* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download WHAT`S IMPORTANT IN……

Foreign-exchange reserves wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Economic growth wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Real bills doctrine wikipedia , lookup

Fear of floating wikipedia , lookup

Full employment wikipedia , lookup

Nominal rigidity wikipedia , lookup

Exchange rate wikipedia , lookup

Long Depression wikipedia , lookup

Business cycle wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Inflation targeting wikipedia , lookup

Phillips curve wikipedia , lookup

Monetary policy wikipedia , lookup

Stagflation wikipedia , lookup

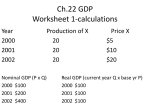

WHAT’S IMPORTANT IN… Macroeconomics Mankiw 4TH Edi. This is your instructor’s outline of what is important in each Chapter. There are 2 -5 major topics in each chapter. Sub-topics include related concepts and formulas. Please use the text for relevant definitions (“key concepts” at the end of each chapter and in the margin). Chapter 1: Ten Principles of Economics 1. Definition: Economics a. Scarcity b. Wants c. Resources 2. Ten Principles 1. People Face Tradeoffs (Ch. 2, 3, 12) 2. The Cost of Something Is What You Give Up to Get It (Ch. 2, 3) 3. Rational People Think at the Margin (Ch. 4) 4. People Respond to Incentives (Ch. 12, 15, 23) 5. Trade Can Make Everyone Better Off (Ch. 3) 6. Markets Are Usually a Good Way to Organize Economic Activity (Ch. 4) 7. Governments Can Sometimes Improve Market Outcomes (Micro) 8. A Country’s Standard of Living Depends on Its Ability to Produce Goods and Services (Ch. 10, 12, 23) 9. Prices Rise When the Government Prints Too Much Money (Ch. 2, 11, 16, 17, 23) 10. Society Faces a Short-Run Tradeoff Between Inflation and Unemployment (Ch. 16, 20, 21, 23) This course has a lot of Percent Increase questions. Contact me if you do not know how to do them. What is the Percent Increase in NGDP? The formula to use is: (NGDP (from later year) - NGDP (from earlier year)) divided by NGDP from earlier year times 100. (NGDP (from year 2002) – NGDP (from year 2000)) ÷ NGDP (year 2000) x 100 = Percent Increase = Example Problem: Assume NGDP in 2000 is $9,718 Assume NGDP in 2002 is $10,428 ($10,428 - $9718) ÷ $9,718 = $710 ÷ $9718 = .073 .073 x 100 = 7.3% increase 6 formulas that may help: For any given year: 1. GDP Deflator = (NGDP ÷ RGDP) x 100 = NGDP divided by RGDP, times 100 2. RGDP = (NDGP ÷ GDP Deflator) x 100 = NGDP divided by GDP deflator, times 100 Page 1 3. NGDP = (GDP Deflator ÷ 100) x RGDP = GDP Deflator divided by 100, times RGDP The percent change from 1 year to another: 4. Percent change in RGDP: (RGDP (later year) – RGDP (earlier year)) ÷ RGDP (earlier year) x 100 = 5. Percent change in NGDP: (NGDP (later year) – NGDP (earlier year)) ÷ NGDP (earlier year) x 100 = (Like in example above) 6. Percent change in GDP Deflator: (GDP Deflator (later year) – GDP Deflator (earlier year)) ÷ NGDP (earlier year) x 100 = Chapter 2: Thinking Like an Economist 1. 2. 3. 4. 5. 1. 2. 1. 2. 3. Economics as a Science a. Lab experiments b. Role of assumptions Production Possibilities Frontier (PPF) a. Opportunity costs b. Applications to the real world Microeconomics vs. Macroeconomics Normative Vs. Positive Why Economists Disagree Chapter 3: Interdependence and the Gains from Trade Comparative Advantage a. Rule: Each person should produce the item for which (s)he has the lowest opportunity cost; and trade for the rest. b. Absolute advantage c. Relationships to opportunity costs d. Trade Application to International Trade Chapter 4: The Market Forces of Supply and Demand Markets Demand a. Law of Demand b. Determinants of demand i. Depiction on graph ii. Specifics a) Income b) Prices of related goods and services 1. Substitutes 2. Compliments c) Tastes d) Expectations for future 1. Increase in price 2. Decrease in price e) Number of buyers Supply a. Law of Supply b. Determinants of supply Page 2 i. ii. 4. 5. 1. 2. 3. 1. 2. 3. Depiction on graph Specifics 1. Input prices 2. Technology 3. Expectations for future 1. Increase in price 2. Decrease in price 4. Number of sellers Equilibrium a. Surpluses b. Shortages Changes in equilibrium a. Change in demand b. Change in supply c. Change in both supply and demand Chapter 10: Measuring a Nation’s Income Two Methods of Measuring GDP a. Income b. Expenditure Definition of GDP is: a. “Market Value” b. “of All” c. “Final” d. “Goods & Services” e. “Produced” f. Within a country” g. “in a given period of time” Real vs. Nominal GDP a. Definition of RGDP b. Uses of RGDP 1.Measure of economic growth 2.Compare GDP form county to country c. Computation of 1.RGDP 2.NGDP 3.GDP deflator d. Limits of GDP and an indicator of well being Chapter 11: Measuring the Cost of Living Inflation: Concept Calculating the Consumer Price Index and using it a. Step one: Fix the market basket b. Step two: Find the prices c. Step three: Compute the basket’s cost d. Step four: Choose a base year and compute the index CPI yr n = ($MB yr n ÷ $MB yr Base) × 100 e. Step five: Compute the inflation rate Inflation rate yr 1 to yr 2 = (CPI yr 2 – CPI yr 1 ÷ CPI yr 1) × 100 Problem’s with CPI Page 3 a. b. c. d. 4. Substitution bias New goods Unmeasured quality goods Compare GDP deflator i. CPI measures imports but GDP deflator measures only domestic ii. CPI is fixed weight but GDP deflator is not iii. Practical difference Uses of CPI on other indices a. Comparison of wages or prices over time Salary yr 2 = Salary yr 1 × (CPI yr 2 ÷ CPI yr 1) b. Indexation c. Real and nominal interest rates Real = Nominal – Inflation Chapter 11 Macro Formulas 1. The cost of the Market Basket in dollars for any given year is: $MB = SUM of P*Q (for all products Q in the Market Basket) Example: The goods in the Market Basket are 5 items of A and 3 of B. The Price of A is $4 and the Price of B is $6. A = 5 items @ $4.00 each and B = 3 items @ $6.00 each. So (4*5) + (6*3) = 20 + 18 = $38.00 The cost of the Market Basket = $MB = ($4*5) + ($6*3) = $38 2. The CPI for any year is: CPI of any given year = $MB of any given year ÷ $MB base year*100 (CPI of any given year = Market Basket Price of any given year divided by Market Basket Price of base year times 100) Example: The cost of the Market Basket in the base year is $38; in 2002, it is $42. What is the CPI for 2002? ($MB 2002 ÷ $MB base year)*100 = ($42 ÷ $38)*100 = 1.105*100 = 110.5 CPI for 2002 = 110.5 3. The Inflation Rate for any time period is: Inflation rate (in %) = CPI (later year) – CPI (earlier year) ÷ CPI (earlier year) x 100 = ______% Example: The CPI in 2002 is 110.5 and in 2000 it was 101.2. What is the inflation rate? Inflation rate (in %) = CPI (2002) – CPI (2000) ÷ CPI (2000) x 100 = ((110.5-101.2) ÷ 101.2) x100 = (9.3/101.2) *100 =.92*100 = 9.2% for 2000 to 2002 (or 4.6% per yr) 4. To compare a value, like salary or price, in one year to another year: V new = (V old*CPI new) ÷ CPI old Example: Salary is $50,000 in 1996 when CPI was 100. CPI now is 200. How much must my salary increase for me to keep up with inflation V2008 = (V 1996*CPI 2008) ÷ CPI 1996 = ($50,000*200) ÷ 100 = $50,000*2 = $100,000 Page 4 Chapter 12: Production and Growth 1. 2. 3. 4. What’s in a Number: Why small annual changes mean big long run differences. Productivity: Key to growth a. Definition (output per hour worked) b. Income = Output (Expenditures) c. Determinants i. Physical capital ii. Human capital iii. Natural resources iv. Technology Public Policies to Promote Growth a. Savings and investment i. Catch-up effect ii. Investment from abroad 1. Private 2. World Bank and IMF b. Education c. Property rights and stability d. Free trade e. R & D (Remember the #1 cause of economic growth is technology) Population and Economic Growth a. Impacts on natural resources b. Impacts on physical capital c. Impacts on technology Chapter 12 Macro Formulas Rule of 70: 70 ÷ % = year to double original value The rule of 70 can apply to a) Economic growth rates: Example: The U.S. growth rate is 2% a year. How many years will it take to double the standard of living? Answer: 70 ÷ 2% = 35 Years b) Finance and savings: Example: You inherit $10,000. You save it at 7%. How long does it take to double your savings? Answer: 70 ÷ 2% = 10 Years Economic Growth Rate: Equals % change in Standard of Living (SOL) Equals % change in Per Capital Income Per Capital Income for any year = RGDP ÷ Population for any given year Recognize that economic growth is computed as a percent change. So it is similar to Chapter 10, percent change in RGDP or NGDP and to Chapter 11, percent change in CPI. Page 5 Here is the detailed formula: Economic growth rate = % change in Per Capita RGDP = % change in Standard of Living = ((RGDP ÷ Population) in the later year – (RGDP ÷ Population) in the earlier year)) ÷ (RGDP ÷ Population) in the earlier year) x100 Example: Compute the Economic Growth rate for: Population in 2005 is 100; and RGDP is 800 Population in 2006 is 120; and RGDP is 1200 ((1200 ÷ 120) – (800 ÷ 100)) ÷ (800 ÷ 100) x 100 ((10 – 8) ÷ 8) x 100 (2 ÷ 8) x 100 .25 x 100 = 25% Chapter 15: Unemployment and Its Natural Rate 1. 2. 3. Measuring Unemployment a. U R = (U ÷ Labor Force) × 100 b. LFP R = (Labor Force ÷ Adult Population) × 100 Concerns c. Discouraged workers d. Duration National Fictional & Structural Unemployment a. Job search (frictional unemployment) b. Minimum Wage, Efficiency Wage and Unions (Structural unemployment) Chapter 15 Macro Formulas There are 10 equations which relate the categories of the adult population: 1) CNP = NLF + CLF 2) NLF = CNP - CLF 3) CLF = CNP - NLF 4) CNP = NLF = U + E 5) NLF = CNP - U - E 6) U = CNP - NLF - E 7) E = CNP - NLF - U 8) CLF = U + E 9) U = CLF - E 10) E = CLF - U These equations compute 3 key rates: Unemployment, Employment, Labor Force Participation Rate, The 1st equation is the basic form: a. UR = (U ÷ CLF) x 100 UR = (U ÷ (U + E)) x 100 UR = (U ÷ (CNP – NLF)) x 100 b. ER = (E ÷ CNP) x 100 ER = (E ÷ (NFL+CLF)) x100 Page 6 ER = (E ÷ (NLF+E+U)) x100 ER = ((CLF-U) ÷ (NLF+CLF)) x100 ER = ((CLF-U) ÷ (NLF+E+U)) x100 ER = ((CNP-NLF-U) ÷ (NLF+CLF)) x100 ER = ((CNP-NLF-U) ÷ (NLF+E+U)) x100 c. LFPR = (CLF ÷ CNP) x 100 LFPR = (CLF ÷ (NLF + CLF)) x 100 LFPR = (CLF ÷ (NLF + E + U)) x 100 LFPR = ((U + E) ÷ CNP) x 100 LFPR = ((U + E) ÷ (NLF + CLF)) x 100 LFPR = ((U + E) ÷ (NLF + E+ U)) x 100 LFPR = ((CNP - NLF) ÷ CNP) x 100 LFPR = ((CNP - NLF) ÷ (NLF + CLF)) x 100 LFPR = ((CNP - NLF) ÷ (NLF + CE +U)) x 100 Example: NLF = 50, E = 60, U = 5, CLF = 65, (CNP = CLF +NLF) What is ER, UR, LFPR ER = (E ÷ CNP) x 100 = (60 ÷ (CLF + NLF)) x 100 = (60 ÷ (65 + 50)) x 100 = (60 ÷ 115) x 100 = 52% UR = (U ÷ CLF) x 100 = (5 ÷ 65) x 100 = 7.7% LFPR = (CLF ÷ CNP) x 100 = (65 ÷ (CLF + NLF)) x 100 = (65 ÷ (65 + 50)) x 100 = 56.5% The following equations help explain long term versus short term unemployment a. NR = FR + SR Natural Rate of Unemployment = Long Term Unemployment Rate = Frictional Rate of unemployment + Structural Rate of Unemployment FR = NR - SR SR = NR - FR Cyclical rate of Unemployment = Actual UR measured by BLS minus the Natural Unemployment Rate. CR = UR - NR UR = CR + NR NR = UR - CR Example: UR is 5.5% CR is 1.5% 1. SR is 2.0% What is FR? Answer: First solve for NR. (NR = UR - CR) = (5.5 – 1.5 = 4.0) Now solve for FR. (FR = NR - SR) = (4.0 - 2%) = 2% Chapter 16: The Monetary System Money – Concept a. Definition i. Contrast barter ii. Double coincidence of wants b. Functions iii. Medium of Exchange iv. Unit of Accounting v. Store of Value Page 7 c. d. 2. 3. 4. Liquidity Types vi. Fiat vii. Commodity Money – Measurement a. M–1 b. M–2 The FED (Federal Reserve Bank) a. Organization b. Role in money supply Banks and Money Supply a. Fractional Reserve Banking i. Actual Reserves (AR) ii. Required Reserves (RR) = Demand Deposits × Required Reserve Ratio iii. Excess Reserves = Actual Reserves – Required Reserves = Loanable Funds b. Money multiplier i. Formula: m = 1 ÷ RRR ii. Maximum increase in money supply = initial increase × m iii. Leakage 5. Tools of the FED a. Open market operations b. Reserve requirement c. Discount rate Chapter 16 Macro Formulas i. Money = M.S = M1 = Demand Deposit + Cash in hands of public ii. Actual Reserves = $AR = Vault Cash + Deposits by commercial banks with the FED iii. Required Reserves = $RR = $Demand Deposits multiplied by r (r in decimal form, r is required reserve ratio, which is set by FED) iv. Excess Reserve = Funds a bank can lend = $ER = $AR-$RR v. Maximum money multiplier = 1÷ r (r is in decimal form) vi. Maximum change in Money Supply = initial change in MS multiplied by 1÷ r Note: Initial change in M.S is often the amount of US Government Bonds bought (or sold) by the FED Chapter 17: Money Growth & Inflation 1. Quantity Theory of Money (Classical Theory) a. Concept: Long run impact of money growth is inflation b. Equation: MV = PY i. V is constant ii. Y is not impacted by M or V iii. Therefore, percent change in M = percent change in P c. Price level and value of money are reciprocal i. As $ needed to buy M Basket rises, we ↑ price level ii. As the number of M Baskets a dollar can purchase falls, we ↓ the value of money. d. Implication of “Monetary Injection” i. As FED increases MS, inflation occurs e. Implication of increase in MS on real values in long run = zero i. Classical Dichotomy ii. Monetary Neutrality Page 8 2. Inflation “Tax” a. Gov’t can raise money 3 ways i. Raise revenues / taxes ii. Borrow iii. Print money b. The result of printing money is like a Tax on everyone who holds money 3. Fisher Effect: Nominal interest rate adjusts to expected inflation a. Impact of “monetary neutrality” on interest rates b. Real interest rate = Nominal interest rate – Inflation c. Nominal interest rate = Real interest rate + Inflation i. Real rate determined by supply and demand in the market for loanable funds ii. Inflation is determined by rate of MS growth determined by the FED 4. Costs of Inflation a. Impact of anticipated inflation on real variables i. Shoeleather Costs ii. Menu Costs iii. Resource misallocation iv. Tax distortions v. Confusion b. Impact of unexpected inflation on real variables i. Wealth redistribution Chapter 17 Macro formulas Quantity Theory of Money MV=PY Chapter 20: Aggregate Demand & Aggregate Supply 1. Economic Fluctuations: General a. Characteristics i. Irregular ii. RGDP and other output indicators increase together iii. RGDP and U vary inversely b. Short run vs. Long run Aggregate Demand (AD) a. Shape i. Real balances effect ii. Interest rate effect iii. Exchange rate effect b. Shifts (determinants) Aggregate Supply a. Long run shape (LRAS) b. Short run shape (SRAS) i. Misperceptions ii. Sticky wages and prices c. Shifts (determinants) i. Both LRAS / SRAS ii. Only SRAS: change in expected price level Equilibrium AD / AS a. Explaining economic Fluctuations as shifts in AD / AS 2. 3. 4. Page 9 b. Case studies (fair game for exam) Chapter 21: The Influence of Monetary & Fiscal Policy on Aggregate Demand 1. Monetary Policy a. The theory of liquidity preference (the market for money) b. Impact on the shape of the AD curve (interest rate effect) c. Impact of theory on shifting AD i. MS ↑, i ↓, C & I ↑, AD↑ ii. MS ↓, i ↑, C&I ↓, AD ↓ 2. Fiscal Policy a. Definition b. ↑ G (or ↓ T), leading to ↑ C & I i. Multiplier effect 1. Change in equilibrium RGDP = change in G (or ↑C/↑I) × m ii. Crowding out 3. Pro’s & Con’s of Stabilization policy (see also Debate # 1, Ch. 23) a. LAG’s i. Fiscal ii. Monetary policy b. Imprecision of economic forecasts c. Politics and the FED 4. Automatic Stabilizers a. Balanced Budget Amendment 5. Supply Side Economics (See debate #4, Ch 23) Chapter 21 Macro formulas Four Formulas to Compute Government Spending Need to Close Recessionary Gap 1. 2. 3. 4. 1. 2. 3. 4. 5. MPC=Change in Consumption ÷ Change in Income Multiplier = m = 1 ÷ 1- MPC Change in equilibrium RGDP = Change in Government Spending times multiplier = Change in G x “m” Change in G = Amount of Recessionary Gap ÷ m Chapter 23: Five Debates over Macroeconomic Policy Should Policymakers Try to Stabilize the Economy? Should Monetary Policy Be Made by Rule or Discretion? a. Monetary Rule: example is M ↑ as RGDP ↑ b. The Political Business Cycle c. Time inconsistency of policy d. Flexibility Should the Central Bank Aim for Zero Inflation a. Inflation fallacy Should the Government Balance Its Budget? Should the Tax Laws Be Refined to Encourage Savings Page 10