Country Commerce India Brochure

... The government continues to liberalise foreign investment. In July 2015 it said that the sectoral cap on foreign direct investment (FDI) in all sectors except banking and defence will now be a composite cap for foreign-equity investments from both direct and portfolio investors. The move simplifies ...

... The government continues to liberalise foreign investment. In July 2015 it said that the sectoral cap on foreign direct investment (FDI) in all sectors except banking and defence will now be a composite cap for foreign-equity investments from both direct and portfolio investors. The move simplifies ...

Uber is now worth $17 billion

... Uber has announced an enormous new round of funding this afternoon. The company is taking on $1.2 billion in fresh capital, an investment that values it at $17 billion, not counting all the cash it has in the bank. The only startup to raise money at a higher valuation before going public was Faceboo ...

... Uber has announced an enormous new round of funding this afternoon. The company is taking on $1.2 billion in fresh capital, an investment that values it at $17 billion, not counting all the cash it has in the bank. The only startup to raise money at a higher valuation before going public was Faceboo ...

The Re-emergence of Collective Investment Trust Funds | Manning

... majority of the assets but market data indicates that the demand and usage of CITs has notably increased. The increase in demand for CITs can be attributed to multiple factors. First, since defined contribution plans have become the primary employer-sponsored retirement savings vehicle, employers ar ...

... majority of the assets but market data indicates that the demand and usage of CITs has notably increased. The increase in demand for CITs can be attributed to multiple factors. First, since defined contribution plans have become the primary employer-sponsored retirement savings vehicle, employers ar ...

financial institutions and markets

... CMISA, Korea’s financial regulatory scheme will be restructured to functional regulation, under which a single regulation is imposed on a single investment service regardless of the institutions that provide it. Investor protection is expected to be stronger under the CMISA. New devices for investor ...

... CMISA, Korea’s financial regulatory scheme will be restructured to functional regulation, under which a single regulation is imposed on a single investment service regardless of the institutions that provide it. Investor protection is expected to be stronger under the CMISA. New devices for investor ...

Value Line - University of New Haven

... "Quick Study Guide." The Selection & Opinion section contains Value Line's latest economic and stock market forecasts, one-page write-ups about interesting and attractive stocks, model portfolios, and financial and stock market statistics. The Summary & Index contains an index of all stocks in the I ...

... "Quick Study Guide." The Selection & Opinion section contains Value Line's latest economic and stock market forecasts, one-page write-ups about interesting and attractive stocks, model portfolios, and financial and stock market statistics. The Summary & Index contains an index of all stocks in the I ...

Returns and How They Get That Way

... fast. A beta of zero means a total lack of correlation – the much sought-after "market neutral" fund, where all of the return comes from investor skill. A negative beta means an inverse correlation (a short position on an index fund is the best example). I believe the alpha/beta model is an excellen ...

... fast. A beta of zero means a total lack of correlation – the much sought-after "market neutral" fund, where all of the return comes from investor skill. A negative beta means an inverse correlation (a short position on an index fund is the best example). I believe the alpha/beta model is an excellen ...

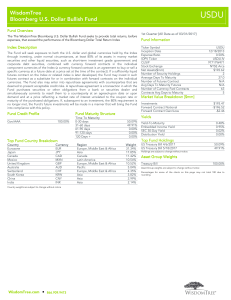

WisdomTree Bloomberg U.S. Dollar Bullish Fund

... through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, combined with currency forward contracts in the individual component currencies of the Index ...

... through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, combined with currency forward contracts in the individual component currencies of the Index ...

FRONT STREET TACTICAL BOND FUND Interim Management

... looking information involves known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. For this purpose, ...

... looking information involves known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. For this purpose, ...

Investment advisory and Treasury Management Services

... Laws) for opening bank accounts, making investments and in all aspects of portfolio management and deployment of funds Assist the SDF take necessary approvals of the respective statutory authorities (Exchange Control Authorities/Central Banks/Securities Regulators etc.) of the member states so that ...

... Laws) for opening bank accounts, making investments and in all aspects of portfolio management and deployment of funds Assist the SDF take necessary approvals of the respective statutory authorities (Exchange Control Authorities/Central Banks/Securities Regulators etc.) of the member states so that ...

The time has come: Let's shut down the financial casino

... special crisis fund should be set up in each country. The fund is fed by a one-off extra duty on all capital income above 50.000 Euro and a 1% extra tax on all corporate profits in the financial sector. A share of this fund should be used internationally for the assistance to those poor countries wh ...

... special crisis fund should be set up in each country. The fund is fed by a one-off extra duty on all capital income above 50.000 Euro and a 1% extra tax on all corporate profits in the financial sector. A share of this fund should be used internationally for the assistance to those poor countries wh ...

comgest growth mid-caps europe

... downward: consensus now expects less than 2% earnings per share growth in 2016 for the broader index, largely reflecting subdued external macro-economic factors. As a result and as always, we prefer to focus on businesses that can deliver growth despite, and not thanks to, the economic environment. ...

... downward: consensus now expects less than 2% earnings per share growth in 2016 for the broader index, largely reflecting subdued external macro-economic factors. As a result and as always, we prefer to focus on businesses that can deliver growth despite, and not thanks to, the economic environment. ...

Financial Self Reliance: It's Not As Hard As You Think

... in your own handwriting Date at top, signature at bottom Name a guardian, alternates, disposition of assets No notary or witnesses Caution: Consult attorney about language Caution: Use only if you don’t have significant assets or a complicated family situation ...

... in your own handwriting Date at top, signature at bottom Name a guardian, alternates, disposition of assets No notary or witnesses Caution: Consult attorney about language Caution: Use only if you don’t have significant assets or a complicated family situation ...

Schroders strengthens its global quantitative equities team in Australia

... worldwide. While many financial institutions try to provide all things to their clients, Schroders specialise in just one - pure investment management. Schroder Investment Management Australia Limited (SIMAL), is a wholly owned subsidiary of Schroders plc, a publicly listed UK company descending fro ...

... worldwide. While many financial institutions try to provide all things to their clients, Schroders specialise in just one - pure investment management. Schroder Investment Management Australia Limited (SIMAL), is a wholly owned subsidiary of Schroders plc, a publicly listed UK company descending fro ...

Compound Growth Rates and Yield - Jim Thomas

... advisory board (“BIVA”). The views expressed are those of the instructors, commentators, guests and participants, as the case may be, and do not necessarily represent those of BetterInvesting™ or BIVA. Investors should conduct their own review and analysis of any company of interest before making an ...

... advisory board (“BIVA”). The views expressed are those of the instructors, commentators, guests and participants, as the case may be, and do not necessarily represent those of BetterInvesting™ or BIVA. Investors should conduct their own review and analysis of any company of interest before making an ...

BlackRock US Corporate Bond Index Fund

... The custodian of the Fund is J.P. Morgan Bank (Ireland) plc. Further information about the Fund can be obtained from the latest annual report and half-yearly reports of the BlackRock Fixed Income Dublin Funds plc (BFIDF). These documents are available free of charge in English and certain other lang ...

... The custodian of the Fund is J.P. Morgan Bank (Ireland) plc. Further information about the Fund can be obtained from the latest annual report and half-yearly reports of the BlackRock Fixed Income Dublin Funds plc (BFIDF). These documents are available free of charge in English and certain other lang ...

Banking request for proposals - Association of County Commissions

... Institutions may be added at anytime upon a written request irrespective of this request for proposals. Requests will be e-mailed to participating institution’s listed point of contact and copied to a secondary contact (if requested). A preliminary e-mail will be sent out approximately two business ...

... Institutions may be added at anytime upon a written request irrespective of this request for proposals. Requests will be e-mailed to participating institution’s listed point of contact and copied to a secondary contact (if requested). A preliminary e-mail will be sent out approximately two business ...

INTRODUCTION HIGHLIGHTS Regulatory Issues Market

... Million) being received. The note was listed at the USE on 25th June 2012. The 10 year note is trading at a yield rate of 85% of the rate on a two year government bond. The issue is part of a program which will allow the AfDB to issue bonds in multiple tranches to fund infrastructure and other proje ...

... Million) being received. The note was listed at the USE on 25th June 2012. The 10 year note is trading at a yield rate of 85% of the rate on a two year government bond. The issue is part of a program which will allow the AfDB to issue bonds in multiple tranches to fund infrastructure and other proje ...

Report 52 - Fixed Maturity EUR Industrial Bond Funds

... Until December 31st, 2011 returns of all institutional mandates were presented net of fees, namely actual custody fees, management commissions and transaction costs. There are no performance based fees. For the mutual funds, and institutional mandates from January 1st, 2012, the returns are prese ...

... Until December 31st, 2011 returns of all institutional mandates were presented net of fees, namely actual custody fees, management commissions and transaction costs. There are no performance based fees. For the mutual funds, and institutional mandates from January 1st, 2012, the returns are prese ...

CMU Briefing Paper - For Print

... As table 1 shows, 62% of EU households’ financial savings are typically long term: pension funds, life insurance, shares, funds and bonds. In addition, in the EU, financial savings are often not the biggest part of households’ savings: when one takes property assets into account as well, the long te ...

... As table 1 shows, 62% of EU households’ financial savings are typically long term: pension funds, life insurance, shares, funds and bonds. In addition, in the EU, financial savings are often not the biggest part of households’ savings: when one takes property assets into account as well, the long te ...

THE BEST OF THE VALIDEA HOT LIST – 2010

... the market crash, and will now be able to avoid the next market plunge -- just think about all of the stories you've seen in the past year or so that claim to identified "the next bubble". But the reason that the crash was so severe and shocking was precisely because so few strategists rang the warn ...

... the market crash, and will now be able to avoid the next market plunge -- just think about all of the stories you've seen in the past year or so that claim to identified "the next bubble". But the reason that the crash was so severe and shocking was precisely because so few strategists rang the warn ...

Maybank Investment Bank issues 6 new Call Warrants and 2 new

... Maybank’s founding fathers envisioned that the Bank would be a prime catalyst for economic and social development wherever it served. That basic philosophy has never changed and lives on today in its mission to humanise financial services across Asia. This is demonstrated through the Group’s commitm ...

... Maybank’s founding fathers envisioned that the Bank would be a prime catalyst for economic and social development wherever it served. That basic philosophy has never changed and lives on today in its mission to humanise financial services across Asia. This is demonstrated through the Group’s commitm ...

Rev. Rul. 95-16

... Is the carryover of a taxpayer's disallowed investment interest to a succeeding taxable year under section 163(d)(2) of the Internal Revenue Code limited by the taxpayer's taxable income for the taxable year in which the interest was paid or accrued? Law and Analysis Section 63(a) defines taxable in ...

... Is the carryover of a taxpayer's disallowed investment interest to a succeeding taxable year under section 163(d)(2) of the Internal Revenue Code limited by the taxpayer's taxable income for the taxable year in which the interest was paid or accrued? Law and Analysis Section 63(a) defines taxable in ...

Mutual Fund Performance and Manager Style. J.L. Davis, FAJ, Jan

... Sample consisted of 4,686 funds covering 26,564 fund-years from 1962-98, i.e.,in 26,564 time the fund was classified as an equity fund and had at least one valid monthly return. The median equity weight for the fund year: 93 percent. ...

... Sample consisted of 4,686 funds covering 26,564 fund-years from 1962-98, i.e.,in 26,564 time the fund was classified as an equity fund and had at least one valid monthly return. The median equity weight for the fund year: 93 percent. ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.