Investment Fund Overview

... below. You can work with your financial advisor to invest your account, and the following investment fund overview might help you choose. Please remember that potential stock market volatility may alter the performance numbers shown. The chart lists past performance and does not guarantee future res ...

... below. You can work with your financial advisor to invest your account, and the following investment fund overview might help you choose. Please remember that potential stock market volatility may alter the performance numbers shown. The chart lists past performance and does not guarantee future res ...

PDF

... injected into the tortoise would cause a magical transformation to Gamera, the iconic flying turtle of sci-fi fame. More recently there has been a significant pullback, as the depth of the issues and caution about the unknown result of the pending third injection have combined to blunt the previous ...

... injected into the tortoise would cause a magical transformation to Gamera, the iconic flying turtle of sci-fi fame. More recently there has been a significant pullback, as the depth of the issues and caution about the unknown result of the pending third injection have combined to blunt the previous ...

Chapter Twenty - Cengage Learning

... – Additional commission charges are based on the number of shares and the value of stock bought and sold – Generally, online transactions are less expensive when compared to trading through a full-service brokerage firm – Full-service brokerages charge a percentage of the transaction amount (as much ...

... – Additional commission charges are based on the number of shares and the value of stock bought and sold – Generally, online transactions are less expensive when compared to trading through a full-service brokerage firm – Full-service brokerages charge a percentage of the transaction amount (as much ...

TIB Powerpoint - CP11/11

... … but what uninformed/non-advised/ill advised customers are likely to buy may be a world apart from the best investment > ‘Easy Products’ , ie selling customers what they are most likely to buy, optimises sales for providers … not investment propositions for investors - plain vanilla FTSE 100 offeri ...

... … but what uninformed/non-advised/ill advised customers are likely to buy may be a world apart from the best investment > ‘Easy Products’ , ie selling customers what they are most likely to buy, optimises sales for providers … not investment propositions for investors - plain vanilla FTSE 100 offeri ...

Infrastructure Bonds in Chile

... Due diligence of legal, regulatory and institutional frameworks well as political risk. Legal protection of private property and strength of concession ...

... Due diligence of legal, regulatory and institutional frameworks well as political risk. Legal protection of private property and strength of concession ...

Full Article - Nash Family Wealth

... Canso is named after a naval support airplane used in World War II. The plane continued in use long after the war and was known for its dependability. Canso’s mission is similar: Deliver dependable returns in all environments. As such, the firm’s culture is much more focused on achieving investment ...

... Canso is named after a naval support airplane used in World War II. The plane continued in use long after the war and was known for its dependability. Canso’s mission is similar: Deliver dependable returns in all environments. As such, the firm’s culture is much more focused on achieving investment ...

11 Investment in the public sector

... Opportunity Cost of Public Sector Investment • An increase in public sector investment means either – A reduction of other expenditure (BC) – Or an increase in taxes (YZ) © John Tribe ...

... Opportunity Cost of Public Sector Investment • An increase in public sector investment means either – A reduction of other expenditure (BC) – Or an increase in taxes (YZ) © John Tribe ...

Transaction Cost Theory to Examine IT impact on the Governance of

... Since the late 1970s, Transaction Cost Economics (TCE) has been one of the standard frameworks for analyzing the choice of organizational governance. TCE has had enormous impact not only on the study of economic organization but also on business administration, particularly on strategy, organization ...

... Since the late 1970s, Transaction Cost Economics (TCE) has been one of the standard frameworks for analyzing the choice of organizational governance. TCE has had enormous impact not only on the study of economic organization but also on business administration, particularly on strategy, organization ...

Disconcerting Discourse Communities: the CIG

... The group has currently expanded to three groups with $300,000 to invest ($100,000 per group) and each group focusing on small, medium, or large businesses (small, mid, and large cap groups) (Hempt). Not only is this group challenging to get into, it seems like one of the most stressful groups as we ...

... The group has currently expanded to three groups with $300,000 to invest ($100,000 per group) and each group focusing on small, medium, or large businesses (small, mid, and large cap groups) (Hempt). Not only is this group challenging to get into, it seems like one of the most stressful groups as we ...

Strategy Guide - Standard Life Investments

... ¬ We strive for excellent bottom-up stock selection and alpha capture expertise from our highly experienced GEM equities team. ¬ Our industry-leading multi-asset specialists seek to produce return-seeking enhanceddiversification strategies to create a more durably diversified portfolio. ¬ We have ...

... ¬ We strive for excellent bottom-up stock selection and alpha capture expertise from our highly experienced GEM equities team. ¬ Our industry-leading multi-asset specialists seek to produce return-seeking enhanceddiversification strategies to create a more durably diversified portfolio. ¬ We have ...

3rd Biennial International Conference on Business, Banking & Finance Panel Discussion:

... Ability to diversify revenue streams away from the vagaries of domestic or home markets and reduce concentration risk Ability to expand product suite to include previously untraditional business lines e.g. brokerage, capital markets, high end real estate and commodities etc. Regional financials were ...

... Ability to diversify revenue streams away from the vagaries of domestic or home markets and reduce concentration risk Ability to expand product suite to include previously untraditional business lines e.g. brokerage, capital markets, high end real estate and commodities etc. Regional financials were ...

An Overview of the Regulatory Framework Applying to Collective

... Applicable fiduciary compliance solutions include: For plan investments in/out of CIT ...

... Applicable fiduciary compliance solutions include: For plan investments in/out of CIT ...

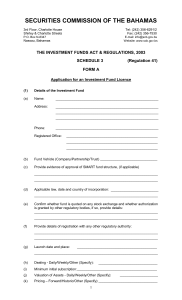

The Investment Funds Act, 2003 - Securities Commission of the

... Association, including copies of all material agreements) Copies of certificates and other documents of proof for information contained in submitted resumes. Financial statements Prescribed Application Fee (non-refundable) Other relevant documentation as requested by the Commission. ...

... Association, including copies of all material agreements) Copies of certificates and other documents of proof for information contained in submitted resumes. Financial statements Prescribed Application Fee (non-refundable) Other relevant documentation as requested by the Commission. ...

Advantages and disadvantages of investing in the Stock

... The income return represents periodic cash flows generated by the investment. These include dividends paid for ordinary shares and periodic interest paid for bonds. Stocks that pay dividends typically distribute them quarterly. Government bonds pay interest on a semi annual basis, and debentures pay ...

... The income return represents periodic cash flows generated by the investment. These include dividends paid for ordinary shares and periodic interest paid for bonds. Stocks that pay dividends typically distribute them quarterly. Government bonds pay interest on a semi annual basis, and debentures pay ...

Ethical Leadership Factsheet

... The Stanford Social Innovation Review (2009) has described areas where ethical issues arise in the nonprofit sector. The first is compensation. Nonprofit organizations sometimes find themselves walking a thin line when it comes to compensating their employees. The sector may be nonprofit, but it's b ...

... The Stanford Social Innovation Review (2009) has described areas where ethical issues arise in the nonprofit sector. The first is compensation. Nonprofit organizations sometimes find themselves walking a thin line when it comes to compensating their employees. The sector may be nonprofit, but it's b ...

Takeout financing

... in ratings of infrastructure SPV bonds raised by developers (SPV) would lead to major players with long term funds like insurance and PF getting enthused to subscribe to such bonds. ...

... in ratings of infrastructure SPV bonds raised by developers (SPV) would lead to major players with long term funds like insurance and PF getting enthused to subscribe to such bonds. ...

Private Offerings to U.S. Investors by Non

... who is engaged in the business of providing advice, making recommendations, issuing reports or furnishing analyses of securities either directly or through publications for compensation. Absent an exemption, this would require nearly all investment fund advisers with U.S. investors to register as in ...

... who is engaged in the business of providing advice, making recommendations, issuing reports or furnishing analyses of securities either directly or through publications for compensation. Absent an exemption, this would require nearly all investment fund advisers with U.S. investors to register as in ...

the nigerian investment climate . . . cont`d

... NIPC coordinates the operations of the One Stop Investment Centre (OSIC) which essentially provides pre-investment services. ...

... NIPC coordinates the operations of the One Stop Investment Centre (OSIC) which essentially provides pre-investment services. ...

impact on citizens` long term savings

... BlackRock is a premier provider of asset management, risk management, and advisory services to institutional, intermediary, and individual clients worldwide. As of 31 March 2015, the assets BlackRock manages on behalf of its clients totalled £3.22 trillion across equity, fixed income, cash managemen ...

... BlackRock is a premier provider of asset management, risk management, and advisory services to institutional, intermediary, and individual clients worldwide. As of 31 March 2015, the assets BlackRock manages on behalf of its clients totalled £3.22 trillion across equity, fixed income, cash managemen ...

Click here - WHAS Crusade for Children

... Number of clients Type of clientele (individual, trust, business, etc.) and range of portfolio sizes Number of staff (investment –related staff only) Assets under management Number of offices and local presence of those offices Location of corporate headquarters Related organizations Discussion of a ...

... Number of clients Type of clientele (individual, trust, business, etc.) and range of portfolio sizes Number of staff (investment –related staff only) Assets under management Number of offices and local presence of those offices Location of corporate headquarters Related organizations Discussion of a ...

Slide - Centre for Law, Markets and Regulation

... from official reserves.’; • IWGSWF [now IFSWF] in their GAPP (2008): ‘SWFs are defined as special purpose investment funds or arrangements, owned by the general government. Created by the general government for macroeconomic purposes, SWFs hold, manage or administer assets to achieve financial objec ...

... from official reserves.’; • IWGSWF [now IFSWF] in their GAPP (2008): ‘SWFs are defined as special purpose investment funds or arrangements, owned by the general government. Created by the general government for macroeconomic purposes, SWFs hold, manage or administer assets to achieve financial objec ...

International With-Profit Bond from Aviva

... The international With-Profit Funds are reinsured into Aviva’s With-Profit Fund. This means that investors enjoy all the benefits of a well established With-Profit Fund from the largest insurance services provider in the UK. The value of an investment can go down as well as up and is not guaranteed. ...

... The international With-Profit Funds are reinsured into Aviva’s With-Profit Fund. This means that investors enjoy all the benefits of a well established With-Profit Fund from the largest insurance services provider in the UK. The value of an investment can go down as well as up and is not guaranteed. ...

Primary Market Liquidity Vs. Secondary Market Liquidity

... providers, investors are able to enjoy efficient products with liquidity, strong counterparty risk management and relatively low costs ...

... providers, investors are able to enjoy efficient products with liquidity, strong counterparty risk management and relatively low costs ...

Personalised discretionary portfolio management: the tailor

... only and does not contain any investment recommendation within the terms of the royal decree of 5 March 2006. Its content is based on information sources judged to be reliable. No guarantee, warranty or representation – express or implied – is given by ING Belgium or any other company of ING Group a ...

... only and does not contain any investment recommendation within the terms of the royal decree of 5 March 2006. Its content is based on information sources judged to be reliable. No guarantee, warranty or representation – express or implied – is given by ING Belgium or any other company of ING Group a ...

Hang Seng Investment`s First Northbound Fund Makes Mainland

... Hang Seng Bank, said: “We are delighted to start the public offering of Hang Seng Investment’s first northbound fund on the Mainland, providing a new investment option for Mainland investors. The public offering of the Fund demonstrates how our good cross-border connectivity enables us to capitalise ...

... Hang Seng Bank, said: “We are delighted to start the public offering of Hang Seng Investment’s first northbound fund on the Mainland, providing a new investment option for Mainland investors. The public offering of the Fund demonstrates how our good cross-border connectivity enables us to capitalise ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.