5. Approaches to policy and macroeconomic context

... o The 2007-08 financial crisis and its aftermath The Global Financial Crisis is sometimes called The Great Recession, and it refers to the decline in world GDP in 2008-2009. Before the crash, asset prices were high and rising, and there was a boom in economic demand. There were risky bank loans and ...

... o The 2007-08 financial crisis and its aftermath The Global Financial Crisis is sometimes called The Great Recession, and it refers to the decline in world GDP in 2008-2009. Before the crash, asset prices were high and rising, and there was a boom in economic demand. There were risky bank loans and ...

Deflation August26

... A. A fall in the general price level, but harmful deflation is about more than that Technically, deflation is defined as a decline in the general price level. However, not all forms of deflation are created equal. As illustrated in 2009, total inflation can be pushed below zero because of large fluc ...

... A. A fall in the general price level, but harmful deflation is about more than that Technically, deflation is defined as a decline in the general price level. However, not all forms of deflation are created equal. As illustrated in 2009, total inflation can be pushed below zero because of large fluc ...

Monetary Policy Practice

... If the Fed believes there is too much money in the economy, they can try to reduce lending activity by banks. In order to do this, they should _________________ the discount rate. This would cause banks to _______________ their interest rates. As interest rates increase, money becomes ______________ ...

... If the Fed believes there is too much money in the economy, they can try to reduce lending activity by banks. In order to do this, they should _________________ the discount rate. This would cause banks to _______________ their interest rates. As interest rates increase, money becomes ______________ ...

Chapter 3: Economic Challenges Facing Contemporary Business.

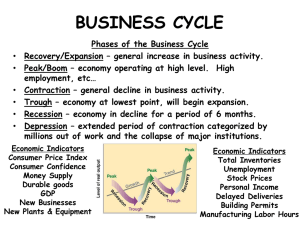

... • Business decisions and consumer behavior differ at various stages of the business cycle: Prosperity—High consumer confidence, businesses expanding Recession—Cyclical economic contraction lasting for six months or longer Depression—Extended recession ...

... • Business decisions and consumer behavior differ at various stages of the business cycle: Prosperity—High consumer confidence, businesses expanding Recession—Cyclical economic contraction lasting for six months or longer Depression—Extended recession ...

Economic Challenges

... • Business decisions and consumer behavior differ at various stages of the business cycle: Prosperity—High consumer confidence, businesses expanding Recession—Cyclical economic contraction lasting for six months or longer Depression—Extended recession ...

... • Business decisions and consumer behavior differ at various stages of the business cycle: Prosperity—High consumer confidence, businesses expanding Recession—Cyclical economic contraction lasting for six months or longer Depression—Extended recession ...

Understanding Deflation

... This is because inflation as measured by regular price indices is often biased upward; for instance, according to statistical analysis, the annual inflation rate as measured by core Personal Consumption Expenditure (PCE) price index is probably biased upward by about 0.5 percentage point, and the bi ...

... This is because inflation as measured by regular price indices is often biased upward; for instance, according to statistical analysis, the annual inflation rate as measured by core Personal Consumption Expenditure (PCE) price index is probably biased upward by about 0.5 percentage point, and the bi ...

Box 3 Deflation - Central Bank of Iceland

... occur under such conditions and call either for a temporary reduction in real wages or negative GDP growth, reluctance to reduce nominal wages and the fact that nominal interest rates can hardly drop below zero could cause unemployment to rise. Malignant deflation goes hand in hand with stagnation o ...

... occur under such conditions and call either for a temporary reduction in real wages or negative GDP growth, reluctance to reduce nominal wages and the fact that nominal interest rates can hardly drop below zero could cause unemployment to rise. Malignant deflation goes hand in hand with stagnation o ...

Perfect Competition

... 1. If prices are falling consumers will be more reluctant to spend because they feel that prices will be lower in the future. This delay in spending will reduce AD and cause lower economic growth. 2. Monetary policy becomes ineffective because interest rates cannot fall below 0. Therefore real inter ...

... 1. If prices are falling consumers will be more reluctant to spend because they feel that prices will be lower in the future. This delay in spending will reduce AD and cause lower economic growth. 2. Monetary policy becomes ineffective because interest rates cannot fall below 0. Therefore real inter ...

Economic Fluctuations: Unemployment and Inflation

... when people are not spending money then stuff piles up on the shelves at the store, and merchants lower prices in hopes of moving their goods and services. It becomes a vicious spiral. Deflation tends to cripple an economy. Another troubling possibility is stagflation – a combination of inflation an ...

... when people are not spending money then stuff piles up on the shelves at the store, and merchants lower prices in hopes of moving their goods and services. It becomes a vicious spiral. Deflation tends to cripple an economy. Another troubling possibility is stagflation – a combination of inflation an ...

Understanding the Impacts of Deflation

... about deflation. Perhaps it is more widely believed that inflation is bad, so deflation must be good. If prices go down, it makes sense to believe the situation would likely encourage more buying. In fact, it can actually have the opposite effect. If consumers and corporations expect prices to go do ...

... about deflation. Perhaps it is more widely believed that inflation is bad, so deflation must be good. If prices go down, it makes sense to believe the situation would likely encourage more buying. In fact, it can actually have the opposite effect. If consumers and corporations expect prices to go do ...

Word Document

... Late in the Depression the Fed believed it had a loose policy, but did not take into account bank failures which made the money supply still contractionary. Ludwig von Mises and F.A. Hayek believed the Great Depression was an Austrian Business Cycle. Barry Eichengreen theorized in Golden Fette ...

... Late in the Depression the Fed believed it had a loose policy, but did not take into account bank failures which made the money supply still contractionary. Ludwig von Mises and F.A. Hayek believed the Great Depression was an Austrian Business Cycle. Barry Eichengreen theorized in Golden Fette ...

Deflation: Good and Bad

... Which brings us to the difference between good and bad deflation. For sure, it would be a stretch to describe what’s happening in the U.S. as bad deflation. That occurs when there is a broad based decline in prices that lasts for a considerable time and has detrimental effects on economic behavior. ...

... Which brings us to the difference between good and bad deflation. For sure, it would be a stretch to describe what’s happening in the U.S. as bad deflation. That occurs when there is a broad based decline in prices that lasts for a considerable time and has detrimental effects on economic behavior. ...

Just Say No to Rate Cuts - Lawrence Capital Management

... "money x velocity = price x quantity." Money is defined as the money supply, while velocity is the number of times that money circulates. The right side of the equation defines nominal GDP -- the price of all goods (P), times the quantity of all goods (Q). Typically, economists use the equation to ...

... "money x velocity = price x quantity." Money is defined as the money supply, while velocity is the number of times that money circulates. The right side of the equation defines nominal GDP -- the price of all goods (P), times the quantity of all goods (Q). Typically, economists use the equation to ...

Negative interest rates

... negative when expectations are deflationary, economists add a zero floor for the NOMINAL_RATE based on the argument that consumers can always elect to hold cash rather than invest. The REAL_RATE is presumed to be non-negative on the grounds that there should be a premium for foregoing consumption ev ...

... negative when expectations are deflationary, economists add a zero floor for the NOMINAL_RATE based on the argument that consumers can always elect to hold cash rather than invest. The REAL_RATE is presumed to be non-negative on the grounds that there should be a premium for foregoing consumption ev ...

Factors affecting business success

... To be successful an entrepreneur must be able to both plant and grow his/her business The following list of personal traits are generally required: ...

... To be successful an entrepreneur must be able to both plant and grow his/her business The following list of personal traits are generally required: ...

The Great Crash

... household goods on credit. The best explanation for this is the following: ________________. – A. Americans purchased good on the installment plan, putting down only a small amount of the total cost of the good and then making monthly payments – B. Because of the uneven distribution wealth, the midd ...

... household goods on credit. The best explanation for this is the following: ________________. – A. Americans purchased good on the installment plan, putting down only a small amount of the total cost of the good and then making monthly payments – B. Because of the uneven distribution wealth, the midd ...

module 31 review

... 2. Now assume that the Fed is following a policy of targeting the federal funds rate. What will the Fed do in the situation described in question 1 to keep the federal funds rate unchanged? Illustrate with a diagram. ...

... 2. Now assume that the Fed is following a policy of targeting the federal funds rate. What will the Fed do in the situation described in question 1 to keep the federal funds rate unchanged? Illustrate with a diagram. ...

Why Has This Recession Not Produced a Price Deflation?

... There was therefore an effective segmentation of the world economy where the “Southern” wages remained tied to some subsistence level because of the existence of huge labour reserves, while the “Northern” wages could move up with increases in labour productivity, notwithstanding the existence of som ...

... There was therefore an effective segmentation of the world economy where the “Southern” wages remained tied to some subsistence level because of the existence of huge labour reserves, while the “Northern” wages could move up with increases in labour productivity, notwithstanding the existence of som ...

2.2.

... The supply and demand for money is the major influence on the level of interest rates. As amounts saved increase, interest rates tend to decline. When borrowing by consumers, businesses, and government increases, interest rates are likely to rise. See assignment in G:drive (Banks) ...

... The supply and demand for money is the major influence on the level of interest rates. As amounts saved increase, interest rates tend to decline. When borrowing by consumers, businesses, and government increases, interest rates are likely to rise. See assignment in G:drive (Banks) ...

I) Inflation

... • A) Demand pull inflationA rise in the general level of prices caused by too high a level of aggregate Shortage demand in relation to E2 aggregate supply. E1 D2 • This is continuously happening because of a constant increase in population and an increase in relative wealth. D1 ...

... • A) Demand pull inflationA rise in the general level of prices caused by too high a level of aggregate Shortage demand in relation to E2 aggregate supply. E1 D2 • This is continuously happening because of a constant increase in population and an increase in relative wealth. D1 ...

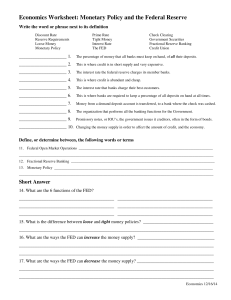

Economics Worksheet: Monetary Policy and the Federal Reserve

... The percentage of money that all banks must keep on hand, of all their deposits. ...

... The percentage of money that all banks must keep on hand, of all their deposits. ...

Economics - APAblog.org

... Measures the number of the people who are able to work but do not have a job during a given period of time Participation Rate: A measure of the active portion of an economy's labor force. The participation rate refers to the number of people who are either employed or are actively looking for work. ...

... Measures the number of the people who are able to work but do not have a job during a given period of time Participation Rate: A measure of the active portion of an economy's labor force. The participation rate refers to the number of people who are either employed or are actively looking for work. ...

BUSINESS CYCLE, FEDERAL RESERVE, TAXATION

... • During a period of inflation, prices of almost everything keep rising. Inflation is a natural occurrence, but high rates of inflation can cause a decline in business activity. • Inflation is caused by an increase in the money supply. Money in circulation, or being spent. RECESSION • During a perio ...

... • During a period of inflation, prices of almost everything keep rising. Inflation is a natural occurrence, but high rates of inflation can cause a decline in business activity. • Inflation is caused by an increase in the money supply. Money in circulation, or being spent. RECESSION • During a perio ...