Singapore`s Exchange Rate Policy - Monetary Authority of Singapore

... contain inflationary pressures. The NEER appreciated by 30% during this period or 5.0% per year. 1985-88: Recession and Deflationary Pressures In 1985, external economic conditions suddenly changed, plunging the economy into a sharp recession. For the economy to regain competitiveness, the REER had ...

... contain inflationary pressures. The NEER appreciated by 30% during this period or 5.0% per year. 1985-88: Recession and Deflationary Pressures In 1985, external economic conditions suddenly changed, plunging the economy into a sharp recession. For the economy to regain competitiveness, the REER had ...

click

... Exchange Rate When people in countries with different currencies buy from and sell to each other, an exchange of currencies must also take place. exchange rate The price of one country’s currency in terms of another country’s currency; the ratio at which two currencies are traded for each other. Wi ...

... Exchange Rate When people in countries with different currencies buy from and sell to each other, an exchange of currencies must also take place. exchange rate The price of one country’s currency in terms of another country’s currency; the ratio at which two currencies are traded for each other. Wi ...

Money supply, the Fed and Monetary Policy

... Policy • The purpose of monetary policy is to control the money supply. The Fed doesn’t print money, but they do increase or decrease how much is in circulation. They also control interest rates. ...

... Policy • The purpose of monetary policy is to control the money supply. The Fed doesn’t print money, but they do increase or decrease how much is in circulation. They also control interest rates. ...

Powerpoint Presentation

... Either way you have an unstable macroeconomic variable. But the latter choice (stabilizing P) requires constant government intervention; whereas, the former is natural. ...

... Either way you have an unstable macroeconomic variable. But the latter choice (stabilizing P) requires constant government intervention; whereas, the former is natural. ...

Effects of Fiscal Policy under Different Capital Mobility

... The money market equilibrium can be pictured as the “LM curve” of figure1. It shows all possible combinations of interest rate i and real GDP Y that are consistent with equilibrium in the money sector of the national economy, given the state of other fundamental influences. If any of these other fun ...

... The money market equilibrium can be pictured as the “LM curve” of figure1. It shows all possible combinations of interest rate i and real GDP Y that are consistent with equilibrium in the money sector of the national economy, given the state of other fundamental influences. If any of these other fun ...

The Dollar-Euro Exchange Rate and the Limits to

... fundamentals would matter in exactly the same way for more than 30 years, or that they could fully prespecify how this relationship might have changed over time. It is thus not surprising that academic economists have found that their models forecast exchange rates no better than flipping a coin do ...

... fundamentals would matter in exactly the same way for more than 30 years, or that they could fully prespecify how this relationship might have changed over time. It is thus not surprising that academic economists have found that their models forecast exchange rates no better than flipping a coin do ...

Evaluating development efforts

... and a consequent increase in the current account deficit of the balance of payments, and an adverse real shock to the economy as the tradable sector loses competitiveness with imports. No country pursued this policy to the letter, but many let their nominal exchange rates appreciate to some extent, ...

... and a consequent increase in the current account deficit of the balance of payments, and an adverse real shock to the economy as the tradable sector loses competitiveness with imports. No country pursued this policy to the letter, but many let their nominal exchange rates appreciate to some extent, ...

3d_Dong He presentation_10 Dec (Bob paper)

... In its original and narrow sense, the Triffin Dilemma points to a potentially explosive path of reserve currency issuance: short-term liabilities of the reserve issuing country grows infinitely against the backing of a stagnant stock of gold. This would cause a run on the currency, particularly if t ...

... In its original and narrow sense, the Triffin Dilemma points to a potentially explosive path of reserve currency issuance: short-term liabilities of the reserve issuing country grows infinitely against the backing of a stagnant stock of gold. This would cause a run on the currency, particularly if t ...

Beyond the Border - Brazil: The First Financial Crisis of 1999

... Despite some problems, the Real Plan was cause for optimism. Brazil took steps to correct a large federal deficit, reducing funds transferred by the federal government to the states and municipalities and increasing federal income taxes. Monetary policy became more restrained. Finally, Brazil pegged ...

... Despite some problems, the Real Plan was cause for optimism. Brazil took steps to correct a large federal deficit, reducing funds transferred by the federal government to the states and municipalities and increasing federal income taxes. Monetary policy became more restrained. Finally, Brazil pegged ...

Currency Wars and Competitive Devaluation.

... currencies, that led to the fall of the goldstandard system. Devaluations reached unprecedented levels, affecting the living ...

... currencies, that led to the fall of the goldstandard system. Devaluations reached unprecedented levels, affecting the living ...

Matias Vernengo

... Aid inflows lead to an appreciation of the exchange rate. In contrast to the conventional model, contractionary monetary policy, by raising the rate of interest leads to an appreciation of the exchange rate. In particular, if sterilization leads to lower prices for bonds and higher rates of interest ...

... Aid inflows lead to an appreciation of the exchange rate. In contrast to the conventional model, contractionary monetary policy, by raising the rate of interest leads to an appreciation of the exchange rate. In particular, if sterilization leads to lower prices for bonds and higher rates of interest ...

monetary models of dollar/yen/euro nominal exchange rates

... A second obvious problem is that money demand has been extremely unstable over the past two decades. Deregulation and innovation have been pervasive throughout the OECD, making the connection between any measure of money and prices a tenuous one.5 Moreover, in¯ation rates across the United States, G ...

... A second obvious problem is that money demand has been extremely unstable over the past two decades. Deregulation and innovation have been pervasive throughout the OECD, making the connection between any measure of money and prices a tenuous one.5 Moreover, in¯ation rates across the United States, G ...

Convertibility_eac_comesa

... Business benefits from the transparency associated with transferring funds in the region ...

... Business benefits from the transparency associated with transferring funds in the region ...

Changes in demand of domestic goods relative

... Pass through from the exchange rate to import prices measures the percentage by which import prices change when the value of the domestic currency changes by 1%. In the DD-AA model, the pass through rate is 100%: import prices in domestic currency exactly match a depreciation of the domestic curren ...

... Pass through from the exchange rate to import prices measures the percentage by which import prices change when the value of the domestic currency changes by 1%. In the DD-AA model, the pass through rate is 100%: import prices in domestic currency exactly match a depreciation of the domestic curren ...

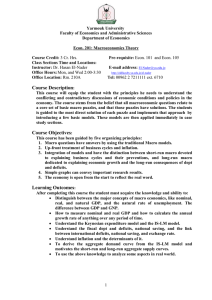

Yarmouk University Economics 200

... Understand the fiscal dept and deficits, national saving, and the link between international deficits, national saving, and exchange rate. Understand inflation and the determinants of it. To derive the aggregate demand curve from the IS-LM model and motivates the short-run and long-run aggrega ...

... Understand the fiscal dept and deficits, national saving, and the link between international deficits, national saving, and exchange rate. Understand inflation and the determinants of it. To derive the aggregate demand curve from the IS-LM model and motivates the short-run and long-run aggrega ...

Money

... • 2. Because very few people have enough money to pay for a house in full, they have to finance it with a home mortgage loan (long term property loan) These are normally 30 year loans • 3. To buy a house also requires a down payment, which is usually 20 percent of the purchase price of the property ...

... • 2. Because very few people have enough money to pay for a house in full, they have to finance it with a home mortgage loan (long term property loan) These are normally 30 year loans • 3. To buy a house also requires a down payment, which is usually 20 percent of the purchase price of the property ...

NBER WORKING PAPER SERIES THE LOGIC OF CURRENCY CRISES Maurice Obstfeld

... validate those attacks. Dellas and Stockman (1993) build on my 1986 analysis to show how the possibility that a government will Introduce capital controls in a crisis can generate self—fulfilling attacks. These papers do not, however, derive official responses from models of optimal government behav ...

... validate those attacks. Dellas and Stockman (1993) build on my 1986 analysis to show how the possibility that a government will Introduce capital controls in a crisis can generate self—fulfilling attacks. These papers do not, however, derive official responses from models of optimal government behav ...

Sample Midterm 2

... The statistics for the country of Absurdistan in year 2007 show that there are 15 people who are unemployed, and 45 people who are employed. The adult population of the country in that year was 80 people. Use this information to calculate a. the labor force b. the labor force participation rate c. t ...

... The statistics for the country of Absurdistan in year 2007 show that there are 15 people who are unemployed, and 45 people who are employed. The adult population of the country in that year was 80 people. Use this information to calculate a. the labor force b. the labor force participation rate c. t ...

The Causes, Solution and Consequences of the 1997 Monetary Crisis

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

Document

... deficit of 1,475 md in 2006, 0.2% of GDP. This figure was below the percentage registered in 2005 (0.6% of GDP). This small deficit was the result of an increase of the petroleum trade surplus and inflows received by Mexican workers abroad (remittances). Banxico • Workers’ remittances increased in 2 ...

... deficit of 1,475 md in 2006, 0.2% of GDP. This figure was below the percentage registered in 2005 (0.6% of GDP). This small deficit was the result of an increase of the petroleum trade surplus and inflows received by Mexican workers abroad (remittances). Banxico • Workers’ remittances increased in 2 ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.