English

... –Consequences: changes to existing laws or introduction of new laws is either forbidden or investor must be compensated for any additional costs Two types: –Fiscal issues: only fiscal laws are frozen (e.g. taxes and royalties). Often tolerated! –General issues: Any law that effects the investment is ...

... –Consequences: changes to existing laws or introduction of new laws is either forbidden or investor must be compensated for any additional costs Two types: –Fiscal issues: only fiscal laws are frozen (e.g. taxes and royalties). Often tolerated! –General issues: Any law that effects the investment is ...

Brokerage Accounts, Transferring Stocks, and Handling Bonds

... the Federal Deposit Insurance Corporation (“FDIC”). ...

... the Federal Deposit Insurance Corporation (“FDIC”). ...

Winning the Credibility War

... The same events are often described by the client and the advisor is diametrically opposed terms. It may be that they both attempt to describe the events as best as they can but, no doubt, biases affect their recollection of what happened. Consider this scenario: Client. “I was referred to Mac (the ...

... The same events are often described by the client and the advisor is diametrically opposed terms. It may be that they both attempt to describe the events as best as they can but, no doubt, biases affect their recollection of what happened. Consider this scenario: Client. “I was referred to Mac (the ...

profile portfolio performance manager`s commentary

... in the last week as investors focused on the possibility that monetary easing may be pared back earlier than expected. This was prompted by ambiguous comments from European Central Bank president, Mario Draghi, which caused bond yields to rise in Europe and beyond. There has been improving economic ...

... in the last week as investors focused on the possibility that monetary easing may be pared back earlier than expected. This was prompted by ambiguous comments from European Central Bank president, Mario Draghi, which caused bond yields to rise in Europe and beyond. There has been improving economic ...

Fact Sheet - Franklin Templeton Investments

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

... Copyright© 2017. Franklin Templeton Investments. All Rights Reserved. Issued by Templeton Asset Management Ltd. Registration No.(UEN) 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific object ...

Emerging Markets Fund

... combined balances, including up to $20,000 in the OA. The first $20,000 in the Ordinary Account and the first $40,000 in the Special Account will not be allowed to be invested under the CPF Investment Scheme. Prior to 12 June 2015, class A-SGD shares were included under the CPF Investment Scheme. FI ...

... combined balances, including up to $20,000 in the OA. The first $20,000 in the Ordinary Account and the first $40,000 in the Special Account will not be allowed to be invested under the CPF Investment Scheme. Prior to 12 June 2015, class A-SGD shares were included under the CPF Investment Scheme. FI ...

2017-01-0130-SBIMF_Blue Chip Leaflet Dec A5

... business models, high visibility and reach and good recognition. In essence, they can help you steadily achieve your long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on gener ...

... business models, high visibility and reach and good recognition. In essence, they can help you steadily achieve your long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on gener ...

Investment Management Process p2ch1

... To measure the level of wealth created by an investment rather than the change in wealth, need to cumulate returns over time ...

... To measure the level of wealth created by an investment rather than the change in wealth, need to cumulate returns over time ...

the financial aid formula 529 college savings plans

... Please consider the investment objectives, risks, charges and expenses associated with 529 plan investments before investing. Contact your financial advisor or visit columbiathreadneedle.com/us for a program brochure, which contains this and other important information about the plan. Read it carefu ...

... Please consider the investment objectives, risks, charges and expenses associated with 529 plan investments before investing. Contact your financial advisor or visit columbiathreadneedle.com/us for a program brochure, which contains this and other important information about the plan. Read it carefu ...

how hedge funds are structured

... fee based on the fund’s annual performance. Managers only get a performance fee if the fund makes money above a certain benchmark. ...

... fee based on the fund’s annual performance. Managers only get a performance fee if the fund makes money above a certain benchmark. ...

Stable Value Option

... mix of high quality, publicly traded, fixed-income securities. The average credit quality of all of the investments backing the SVO will be AA/Aa or better as measured by S&P or Moody’s credit rating services. Derivative securities can be used for hedging and replication purposes only. U.S. Treasury ...

... mix of high quality, publicly traded, fixed-income securities. The average credit quality of all of the investments backing the SVO will be AA/Aa or better as measured by S&P or Moody’s credit rating services. Derivative securities can be used for hedging and replication purposes only. U.S. Treasury ...

Summch01

... How do we measure the rate of return on an investment ? How do investors measure risk related to alternative investments ? What factors contribute to the rate of return that an investor requires on an investment? What macroeconomic and microeconomic factors contribute to changes in the required rate ...

... How do we measure the rate of return on an investment ? How do investors measure risk related to alternative investments ? What factors contribute to the rate of return that an investor requires on an investment? What macroeconomic and microeconomic factors contribute to changes in the required rate ...

Impact on SAA - Insurance Top 10 Australia

... In our “Top 10 Investment Ideas for Insurers in 2016,” we warned of a possible sea change in the economic environment during 2016, with the potential for material unforeseen risks emerging at some point. While we could in no way have predicted with any conviction the dramatic change in the geopoliti ...

... In our “Top 10 Investment Ideas for Insurers in 2016,” we warned of a possible sea change in the economic environment during 2016, with the potential for material unforeseen risks emerging at some point. While we could in no way have predicted with any conviction the dramatic change in the geopoliti ...

Financial Literacy Notes

... Responsible use of credit is one tool to help achieve financial and lifestyle goals. To successfully advance through financial life stages, a consumer must create, establish and maintain credit worthiness. Disciplined consumers borrow within their means at favorable terms and responsibly repay debt ...

... Responsible use of credit is one tool to help achieve financial and lifestyle goals. To successfully advance through financial life stages, a consumer must create, establish and maintain credit worthiness. Disciplined consumers borrow within their means at favorable terms and responsibly repay debt ...

Tutorial 3

... development of the airport and other infrastructure facilities such as hotels and a rail link from the airport to the city. After all the formalities had gone through and the Canadian Pension Fund had spent time and resources on the purchase scheme, the government ‘pulled the plug’ on the grounds th ...

... development of the airport and other infrastructure facilities such as hotels and a rail link from the airport to the city. After all the formalities had gone through and the Canadian Pension Fund had spent time and resources on the purchase scheme, the government ‘pulled the plug’ on the grounds th ...

St Andrew`s Retirement Plan

... Part of the National Australia Bank Group of Companies. An investment with NULIS Nominees (Australia) Limited is not a deposit or liability of, and is not guaranteed by, NAB. ...

... Part of the National Australia Bank Group of Companies. An investment with NULIS Nominees (Australia) Limited is not a deposit or liability of, and is not guaranteed by, NAB. ...

Production Incentive

... - Majority black-owned (50 + 1%) - Have a predominantly black management team - Have a turnover of R250 000 to R35m per annum - Be registered with SARS for VAT - Be operating for one year / provide proof of a contract/tender ...

... - Majority black-owned (50 + 1%) - Have a predominantly black management team - Have a turnover of R250 000 to R35m per annum - Be registered with SARS for VAT - Be operating for one year / provide proof of a contract/tender ...

Some Basics of Venture Capital

... • Typically a (small) division of a large technology company • Examples: Intel, Cisco, Siemens, AT&T • Corporate funding for strategic investment • Help companies whose success may spur revenue growth of VC corporation • Not exclusively or primarily concerned with return on investment • May provide ...

... • Typically a (small) division of a large technology company • Examples: Intel, Cisco, Siemens, AT&T • Corporate funding for strategic investment • Help companies whose success may spur revenue growth of VC corporation • Not exclusively or primarily concerned with return on investment • May provide ...

Sustainable Infrastructure Investment

... Partnership – IDB and Mercer IDB is committed to driving sustainable and resilient development To inform our strategy on sustainable infrastructure development, we are embarking on a project with Mercer Investments ...

... Partnership – IDB and Mercer IDB is committed to driving sustainable and resilient development To inform our strategy on sustainable infrastructure development, we are embarking on a project with Mercer Investments ...

FINER S An attractive, securitized, tailor

... or sell securities. The only binding terms of these transactions are set forth in the transaction-specific contracts and confirmations prepared by Credit Suisse. Credit Suisse provides no guarantee regarding the reliability and completeness of this document, and cannot accept any liability for losse ...

... or sell securities. The only binding terms of these transactions are set forth in the transaction-specific contracts and confirmations prepared by Credit Suisse. Credit Suisse provides no guarantee regarding the reliability and completeness of this document, and cannot accept any liability for losse ...

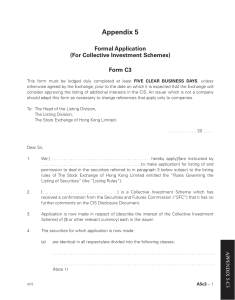

Appendix 5

... all information required to be included in the CIS Disclosure Document/listing document, where applicable, pursuant to Section 104 of the Securities and Futures Ordinance and the applicable codes enacted under the Ordinance, and by the Listing Rules, the Companies (Winding Up and Miscellaneous Provi ...

... all information required to be included in the CIS Disclosure Document/listing document, where applicable, pursuant to Section 104 of the Securities and Futures Ordinance and the applicable codes enacted under the Ordinance, and by the Listing Rules, the Companies (Winding Up and Miscellaneous Provi ...

How to Establish an Alternative Investment Fund in

... »» an investor who receives an appraisal from an EU credit institution, a MiFID firm or a UCITS management company that the investor has the appropriate expertise, experience and knowledge to adequately understand the investment in the QIAIF; or ...

... »» an investor who receives an appraisal from an EU credit institution, a MiFID firm or a UCITS management company that the investor has the appropriate expertise, experience and knowledge to adequately understand the investment in the QIAIF; or ...

25648 Demonstrate understanding of investment concepts

... includes but is not limited to – multisector funds, single sector funds, direct bonds, direct equities; evidence of comparison and evaluation of a minimum of two products and/or services from each type in range is required. ...

... includes but is not limited to – multisector funds, single sector funds, direct bonds, direct equities; evidence of comparison and evaluation of a minimum of two products and/or services from each type in range is required. ...

International Investment

... transaction cost, fund manager incur additional travel costs etc., Size and Number of International Open-end Funds 1990-99: Global/International Mutual Funds assets grew from $46.2b to $501.4b Cash flow into international funds in 2000 was $49.9b. ...

... transaction cost, fund manager incur additional travel costs etc., Size and Number of International Open-end Funds 1990-99: Global/International Mutual Funds assets grew from $46.2b to $501.4b Cash flow into international funds in 2000 was $49.9b. ...

3i agrees sale of Inspecta to ACTA*

... Helsinki-headquartered Inspecta Group (“the Company”) to Netherlands-based ACTA*. ACTA* is the Dutch Holding company of Kiwa and Shield Group International. The transaction remains conditional upon approval by the relevant Competition Authorities, but is expected to complete in May 2015. 3i, and fun ...

... Helsinki-headquartered Inspecta Group (“the Company”) to Netherlands-based ACTA*. ACTA* is the Dutch Holding company of Kiwa and Shield Group International. The transaction remains conditional upon approval by the relevant Competition Authorities, but is expected to complete in May 2015. 3i, and fun ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.