Inflation and Anti-inflationary Policy Fichier

... well as recipients of fixed incomes - transfers. If inflation occurs at the same level as in the previous period and remains so in an economy without any cause, it is called inertial inflation. Thus, we can have inflation if we expect it. When actual inflation exceeds expected inflation, we are talk ...

... well as recipients of fixed incomes - transfers. If inflation occurs at the same level as in the previous period and remains so in an economy without any cause, it is called inertial inflation. Thus, we can have inflation if we expect it. When actual inflation exceeds expected inflation, we are talk ...

Document

... The demand for money is the quantity of monetary assets people want to hold in their portfolios Money demand depends on expected return, risk, and liquidity Money is the most liquid asset Money pays a low return People's money-holding decisions depend on how much they value liquidity against th ...

... The demand for money is the quantity of monetary assets people want to hold in their portfolios Money demand depends on expected return, risk, and liquidity Money is the most liquid asset Money pays a low return People's money-holding decisions depend on how much they value liquidity against th ...

What Is Monetary Policy?

... cause turmoil in the financial system. Many investors refused to buy mortgage-backed securities, and some investors would only buy bonds issued by the U.S. Treasury. ...

... cause turmoil in the financial system. Many investors refused to buy mortgage-backed securities, and some investors would only buy bonds issued by the U.S. Treasury. ...

12 INFLATION, JOBS, AND THE BUSINESS CYCLE*

... The Keynesian cycle theory regards fluctuations in investment driven by fluctuations in business confidence as the main sources of fluctuations in aggregate demand. The money wage rate is rigid. The monetarist cycle theory sees fluctuations in consumption expenditure and investment driven by flu ...

... The Keynesian cycle theory regards fluctuations in investment driven by fluctuations in business confidence as the main sources of fluctuations in aggregate demand. The money wage rate is rigid. The monetarist cycle theory sees fluctuations in consumption expenditure and investment driven by flu ...

NBER WORKING PAPER SERIES Matthew Canzoneri

... A standard neo-Wicksellian model is embedded within our model. It is obtained by stripping out the banks and assuming that only cash is useful to households in transacting. There is a money (or cash) demand equation in the neo-Wicksellian model, but it is decoupled from the rest of the model; its so ...

... A standard neo-Wicksellian model is embedded within our model. It is obtained by stripping out the banks and assuming that only cash is useful to households in transacting. There is a money (or cash) demand equation in the neo-Wicksellian model, but it is decoupled from the rest of the model; its so ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research Volume Title: Economic Analysis of Environmental Problems

... [1] have shown that the removal of the malleability assumption does not change the asymptotic properties of optimal growth models. Only the transition from the initial situation to the ultimate equilibrium is changed. When we come to discuss short-run problems, in section 3, capital will no longer b ...

... [1] have shown that the removal of the malleability assumption does not change the asymptotic properties of optimal growth models. Only the transition from the initial situation to the ultimate equilibrium is changed. When we come to discuss short-run problems, in section 3, capital will no longer b ...

risk premia on key asset classes: a south african perspective

... • Estimating the future is inherently uncertain, if not impossible • Setting expected long-term returns nevertheless important for many actuaries • This paper proposes a framework for attempting to do so, and looks at historical experience in South Africa • Possible starting point for further resear ...

... • Estimating the future is inherently uncertain, if not impossible • Setting expected long-term returns nevertheless important for many actuaries • This paper proposes a framework for attempting to do so, and looks at historical experience in South Africa • Possible starting point for further resear ...

Chapter 2

... values one fish as having a worth of three coconuts. She gave Rachel 300 coconuts and 100 fish for helping her to harvest coconuts and catch fish, all of which were consumed by Rachel. Monica consumed the remaining fish and coconuts. In terms of fish, total consumption by both Monica and Rachel woul ...

... values one fish as having a worth of three coconuts. She gave Rachel 300 coconuts and 100 fish for helping her to harvest coconuts and catch fish, all of which were consumed by Rachel. Monica consumed the remaining fish and coconuts. In terms of fish, total consumption by both Monica and Rachel woul ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... investment was thought to be Ricardo’s theory of comparative advantage. Still foreign investment cannot be defined by this theory, which is established on two countries, two products and a perfect movability of factors at local level. The theory however did not even support foreign investment. So, a ...

... investment was thought to be Ricardo’s theory of comparative advantage. Still foreign investment cannot be defined by this theory, which is established on two countries, two products and a perfect movability of factors at local level. The theory however did not even support foreign investment. So, a ...

Estimating The Optimal Level of Inflation (Inflation Threshold) in the Kingdom of Saudi Arabia

... countries is 10%, with the exception of countries developed where the rate dropped significantly from previous average. Possible separation between exporting and non-oil exporter, where it became clear that increasing the level of inflation in oil-exporting countries by 3% would lead to a decrease i ...

... countries is 10%, with the exception of countries developed where the rate dropped significantly from previous average. Possible separation between exporting and non-oil exporter, where it became clear that increasing the level of inflation in oil-exporting countries by 3% would lead to a decrease i ...

The Fed Needs to Change Course David Malpass

... other with the Fed as counterparty) has fallen to $100 billion from a $400 billion level prior to the 2008 crisis. Once viewed as critical to efficient capital allocation, these markets will take time to rebuild when interest rates normalize. With the Fed a heavy buyer of longer-maturity Treasuries, ...

... other with the Fed as counterparty) has fallen to $100 billion from a $400 billion level prior to the 2008 crisis. Once viewed as critical to efficient capital allocation, these markets will take time to rebuild when interest rates normalize. With the Fed a heavy buyer of longer-maturity Treasuries, ...

NBER WORKING PAPER SERIES HAPPY NEWS FROM THE DISMAL SCIENCE:

... shocks, fiscal stimulus packages, wars, etc can cause a country's tax rate to deviate from this level in the short run. As such, the concept is most useful when thinking about long-run average tax rates. Although we deal with certain "irrational" limits on debt, we are more interested in the inevi ...

... shocks, fiscal stimulus packages, wars, etc can cause a country's tax rate to deviate from this level in the short run. As such, the concept is most useful when thinking about long-run average tax rates. Although we deal with certain "irrational" limits on debt, we are more interested in the inevi ...

NBER WORKING PAPER SERIES INFLATION: THEORY AND EVIDENCE Bennett 1. McCallum

... This survey attempts to cover an extremely broad topic by organizing around three sets of issues: ongoing (steady state) inflation; cyclical interaction of inflation with real variables; and positive analysis of monetary policy behavior. With regard to ongoing inflation, the paper demonstrates that ...

... This survey attempts to cover an extremely broad topic by organizing around three sets of issues: ongoing (steady state) inflation; cyclical interaction of inflation with real variables; and positive analysis of monetary policy behavior. With regard to ongoing inflation, the paper demonstrates that ...

NBER WORKING PAPER SERIES HOW DO MONETARY AND FISCAL POLICY

... In this sense, we view our paper as the beginning of a research agenda, and not as the final word on policy coordination within a monetary union. We do not attempt a serious calibration to any particular country; instead, we calibrate a series of models that seem to capture important aspects of the ...

... In this sense, we view our paper as the beginning of a research agenda, and not as the final word on policy coordination within a monetary union. We do not attempt a serious calibration to any particular country; instead, we calibrate a series of models that seem to capture important aspects of the ...

(classical) theory of the demand for money

... – If interest rates are below normal value, individuals expect the interest rate on bonds to rise in the future and so expect to suffer capital losses on them. (Note: when interest rates rise, the price of a bond falls). As a result, individuals will be more likely to hold their wealth as money rath ...

... – If interest rates are below normal value, individuals expect the interest rate on bonds to rise in the future and so expect to suffer capital losses on them. (Note: when interest rates rise, the price of a bond falls). As a result, individuals will be more likely to hold their wealth as money rath ...

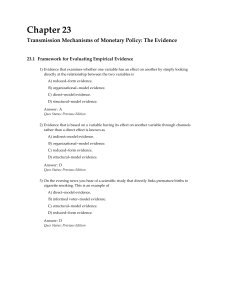

Economics of Money, Banking, and Financial Markets, 8e

... 4) The monetarist-Keynesian debate on the importance of monetary policy is unresolved because monetarists and Keynesians focus on two different types of evidence that generate conflicting conclusions. Monetarists tend to focus on A) structural-model evidence, while Keynesians focus on reduced-form e ...

... 4) The monetarist-Keynesian debate on the importance of monetary policy is unresolved because monetarists and Keynesians focus on two different types of evidence that generate conflicting conclusions. Monetarists tend to focus on A) structural-model evidence, while Keynesians focus on reduced-form e ...

SILICON VALLEY BANCSHARES - Investor Relations Solutions

... During 1993, the Company and Bank consented to formal supervisory orders by the Federal Reserve Bank of San Francisco and the Bank consented to a formal supervisory order by the California State Banking Department. These orders require, among other actions, the following: suspension of cash dividend ...

... During 1993, the Company and Bank consented to formal supervisory orders by the Federal Reserve Bank of San Francisco and the Bank consented to a formal supervisory order by the California State Banking Department. These orders require, among other actions, the following: suspension of cash dividend ...

I. International and Domestic Developments Affecting Financial Stability

... growth, there is a policy divergence between the Fed and the ECB. However, the monetary easing policies implemented to ...

... growth, there is a policy divergence between the Fed and the ECB. However, the monetary easing policies implemented to ...

455 KB - Financial System Inquiry

... General attitudes may indeed have been influenced by financial deregulation, but it is impossible to isolate one set of influences from others ...

... General attitudes may indeed have been influenced by financial deregulation, but it is impossible to isolate one set of influences from others ...

Topic 5 Money & Investment HO

... bulk of the fall in output and allowing c to fall by only a small amount. ...

... bulk of the fall in output and allowing c to fall by only a small amount. ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.