Chinese Bond Market Challenges

... In June 18, 2007 the data price contains T-bond 040007, YTM = 4.19, yield = 2.71%. The yield is much lower than the last working day (June 15, 2007). With the same YTM T-bond yield was 3.57% and 040007 is below the yield of 030007 (3.36%) with the YTM = 3.175 years. So, this data is anomaly. ...

... In June 18, 2007 the data price contains T-bond 040007, YTM = 4.19, yield = 2.71%. The yield is much lower than the last working day (June 15, 2007). With the same YTM T-bond yield was 3.57% and 040007 is below the yield of 030007 (3.36%) with the YTM = 3.175 years. So, this data is anomaly. ...

Coupon Blending. Automated. Scalable. Available to ALL Market

... percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted ...

... percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted ...

No Slide Title

... but is concerned that the deal will become unprofitable if the euro falls relative to the U.S. dollar ...

... but is concerned that the deal will become unprofitable if the euro falls relative to the U.S. dollar ...

Bonds[1] bernadette 2-15-11

... come, their returns are free. So they can be a good investment, however it all depends on the buyer personal sitiuation as well. • Corporate bonds are a way for a company to issue bonds as well as stocks. There are three lengths of time a corporate bond can go for - less than five years, 5 to 12 or ...

... come, their returns are free. So they can be a good investment, however it all depends on the buyer personal sitiuation as well. • Corporate bonds are a way for a company to issue bonds as well as stocks. There are three lengths of time a corporate bond can go for - less than five years, 5 to 12 or ...

Explaining the Excess Spread Premiums on Catastrophe Bonds

... the impact of the variations in the LIBOR, proxy of the risk-free rate. As the values of the spread premiums range from 0 to 1, we take natural log of them to induce their range more covering the whole real numbers, By doing so, we make our dependant variable more conforming to normal distribution. ...

... the impact of the variations in the LIBOR, proxy of the risk-free rate. As the values of the spread premiums range from 0 to 1, we take natural log of them to induce their range more covering the whole real numbers, By doing so, we make our dependant variable more conforming to normal distribution. ...

docx - Minds on the Markets

... investment has to its potential rate of return? 7. In bad economic times, what happens to the risk / return curve? 8. The most basic strategy for reducing risk is? 9. What is the ultimate goal for a portfolio? 10.What are the most common risks that can cause our expected return of an investment to b ...

... investment has to its potential rate of return? 7. In bad economic times, what happens to the risk / return curve? 8. The most basic strategy for reducing risk is? 9. What is the ultimate goal for a portfolio? 10.What are the most common risks that can cause our expected return of an investment to b ...

Are you wondering why a company pulled your credit

... Multiple inquiries from the same company can happen when you are applying for credit. Here are a few examples: At loan origination – in order to determine the best loan product, rates, etc. After a Rapid Rescore® – in order to show the new credit score after trade lines have been revised or correcte ...

... Multiple inquiries from the same company can happen when you are applying for credit. Here are a few examples: At loan origination – in order to determine the best loan product, rates, etc. After a Rapid Rescore® – in order to show the new credit score after trade lines have been revised or correcte ...

2009018771602

... The Hearing Panel decision described the Countrywide CMO as an “interest only” tranche, but—in another part of the decision—stated that the CMO paid interest monthly for some years before starting to pay back principal. The Hearing Panel concluded that the CMO was inappropriate for VG because its pa ...

... The Hearing Panel decision described the Countrywide CMO as an “interest only” tranche, but—in another part of the decision—stated that the CMO paid interest monthly for some years before starting to pay back principal. The Hearing Panel concluded that the CMO was inappropriate for VG because its pa ...

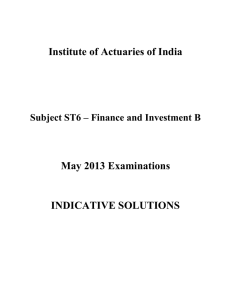

Institute of Actuaries of India May 2013 Examinations INDICATIVE SOLUTIONS

... To show equivalence we need to create two portfolios with identical pay-off and show that there price at time 0 should be equal. We start at the end of day 0 and go long for future contracts and increase the same for number of contracts every day till n. So, by beginning of day i we will have contra ...

... To show equivalence we need to create two portfolios with identical pay-off and show that there price at time 0 should be equal. We start at the end of day 0 and go long for future contracts and increase the same for number of contracts every day till n. So, by beginning of day i we will have contra ...

Notice Concerning Debt Financing

... Loan agreements with each lender will be concluded on April 24, 2017 From May 22, 2017 as the From June 20, 2017 as the first interest payment date, first interest payment date, and the 20th day of every and the 20th day of every month thereafter (Note 2) March, June, September and December thereaft ...

... Loan agreements with each lender will be concluded on April 24, 2017 From May 22, 2017 as the From June 20, 2017 as the first interest payment date, first interest payment date, and the 20th day of every and the 20th day of every month thereafter (Note 2) March, June, September and December thereaft ...

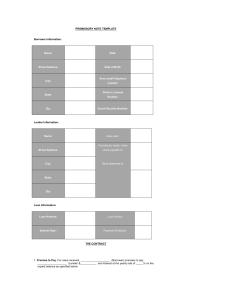

Promissory Note Template

... deed of trust covering the real estate commonly known as _________________ and more fully described as follows: ___________________________________ 8. Collection Costs. If Lender prevails in a lawsuit to collect on this note, Borrower will pay Lender's costs and lawyer's fees in an amount the court ...

... deed of trust covering the real estate commonly known as _________________ and more fully described as follows: ___________________________________ 8. Collection Costs. If Lender prevails in a lawsuit to collect on this note, Borrower will pay Lender's costs and lawyer's fees in an amount the court ...

Quarterly report

... bonds. Not only are yields low, but a cyclical rise in inflation and substantial political risk in Europe appear to be on the cards. This contrasts with our more constructive, yet highly selective approach to emerging-market debt. ...

... bonds. Not only are yields low, but a cyclical rise in inflation and substantial political risk in Europe appear to be on the cards. This contrasts with our more constructive, yet highly selective approach to emerging-market debt. ...

NHA Mortgage-Backed Securities

... Although most NHA MBS are issued in terms of 3 or 5 years, some pools are issued with terms of 10 years or longer. The large number of issues outstanding also provides for an active secondary market that offers a variety of terms, coupons and yields. ...

... Although most NHA MBS are issued in terms of 3 or 5 years, some pools are issued with terms of 10 years or longer. The large number of issues outstanding also provides for an active secondary market that offers a variety of terms, coupons and yields. ...

14ed Bonds

... Yields on longer term bonds usually are greater than on shorter term bonds, so the MRP is more affected by interest rate risk than by reinvestment rate risk. ...

... Yields on longer term bonds usually are greater than on shorter term bonds, so the MRP is more affected by interest rate risk than by reinvestment rate risk. ...

Personal Finance for College Students Use Money Wisely

... © 2008 BALANCE FINANCIAL FITNESS PROGRAM ...

... © 2008 BALANCE FINANCIAL FITNESS PROGRAM ...

Dual currency bond

... but still buy a specified number of shares in the firm of the issuer at a specified price. – They can be viewed as straight fixed-rate bonds with the addition of a call option (or warrant) feature. – The warrant entitles the bondholder to purchase a certain number of equity shares in the issuer at a ...

... but still buy a specified number of shares in the firm of the issuer at a specified price. – They can be viewed as straight fixed-rate bonds with the addition of a call option (or warrant) feature. – The warrant entitles the bondholder to purchase a certain number of equity shares in the issuer at a ...

Derivatives

... Rules of Credit Investing • Equity declines drove re-allocations to fixed income – Simultaneously government yields decreased to all time lows – Credit default rates neared all time highs – Pension fund shortfalls (Focus on ALM) ...

... Rules of Credit Investing • Equity declines drove re-allocations to fixed income – Simultaneously government yields decreased to all time lows – Credit default rates neared all time highs – Pension fund shortfalls (Focus on ALM) ...

Markets Defy Fed`s Bond-Buying Push

... billion of bonds through next June, plus perhaps $300 billion more by reinvesting funds received as bonds from an earlier program mature. The challenge the Fed faces is clear: The economy grew at an annualized rate of just 2.1% from the end of March through September, leaving unemployment stubbornly ...

... billion of bonds through next June, plus perhaps $300 billion more by reinvesting funds received as bonds from an earlier program mature. The challenge the Fed faces is clear: The economy grew at an annualized rate of just 2.1% from the end of March through September, leaving unemployment stubbornly ...

Intergrated Bank Corporation (IBC) is a medium

... costs totaling 40 basis points when originating new (zero-point) mortgages. Refinancing only makes economic sense if the future interest rate savings from refinancing at least cover the refinancing costs. Second, some homeowners may simply not be paying attention and, thus, don’t get around to refin ...

... costs totaling 40 basis points when originating new (zero-point) mortgages. Refinancing only makes economic sense if the future interest rate savings from refinancing at least cover the refinancing costs. Second, some homeowners may simply not be paying attention and, thus, don’t get around to refin ...

Consumer Money Rates

... owner of the mortgage to pay back the amount as a series of installments over a fixed period of time, usually 15 or 30 years. FRM’s offer the borrower the security of fixed monthly payments, determined when the mortgage is taken out, for the entire duration of the mortgage. This initial price or rat ...

... owner of the mortgage to pay back the amount as a series of installments over a fixed period of time, usually 15 or 30 years. FRM’s offer the borrower the security of fixed monthly payments, determined when the mortgage is taken out, for the entire duration of the mortgage. This initial price or rat ...

Snímek 1

... cash payments before the holding period is over. A coupon bond that makes an intermediate cash payment before the holding period is over requires that this payment be reinvested is uncertain, there is some uncertainty about the return on this coupon bond even the when the time to maturity equals the ...

... cash payments before the holding period is over. A coupon bond that makes an intermediate cash payment before the holding period is over requires that this payment be reinvested is uncertain, there is some uncertainty about the return on this coupon bond even the when the time to maturity equals the ...

MathFinLec6 - United International College

... issuer the right to call or redeem the bonds after a few years. • For example, the issuer may have the right to call an issue of bonds at any time after five years at par value. Alternately, there may be a declining schedule of redemption price such that the issuer pays 105% of par value to call dur ...

... issuer the right to call or redeem the bonds after a few years. • For example, the issuer may have the right to call an issue of bonds at any time after five years at par value. Alternately, there may be a declining schedule of redemption price such that the issuer pays 105% of par value to call dur ...

A Primer on Bonds Bond Prices and Yields

... Pension funds pay lifetime annuities to recipients. è Firm expects to be in business indefinitely, its pension obligation ≈ perpetuity. è Suppose, your pension fund must make perpetual payments of $2 million/year. è The yield to maturity on all bonds is 16%. (a) duration of 5-year bonds with coupon ...

... Pension funds pay lifetime annuities to recipients. è Firm expects to be in business indefinitely, its pension obligation ≈ perpetuity. è Suppose, your pension fund must make perpetual payments of $2 million/year. è The yield to maturity on all bonds is 16%. (a) duration of 5-year bonds with coupon ...

Interest rates on mortgages 2. Fixed Rate Mortgage

... The borrower makes interest payments to the lender throughout the period of the loan. The borrower also puts money aside each month, into some form of investment to pay off the capital Investment may grow through regular contributions and investment so that the capital borrowed can be paid off at ...

... The borrower makes interest payments to the lender throughout the period of the loan. The borrower also puts money aside each month, into some form of investment to pay off the capital Investment may grow through regular contributions and investment so that the capital borrowed can be paid off at ...

Forecasting Bond Prices and Yields

... that Seminole Financial, Inc. has a portfolio of bonds with the required return (k) on each type of bond as shown in the upper portion of Exhibit 8A.2. Interest rates are expected to increase, causing an anticipated increase of 1 percent in the required return of each type of bond. Assuming no adjus ...

... that Seminole Financial, Inc. has a portfolio of bonds with the required return (k) on each type of bond as shown in the upper portion of Exhibit 8A.2. Interest rates are expected to increase, causing an anticipated increase of 1 percent in the required return of each type of bond. Assuming no adjus ...

![Bonds[1] bernadette 2-15-11](http://s1.studyres.com/store/data/008221501_1-fa7b1ba3bcf572926a18d3dd6c220c1d-300x300.png)