accounting - WordPress.com

... b. Accurate, current information makes it easier to predict future income and financial position. 2. Accrual accounting is difficult to understand. a. Confusion exists because net income does not equal the period's change in cash. b. The cash balance of a company with high income may even decrease d ...

... b. Accurate, current information makes it easier to predict future income and financial position. 2. Accrual accounting is difficult to understand. a. Confusion exists because net income does not equal the period's change in cash. b. The cash balance of a company with high income may even decrease d ...

Managerial Accounting

... What is Managerial Accounting? • It is the process of identifying, measuring, accumulating, analyzing, preparing, interpreting, and communicating information that managers use to fulfill organizational objectives. • The branch of accounting that produces information for managers within an organizat ...

... What is Managerial Accounting? • It is the process of identifying, measuring, accumulating, analyzing, preparing, interpreting, and communicating information that managers use to fulfill organizational objectives. • The branch of accounting that produces information for managers within an organizat ...

Managerial accounting

... Total Work in Process – (1) cost of beginning work in process and (2) total manufacturing costs for the current period. Total Manufacturing Costs – sum of direct material costs, direct labor costs, and manufacturing overhead in the current year. ...

... Total Work in Process – (1) cost of beginning work in process and (2) total manufacturing costs for the current period. Total Manufacturing Costs – sum of direct material costs, direct labor costs, and manufacturing overhead in the current year. ...

GNB Chapter 8

... identify areas that would benefit from process improvements. While the theory of constraints approach discussed in Chapter 1 is a powerful tool for targeting improvement efforts, activity rates can also provide valuable clues on where to focus improvement efforts. Benchmarking can be used to compare ...

... identify areas that would benefit from process improvements. While the theory of constraints approach discussed in Chapter 1 is a powerful tool for targeting improvement efforts, activity rates can also provide valuable clues on where to focus improvement efforts. Benchmarking can be used to compare ...

Sample September / December 2015 answers

... feel under pressure to achieve good results in this financial year. The flotation raised equity capital, so there will be new shareholders who will want to see strong performance in the expectation of a dividend pay-out. In addition, the introduction of the cash-settled share-based payment plan moti ...

... feel under pressure to achieve good results in this financial year. The flotation raised equity capital, so there will be new shareholders who will want to see strong performance in the expectation of a dividend pay-out. In addition, the introduction of the cash-settled share-based payment plan moti ...

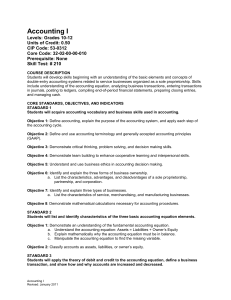

Accounting I

... b. Prepare a bank statement reconciliation and make necessary journal entries. c. Demonstrate cash proof of the checkbook, bank statement and cash account. Objective 2: Establish and replenish a petty cash fund a. List and discuss situations in which a petty cash fund would be used. b. Journalize an ...

... b. Prepare a bank statement reconciliation and make necessary journal entries. c. Demonstrate cash proof of the checkbook, bank statement and cash account. Objective 2: Establish and replenish a petty cash fund a. List and discuss situations in which a petty cash fund would be used. b. Journalize an ...

Manufacturing Costs

... Raw materials that cannot be easily associated with the finished product. Not physically part of the finished product or they are an insignificant part of finished product in terms of cost. Considered part of manufacturing overhead. ...

... Raw materials that cannot be easily associated with the finished product. Not physically part of the finished product or they are an insignificant part of finished product in terms of cost. Considered part of manufacturing overhead. ...

Chapter 1 - Pearson Schools and FE Colleges

... This concept is important since it assists in analysis of financial information and decision-making, and it is vital that the organisation uses the same accounting principles each year. If the organisation was constantly changing its methods then this would result in misleading profits being calculate ...

... This concept is important since it assists in analysis of financial information and decision-making, and it is vital that the organisation uses the same accounting principles each year. If the organisation was constantly changing its methods then this would result in misleading profits being calculate ...

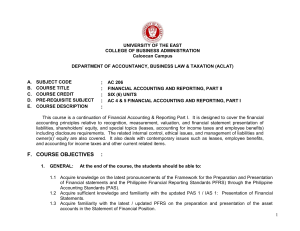

UNIVERSITY OF THE EAST – CALOOCAN CAMPUS

... This course is a continuation of Financial Accounting & Reporting Part I. It is designed to cover the financial accounting principles relative to recognition, measurement, valuation, and financial statement presentation of liabilities, shareholders’ equity, and special topics (leases, accounting for ...

... This course is a continuation of Financial Accounting & Reporting Part I. It is designed to cover the financial accounting principles relative to recognition, measurement, valuation, and financial statement presentation of liabilities, shareholders’ equity, and special topics (leases, accounting for ...

managerial accounting information: a key to

... Responsibility flows up through the organization. People at the bottom are responsible for specific tasks, but the chairman is responsible for the operation of the entire organization. A distinction is often made between line and staff departments. Line departments engage in activities that create a ...

... Responsibility flows up through the organization. People at the bottom are responsible for specific tasks, but the chairman is responsible for the operation of the entire organization. A distinction is often made between line and staff departments. Line departments engage in activities that create a ...

4.2.2 Standard Costing - College of Education and External Studies

... where such action is guided by cost accounting. He further said that it involves control of material usage and material prices of wage costs, separating the effect of efficiency from rates of pay, of maintenance and service costs of all the other items of direct expenses. 2.2 Various techniques used ...

... where such action is guided by cost accounting. He further said that it involves control of material usage and material prices of wage costs, separating the effect of efficiency from rates of pay, of maintenance and service costs of all the other items of direct expenses. 2.2 Various techniques used ...

Certified Hospitality Accountant Executive (CHAE) Review

... Associate Dean and Professor Rosen College of Hospitality Management University of Central Florida Orlando, FL ...

... Associate Dean and Professor Rosen College of Hospitality Management University of Central Florida Orlando, FL ...

Understanding Internal Control over Financial Reporting and

... information the auditor has identified relating to significant findings or issues that is inconsistent with or contradicts the auditor’s final conclusions. The relevant records to be retained include, but are not limited to, procedures performed in response to the information, and records, documenta ...

... information the auditor has identified relating to significant findings or issues that is inconsistent with or contradicts the auditor’s final conclusions. The relevant records to be retained include, but are not limited to, procedures performed in response to the information, and records, documenta ...

Session 06 Production Costs

... 5.2: Short-Run Cost Curves and the Long-Run Planning Curve The appropriate size or scale for the new plant depends on how much the firm wants to produce. For example, if q is the desired rate of output in the long run, the average cost per unit is lowest with a small plant. If the desired output ra ...

... 5.2: Short-Run Cost Curves and the Long-Run Planning Curve The appropriate size or scale for the new plant depends on how much the firm wants to produce. For example, if q is the desired rate of output in the long run, the average cost per unit is lowest with a small plant. If the desired output ra ...

MGMT-026 Chapter 05 Slides

... Each sales transaction for a seller of merchandise involves two parts: ...

... Each sales transaction for a seller of merchandise involves two parts: ...

The Quality Professional: A catalyst for change and excellence…

... The content and inter-relationships of the ISO 9001 standards (ISO 9000, ISO 9001, ISO 9004) ISO 19011, The international standard against which defines how audits should be conducted. The Roles, Responsibilities, and qualities of a Lead Auditor / Internal Auditor Planning and executing an audit in ...

... The content and inter-relationships of the ISO 9001 standards (ISO 9000, ISO 9001, ISO 9004) ISO 19011, The international standard against which defines how audits should be conducted. The Roles, Responsibilities, and qualities of a Lead Auditor / Internal Auditor Planning and executing an audit in ...

BCAS 15: Product Mix Decisions

... manned by top level management. It is a part of organizational culture patronized by top level management. 15.7.2 Organization should have its own mechanism to generate the following information and reporting the same through proper channel so that product mix decisions can be easily undertook: a) C ...

... manned by top level management. It is a part of organizational culture patronized by top level management. 15.7.2 Organization should have its own mechanism to generate the following information and reporting the same through proper channel so that product mix decisions can be easily undertook: a) C ...

Cost Of Goods Sold - McGraw Hill Higher Education

... © 2012 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. ...

... © 2012 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. ...

File

... Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP) - A set of rules and practices, having substantial authoritative support, that the accounting profession recognizes as a general guide for financial reporting purposes. Standard-setting bodies: ...

... Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP) - A set of rules and practices, having substantial authoritative support, that the accounting profession recognizes as a general guide for financial reporting purposes. Standard-setting bodies: ...

The purposes of accounting

... This is what you want from your external auditor. “In my opinion, these financial statements present fairly, in all material respects, the financial position of the Government as at March 31, 2009 and the results of its operations, the changes in its net debt and its cash flows for the year then end ...

... This is what you want from your external auditor. “In my opinion, these financial statements present fairly, in all material respects, the financial position of the Government as at March 31, 2009 and the results of its operations, the changes in its net debt and its cash flows for the year then end ...

Document

... Written exam : Those who have obtained a total score of less than 25 points are allowed to retake one of the two mid-term exams on week 12. Students can sign up for the retake exam during the seminar on week 11, whereby they must choose in advance which of the two mid-term exams they wish to retake. ...

... Written exam : Those who have obtained a total score of less than 25 points are allowed to retake one of the two mid-term exams on week 12. Students can sign up for the retake exam during the seminar on week 11, whereby they must choose in advance which of the two mid-term exams they wish to retake. ...

BCAS 21: Product Mix Decisions

... manned by top level management. It is a part of organizational culture patronized by top level management. 21.7.2 Organization should have its own mechanism to generate the following information and reporting the same through proper channel so that product mix decisions can be easily undertook: a) C ...

... manned by top level management. It is a part of organizational culture patronized by top level management. 21.7.2 Organization should have its own mechanism to generate the following information and reporting the same through proper channel so that product mix decisions can be easily undertook: a) C ...

Boca Raton Boosts Audit Oversight, Improves

... “Optum Audit Management has been a great benefit to us,” says Karen Heck, Boca Raton Regional Hospital A/R analyst, patient financial services. “I use it every day and can get far more accomplished with it than if I had to work manually, or use another system.” Using Audit Management, the hospital n ...

... “Optum Audit Management has been a great benefit to us,” says Karen Heck, Boca Raton Regional Hospital A/R analyst, patient financial services. “I use it every day and can get far more accomplished with it than if I had to work manually, or use another system.” Using Audit Management, the hospital n ...