From shareholder value to private equity – the changing

... maximisation of the value of shares rather than long-term profits is the central purpose of a firm. By focusing on a short-term shareholders’ financial interest, corporate management can tone down, or even disregard altogether, the claims of other parties including workers. They can also have part o ...

... maximisation of the value of shares rather than long-term profits is the central purpose of a firm. By focusing on a short-term shareholders’ financial interest, corporate management can tone down, or even disregard altogether, the claims of other parties including workers. They can also have part o ...

a bond or a stock?

... of job dividends over the next 10, 20 or even 30 years. Sure, clients can’t really touch, feel or see human capital, but like an oil reserve deep under the sands of Alberta, it will eventually be extracted and so it’s definitely worth something now. In fact, any and all companies operating in the na ...

... of job dividends over the next 10, 20 or even 30 years. Sure, clients can’t really touch, feel or see human capital, but like an oil reserve deep under the sands of Alberta, it will eventually be extracted and so it’s definitely worth something now. In fact, any and all companies operating in the na ...

Understanding Human Capital

... with a significant pension benefit and outside assets that are heavily invested in fixed income. As a result, that person may need more equity exposure in their retirement portfolio to offset the fixed-income holdings. The graphic below shows how our portfolio construction process can accommodate an ...

... with a significant pension benefit and outside assets that are heavily invested in fixed income. As a result, that person may need more equity exposure in their retirement portfolio to offset the fixed-income holdings. The graphic below shows how our portfolio construction process can accommodate an ...

Guide to Preparing a Business Plan

... For the promoters, there are two lessons to be learned from this. First, a business proposal must be directed to an appropriate financial institution. Second, it must be presented in a manner which effectively sells it to the potential investor. Promoters seeking external funding for a project must ...

... For the promoters, there are two lessons to be learned from this. First, a business proposal must be directed to an appropriate financial institution. Second, it must be presented in a manner which effectively sells it to the potential investor. Promoters seeking external funding for a project must ...

Supplement to “Output contingent securities and

... convinced that a change in the investment of each firm does not affect the probability over the aggregate output. We also stress that shocks are not independent across firms. Independence would reduce the model to the case without aggregate uncertainty, where the choice of the firms’ objective is no ...

... convinced that a change in the investment of each firm does not affect the probability over the aggregate output. We also stress that shocks are not independent across firms. Independence would reduce the model to the case without aggregate uncertainty, where the choice of the firms’ objective is no ...

award from institutional investor magazine

... “Following a public call for nominations, the editorial staff of Institutional Investor magazine selects award nominees based on how strongly candidates – both those put forward via the call for nominations and those independently identified by the editorial staff - meet the criteria for their respe ...

... “Following a public call for nominations, the editorial staff of Institutional Investor magazine selects award nominees based on how strongly candidates – both those put forward via the call for nominations and those independently identified by the editorial staff - meet the criteria for their respe ...

Why do companies go public?

... Why do bank credit interest rate falls after IPO? Improvement in credit quality: leverage reduced and firms become safer. So include ROA, Leverage, and Size to control for risk. Results remain the same! More information about borrowers More outside financing options to weaken bank bargaining power I ...

... Why do bank credit interest rate falls after IPO? Improvement in credit quality: leverage reduced and firms become safer. So include ROA, Leverage, and Size to control for risk. Results remain the same! More information about borrowers More outside financing options to weaken bank bargaining power I ...

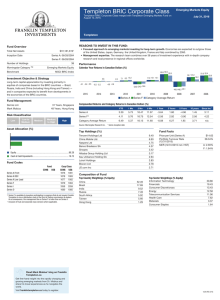

Templeton BRIC Corporate Class Series A

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

Five-Year Ranking: Pimco Leads 10

... are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. The Morningstar RatingTM for funds, or "star rating", is calculated for managed with at least a three-year history. Exchange-traded funds and open-ended mutual fund ...

... are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. The Morningstar RatingTM for funds, or "star rating", is calculated for managed with at least a three-year history. Exchange-traded funds and open-ended mutual fund ...

CIT Investment Discl..

... invests in equities, the principal risk is stock market risk, that is, the risk that the price of the stocks in which the Fund invests may fluctuate or fall in response to economic events or trends. The prices of bonds in which a Fund may invest may fall because of a rise in interest rates. Investme ...

... invests in equities, the principal risk is stock market risk, that is, the risk that the price of the stocks in which the Fund invests may fluctuate or fall in response to economic events or trends. The prices of bonds in which a Fund may invest may fall because of a rise in interest rates. Investme ...

simibtopic4 - Homework Market

... adopted different research methods and created basic assumptions towards different research objects, and consequently created various ...

... adopted different research methods and created basic assumptions towards different research objects, and consequently created various ...

Venture Capital Investment and Small Business Affiliation Rules

... Unlike their underfinanced counterparts, venture capital companies (VCCs) are well financed and what they lack in technical capability, they make up for in business acumen and financial wherewithal. Moreover, risky investments with large upsides are exactly the type of opportunities that can produce ...

... Unlike their underfinanced counterparts, venture capital companies (VCCs) are well financed and what they lack in technical capability, they make up for in business acumen and financial wherewithal. Moreover, risky investments with large upsides are exactly the type of opportunities that can produce ...

PRESCIENT GLOBAL POSITIVE RETURN (EURO) FUND

... The value may go up as well as down and past performance is not necessarily a guide to future performance. CISs are traded at the ruling price and can engage in scrip lending and borrowing. The collective investment scheme may borrow up to 10% of the market value of the portfolio to bridge insuffic ...

... The value may go up as well as down and past performance is not necessarily a guide to future performance. CISs are traded at the ruling price and can engage in scrip lending and borrowing. The collective investment scheme may borrow up to 10% of the market value of the portfolio to bridge insuffic ...

The Rise of Corporate Savings

... with household finances, some as basic as checking or savings accounts. Indeed, the sharp increase in firms’ savings behavior has changed the net position of the (nonfinancial) corporate sector vis-à-vis the rest of the economy. The net position is defined as the difference between how much other se ...

... with household finances, some as basic as checking or savings accounts. Indeed, the sharp increase in firms’ savings behavior has changed the net position of the (nonfinancial) corporate sector vis-à-vis the rest of the economy. The net position is defined as the difference between how much other se ...

Positioning Your Portfolio for Rising Interest Rates

... The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate s ...

... The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate s ...

(acc) USD - Fund Fact Sheet - Franklin Templeton Investments

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

CI Investment Grade Bond Fund

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

Dreyfus Total Emerging Markets Fund

... Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance (not including the effects of sales charges, loads and redemption fees if applicable), placing more emphasis on downward variations and rewarding consistent performance. Managed pro ...

... Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance (not including the effects of sales charges, loads and redemption fees if applicable), placing more emphasis on downward variations and rewarding consistent performance. Managed pro ...

disclosure quality on the polish alternative investment market

... Exchange, started in late August, 2007. It is the fastest growing alternative investment market of 10 AIM operating in the European Union, when the number of issuers is analysed. 6 years after the opening, the number of companies listed on the market was 446, beating all markets except the London AI ...

... Exchange, started in late August, 2007. It is the fastest growing alternative investment market of 10 AIM operating in the European Union, when the number of issuers is analysed. 6 years after the opening, the number of companies listed on the market was 446, beating all markets except the London AI ...

THE CENTRAL BANK OF THE RUSSIAN FEDERATION DEPUTY

... Therefore, it is recommended that documents submitted by supervised companies to the Bank of Russia in accordance with the following list of laws and regulations be sent to the aforesaid Main Branches of the Central Bank of the Russian Federation in charge of control and supervision of the respectiv ...

... Therefore, it is recommended that documents submitted by supervised companies to the Bank of Russia in accordance with the following list of laws and regulations be sent to the aforesaid Main Branches of the Central Bank of the Russian Federation in charge of control and supervision of the respectiv ...

Impact Investing: Trading Up, Not Trading Off

... environmental investing. As an economy, the United States is highly inefficient in its use of resources, which suggests an opportunity for extra-normal investment returns as resources become increasingly scarce and are priced more on scarcity value, thus opening up resource efficiency and resource ...

... environmental investing. As an economy, the United States is highly inefficient in its use of resources, which suggests an opportunity for extra-normal investment returns as resources become increasingly scarce and are priced more on scarcity value, thus opening up resource efficiency and resource ...

Investment in Financial Capital

... Calculating the Return on an Investment Rate of Return is the total income you receive on an investment over a specific period of time divided by the original amount invested. ...

... Calculating the Return on an Investment Rate of Return is the total income you receive on an investment over a specific period of time divided by the original amount invested. ...

Aberdeen Global - Eastern European Equity Fund

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...