Investing

... • Dividends : cash payment to shareholders by the company from its profits dividends are not automatic…the Board of Directors decides IF and HOW MUCH the dividend will be ...

... • Dividends : cash payment to shareholders by the company from its profits dividends are not automatic…the Board of Directors decides IF and HOW MUCH the dividend will be ...

Investment Methodology and the Batting Average

... Plan sponsors must prudently select and monitor the investment options made available to participants. This can be a challenging task. The Nationwide Financial Fiduciary SeriesSM can help you make this task easier for your clients by providing a model Investment Policy Statement (IPS) as well as coo ...

... Plan sponsors must prudently select and monitor the investment options made available to participants. This can be a challenging task. The Nationwide Financial Fiduciary SeriesSM can help you make this task easier for your clients by providing a model Investment Policy Statement (IPS) as well as coo ...

Chapter Fifteen

... Funds with a Growth and Income Objective • Growth and Income Fund – objective is a combination of growth and income; invests in companies expected to show average or better growth and to pay steady or rising dividends. • Life-Cycle Funds – create a diversified, all-in-one portfolio for those indivi ...

... Funds with a Growth and Income Objective • Growth and Income Fund – objective is a combination of growth and income; invests in companies expected to show average or better growth and to pay steady or rising dividends. • Life-Cycle Funds – create a diversified, all-in-one portfolio for those indivi ...

Net investment income (Millions) 2006 2005 Public markets 4,870

... 13.7 per cent. This is the fourth year in a row in which OMERS has achieved a double-digit return, earning net investment income for 2006 of $6.5 billion, compared with $5.5 billion in 2005. The fair market value of net assets increased 15.9 per cent, to total $47.6 billion as at December 31, 2006, ...

... 13.7 per cent. This is the fourth year in a row in which OMERS has achieved a double-digit return, earning net investment income for 2006 of $6.5 billion, compared with $5.5 billion in 2005. The fair market value of net assets increased 15.9 per cent, to total $47.6 billion as at December 31, 2006, ...

Collective investment schemes regulations

... in collective investments can reduce the risk of investing by investment diversification. The publication focuses on regulatory issues facing participants in the western investment management industry. This experience can be used in the collective investments practice in Russia. Keywords: collective ...

... in collective investments can reduce the risk of investing by investment diversification. The publication focuses on regulatory issues facing participants in the western investment management industry. This experience can be used in the collective investments practice in Russia. Keywords: collective ...

February Minutes

... the year. With no further discussion or questions regarding the financials, Bill Miles made a motion to accept the financial report as presented. Gary Toebben seconded it. Motion passed. Mike handed the floor to Dave Huntley for a review of the investments. HR Investment Report Dave Huntley was plea ...

... the year. With no further discussion or questions regarding the financials, Bill Miles made a motion to accept the financial report as presented. Gary Toebben seconded it. Motion passed. Mike handed the floor to Dave Huntley for a review of the investments. HR Investment Report Dave Huntley was plea ...

Co-operators Ethical Select Growth Portfolio - The Co

... When you make a deposit, Co-operators pays your financial advisor a commission of 3%. If you have an RRSP or non-registered account you can withdraw 10% of the value of the units of your segregated funds at December 31 without paying a deferred sales charge. If you have a registered retirement incom ...

... When you make a deposit, Co-operators pays your financial advisor a commission of 3%. If you have an RRSP or non-registered account you can withdraw 10% of the value of the units of your segregated funds at December 31 without paying a deferred sales charge. If you have a registered retirement incom ...

Financial Services Guaranteed Investment

... • seek capital protection; • wish to diversify your portfolio; ...

... • seek capital protection; • wish to diversify your portfolio; ...

Invesco Short Term Bond Fund fact sheet

... expenses reimbursed currently or in the past, the Morningstar rating would have been lower. Class A shares received 3 stars for the overall, 4 stars for the three years, 4 stars for the five years and 2 stars for the 10 years. The fund was rated among 450, 450, 376 and 261 funds within the Morningst ...

... expenses reimbursed currently or in the past, the Morningstar rating would have been lower. Class A shares received 3 stars for the overall, 4 stars for the three years, 4 stars for the five years and 2 stars for the 10 years. The fund was rated among 450, 450, 376 and 261 funds within the Morningst ...

China opens up the securities investment fund

... like Tianjin, Chongqing, Qingdao and Beijing. The QDLP allows qualified WFOE fund managers to set up domestic private RMB funds and invest into offshore securities markets. The WFOE fund manager can be established as a corporation or a partnership. Establishing a WFOE or joint venture fund manager i ...

... like Tianjin, Chongqing, Qingdao and Beijing. The QDLP allows qualified WFOE fund managers to set up domestic private RMB funds and invest into offshore securities markets. The WFOE fund manager can be established as a corporation or a partnership. Establishing a WFOE or joint venture fund manager i ...

28095 Analyse personal financial investment opportunities

... This unit standard can be awarded with Achieved, Merit, or Excellence. For the Achieved grade to be awarded, the outcome must be achieved as specified in the outcome statement. For Merit or Excellence to be awarded, the candidate must meet the Merit or Excellence criteria specified above. ...

... This unit standard can be awarded with Achieved, Merit, or Excellence. For the Achieved grade to be awarded, the outcome must be achieved as specified in the outcome statement. For Merit or Excellence to be awarded, the candidate must meet the Merit or Excellence criteria specified above. ...

Emerging Markets Extended Opportunities Fund

... benefit from the potential of higher excess returns through a robust, diversified fund solution. • Enhanced return potential – the Fund places greater focus on subsets of the asset class that remain under-researched and less congested with global investors. The portfolio’s active risk is deliberate ...

... benefit from the potential of higher excess returns through a robust, diversified fund solution. • Enhanced return potential – the Fund places greater focus on subsets of the asset class that remain under-researched and less congested with global investors. The portfolio’s active risk is deliberate ...

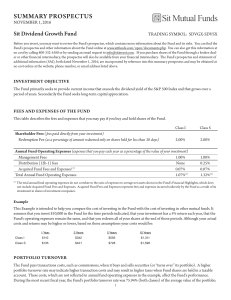

summary prospectus

... You could lose money by investing in the Fund. The principal risks of investing in the Fund are as follows: ›› Dividend Paying Company Risk: The Fund’s income objective may limit its ability to appreciate during a broad market advance because dividend paying stocks may not experience the same capita ...

... You could lose money by investing in the Fund. The principal risks of investing in the Fund are as follows: ›› Dividend Paying Company Risk: The Fund’s income objective may limit its ability to appreciate during a broad market advance because dividend paying stocks may not experience the same capita ...

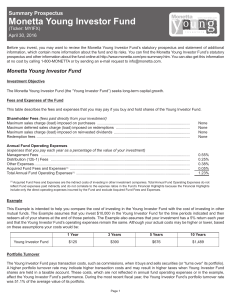

Monetta Young Investor Fund

... broad-based market indices that primarily include stocks of large capitalization U.S. companies. The balance of the Fund is directly invested in common stocks of companies of all market capitalization ranges and is diversified among industries and market sectors. However, the Adviser will primarily ...

... broad-based market indices that primarily include stocks of large capitalization U.S. companies. The balance of the Fund is directly invested in common stocks of companies of all market capitalization ranges and is diversified among industries and market sectors. However, the Adviser will primarily ...

state residents urged to be on guard against affinity fraud

... Investors need to be careful and ask the questions on the checklist to make sure they know what they're getting into and whether it meets their investment objectives," he/she said. According to Administrator, many investors fail to realize that with callable CDs only the issuer, not the investor, ca ...

... Investors need to be careful and ask the questions on the checklist to make sure they know what they're getting into and whether it meets their investment objectives," he/she said. According to Administrator, many investors fail to realize that with callable CDs only the issuer, not the investor, ca ...

Full Presentation

... The investment must not be solely for the purpose of earning a living for the investor and his or her family. The marginality of an investment enterprise is measured by its capacity to employ U.S. workers other than the investor and his or her family members. Determining if the investment is margina ...

... The investment must not be solely for the purpose of earning a living for the investor and his or her family. The marginality of an investment enterprise is measured by its capacity to employ U.S. workers other than the investor and his or her family members. Determining if the investment is margina ...

The Leverage effect of Structural Funds

... What about leverage effects of cohesion policy in terms of private investment? They take a variety of forms. Some of them can be traced to the general impact of cohesion policy on regions and Member States. The underlying philosophy of the policy is that economic growth is dependent on investment i ...

... What about leverage effects of cohesion policy in terms of private investment? They take a variety of forms. Some of them can be traced to the general impact of cohesion policy on regions and Member States. The underlying philosophy of the policy is that economic growth is dependent on investment i ...

Document

... illennials may be problematic, but consider their potential for radically improving government. With good reason, Tom Brokaw coined the term “the greatest generation,” in his book of the same name, to describe those who grew up during the Great Depression and went on to persevere through WWII. I was ...

... illennials may be problematic, but consider their potential for radically improving government. With good reason, Tom Brokaw coined the term “the greatest generation,” in his book of the same name, to describe those who grew up during the Great Depression and went on to persevere through WWII. I was ...

China`s First PERE+REITs Product Launched EBP

... The underlying asset of the IMIX Park REITs is Guanyinqiao IMIX Park Mall in Chongqing, which boasts a total GFA of 130,000 sq. m and maintains an occupancy rate of higher than 97%. Its rental income has been steadily increasing in recent years, and it has been recognised many times by residents of ...

... The underlying asset of the IMIX Park REITs is Guanyinqiao IMIX Park Mall in Chongqing, which boasts a total GFA of 130,000 sq. m and maintains an occupancy rate of higher than 97%. Its rental income has been steadily increasing in recent years, and it has been recognised many times by residents of ...

New Fund Manager for Bioventures

... magazine as South Africa’s top corporate advisor and sponsor, both rankings by deal flow. In 2003 Ernst & Young ranked Java Capital as the top corporate advisor and DealMaker magazine ranked Java Capital first in the category of legal advisor and second in the categories of sponsor and investment ad ...

... magazine as South Africa’s top corporate advisor and sponsor, both rankings by deal flow. In 2003 Ernst & Young ranked Java Capital as the top corporate advisor and DealMaker magazine ranked Java Capital first in the category of legal advisor and second in the categories of sponsor and investment ad ...

THEME: THE CHANGING ECONOMIC LANDSCAPE WITHIN EAC

... by the Exon–Florio Amendment to the Omnibus Trade and Competitiveness Act of 1988, Pub. L. No. 100-418, § 5021, 102 Stat. 1107, 1426 (codified as amended at 50 U.S.C. app. § 2170 (2000)), as administered by the Committee on Foreign Investment in the United States (CFIUS). ...

... by the Exon–Florio Amendment to the Omnibus Trade and Competitiveness Act of 1988, Pub. L. No. 100-418, § 5021, 102 Stat. 1107, 1426 (codified as amended at 50 U.S.C. app. § 2170 (2000)), as administered by the Committee on Foreign Investment in the United States (CFIUS). ...

Investment

... more unit of capital is employed. MEC depends upon two factors- Prospective yield and supply price Prospective yield: PY is calculated by aggregating net income of every year of a machine through out its life time. To estimate net income, cost is deducted from annual output of machine. Supply Pr ...

... more unit of capital is employed. MEC depends upon two factors- Prospective yield and supply price Prospective yield: PY is calculated by aggregating net income of every year of a machine through out its life time. To estimate net income, cost is deducted from annual output of machine. Supply Pr ...

CROMWELL RIVERPARK TRUST

... All information relates to A Class Units in the Cromwell Riverpark Trust. (1) Based on “as if complete” valuation by Landmark White Brisbane Pty Ltd. (2) Based on 15 year agreement for lease from date of practical completion, estimated at June 2010. (3) The proportion of distributions that are tax d ...

... All information relates to A Class Units in the Cromwell Riverpark Trust. (1) Based on “as if complete” valuation by Landmark White Brisbane Pty Ltd. (2) Based on 15 year agreement for lease from date of practical completion, estimated at June 2010. (3) The proportion of distributions that are tax d ...

MFS MERIDIAN ® FUNDS ― EMERGING MARKETS DEBT LOCAL

... markets and legal, regulatory, and accounting systems, and greater political, social, and economic instability making them more volatile and less liquid than more developed markets. Derivatives Risk: Derivatives can be highly volatile and can involve leverage. Gains or losses from derivatives can be ...

... markets and legal, regulatory, and accounting systems, and greater political, social, and economic instability making them more volatile and less liquid than more developed markets. Derivatives Risk: Derivatives can be highly volatile and can involve leverage. Gains or losses from derivatives can be ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.