essen-ch18-presentat..

... One of the Ten Principles from Chapter 1: Markets are usually a good way to organize economic activity. Financial markets help allocate the economy’s scarce resources to their most efficient uses. ...

... One of the Ten Principles from Chapter 1: Markets are usually a good way to organize economic activity. Financial markets help allocate the economy’s scarce resources to their most efficient uses. ...

Westerville City Schools COURSE OF STUDY BUXXX: Personal Finance

... Investing: The goal of financial management is to increase one’s net worth. Investing, through a variety of options, is one way to build wealth and increase financial security. Many factors impact investment and retirement plans, including government regulations and global economic and environmental ...

... Investing: The goal of financial management is to increase one’s net worth. Investing, through a variety of options, is one way to build wealth and increase financial security. Many factors impact investment and retirement plans, including government regulations and global economic and environmental ...

2015 tech growth equity

... private equity activity. We have a unique viewpoint that focuses on growth investing rather than seed or early stage investing, is specific to the tech sector and integrates private equity growth tech investment with late stage venture investing. We believe our analysis provides unique insight to te ...

... private equity activity. We have a unique viewpoint that focuses on growth investing rather than seed or early stage investing, is specific to the tech sector and integrates private equity growth tech investment with late stage venture investing. We believe our analysis provides unique insight to te ...

Beauty in Art, Mathematics, and Nature

... free up your money and be available to you within a short period of time. This is not true of assets such as a house or car, which take a relatively longer amount of time to sell. He addressed several factors that influence a person's decision to invest in a stock or mutual fund. oDe of the' factox: ...

... free up your money and be available to you within a short period of time. This is not true of assets such as a house or car, which take a relatively longer amount of time to sell. He addressed several factors that influence a person's decision to invest in a stock or mutual fund. oDe of the' factox: ...

Study on Obstacles and Solutions to China’s Low-Carbon Industrial Investment Fund

... and it raised over 220 million RMB capital. These capital was all from Zhejiang folk. The profit model of Nuohai low-carbon fund is that: first, invest in low-carbon high growth areas of the business to get equity, then foster the enterprise listed, and finally make profits by the way of sale shares ...

... and it raised over 220 million RMB capital. These capital was all from Zhejiang folk. The profit model of Nuohai low-carbon fund is that: first, invest in low-carbon high growth areas of the business to get equity, then foster the enterprise listed, and finally make profits by the way of sale shares ...

CI Money Market Fund - Mutual Fund Search

... is based on choice giving you the power to choose the investments that meet your individual needs. We offer an extraordinary selection of funds and leading portfolio management teams whose investment expertise is among the best in the world. We market our funds through a network of more than 40,000 ...

... is based on choice giving you the power to choose the investments that meet your individual needs. We offer an extraordinary selection of funds and leading portfolio management teams whose investment expertise is among the best in the world. We market our funds through a network of more than 40,000 ...

Active Management and Emerging Markets Equities

... sustainable investment process and comprehensive risk management. The higher the quality of these factors and a manager’s superior ability to employ this skill set, the greater the chance the portfolio will outperform. Investors must make a crucial qualitative judgment on manager quality. The import ...

... sustainable investment process and comprehensive risk management. The higher the quality of these factors and a manager’s superior ability to employ this skill set, the greater the chance the portfolio will outperform. Investors must make a crucial qualitative judgment on manager quality. The import ...

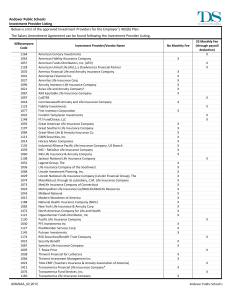

SALARY REDUCTION AGREEMENT (SRA) 403(b)

... elective deferrals under Code Section 402(g). If, based on information held by my employer or the plan administrator (Tax Deferred Solutions/TDS), either my employer or TDS believes additional contributions will cause me to exceed limits under Code Section 415 or 402(g), I authorize the automatic ca ...

... elective deferrals under Code Section 402(g). If, based on information held by my employer or the plan administrator (Tax Deferred Solutions/TDS), either my employer or TDS believes additional contributions will cause me to exceed limits under Code Section 415 or 402(g), I authorize the automatic ca ...

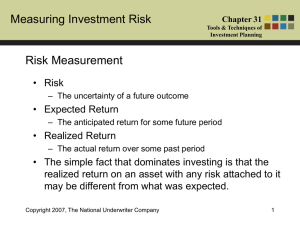

Chapter 31 Tools & Techniques of Investment Planning

... proportion of a security’s or portfolio’s total variability is explained by its relationship to a benchmark or index and how much is its independent risk unrelated to the benchmark or index. • When used in conjunction with ratings of mutual funds or the performance of professional managers, it advis ...

... proportion of a security’s or portfolio’s total variability is explained by its relationship to a benchmark or index and how much is its independent risk unrelated to the benchmark or index. • When used in conjunction with ratings of mutual funds or the performance of professional managers, it advis ...

Equity Linked Debentures

... So what are ELD’s? • An ELD is a form of a fixed income product. • It differs from standard fixed-income product as the final payout is also based on the return of the underlying equity, which can be a set of stocks, basket of stocks or an equity index (all predefined) ...

... So what are ELD’s? • An ELD is a form of a fixed income product. • It differs from standard fixed-income product as the final payout is also based on the return of the underlying equity, which can be a set of stocks, basket of stocks or an equity index (all predefined) ...

Making Lifetime Investing Planning a Reality

... – Can include the concept of one or more goals for consumption spending – Can include investment costs like fees and taxes – Allocation must be selected based on some criteria (e.g. probability of fulfilling consumption goals) – Implicitly assumes that allocations are rebalanced frequently back to o ...

... – Can include the concept of one or more goals for consumption spending – Can include investment costs like fees and taxes – Allocation must be selected based on some criteria (e.g. probability of fulfilling consumption goals) – Implicitly assumes that allocations are rebalanced frequently back to o ...

print - MFS Investment Management

... References to future expected returns and performance are not promises or estimates of actual performance that may be realized by an investor, and should not be relied upon. The forecasts are for illustrative purposes only and are not to be relied upon as advice, interpreted as a recommendation or b ...

... References to future expected returns and performance are not promises or estimates of actual performance that may be realized by an investor, and should not be relied upon. The forecasts are for illustrative purposes only and are not to be relied upon as advice, interpreted as a recommendation or b ...

ucits – past, present and future

... “Pooled investment” products of the type described above, amount to investment products. These can be distinguished from investment services. Asset management is an investment service. So for example, a wealthy individual with several million pounds (or Euros) to invest could approach an authorised ...

... “Pooled investment” products of the type described above, amount to investment products. These can be distinguished from investment services. Asset management is an investment service. So for example, a wealthy individual with several million pounds (or Euros) to invest could approach an authorised ...

Proceedings of 10th Annual London Business Research Conference

... positively on individual investors’ performance. Although the prospect variables (two sub groups; regret aversion and loss aversion) are supposed to have a positive impact on investment performance, it is found that regret aversion is to be influenced positively while in contrast negative impact exi ...

... positively on individual investors’ performance. Although the prospect variables (two sub groups; regret aversion and loss aversion) are supposed to have a positive impact on investment performance, it is found that regret aversion is to be influenced positively while in contrast negative impact exi ...

ETFs: A Call for Greater Transparency and Consistent

... exposure is achieved by a swap, then to address systemic and investor concerns, the following features must be incorporated. First, any counterparty exposure must be wholly offset with high quality collateral. Second, the swap structure should follow best practices as outlined in the section below t ...

... exposure is achieved by a swap, then to address systemic and investor concerns, the following features must be incorporated. First, any counterparty exposure must be wholly offset with high quality collateral. Second, the swap structure should follow best practices as outlined in the section below t ...

Infrastructure for Development - Africa

... o BRICS keen to expand their commercial and strategic links with resource rich countries, mostly pursuing this through bilateral deals. A new bank could help achieve such objective with less financial and political exposure with a multi-lateral approach ...

... o BRICS keen to expand their commercial and strategic links with resource rich countries, mostly pursuing this through bilateral deals. A new bank could help achieve such objective with less financial and political exposure with a multi-lateral approach ...

Do large cash holdings and low leverage always

... This study provides the first empirical evidence on the validity of the ex ante investment efficiency measure in Biddle, Hilary, and Verdi (2009) and improves its ability to capture inefficient investments. We find that investments improve rather than deteriorate future performance for firms that ar ...

... This study provides the first empirical evidence on the validity of the ex ante investment efficiency measure in Biddle, Hilary, and Verdi (2009) and improves its ability to capture inefficient investments. We find that investments improve rather than deteriorate future performance for firms that ar ...

Stimulating Investment in Emerging-Market SMEs

... lthough many large institutions have begun to stabilize and recover from the global financial crisis, a serious credit crunch continues. Small- and medium-sized enterprises (SMEs) face particular challenges to survival and growth. Even in good economic times, these firms lack access to flexible capi ...

... lthough many large institutions have begun to stabilize and recover from the global financial crisis, a serious credit crunch continues. Small- and medium-sized enterprises (SMEs) face particular challenges to survival and growth. Even in good economic times, these firms lack access to flexible capi ...

Setting up a Sovereign Wealth Fund: Some Policy and

... macroeconomic framework and investment objectives. It is also based on our experience with international reserves management, as such macroeconomic and financial theory, when available, support our recommendations. The “roadmap” starts by taking as a given policymakers’ broad objectives. Typically, ...

... macroeconomic framework and investment objectives. It is also based on our experience with international reserves management, as such macroeconomic and financial theory, when available, support our recommendations. The “roadmap” starts by taking as a given policymakers’ broad objectives. Typically, ...

Establishment of the COAG Reform Fund

... agreements between the Commonwealth and States or Territories. Date of effect: This measure takes effect 1 January 2009. Proposal announced: This measure was announced in the ...

... agreements between the Commonwealth and States or Territories. Date of effect: This measure takes effect 1 January 2009. Proposal announced: This measure was announced in the ...

Special Conditions Portfolio Management Service

... 1. The Agreement may be terminated at any time on the Client's initiative, without justification and with immediate effect. Any request for full withdrawal of assets from the Portfolio entails termination of the Agreement. The Client will provide notification of their intention to bring an end to the A ...

... 1. The Agreement may be terminated at any time on the Client's initiative, without justification and with immediate effect. Any request for full withdrawal of assets from the Portfolio entails termination of the Agreement. The Client will provide notification of their intention to bring an end to the A ...

STRS Total Guaranteed Return Choice 2018

... returns, participants must “lock-in” their contributions and transfers made during the year until the end of a five-year term. The interest rate is paid on the contributions and transfers until the end of the five-year term and is credited to the account on a daily basis. The five-year term begins w ...

... returns, participants must “lock-in” their contributions and transfers made during the year until the end of a five-year term. The interest rate is paid on the contributions and transfers until the end of the five-year term and is credited to the account on a daily basis. The five-year term begins w ...

Date of Submission: 17-11-2014 FIN 460 Section: 02 Submitted by

... There are 6 companies which are off same industry. In terms of standard deviation (which means the volatility of the investment) the more it is, the more it get deviate from the mean (average) as a result there are more risk which might lower the stock of the company as a result less profit. For exa ...

... There are 6 companies which are off same industry. In terms of standard deviation (which means the volatility of the investment) the more it is, the more it get deviate from the mean (average) as a result there are more risk which might lower the stock of the company as a result less profit. For exa ...

inheritance tax portfolio service

... for taxation purposes includes AIM listings). The underlying business assets must be employed in an ongoing qualifying trade. This effectively excludes businesses which trade in securities, land or buildings, or are involved in investment activities. ...

... for taxation purposes includes AIM listings). The underlying business assets must be employed in an ongoing qualifying trade. This effectively excludes businesses which trade in securities, land or buildings, or are involved in investment activities. ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.