Saving, Investment, and the Financial System

... purchasing bonds from firms, or it can occur indirectly, such as making deposits in a bank. ...

... purchasing bonds from firms, or it can occur indirectly, such as making deposits in a bank. ...

Has durable goods spending become less sensitive to interest rates?

... that prevailed during typical recoveries in the past, declining real interest rates in the current recovery could have provided a stronger boost to durable goods spending. This spending, in turn, could have contributed more strongly to real GDP growth a few years into the recovery, when interest rat ...

... that prevailed during typical recoveries in the past, declining real interest rates in the current recovery could have provided a stronger boost to durable goods spending. This spending, in turn, could have contributed more strongly to real GDP growth a few years into the recovery, when interest rat ...

Money and Inflation Adapted for EC 204 by Prof. Bob Murphy

... How P responds to M M e L (r , Y ) P For given values of r, Y, and e, a change in M causes P to change by the same percentage – just like in the quantity theory of money. ...

... How P responds to M M e L (r , Y ) P For given values of r, Y, and e, a change in M causes P to change by the same percentage – just like in the quantity theory of money. ...

The Role of Expectations in the FRB/US Macroeconomic Model

... have been developed over the past thirty years. Macroeconomic models are systems of equations that summarize the interactions among such economic variables as gross domestic product (GDP), inflation, and interest rates. These models can be grouped into several types: Traditional structural models ty ...

... have been developed over the past thirty years. Macroeconomic models are systems of equations that summarize the interactions among such economic variables as gross domestic product (GDP), inflation, and interest rates. These models can be grouped into several types: Traditional structural models ty ...

Should the European Central Bank and the

... on deficits, rather than debt levels, is misplaced. Luxembourg – whose debt is only about 5% of GDP – could presumably run high deficits for quite some time before anyone would worry about its ability to service its debt. In Canzoneri and Diba (1999), we surveyed a number of arguments for fiscal con ...

... on deficits, rather than debt levels, is misplaced. Luxembourg – whose debt is only about 5% of GDP – could presumably run high deficits for quite some time before anyone would worry about its ability to service its debt. In Canzoneri and Diba (1999), we surveyed a number of arguments for fiscal con ...

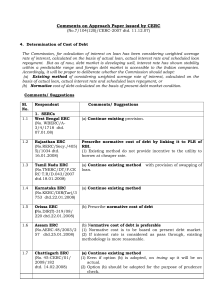

Comments on approach paper 04 - Central Electricity Regulatory

... (a) Continue existing method - but be linked to normative credit rating and applicable interest rates. (1) (i) recovery of interest should be so structured that interest component recovered through tariff matches closely to the interest payable determined by the Commission; (ii) presently interest c ...

... (a) Continue existing method - but be linked to normative credit rating and applicable interest rates. (1) (i) recovery of interest should be so structured that interest component recovered through tariff matches closely to the interest payable determined by the Commission; (ii) presently interest c ...

Monetary Policy Statement June 2013 Contents

... Despite having fallen over the past few weeks, the New Zealand dollar remains overvalued and continues to be a headwind for the tradables sector, restricting export earnings and encouraging demand for imports. Fiscal consolidation will continue to constrain aggregate demand over the projection horiz ...

... Despite having fallen over the past few weeks, the New Zealand dollar remains overvalued and continues to be a headwind for the tradables sector, restricting export earnings and encouraging demand for imports. Fiscal consolidation will continue to constrain aggregate demand over the projection horiz ...

PPT

... Unemployment rates vary by ethnic group… … and by education level. • These two observations are statistically related. Copyright © 2017 Pearson Education, Inc. All Rights Reserved ...

... Unemployment rates vary by ethnic group… … and by education level. • These two observations are statistically related. Copyright © 2017 Pearson Education, Inc. All Rights Reserved ...

86007026I_en.pdf

... emphasize that different transition paths can be adopted in EEs, without necessarily contradicting the basic tenets of the impossible trinity theorem. In contrast with this perennial more general debate about the superiority of exchange rate regimes in defined circumstances, theory and evidence on t ...

... emphasize that different transition paths can be adopted in EEs, without necessarily contradicting the basic tenets of the impossible trinity theorem. In contrast with this perennial more general debate about the superiority of exchange rate regimes in defined circumstances, theory and evidence on t ...

Notes 9: Putting the Economy Together

... We draw the goods demand curve in {Y, r} space because we are eventually going to see how the money market (particularly, the Fed) affects output (Y). That leads us to the money market and the LM curve: Money Market Equilibrium (LM curve): This curve summarizes EVERYTHING that happens in the money m ...

... We draw the goods demand curve in {Y, r} space because we are eventually going to see how the money market (particularly, the Fed) affects output (Y). That leads us to the money market and the LM curve: Money Market Equilibrium (LM curve): This curve summarizes EVERYTHING that happens in the money m ...

4. The Goods Market

... determines the movements in its relative price. Wages and excess demand conditions captured in the price of total supply (PT) are assumed to affect each expenditure component equally in the long run. Therefore, changes in PT do not alter relative prices in the long run. However, the pace of adjustme ...

... determines the movements in its relative price. Wages and excess demand conditions captured in the price of total supply (PT) are assumed to affect each expenditure component equally in the long run. Therefore, changes in PT do not alter relative prices in the long run. However, the pace of adjustme ...

Monetary Policy and the Federal Reserve: Current Policy and

... perceived. In addition, the Fed acts as a “lender of last resort” to the nation’s financial system, meaning that it ensures continued smooth functioning of financial intermediation by providing financial markets with adequate liquidity. This role has become of great importance following the onset of ...

... perceived. In addition, the Fed acts as a “lender of last resort” to the nation’s financial system, meaning that it ensures continued smooth functioning of financial intermediation by providing financial markets with adequate liquidity. This role has become of great importance following the onset of ...

Paper

... When individuals profiles are not available, the pension schemes forthcoming charge estimation is not obvious. In order to pass round this difficulty and to estimate the amounts of rights vested by the forthcoming retirees generations, we dealt with the activity rates by generation. Consider for ins ...

... When individuals profiles are not available, the pension schemes forthcoming charge estimation is not obvious. In order to pass round this difficulty and to estimate the amounts of rights vested by the forthcoming retirees generations, we dealt with the activity rates by generation. Consider for ins ...

The Effects of Credit Subsidies on Development

... wealth, since one’s assignment in this distribution is an accident of birth.1 In this paper we study one common policy intervention, interest rate subsidies on loans, designed to improve access to credit. Although well intentioned, we show that this policy is not an effective way to reduce the probl ...

... wealth, since one’s assignment in this distribution is an accident of birth.1 In this paper we study one common policy intervention, interest rate subsidies on loans, designed to improve access to credit. Although well intentioned, we show that this policy is not an effective way to reduce the probl ...

Quantifying the Effects of the Demographic Transition in Developing

... expected to deeply affect the health insurance system because the demand for health services rises steeply after retirement (see Bohn, 2003; Heller, 2003) as well as financial markets, since the retired baby-boomers will increase the demand of particular financial products, such as short-term riskle ...

... expected to deeply affect the health insurance system because the demand for health services rises steeply after retirement (see Bohn, 2003; Heller, 2003) as well as financial markets, since the retired baby-boomers will increase the demand of particular financial products, such as short-term riskle ...

Key Review Questions for ECO 2030 final exam

... theories, and the effects of macroeconomic policies. The course provides a conceptual framework for understanding the influence of macroeconomics upon business and society. ...

... theories, and the effects of macroeconomic policies. The course provides a conceptual framework for understanding the influence of macroeconomics upon business and society. ...

The Russell 2000® Index in a rising interest rate

... impact small caps, we also looked at how the sectors that make up the Russell 2000 performed – see Table 2. Using the same most recent three periods of Fed tightening, we find no discernible pattern of over- or underperformance among small cap sectors. This result is perhaps surprising, given that s ...

... impact small caps, we also looked at how the sectors that make up the Russell 2000 performed – see Table 2. Using the same most recent three periods of Fed tightening, we find no discernible pattern of over- or underperformance among small cap sectors. This result is perhaps surprising, given that s ...

Document

... • To find that point, we need to know the consumers utility curve, which shows preferences for various combination of c and cf. • These curves have three important properties: 1. Slope downward from left to right. 2. Farther away from origin represents more utility. 3. Utility curves are bowed towar ...

... • To find that point, we need to know the consumers utility curve, which shows preferences for various combination of c and cf. • These curves have three important properties: 1. Slope downward from left to right. 2. Farther away from origin represents more utility. 3. Utility curves are bowed towar ...

Unemployment and Economic Recovery

... increases, some firms may initially be able to increase production without adding workers by raising the productivity of the labor on hand. But once the labor on hand has been fully utilized, output will grow at the growth rate of productivity until firms add workers. As an economic expansion progre ...

... increases, some firms may initially be able to increase production without adding workers by raising the productivity of the labor on hand. But once the labor on hand has been fully utilized, output will grow at the growth rate of productivity until firms add workers. As an economic expansion progre ...

Chapter 11: Aggregate Demand II, Applying the IS

... In fact, the Fed targets the federal funds rate – th iinterest the t t rate t banks b k charge h one another th on overnight loans. ...

... In fact, the Fed targets the federal funds rate – th iinterest the t t rate t banks b k charge h one another th on overnight loans. ...

34 Power Point

... how much should Congress increase G to end the recession? B. If there is crowding out, will Congress need to ...

... how much should Congress increase G to end the recession? B. If there is crowding out, will Congress need to ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.