Internationalization of Renminbi: What does the Evidence Suggest?

... 1949 shortly before the communist takeover of the Mainland to fight the hyperinflation that plagued the Middle Kingdom under the Kuomintang government (Financial Times 2008). Ever since the opening up of the Chinese economy in the late 1970s the RMB has mostly been kept undervalued as part of Beijin ...

... 1949 shortly before the communist takeover of the Mainland to fight the hyperinflation that plagued the Middle Kingdom under the Kuomintang government (Financial Times 2008). Ever since the opening up of the Chinese economy in the late 1970s the RMB has mostly been kept undervalued as part of Beijin ...

Capital Flows and Financial Crises - E-Prints Complutense

... might be summarized as follows (see more details in Bustelo, 1998 and Bustelo et al., 1999 and 2000). First, financial opening, together with the currency pegs to the US dollar and with the low interest rates prevailing a the time in developed countries, led to large capital inflows, mainly in the f ...

... might be summarized as follows (see more details in Bustelo, 1998 and Bustelo et al., 1999 and 2000). First, financial opening, together with the currency pegs to the US dollar and with the low interest rates prevailing a the time in developed countries, led to large capital inflows, mainly in the f ...

Austrian Business Cycle Theory and Global Crisis[1]

... The grey columns in figure 1 indicate the contraction periods of the US economy, as determined by the National Bureau of Economic Research. It is evident that in the contraction periods, the Fed put into effect expansionary monetary policies by lowering market interest rates. Before the global crisi ...

... The grey columns in figure 1 indicate the contraction periods of the US economy, as determined by the National Bureau of Economic Research. It is evident that in the contraction periods, the Fed put into effect expansionary monetary policies by lowering market interest rates. Before the global crisi ...

The Responses of U.S. Firms to Exchange Rate Fluctuations

... exportpricesdo not actuallyindicatethe prices paidbyfinal purchasers of U.S. products abroad. In our view, for a significantproportionof U.S. exports-particularly those that take the form of intrafirmtradeexport price changes are more likely to reflect changes in the internal prices at whichproducts ...

... exportpricesdo not actuallyindicatethe prices paidbyfinal purchasers of U.S. products abroad. In our view, for a significantproportionof U.S. exports-particularly those that take the form of intrafirmtradeexport price changes are more likely to reflect changes in the internal prices at whichproducts ...

Renminbi Undervaluation, China`s Surplus, and the US Trade Deficit

... Toronto, China announced that it would shift to a more flexible exchange rate policy. From mid-June to July 30 the yuan rose 0.8 percent against the dollar. In contrast, the currency had remained fixed (at about 6.83 yuan to the dollar) from September 2008 to early June 2010. Pressure not only from ...

... Toronto, China announced that it would shift to a more flexible exchange rate policy. From mid-June to July 30 the yuan rose 0.8 percent against the dollar. In contrast, the currency had remained fixed (at about 6.83 yuan to the dollar) from September 2008 to early June 2010. Pressure not only from ...

Answers to Text Questions and Problems for Chapter 6

... 1. The CPI measures the cost of buying a particular “basket” of goods and services, relative to a specified base year. The official basket of goods and services is intended to correspond to the buying patterns of the typical family. However, a family whose buying patterns differ from the average may ...

... 1. The CPI measures the cost of buying a particular “basket” of goods and services, relative to a specified base year. The official basket of goods and services is intended to correspond to the buying patterns of the typical family. However, a family whose buying patterns differ from the average may ...

Economic Effects of Currency Unions ∗ Silvana Tenreyro Robert J. Barro

... adopt the same currency. The underlying assumption in the analysis is that there exist factors driving the decision to adopt a third country’s currency that are independent of the bilateral links between two potential clients. In other words, the basic idea is to isolate the motive that relates to t ...

... adopt the same currency. The underlying assumption in the analysis is that there exist factors driving the decision to adopt a third country’s currency that are independent of the bilateral links between two potential clients. In other words, the basic idea is to isolate the motive that relates to t ...

NBER WORKING PAPER SERIES HOW MANY MONIES? A GENETIC APPROACH TO FINDING

... The change in the domestic price level will be associated with a change in the nominal exchange rate, unless the foreign country experiences the same shock. For instance, if two ...

... The change in the domestic price level will be associated with a change in the nominal exchange rate, unless the foreign country experiences the same shock. For instance, if two ...

Macroeconomic Policies

... describes the technological progress. Saving rate equals 12,5%, the labor force grows 1% per year and the capital depreciation rate is 3% and A equals 2. Compute the steady state levels of capital and output per efficiency unit and the growth rate of per capita income. ...

... describes the technological progress. Saving rate equals 12,5%, the labor force grows 1% per year and the capital depreciation rate is 3% and A equals 2. Compute the steady state levels of capital and output per efficiency unit and the growth rate of per capita income. ...

the 1997-98 financial crisis in malaysia: causes, response

... managers were convinced that the exchange rate was out of what they perceived as its equilibrium value, one way speculative action was expected [Kawai (2000), p.14]. No less than US dollars108 billion left the region within first six months of the crisis. The herd behavior of local speculators did a ...

... managers were convinced that the exchange rate was out of what they perceived as its equilibrium value, one way speculative action was expected [Kawai (2000), p.14]. No less than US dollars108 billion left the region within first six months of the crisis. The herd behavior of local speculators did a ...

Local versus Producer Currency Pricing: Evidence from

... In the camp of using disaggregated data, Goldberg and Verboven (2005) examine auto prices in …ve European countries from 1970 to 2000 and …nd strong convergence towards both the absolute and the relative versions of the LOP. They also …nd high degrees of pass-through suggesting that pricing in the ...

... In the camp of using disaggregated data, Goldberg and Verboven (2005) examine auto prices in …ve European countries from 1970 to 2000 and …nd strong convergence towards both the absolute and the relative versions of the LOP. They also …nd high degrees of pass-through suggesting that pricing in the ...

Economics 101

... Reserve Bank open market sale of securities to the public? A. Aggregate output decreases, demand for money decreases, the interest rate decreases, planned investment increases, and aggregate output increases. B. Money supply decreases, the interest rate increases, planned investment decreases, aggre ...

... Reserve Bank open market sale of securities to the public? A. Aggregate output decreases, demand for money decreases, the interest rate decreases, planned investment increases, and aggregate output increases. B. Money supply decreases, the interest rate increases, planned investment decreases, aggre ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... undermine the international competitiveness of non-oil exports and make planning and projections difficult at both micro and macro levels of the economy. A good number of small and medium scale enterprises have been strangled out as a result of low dollar/ naira exchange rate and so many other probl ...

... undermine the international competitiveness of non-oil exports and make planning and projections difficult at both micro and macro levels of the economy. A good number of small and medium scale enterprises have been strangled out as a result of low dollar/ naira exchange rate and so many other probl ...

Substitution between domestic and foreign currency loans in Central

... Slovakia. All these countries follow inflation targeting4 strategies and all have a substantial share of foreign currency loans in total loans to the private sector. Our study is not the first approach to credit expansion in Central and Eastern Europe. The investigated topics include e.g. estimating ...

... Slovakia. All these countries follow inflation targeting4 strategies and all have a substantial share of foreign currency loans in total loans to the private sector. Our study is not the first approach to credit expansion in Central and Eastern Europe. The investigated topics include e.g. estimating ...

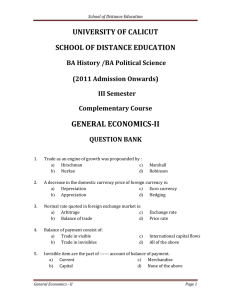

GENERAL ECONOMICSII UNIVERSITY OF CALICUT SCHOOL OF DISTANCE EDUCATION

... 18. An economic transaction is entered in the balance of payment as a credit, if it leads to: a) Receipt of payment from foreigners b) Either the receipt of payment or making of payment c) A payment to foreigners d) Neither the receipt nor making of a payment ...

... 18. An economic transaction is entered in the balance of payment as a credit, if it leads to: a) Receipt of payment from foreigners b) Either the receipt of payment or making of payment c) A payment to foreigners d) Neither the receipt nor making of a payment ...

mmi11 Piccillo 15082658 en

... study the day to day financial series using this framework alone. Nonetheless this work definitely launches some solid foundations to analyze the relationship between stock prices and exchange rates. In a later contribution, Coeurdacier, Kollmann and Martin (2009) specify the financial markets in a ...

... study the day to day financial series using this framework alone. Nonetheless this work definitely launches some solid foundations to analyze the relationship between stock prices and exchange rates. In a later contribution, Coeurdacier, Kollmann and Martin (2009) specify the financial markets in a ...

FINANCIAL ECONO MICS MAY 2012 - Institute of Bankers in Malawi

... The risk on an individual asset is derived from the probability distribution and it is usually assumed that the wealth owner cannot change that. But one of the most important ideas in financial economics is that the portfolio owners can reduce the average risk on the asset he/she owns by holding mor ...

... The risk on an individual asset is derived from the probability distribution and it is usually assumed that the wealth owner cannot change that. But one of the most important ideas in financial economics is that the portfolio owners can reduce the average risk on the asset he/she owns by holding mor ...

Stock prices and the East Asian Financial Crisis

... relationship between stock prices and exchange rates. This suggests that a rise in stock prices, increases the domestic wealth of investors, facilitating a rise in the demand for money. Following the consequent rise in interest rates, capital is attracted into the domestic economy appreciating the d ...

... relationship between stock prices and exchange rates. This suggests that a rise in stock prices, increases the domestic wealth of investors, facilitating a rise in the demand for money. Following the consequent rise in interest rates, capital is attracted into the domestic economy appreciating the d ...

Chapter 28: Monetary Policy in the Short Run

... The Demand for Money • Money is simply a part of your wealth. You can hold assets such as stocks or bonds, or you can hold wealth in the form of money. • Holding wealth in currency or checking deposits means that you sacrifice the potential income from interest and dividends earned on stocks and bo ...

... The Demand for Money • Money is simply a part of your wealth. You can hold assets such as stocks or bonds, or you can hold wealth in the form of money. • Holding wealth in currency or checking deposits means that you sacrifice the potential income from interest and dividends earned on stocks and bo ...

The Open Economy Revisited: the Mundell

... in the domestic industries that produce those products, but destroy jobs in export-producing sectors. ...

... in the domestic industries that produce those products, but destroy jobs in export-producing sectors. ...

Output and the Exchange Rate in the Short Run

... Assume a 75% depreciation of a country’s currency in one week Demand for foreign exchange has increased and supply has decreased Exchange rate goes from XRe to XR’’ Could have been capital flight out of country due to domestic crisis or due to exchange rate being fixed at inappropriate level for lon ...

... Assume a 75% depreciation of a country’s currency in one week Demand for foreign exchange has increased and supply has decreased Exchange rate goes from XRe to XR’’ Could have been capital flight out of country due to domestic crisis or due to exchange rate being fixed at inappropriate level for lon ...

Stylized facts of exchange-rate based stabilization - unu

... understood as the mechanism by which the additional burden on the economy is distributed to different income groups, the so-called inflation tax. Sooner or later these groups—especially if they are backed by politically powerful organizations—will succeed in indexing their nominal incomes to the rat ...

... understood as the mechanism by which the additional burden on the economy is distributed to different income groups, the so-called inflation tax. Sooner or later these groups—especially if they are backed by politically powerful organizations—will succeed in indexing their nominal incomes to the rat ...

2014 CENTRAL BANK OF THE REPUBLIC OF TURKEY

... the inflation targeting regime. The Report presents the MPC’s evaluations pertaining to the inflation outlook, the monetary policy stance, macroeconomic developments, supply and demand conditions and risks to the inflation outlook, as well as CBRT’s forecasts for the medium term inflation and the ou ...

... the inflation targeting regime. The Report presents the MPC’s evaluations pertaining to the inflation outlook, the monetary policy stance, macroeconomic developments, supply and demand conditions and risks to the inflation outlook, as well as CBRT’s forecasts for the medium term inflation and the ou ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.

![Austrian Business Cycle Theory and Global Crisis[1]](http://s1.studyres.com/store/data/004262576_1-483db5f986de48b1a49c963a34d4db2c-300x300.png)