Course Student Name

... Click “Back” twice and you will again see the “State of the Macroeconomy.” Select “Recession” and click “Continue.” You will see the “Initial State of the Economy.” Print out or copy this table for future reference. What is the initial unemployment rate? _____ Click “Continue.” In order to combat a ...

... Click “Back” twice and you will again see the “State of the Macroeconomy.” Select “Recession” and click “Continue.” You will see the “Initial State of the Economy.” Print out or copy this table for future reference. What is the initial unemployment rate? _____ Click “Continue.” In order to combat a ...

Comparing the monetary transmission mechanism in France

... appear to have a smaller pass-through from policy to market interest rates. In the United Kingdom, France and Germany, monetary policy is set with reference to different targets (for inflation, the exchange rate and monetary growth), but in each case policy is implemented primarily through policy ra ...

... appear to have a smaller pass-through from policy to market interest rates. In the United Kingdom, France and Germany, monetary policy is set with reference to different targets (for inflation, the exchange rate and monetary growth), but in each case policy is implemented primarily through policy ra ...

Quiz #4 MW

... c) Market for real money balances: ______excess supply__________________ To figure this out you might find it helpful to draw a sketch of your IS/LM graph and then look at the point you are given (7700, 8) and see where that point is in the graph. If you plug the r value into your IS equation you wi ...

... c) Market for real money balances: ______excess supply__________________ To figure this out you might find it helpful to draw a sketch of your IS/LM graph and then look at the point you are given (7700, 8) and see where that point is in the graph. If you plug the r value into your IS equation you wi ...

Why the U.S. External Imbalance Matters

... especially loath to raise interest rates in the face of a recession. Recent evidence seems to suggest that the pass-through of exchange rates to import prices is relatively low as foreign firms price to market, so there might not be much direct inflationary risk from a lower dollar. However, comfort ...

... especially loath to raise interest rates in the face of a recession. Recent evidence seems to suggest that the pass-through of exchange rates to import prices is relatively low as foreign firms price to market, so there might not be much direct inflationary risk from a lower dollar. However, comfort ...

Costa Rica During the Global Recession: Fiscal Stimulus with Tight

... downturn and higher during an upswing. Open market operations – in which the central bank buys or sells government securities in the open market in order to decrease or increase the money supply -- became the preferred and most frequently utilized means to generate changes in the relevant rate. In t ...

... downturn and higher during an upswing. Open market operations – in which the central bank buys or sells government securities in the open market in order to decrease or increase the money supply -- became the preferred and most frequently utilized means to generate changes in the relevant rate. In t ...

2000 AP Macroeconomics Scoring Guidelines - AP Central

... a) higher income/real GDP increases imports b) higher domestic price level increases imports c) higher interest rate leads to appreciated $ which will increase imports [Note: if only assert $ increases vs. other currencies, no point in part iii.] iv. (1 point) Exports decrease with an explanation: a ...

... a) higher income/real GDP increases imports b) higher domestic price level increases imports c) higher interest rate leads to appreciated $ which will increase imports [Note: if only assert $ increases vs. other currencies, no point in part iii.] iv. (1 point) Exports decrease with an explanation: a ...

Costa Rica: countercyclical fiscal policy with tight monetary policy

... downturn and higher during an upswing. Open market operations – in which the central bank buys or sells government securities in the open market in order to decrease or increase the money supply -- became the preferred and most frequently utilized means to generate changes in the relevant rate. In t ...

... downturn and higher during an upswing. Open market operations – in which the central bank buys or sells government securities in the open market in order to decrease or increase the money supply -- became the preferred and most frequently utilized means to generate changes in the relevant rate. In t ...

Homework 1

... 1. Using aggregate demand, short-run aggregate supply and long-run aggregate supply curves, explain the process by which each of the following economic events will move the economy from one long-run macroeconomic equilibrium to another. Illustrate with diagrams. In each case, what are the short-run ...

... 1. Using aggregate demand, short-run aggregate supply and long-run aggregate supply curves, explain the process by which each of the following economic events will move the economy from one long-run macroeconomic equilibrium to another. Illustrate with diagrams. In each case, what are the short-run ...

Chapters 22 and 26-27 homework - Mr. Sadow`s History Class

... 3. Define asset and liability. 4. Define loans and explain why they are critical for banks. 5. Define and explain reserves/reserve requirement/reserve ratio. 6. Explain the difference between owner’s equity and capital stock. 7. Create two separate balance sheets using the terms from #2-#6 and any n ...

... 3. Define asset and liability. 4. Define loans and explain why they are critical for banks. 5. Define and explain reserves/reserve requirement/reserve ratio. 6. Explain the difference between owner’s equity and capital stock. 7. Create two separate balance sheets using the terms from #2-#6 and any n ...

Macroeconomics

... c) If the Fed wants to reduce the money supply by $40 million, and knows the actual money multiplier is approximately 4, what should it do? Be specific. 2. a) Why is the supply of money vertical for Monetarists? b) Why is the supply of money upward sloping for Keynesians? 3. Identify all of the foll ...

... c) If the Fed wants to reduce the money supply by $40 million, and knows the actual money multiplier is approximately 4, what should it do? Be specific. 2. a) Why is the supply of money vertical for Monetarists? b) Why is the supply of money upward sloping for Keynesians? 3. Identify all of the foll ...

The Causes, Solution and Consequences of the 1997

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

... problem of co-existence of fixed exchange rate regime and liberalized capital flows minimal exchange rate risk for foreign capital positive interest-rate differential (Czech real interest rates higher than in other transition countries) increasing ratio of short-term capital on the financial account ...

chapter overview - Canvas by Instructure

... Redistributive effects of inflation: A. The price index is used to deflate nominal income into real income. Inflation may reduce the real income of individuals in the economy, but won’t necessarily reduce real income for the economy as a whole (someone receives the higher prices that people are payi ...

... Redistributive effects of inflation: A. The price index is used to deflate nominal income into real income. Inflation may reduce the real income of individuals in the economy, but won’t necessarily reduce real income for the economy as a whole (someone receives the higher prices that people are payi ...

WHAT`S IMPORTANT IN……

... 3. The Inflation Rate for any time period is: Inflation rate (in %) = CPI (later year) – CPI (earlier year) ÷ CPI (earlier year) x 100 = ______% Example: The CPI in 2002 is 110.5 and in 2000 it was 101.2. What is the inflation rate? Inflation rate (in %) = CPI (2002) – CPI (2000) ÷ CPI (2000) x 100 ...

... 3. The Inflation Rate for any time period is: Inflation rate (in %) = CPI (later year) – CPI (earlier year) ÷ CPI (earlier year) x 100 = ______% Example: The CPI in 2002 is 110.5 and in 2000 it was 101.2. What is the inflation rate? Inflation rate (in %) = CPI (2002) – CPI (2000) ÷ CPI (2000) x 100 ...

Chapter 24 The Keynesian Framework Chapter 25 The IS-LM World

... Keynesians assume that the quantity of loanable funds does not change when monetary supply is adjusted (reduced/increased) Monetarists and Rational Expectations suggest that when money supply is increased, inflationary expectations rise which cause a higher demand for loanable funds This shifts the ...

... Keynesians assume that the quantity of loanable funds does not change when monetary supply is adjusted (reduced/increased) Monetarists and Rational Expectations suggest that when money supply is increased, inflationary expectations rise which cause a higher demand for loanable funds This shifts the ...

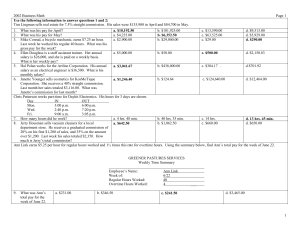

Day IN OUT

... computed at an annual rate of 6%. How much simple interest did she receive? Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the teller also credited $9.28 in interest to her ac ...

... computed at an annual rate of 6%. How much simple interest did she receive? Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the teller also credited $9.28 in interest to her ac ...

THE FIRST GREAT DEPRESSION OF THE 21ST CENTURY

... particular patterns are rooted in the profit motive, which remains the central regulator of business behaviour throughout this history. Capitalism’s sheath mutates constantly in order for its core to remain the same. A full explanation of the theoretical dynamics is beyond the scope of this essay, b ...

... particular patterns are rooted in the profit motive, which remains the central regulator of business behaviour throughout this history. Capitalism’s sheath mutates constantly in order for its core to remain the same. A full explanation of the theoretical dynamics is beyond the scope of this essay, b ...

Impact of exchange rate, inflation rate and interest rate on balance of

... currency value. If the capital account goes into surplus it creates a huge affect on the BOP of a country [1]. The economic crisis in the country can cause a huge affect on the BOP. The regulatory bodies of the countries applied many test to solve this problem [2]. The natural resources of a home co ...

... currency value. If the capital account goes into surplus it creates a huge affect on the BOP of a country [1]. The economic crisis in the country can cause a huge affect on the BOP. The regulatory bodies of the countries applied many test to solve this problem [2]. The natural resources of a home co ...

CENTRAL BANK OF THE REPUBLIC OF TURKEY

... Monetary Policy Strategy – Inflation Targeting Experience of IT in Developing Countries; Inflation has declined in all developing countries. IT has helped authorities to shape inflation expectations and to fight against inflation shocks. Rigidity in inflation has been gradually reduced. Pass-throug ...

... Monetary Policy Strategy – Inflation Targeting Experience of IT in Developing Countries; Inflation has declined in all developing countries. IT has helped authorities to shape inflation expectations and to fight against inflation shocks. Rigidity in inflation has been gradually reduced. Pass-throug ...

Shifting gear: why have neutral interest rates fallen?

... Figure 1 showed how we at the Reserve Bank stepped down our view of the neutral 90-day rate over 2008 to 2010. Although we altered our neutral policy rate assumption, we made no change to our assumption about the neutral interest rate faced by households and businesses. We assumed that the increase ...

... Figure 1 showed how we at the Reserve Bank stepped down our view of the neutral 90-day rate over 2008 to 2010. Although we altered our neutral policy rate assumption, we made no change to our assumption about the neutral interest rate faced by households and businesses. We assumed that the increase ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.