Counterparty A

... The First Boston Corporation and Salomon Brothers, 1983 Purchase mortgage pass-through (or whole mortgage) and then issue special bonds that are collateralized by the mortgages. Multiclass mortgage back securities Reduce reinvestment risk Primary market making, SEC ...

... The First Boston Corporation and Salomon Brothers, 1983 Purchase mortgage pass-through (or whole mortgage) and then issue special bonds that are collateralized by the mortgages. Multiclass mortgage back securities Reduce reinvestment risk Primary market making, SEC ...

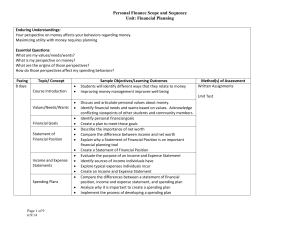

Personal Finance Scope and Sequence Unit: Financial Planning

... Outline the types of accounts and their features typically offered by banks Describe the difference between an ATM and a Debit card Write a check Endorse a check Reconcile a checkbook Calculate the future value of an account at a given interest rate, compounding period and term. Demonstrate mathemat ...

... Outline the types of accounts and their features typically offered by banks Describe the difference between an ATM and a Debit card Write a check Endorse a check Reconcile a checkbook Calculate the future value of an account at a given interest rate, compounding period and term. Demonstrate mathemat ...

十四 Asset Valuation: Debt Investments: Basic Concepts

... Nonrefundable bonds usually have certain restrictions placed on them even if they are callable. If the issuer raises funds in the capital market at a lower interest rate and pays off the existing higher-rate bonds by exercising its right to call the bonds, this is known as “refunding.” Some indentur ...

... Nonrefundable bonds usually have certain restrictions placed on them even if they are callable. If the issuer raises funds in the capital market at a lower interest rate and pays off the existing higher-rate bonds by exercising its right to call the bonds, this is known as “refunding.” Some indentur ...

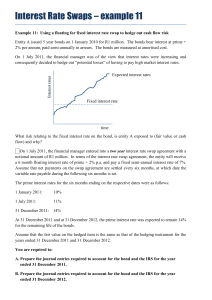

Interest Rate Swaps – example 11

... What risk relating to the fixed interest rate on the bond, is entity A exposed to (fair value or cash flow) and why? On 1 July 2011, the financial manager entered into a two year interest rate swap agreement with a notional amount of R1 million. In terms of the interest rate swap agreement, the enti ...

... What risk relating to the fixed interest rate on the bond, is entity A exposed to (fair value or cash flow) and why? On 1 July 2011, the financial manager entered into a two year interest rate swap agreement with a notional amount of R1 million. In terms of the interest rate swap agreement, the enti ...

Daily Balance *APY Interest Rate $100,000 or more .70 .70 $50,000

... Dormant Fee- If there is no activity for 12 months or more and this account has a balance of less than $100.00, a $5.00 per month maintenance fee plus sales tax will be imposed. Account Closure Fee- If the account is closed within the first 90 days of opening there will be a $10.00 fee. Fees may red ...

... Dormant Fee- If there is no activity for 12 months or more and this account has a balance of less than $100.00, a $5.00 per month maintenance fee plus sales tax will be imposed. Account Closure Fee- If the account is closed within the first 90 days of opening there will be a $10.00 fee. Fees may red ...

140225_Presentation_Intro_Update

... Catley Lakeman sends email to Stockbroker Dealer and Bank Structured Products Desk with price and ...

... Catley Lakeman sends email to Stockbroker Dealer and Bank Structured Products Desk with price and ...

Adjustable Rate Mortgage Disclosure

... • This ARM loan has a premium feature, and your initial interest rate will not be based on the index used for later adjustments. Please ask about our current discount or premium amount. • This type of ARM loan carries a provision for a change in the: Interest Rate and Monthly Payment. • Your payment ...

... • This ARM loan has a premium feature, and your initial interest rate will not be based on the index used for later adjustments. Please ask about our current discount or premium amount. • This type of ARM loan carries a provision for a change in the: Interest Rate and Monthly Payment. • Your payment ...

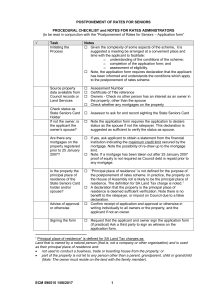

postponement of rates for seniors

... Given the complexity of some aspects of the scheme, it is suggested a meeting be arranged at a convenient place and time with the applicant to facilitate: o understanding of the conditions of the scheme; o completion of the application form; and o assessment of eligibility. Note, the application ...

... Given the complexity of some aspects of the scheme, it is suggested a meeting be arranged at a convenient place and time with the applicant to facilitate: o understanding of the conditions of the scheme; o completion of the application form; and o assessment of eligibility. Note, the application ...

Catastrophe Bonds: An Important New Financial Instrument

... The attraction of CAT bonds to investors is two-fold. First and most important, because it is the reason why the CAT bond market is likely to remain very attractive to investors for a long time and to grow steadily and rapidly, is that the risk of CAT bonds is virtually uncorrelated with the other r ...

... The attraction of CAT bonds to investors is two-fold. First and most important, because it is the reason why the CAT bond market is likely to remain very attractive to investors for a long time and to grow steadily and rapidly, is that the risk of CAT bonds is virtually uncorrelated with the other r ...

Corporate Bonds on Bloomberg News This guide briefly describes

... compared with recent historical values. The graph in the middle of the screen displays the yield spread. The red box at the right of the graph provides statistics such as average and median spread. The spread data summary at the lower left can help you determine a good entry or exit point for a trad ...

... compared with recent historical values. The graph in the middle of the screen displays the yield spread. The red box at the right of the graph provides statistics such as average and median spread. The spread data summary at the lower left can help you determine a good entry or exit point for a trad ...

- Seckman High School

... 5. What is a prepayment penalty? Why might you still wish to pay off a loan early, even when there is a prepayment penalty? Slide 14 ...

... 5. What is a prepayment penalty? Why might you still wish to pay off a loan early, even when there is a prepayment penalty? Slide 14 ...

Issuer Free Writing Prospectus Filed Pursuant to Rule 433

... On or after April 18, 2028 (3 months prior to the maturity date of the notes), at a redemption price equal to 100% of the principal amount of the notes being redeemed, plus accrued and unpaid interest to the date of redemption. “Comparable Government Bond Rate” means, with respect to any redemption ...

... On or after April 18, 2028 (3 months prior to the maturity date of the notes), at a redemption price equal to 100% of the principal amount of the notes being redeemed, plus accrued and unpaid interest to the date of redemption. “Comparable Government Bond Rate” means, with respect to any redemption ...

PPT

... to have been correct – When the non-bank sponsored ABCPs experienced severe liquidity problems their claims on their liquidity providers were not honoured because it was claimed that since the bank-sponsored structures were still sound, a general market disruption had not occurred ...

... to have been correct – When the non-bank sponsored ABCPs experienced severe liquidity problems their claims on their liquidity providers were not honoured because it was claimed that since the bank-sponsored structures were still sound, a general market disruption had not occurred ...

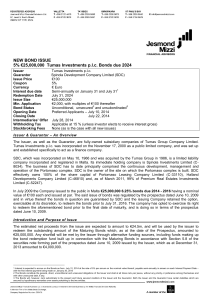

NEW BOND ISSUE 5% €25000000 Tumas Investments plc Bonds

... business tower, commercial areas, catering outlets, extensive underground car parking facilities and the marina itself. The Hilton Malta hotel remains the largest single component of Portomaso’s operations. The incoming travel industry is currently performing at a strong level and is projected to co ...

... business tower, commercial areas, catering outlets, extensive underground car parking facilities and the marina itself. The Hilton Malta hotel remains the largest single component of Portomaso’s operations. The incoming travel industry is currently performing at a strong level and is projected to co ...

Triple-A Failure

... officially designated rating agencies, and grandfathered the big three — S.&P., Moody’s and Fitch. In effect, the government outsourced its regulatory function to three for-profit companies. Bank regulators issued similar rules for banks. Pension funds, mutual funds, insurance regulators followed. O ...

... officially designated rating agencies, and grandfathered the big three — S.&P., Moody’s and Fitch. In effect, the government outsourced its regulatory function to three for-profit companies. Bank regulators issued similar rules for banks. Pension funds, mutual funds, insurance regulators followed. O ...

continued

... Bond Features (continued) 3. Principal and Coupon Rate Bond Principal – amount that the issuer agrees to repay the bondholder at the maturity date Zero-Coupon Bond – interest is paid at the maturity with the exact amount being the difference between the principal value and the price paid for th ...

... Bond Features (continued) 3. Principal and Coupon Rate Bond Principal – amount that the issuer agrees to repay the bondholder at the maturity date Zero-Coupon Bond – interest is paid at the maturity with the exact amount being the difference between the principal value and the price paid for th ...

StrongPCMP4e-ch11

... • Investors prefer to invest short term rather than long term • Borrowers must entice lenders to lengthen their investment horizon by paying a premium for long-term money (the liquidity premium) ...

... • Investors prefer to invest short term rather than long term • Borrowers must entice lenders to lengthen their investment horizon by paying a premium for long-term money (the liquidity premium) ...

PDF

... because the commercial and agricultural mortgage markets are small relative to the residential market. Also, a lack of disaggregate loan-level data exists. It is important to note that caution should be used when comparing commercial and agricultural mortgages to residential mortgages. Commercial mo ...

... because the commercial and agricultural mortgage markets are small relative to the residential market. Also, a lack of disaggregate loan-level data exists. It is important to note that caution should be used when comparing commercial and agricultural mortgages to residential mortgages. Commercial mo ...

The Irresistible Case for Moveable Collateral

... As of 2008 there are more than 70 countries with a unified registry system for all security rights in moveable property.3 World Bank Enterprise Surveys (2001-2005) covering firms in more than 60 low and middle-income countries indicated that 44% of corporate assets were in machinery compared wit ...

... As of 2008 there are more than 70 countries with a unified registry system for all security rights in moveable property.3 World Bank Enterprise Surveys (2001-2005) covering firms in more than 60 low and middle-income countries indicated that 44% of corporate assets were in machinery compared wit ...

ice clear credit llc exhibit h: portfolio approach to cds margining and

... index-derived positions with notional sizes corresponding to their weight in the index. These new, “synthetic,” single-name positions have a coupon which is the same one as the index from which the single-name positions have been derived. Another set algorithm identifies long-short (index/single-nam ...

... index-derived positions with notional sizes corresponding to their weight in the index. These new, “synthetic,” single-name positions have a coupon which is the same one as the index from which the single-name positions have been derived. Another set algorithm identifies long-short (index/single-nam ...

slides - Andrei Simonov

... STRIPS is an acronym for Separate Trading of Registered Interest and Principal of Securities Converts each coupon and principal payment into a separate zero-coupon security. Example: a 30-year bond can be broken down into 60 separate coupon receipts (1 for each semiannual coupon payment with the fir ...

... STRIPS is an acronym for Separate Trading of Registered Interest and Principal of Securities Converts each coupon and principal payment into a separate zero-coupon security. Example: a 30-year bond can be broken down into 60 separate coupon receipts (1 for each semiannual coupon payment with the fir ...

ING Belgium International Finance (Luxembourg)

... Risk Class specific to ING Belgium SA/nv The model used by ING Belgium SA/nv to determine the risk class of a Structured Note analyses the trend of its price in different market scenarios (best-case, baseline, worst-case). Such analysis is based on extreme levels of the underlying values observed hi ...

... Risk Class specific to ING Belgium SA/nv The model used by ING Belgium SA/nv to determine the risk class of a Structured Note analyses the trend of its price in different market scenarios (best-case, baseline, worst-case). Such analysis is based on extreme levels of the underlying values observed hi ...

Application of the United Nations Model to payments received under

... LIBOR plus 1/2%, payable quarterly, for 10 years. It then enters into a 10year interest rate swap with its investment bank, pursuant to which it will make "periodic payments" of 6% quarterly with respect to a "notional principal amount" of $100 million to the investment bank, and the investment bank ...

... LIBOR plus 1/2%, payable quarterly, for 10 years. It then enters into a 10year interest rate swap with its investment bank, pursuant to which it will make "periodic payments" of 6% quarterly with respect to a "notional principal amount" of $100 million to the investment bank, and the investment bank ...

ACC 557 Week 5 DQ2 “ Receivables” Please respond to the

... future and conducting day-to-day operations.” (“External & Internal,”). External risks have to do with making decisions that are dependent on outside factors and internal risks are dependent on internal factors. Internal risks have to do with strategies and programs that the company puts into place. ...

... future and conducting day-to-day operations.” (“External & Internal,”). External risks have to do with making decisions that are dependent on outside factors and internal risks are dependent on internal factors. Internal risks have to do with strategies and programs that the company puts into place. ...