation rates). Capital controls usually take the form of taxes on foreign exchange transactions and/or restrictions on the amount of domestic currenc ...

... Even with draconian capital controls it might not be possible to maintain a fixed exchange rate (due to balance of payment imbalances and differing inflation rates). Capital controls usually take the form of taxes on foreign exchange transactions and/or restrictions on the amount of domestic currenc ...

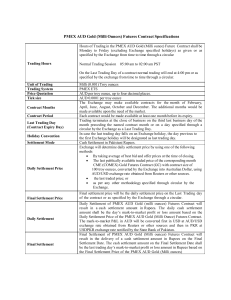

PMEX AUD Gold Futures Contract

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

Answer Key Section 5 and 6 practice test

... 19. In the long run, attempts to expand beyond an economy's natural rate of unemployment tend to result in: A) increased inflation. X B) increased output. C) both increased output and increased inflation. D) neither increased output nor increased inflation. 20. A liquidity trap occurs when conventi ...

... 19. In the long run, attempts to expand beyond an economy's natural rate of unemployment tend to result in: A) increased inflation. X B) increased output. C) both increased output and increased inflation. D) neither increased output nor increased inflation. 20. A liquidity trap occurs when conventi ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.