Is Milton Friedman a Keynesian?

... K1. Keynesians believe that the interest rate, largely (if not M1. Monetarists believe that the interest rate, largely a real wholly) a monetary phenomenon, is determined by the supply of phenomenon, is determined by the supply of and demand for and demand for money. loanable funds, a market which f ...

... K1. Keynesians believe that the interest rate, largely (if not M1. Monetarists believe that the interest rate, largely a real wholly) a monetary phenomenon, is determined by the supply of phenomenon, is determined by the supply of and demand for and demand for money. loanable funds, a market which f ...

Lecture 7: Factors Affect Current Account

... B. multivariate Probit analysis 3% average decline of the current account deficit between t and t+2 with respect to the period between t-1 and t-3 Reversal appear more likely for countries with high CAD, low foreign reserves, high GDP per capita, worsened terms of trade, high investment, high OECD g ...

... B. multivariate Probit analysis 3% average decline of the current account deficit between t and t+2 with respect to the period between t-1 and t-3 Reversal appear more likely for countries with high CAD, low foreign reserves, high GDP per capita, worsened terms of trade, high investment, high OECD g ...

Brazil_en.pdf

... however, is a changed international scene in which there is greater volatility and less local infrastructure or production capacity to meet growing domestic demand. The sharp rise in imports and the burgeoning current account deficit reflect rapid growth in economic activity. Consequently, inflation ...

... however, is a changed international scene in which there is greater volatility and less local infrastructure or production capacity to meet growing domestic demand. The sharp rise in imports and the burgeoning current account deficit reflect rapid growth in economic activity. Consequently, inflation ...

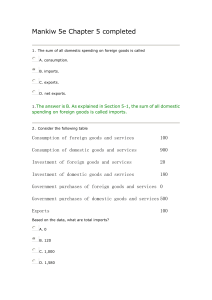

Mankiw 5e Chapter 5 completed

... country's real exchange rate and to net exports? A. The real exchange rate will fall; net exports will rise. B. The real exchange rate will fall; net exports will fall. C. The real exchange rate will rise; net exports will fall. D. The real exchange rate will rise; net exports will rise. ...

... country's real exchange rate and to net exports? A. The real exchange rate will fall; net exports will rise. B. The real exchange rate will fall; net exports will fall. C. The real exchange rate will rise; net exports will fall. D. The real exchange rate will rise; net exports will rise. ...

macro-unit-vii-notes

... 0 Determined by the forces of supply and demand 0 Demand for any currency is downward sloping because as the currency becomes less expensive, people will be able to buy more of that nation’s goods and, therefore, want larger quantities of the currency 0 Supply of any currency is upward sloping becau ...

... 0 Determined by the forces of supply and demand 0 Demand for any currency is downward sloping because as the currency becomes less expensive, people will be able to buy more of that nation’s goods and, therefore, want larger quantities of the currency 0 Supply of any currency is upward sloping becau ...

MS Word - of Planning Commission

... exchange rates have tended to overshoot and that there have been persistent currency misalignments. In short, there is widespread agreement that the external balance achieved under floating rates does not constitute an “equilibrium” or at any rate not a “satisfactory equilibrium”. The Annual Report ...

... exchange rates have tended to overshoot and that there have been persistent currency misalignments. In short, there is widespread agreement that the external balance achieved under floating rates does not constitute an “equilibrium” or at any rate not a “satisfactory equilibrium”. The Annual Report ...

Ec11 Final Spring 2005 Prof

... a. purchases by foreigners of consumer goods produced in the United States b. purchases of services such as visits to the doctor c. purchases of capital goods such as equipment in a factory d. purchases of stock and bonds 39. If the consumer price index was 100 in the base year and 107 the following ...

... a. purchases by foreigners of consumer goods produced in the United States b. purchases of services such as visits to the doctor c. purchases of capital goods such as equipment in a factory d. purchases of stock and bonds 39. If the consumer price index was 100 in the base year and 107 the following ...

AP Macroeconomics

... LRAS is vertical because price level changes will not effect available resources or productivity in the ...

... LRAS is vertical because price level changes will not effect available resources or productivity in the ...

Spring 2015 TEST 3 w/ solution

... payments because government purchasing of goods and services: A) is a type of fiscal policy, while changing taxes and transfer payments is a type of monetary policy. B) is a type of monetary policy, while changing taxes and transfer payments is a type of fiscal policy. C) influences aggregate demand ...

... payments because government purchasing of goods and services: A) is a type of fiscal policy, while changing taxes and transfer payments is a type of monetary policy. B) is a type of monetary policy, while changing taxes and transfer payments is a type of fiscal policy. C) influences aggregate demand ...

Markets and Economic Theory

... allows individuals to benefit from natural differences in tastes and talents and (in the case of international trade) differences in climate and institutional arrangements. The second aspect allows individuals to take advantage of the productivity increases that specialization creates – increases th ...

... allows individuals to benefit from natural differences in tastes and talents and (in the case of international trade) differences in climate and institutional arrangements. The second aspect allows individuals to take advantage of the productivity increases that specialization creates – increases th ...

ECON 8423-001 International Finance

... countries and also allow each country to pool the risk it faces (in, e.g., productivity) with other countries in the world . Nations are also linked through trade in commodity markets and factor markets and this interdependence will also be important for the understanding of international macroecono ...

... countries and also allow each country to pool the risk it faces (in, e.g., productivity) with other countries in the world . Nations are also linked through trade in commodity markets and factor markets and this interdependence will also be important for the understanding of international macroecono ...

Module Saving, Investment, and the Financial System

... by capital inflow are not equivalent. Investment spending financed by capital inflow comes at a higher national cost (the interest that must eventually be paid to a foreigner), than a dollar borrowed from national savings. ...

... by capital inflow are not equivalent. Investment spending financed by capital inflow comes at a higher national cost (the interest that must eventually be paid to a foreigner), than a dollar borrowed from national savings. ...

Enc. 5 for Treasury Management Strategy and Prudential Limits

... These are Money Market Funds which maintain a stable price of £1 per share when investors redeem or purchase shares which means that that any investment will not fluctuate in value. Corporate Bonds: ...

... These are Money Market Funds which maintain a stable price of £1 per share when investors redeem or purchase shares which means that that any investment will not fluctuate in value. Corporate Bonds: ...

Free Enterprise and Central Banking in Formerly

... reports that in the Soviet Union, “the government is forced to spend about $160 billion in subsidies on food and some consumer goods annually, while the cost of many industrial goods is far higher than in the West.” The banking system extends credit to cover the deficits of firms whose prices are se ...

... reports that in the Soviet Union, “the government is forced to spend about $160 billion in subsidies on food and some consumer goods annually, while the cost of many industrial goods is far higher than in the West.” The banking system extends credit to cover the deficits of firms whose prices are se ...

PDF Download

... The annual rate of growth of M3 stood at 11.4% in January 2008 compared to 12.0% in November 2007. The three-month average of the annual growth rate of M3 over the period from November 2007 to January 2008 reached 11.7% and, therefore, remained unchanged compared to that for the period August-Octobe ...

... The annual rate of growth of M3 stood at 11.4% in January 2008 compared to 12.0% in November 2007. The three-month average of the annual growth rate of M3 over the period from November 2007 to January 2008 reached 11.7% and, therefore, remained unchanged compared to that for the period August-Octobe ...

PDF Download

... that the Baltic states accrued substantial current account deficits from the mid-1990s onwards, an outcome which suggests that international investors considered the strict fixed exchange rate regimes as credible. ...

... that the Baltic states accrued substantial current account deficits from the mid-1990s onwards, an outcome which suggests that international investors considered the strict fixed exchange rate regimes as credible. ...

MACROECONOMIC STUDY REVIEW SHEET Bond prices move in

... 103. Within the Classical Dichotomy, because Velocity is stable and Real Output is not influenced by changes in the money supply, when the money supply is changed, it directly influences the ________ ________. 104. _______________ _____________ ______________ states that as long as exchange rates ar ...

... 103. Within the Classical Dichotomy, because Velocity is stable and Real Output is not influenced by changes in the money supply, when the money supply is changed, it directly influences the ________ ________. 104. _______________ _____________ ______________ states that as long as exchange rates ar ...

4. The Euro Area Enlargement

... Slovakia: the Slovak koruna joined the Exchange Rate Mechanism II (ERM II) on 28 November 2005 and observes a central rate of 38.4550 and standard fluctuation margins (±15%) vis-à-vis the euro. ...

... Slovakia: the Slovak koruna joined the Exchange Rate Mechanism II (ERM II) on 28 November 2005 and observes a central rate of 38.4550 and standard fluctuation margins (±15%) vis-à-vis the euro. ...

Cuba_en.pdf

... 25% of their income for social security so that they can claim a pension. In 2011, it was announced that this regime was to be made more flexible, for example, by including a possible grace period for own-account companies during the initial start-up phase, changes to take account of the specific ec ...

... 25% of their income for social security so that they can claim a pension. In 2011, it was announced that this regime was to be made more flexible, for example, by including a possible grace period for own-account companies during the initial start-up phase, changes to take account of the specific ec ...

what the fed liftoff means for the us dollar and stocks

... Once again, the summary data is displayed in table form below: ...

... Once again, the summary data is displayed in table form below: ...

Surging Swedish economy raises questions over negative rates

... krona to head off the threat of deflation. The strong GDP numbers caused the krona to strengthen against the euro by 0.5 per cent to SKr9.32. Economists no longer expect the Riksbank to cut interest rates any further — especially given some opposition to the latest cut from minus 0.35 per cent to m ...

... krona to head off the threat of deflation. The strong GDP numbers caused the krona to strengthen against the euro by 0.5 per cent to SKr9.32. Economists no longer expect the Riksbank to cut interest rates any further — especially given some opposition to the latest cut from minus 0.35 per cent to m ...

ECN202 Practice Questions: Domestic Money

... d. should stop focusing its attention on stabilizing the money supply It was very clear - start looking at money supply 13. We know that both fiscal and monetary policies can be used to manage the macro economy and that there are times when one might be more effective than the other. What if you kne ...

... d. should stop focusing its attention on stabilizing the money supply It was very clear - start looking at money supply 13. We know that both fiscal and monetary policies can be used to manage the macro economy and that there are times when one might be more effective than the other. What if you kne ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.