Chapter 20

... – Determine inventory balances and the cost of goods or services sold for the financial statements. – Prepare internal reports that compare actual unit costs and targeted costs. ...

... – Determine inventory balances and the cost of goods or services sold for the financial statements. – Prepare internal reports that compare actual unit costs and targeted costs. ...

10710 Accounting Eng 30 6 16 - Gauteng Department of Education

... We have audited the annual financial statements of Protea Limited for the year ended 29 February 2016. These financial statements are the responsibility of the company's directors. Basis for Disclaimer of Opinion During the course of our audit we have established that the valuation of fixed assets a ...

... We have audited the annual financial statements of Protea Limited for the year ended 29 February 2016. These financial statements are the responsibility of the company's directors. Basis for Disclaimer of Opinion During the course of our audit we have established that the valuation of fixed assets a ...

Answers

... Calculate the trade payable days for Greystone and compare to prior years, investigate any significant differences. Review after date payments, if they relate to the current year then follow through to the purchase ledger or accrual listing to ensure completeness. Review after date invoices and cred ...

... Calculate the trade payable days for Greystone and compare to prior years, investigate any significant differences. Review after date payments, if they relate to the current year then follow through to the purchase ledger or accrual listing to ensure completeness. Review after date invoices and cred ...

Define - kthsyr12acc

... recording were developed. They are known as Accounting Principles. In the 20th Century, as business became more advanced, Accounting Standards were developed to govern the recording of entries in each country. This also led to the International Accounting Standards. Contained in the standards are th ...

... recording were developed. They are known as Accounting Principles. In the 20th Century, as business became more advanced, Accounting Standards were developed to govern the recording of entries in each country. This also led to the International Accounting Standards. Contained in the standards are th ...

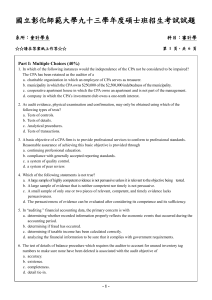

Part II. Essay Questions (60%)

... 17. When the auditor knows that an illegal act has occurred, the auditor must a. report it to the proper governmental authorities. b. consider the effects on the financial statements, including the adequacy of disclosure. c. withdraw from the engagement. d. issue an adverse opinion. 18. The report i ...

... 17. When the auditor knows that an illegal act has occurred, the auditor must a. report it to the proper governmental authorities. b. consider the effects on the financial statements, including the adequacy of disclosure. c. withdraw from the engagement. d. issue an adverse opinion. 18. The report i ...

Student lecture notes - Pearson Higher Education

... The most readily available cost-based approach to pricing is to calculate the total cost per unit of output and add a percentage to that cost called the ……………… A ‘normal’ mark-up may be characteristic. Cost-plus pricing may not take into account the demand for the product. ...

... The most readily available cost-based approach to pricing is to calculate the total cost per unit of output and add a percentage to that cost called the ……………… A ‘normal’ mark-up may be characteristic. Cost-plus pricing may not take into account the demand for the product. ...

Accounting Theory Defined

... Approves principles-based standards, – does not issue detailed application guidelines. Addresses business ventures – not public sector, government or not-for-profit activities. ...

... Approves principles-based standards, – does not issue detailed application guidelines. Addresses business ventures – not public sector, government or not-for-profit activities. ...

Auditor`s Responsibility

... • Reported directly through governance structure • Consider whether fraud has internal control implications ...

... • Reported directly through governance structure • Consider whether fraud has internal control implications ...

Judul - Binus Repository

... • Using the Audit Department as a training ground also helps address the issues of career-path opportunities for the Audit Department. It produces a tangible additional and positive audit product for the organization. Of course, it requires more work on the part of audit management. Panned turnover ...

... • Using the Audit Department as a training ground also helps address the issues of career-path opportunities for the Audit Department. It produces a tangible additional and positive audit product for the organization. Of course, it requires more work on the part of audit management. Panned turnover ...

Determining How Costs Behave

... ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster ...

... ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster ...

INDEPENDENT AUDITOR’S REPORT, CONTINUED INDEPENDENT AUDITOR’S REPORT

... with governance, management, and other personnel, the objectives of which are to provide reasonable assurance that (1) transactions are properly recorded, processed, and summarized to permit the preparation of financial statements in accordance with U.S. generally accepted accounting principles, and ...

... with governance, management, and other personnel, the objectives of which are to provide reasonable assurance that (1) transactions are properly recorded, processed, and summarized to permit the preparation of financial statements in accordance with U.S. generally accepted accounting principles, and ...

Minutes of meeting

... One expert remarked that the difference between these 3 tools is that the first tool involves a definite lag in revenue attribution. It does not say which charges would be affected and in fact it could be either commodity or capacity depending of the tariff ...

... One expert remarked that the difference between these 3 tools is that the first tool involves a definite lag in revenue attribution. It does not say which charges would be affected and in fact it could be either commodity or capacity depending of the tariff ...

9.54- Food Security Scheme - Details of 5 schemes

... 5 selected women will function as an SHG. This will be considered as the basic activity group or unit within a panchayat. Skill up gradation training Trainings and all other technical assistances will be given to these SHG groups. Micro financing The SHG groups will be provided with micro credit ...

... 5 selected women will function as an SHG. This will be considered as the basic activity group or unit within a panchayat. Skill up gradation training Trainings and all other technical assistances will be given to these SHG groups. Micro financing The SHG groups will be provided with micro credit ...

AA Degree with Accounting

... a) 70% or above passing score on Richfield University English Proficiency Examination (RCEPE), or b) A score of 600 or above on the paper-based Test of English as a Foreign Language (TOEFL), corresponding to a score of 100 or above on the internet-based (iBT), or c) High School Diploma or a minimum ...

... a) 70% or above passing score on Richfield University English Proficiency Examination (RCEPE), or b) A score of 600 or above on the paper-based Test of English as a Foreign Language (TOEFL), corresponding to a score of 100 or above on the internet-based (iBT), or c) High School Diploma or a minimum ...

Internal Audit Charter

... In undertaking its work, IA has unrestricted access to all areas, records, property and personnel of the Group. Planning and Fieldwork In planning its activities, IA applies a risk based audit methodology that directs and concentrates its resources to those areas of greatest significance, strategic ...

... In undertaking its work, IA has unrestricted access to all areas, records, property and personnel of the Group. Planning and Fieldwork In planning its activities, IA applies a risk based audit methodology that directs and concentrates its resources to those areas of greatest significance, strategic ...

Hang Chi Holdings Limited 恒智控股有限公司

... (b) major judgmental areas; (c) significant adjustments resulting from audit; (d) the going concern assumptions and any qualifications; (e) compliance with accounting standards; and (f) ...

... (b) major judgmental areas; (c) significant adjustments resulting from audit; (d) the going concern assumptions and any qualifications; (e) compliance with accounting standards; and (f) ...

Statement of Owners` Equity

... International Accounting Accounting procedures and practices must be adapted to accommodate an international business environment. The International Accounting Standards Committee (IASC) was established in 1973 to promote worldwide consistency in financial reporting practices. The IASC soon develop ...

... International Accounting Accounting procedures and practices must be adapted to accommodate an international business environment. The International Accounting Standards Committee (IASC) was established in 1973 to promote worldwide consistency in financial reporting practices. The IASC soon develop ...

Lecture Syllabus Financial Assurance and

... This is a senior honours module. Together with Introductory Financial Accounting, Intermediate Financial Accounting, Advanced Financial Accounting 1 and Auditing, the module is designed to provide comprehensive coverage of the theoretical and practical aspects underpinning the preparation of publish ...

... This is a senior honours module. Together with Introductory Financial Accounting, Intermediate Financial Accounting, Advanced Financial Accounting 1 and Auditing, the module is designed to provide comprehensive coverage of the theoretical and practical aspects underpinning the preparation of publish ...

Paper 2: Fundamentals of Accounting

... (c) Cost Concept (d) Money Measurement Concept. Q2. Which of the following is not a Fixed Asset? (a)Building (b)Bank balance (c)Plant (d)Goodwill. Q3. The basic concepts related to P & L Account are (a )Realization Concept (b)Matching Concept (c )Cost Concept (d )Both (a) and (b) above. Q4. Under wh ...

... (c) Cost Concept (d) Money Measurement Concept. Q2. Which of the following is not a Fixed Asset? (a)Building (b)Bank balance (c)Plant (d)Goodwill. Q3. The basic concepts related to P & L Account are (a )Realization Concept (b)Matching Concept (c )Cost Concept (d )Both (a) and (b) above. Q4. Under wh ...

bf2210 - making managerial decisions using accounting information

... Managers use accounting to help them define the problems their organisations face, to make decisions concerning those problems and to communicate their decisions to others. Building on the first year introduction to management accounting (BF1114, or BF2262 for Combined Honours), this module explores ...

... Managers use accounting to help them define the problems their organisations face, to make decisions concerning those problems and to communicate their decisions to others. Building on the first year introduction to management accounting (BF1114, or BF2262 for Combined Honours), this module explores ...

Analysing a Business Model

... • Subscription /membership – ability to retain customers over a long period of time / acquire new customers at a low costs / consistently increase the share of wallet of old customers. • Transaction based – command a price premium without much increase in costs, exploit economies of scale to lower c ...

... • Subscription /membership – ability to retain customers over a long period of time / acquire new customers at a low costs / consistently increase the share of wallet of old customers. • Transaction based – command a price premium without much increase in costs, exploit economies of scale to lower c ...

1. Upcoming meeting on arts marketing 2. VAT

... We’ve had a substantial number of enquires from members on the whole area of VAT regulations. We commissioned an expert to prepare a general fact sheet which answers the most frequently asked questions as they apply to venues and production companies. For more information click here. 3. THE BUDGET, ...

... We’ve had a substantial number of enquires from members on the whole area of VAT regulations. We commissioned an expert to prepare a general fact sheet which answers the most frequently asked questions as they apply to venues and production companies. For more information click here. 3. THE BUDGET, ...

G.A.A.P.

... ◦ The nature of a non-monetary transaction ◦ The nature of a relationship with a related party with which the business has significant transaction ...

... ◦ The nature of a non-monetary transaction ◦ The nature of a relationship with a related party with which the business has significant transaction ...

Institute for Accounting and Auditing of FBiH

... accordance with ISA and reporting on financial statements in accordance with IAS - Current activities – organizing Audit Case Study training for 300 auditors. Each participant will be expected to agree to a post-training on-site visit by an experienced “international” auditor to review workpapers, d ...

... accordance with ISA and reporting on financial statements in accordance with IAS - Current activities – organizing Audit Case Study training for 300 auditors. Each participant will be expected to agree to a post-training on-site visit by an experienced “international” auditor to review workpapers, d ...