Machine Learning - Fairview Capital

... addressable markets through viable and attractive business models fits venture investing very well. Close to $1 billion has already been invested in artificial intelligence related companies by venture capitalists since 2010 and annual funding to companies in the space has increased seven-fold since ...

... addressable markets through viable and attractive business models fits venture investing very well. Close to $1 billion has already been invested in artificial intelligence related companies by venture capitalists since 2010 and annual funding to companies in the space has increased seven-fold since ...

Management 5187 - Baylor University

... This case is fictional. No events depicted herein are representative of actual operating events transpiring at Allete, Inc. This case is for the express purpose of teaching corporate finance concepts with real-time financial information. ...

... This case is fictional. No events depicted herein are representative of actual operating events transpiring at Allete, Inc. This case is for the express purpose of teaching corporate finance concepts with real-time financial information. ...

Country Commerce Singapore Brochure

... More information from http://www.researchandmarkets.com/reports/2139266/ ...

... More information from http://www.researchandmarkets.com/reports/2139266/ ...

Key Investor Information Franklin Global Aggregate Investment

... The prospectus and the financial reports refer to all sub-funds of Franklin Templeton Investment Funds. All sub-funds of Franklin Templeton Investment Funds have segregated assets and liabilities. As a result, each sub-fund is operated independently from each other. · You may switch into shares of ...

... The prospectus and the financial reports refer to all sub-funds of Franklin Templeton Investment Funds. All sub-funds of Franklin Templeton Investment Funds have segregated assets and liabilities. As a result, each sub-fund is operated independently from each other. · You may switch into shares of ...

Commonly Asked Questions about Managed Funds

... We determine the market value of each fund based on the information we have most recently available. Daily unit prices are available over the phone or from the fund’s website. You can check the value of your investment in a unit trust at any time by multiplying the number of units you hold by the da ...

... We determine the market value of each fund based on the information we have most recently available. Daily unit prices are available over the phone or from the fund’s website. You can check the value of your investment in a unit trust at any time by multiplying the number of units you hold by the da ...

Country Commerce India Brochure

... The government continues to liberalise foreign investment. In July 2015 it said that the sectoral cap on foreign direct investment (FDI) in all sectors except banking and defence will now be a composite cap for foreign-equity investments from both direct and portfolio investors. The move simplifies ...

... The government continues to liberalise foreign investment. In July 2015 it said that the sectoral cap on foreign direct investment (FDI) in all sectors except banking and defence will now be a composite cap for foreign-equity investments from both direct and portfolio investors. The move simplifies ...

a guide to investing

... Those who have a moderate risk approach generally want to benefit from the potentially higher returns of stock market (share based) investments but are not comfortable with the fluctuations in value associated with investing entirely in shares. Moderate risk investors tend to view themselves as havi ...

... Those who have a moderate risk approach generally want to benefit from the potentially higher returns of stock market (share based) investments but are not comfortable with the fluctuations in value associated with investing entirely in shares. Moderate risk investors tend to view themselves as havi ...

The Role of Cash Flows in Value Investing

... debt and equity types. Financing decisions such as these are summarized on the liabilities and owners’ equity side of the balance sheet. In addition to selling securities, a firm can raise cash by borrowing from a lender such as a commercial bank. Funds can also be raised by generating cash flow int ...

... debt and equity types. Financing decisions such as these are summarized on the liabilities and owners’ equity side of the balance sheet. In addition to selling securities, a firm can raise cash by borrowing from a lender such as a commercial bank. Funds can also be raised by generating cash flow int ...

Novartis Global Compact - World Environment Center

... account for more than 20% of the London stock exchange investment) Morley Fund Management, a major London-based asset manager which manages approximately 2.5% of the UK stock market, announced on 3/10/01 that it would begin requiring large UK companies to publish environmental reports ...

... account for more than 20% of the London stock exchange investment) Morley Fund Management, a major London-based asset manager which manages approximately 2.5% of the UK stock market, announced on 3/10/01 that it would begin requiring large UK companies to publish environmental reports ...

Chapter 13

... one year ago at a price of $50. You sold it for $55 because you felt the future uncertainly was too great. During that time you received dividends of $1 per share. Calculate your total return from your investment. ...

... one year ago at a price of $50. You sold it for $55 because you felt the future uncertainly was too great. During that time you received dividends of $1 per share. Calculate your total return from your investment. ...

Fact Sheet - Franklin Templeton Investments

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

Lecture 2: International Capital Flows

... before implementing a meaningful liberalization As this takes a lot of time and effort, capital account liberalization should be gradual ...

... before implementing a meaningful liberalization As this takes a lot of time and effort, capital account liberalization should be gradual ...

Schuldscheindarlehen - Bundesverband Öffentlicher Banken

... mentation, as well as the fact that exploring a broader investor base does not require an expensive external rating. Higher transaction costs (due to more extensive transparency requirements or an expansion of the regulatory framework, for example) would burden access to this financing instrument fo ...

... mentation, as well as the fact that exploring a broader investor base does not require an expensive external rating. Higher transaction costs (due to more extensive transparency requirements or an expansion of the regulatory framework, for example) would burden access to this financing instrument fo ...

Chapter22 - QC Economics

... to produce goods or services for profit – A firm normally owns and operates at least one “plant” or facility in order to produce. ...

... to produce goods or services for profit – A firm normally owns and operates at least one “plant” or facility in order to produce. ...

Resocializing Capital: Putting Pension Savings in the Service of

... As is well known from experiments with earmarking savings for atypical investments,2 finding the capital is only part of the problem. The other is finding enough investment opportunities that satisfy social and economic requirements. To address this issue, I propose to construct an alternative finan ...

... As is well known from experiments with earmarking savings for atypical investments,2 finding the capital is only part of the problem. The other is finding enough investment opportunities that satisfy social and economic requirements. To address this issue, I propose to construct an alternative finan ...

Organizational capital and firm performance. Empirical

... Estimation results of output elasticities are reported in Table 1. They show that, for both the samples and across all the different specifications, labour and OC have the highest elasticities. In both the models (levels and FD) and for both the samples, the translog function provides a better descr ...

... Estimation results of output elasticities are reported in Table 1. They show that, for both the samples and across all the different specifications, labour and OC have the highest elasticities. In both the models (levels and FD) and for both the samples, the translog function provides a better descr ...

investing in haiti - CFI

... promotion agency and the first port of call for investors looking at opportunities in Haiti. CFI´s dedicated and skilled staff is available to support investors throughout the investment process by: • Providing general and customized information to support the investment location assessment and fac ...

... promotion agency and the first port of call for investors looking at opportunities in Haiti. CFI´s dedicated and skilled staff is available to support investors throughout the investment process by: • Providing general and customized information to support the investment location assessment and fac ...

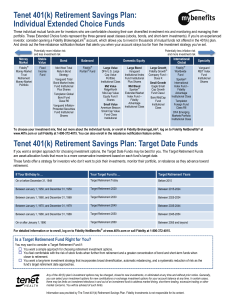

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... fund’s target retirement date approaches. Any of the 401(k) plan’s investment options may be changed, closed to new investments, or eliminated at any time and without prior notice. Generally, you can select your investment options for new contributions or exchange investment options for your account ...

... fund’s target retirement date approaches. Any of the 401(k) plan’s investment options may be changed, closed to new investments, or eliminated at any time and without prior notice. Generally, you can select your investment options for new contributions or exchange investment options for your account ...

Emerging Markets Corporate Bonds

... of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than those in developed markets and are subject to additional risks, such as of adverse governmental regulation and intervention ...

... of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than those in developed markets and are subject to additional risks, such as of adverse governmental regulation and intervention ...

A6 Share Class

... line with the income generated by investments held within the relevant fund The monthly dividend will be determined by a dedicated committee These dividends are expected to be set on a quarterly basis (i.e. for the coming three months). HOWEVER, dividend levels may be revised at any time by the ...

... line with the income generated by investments held within the relevant fund The monthly dividend will be determined by a dedicated committee These dividends are expected to be set on a quarterly basis (i.e. for the coming three months). HOWEVER, dividend levels may be revised at any time by the ...

Growth Equity in the Lower Middle Market

... Growth equity investors partner with management teams to help them expand their businesses. This not only includes investing capital but also bringing growth expertise to the board of directors, management team, and the company. Typically, growth equity investors focus on sectors where they have pas ...

... Growth equity investors partner with management teams to help them expand their businesses. This not only includes investing capital but also bringing growth expertise to the board of directors, management team, and the company. Typically, growth equity investors focus on sectors where they have pas ...

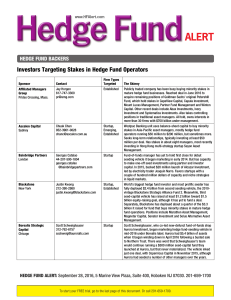

Hedge Fund Backers

... Westpac Banking unit uses balance-sheet capital to buy minority stakes in Asia-Pacific asset managers, mostly hedge fund operators running $50 million to $200 million, but sometimes more. Seeks long-term relationships, typically investing at least $50 million per deal. Has stakes in about eight mana ...

... Westpac Banking unit uses balance-sheet capital to buy minority stakes in Asia-Pacific asset managers, mostly hedge fund operators running $50 million to $200 million, but sometimes more. Seeks long-term relationships, typically investing at least $50 million per deal. Has stakes in about eight mana ...

responsible investment for institutional investors in hedge funds

... strategies. This is particularly true in emerging markets because of price fluctuation and volatility, which can affect the cost of capital, including the cost of food or other agricultural products. ...

... strategies. This is particularly true in emerging markets because of price fluctuation and volatility, which can affect the cost of capital, including the cost of food or other agricultural products. ...

MIS12 Ch14 LT1 Capital Budgeting Methods for

... states. It has five regional distribution centers, 377 stores, and about 14,000 different products stocked in each store. The company is considering investing in new software and hardware modules to upgrade its existing supply chain management system to help it better manage the purchase and movemen ...

... states. It has five regional distribution centers, 377 stores, and about 14,000 different products stocked in each store. The company is considering investing in new software and hardware modules to upgrade its existing supply chain management system to help it better manage the purchase and movemen ...

US Dollar Currency Fund, a sub-fund of Fidelity Funds II, A-USD

... At least 70% invested in US Dollar denominated interest bearing debt securities and other permitted investments. The types of debt securities in which the fund invests may include commercial papers, obligations issued or guaranteed by governments, governmental agencies, or instrumentalities variable ...

... At least 70% invested in US Dollar denominated interest bearing debt securities and other permitted investments. The types of debt securities in which the fund invests may include commercial papers, obligations issued or guaranteed by governments, governmental agencies, or instrumentalities variable ...