How might “animal spirits” affect the investment decision?

... The third attribute, corruption is the exploitation of power for private gain. This can keep animal spirits high as consumers are affected by the false illusion that businesses or economies are thriving until true intentions are exposed and consumer confidence falls. For instance, the Enron scandal ...

... The third attribute, corruption is the exploitation of power for private gain. This can keep animal spirits high as consumers are affected by the false illusion that businesses or economies are thriving until true intentions are exposed and consumer confidence falls. For instance, the Enron scandal ...

529 College Savings Plans

... underlying investments perform Funds can be used at Funds can only be used any accredited college in at participating colleges, the U.S. or abroad typically state universities Note: Investors should consider the investment objectives, risks, charges, and expenses associated with 529 plans before inv ...

... underlying investments perform Funds can be used at Funds can only be used any accredited college in at participating colleges, the U.S. or abroad typically state universities Note: Investors should consider the investment objectives, risks, charges, and expenses associated with 529 plans before inv ...

Function of Financial Markets

... about 10,000, are very small cooperative lending institutions organized around a particular group: union members, employees of a particular firm, and so forth. They acquire funds from deposits called shares and primarily make consumer loans. Thanks to the banking legislation in the 1980s, credit uni ...

... about 10,000, are very small cooperative lending institutions organized around a particular group: union members, employees of a particular firm, and so forth. They acquire funds from deposits called shares and primarily make consumer loans. Thanks to the banking legislation in the 1980s, credit uni ...

Chapter 14. Investment and asset prices

... spending and stock prices • In the case where the firm issues new shares we simply subtract these costs from the value of shares held by existing shareholders • It is optimal for investors to let the firm expand the capital stock (invest) until the expected marginal gain on their shares is driven do ...

... spending and stock prices • In the case where the firm issues new shares we simply subtract these costs from the value of shares held by existing shareholders • It is optimal for investors to let the firm expand the capital stock (invest) until the expected marginal gain on their shares is driven do ...

Developing an Investment Policy Statement Under ERISA

... Although the statements of fact and data in this report have been obtained from, and are based upon, sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s ...

... Although the statements of fact and data in this report have been obtained from, and are based upon, sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s ...

Theory of speculative bubble

... The starting point of Le Bon mass psychology Analysis of collective soul This collective soul establishes in the place where is some group of people and where an event occurs People do not deal as a individuals but deal as a mass. Personal characteristics of individuals are put down and replac ...

... The starting point of Le Bon mass psychology Analysis of collective soul This collective soul establishes in the place where is some group of people and where an event occurs People do not deal as a individuals but deal as a mass. Personal characteristics of individuals are put down and replac ...

Can Financial Engineering Cure Cancer Solve the Energy

... Size: managing large portfolios of complex R&D projects may managing large portfolios of complex R&D projects may require new management and governance structures (e.g., Manhattan Project) Centralization: must preserve the benefits of diversity as scale increases Capacity: is the talent p ...

... Size: managing large portfolios of complex R&D projects may managing large portfolios of complex R&D projects may require new management and governance structures (e.g., Manhattan Project) Centralization: must preserve the benefits of diversity as scale increases Capacity: is the talent p ...

UNCTAD`s Global Action Menu for Investment Facilitation

... national policy tools, and to target them towards foreign investment that is capable of promoting sustainable development. To respond to this systemic gap, in January 2016 UNCTAD launched an Action Menu on Investment Facilitation. The Action Menu aims to help countries address ground-level obstacles ...

... national policy tools, and to target them towards foreign investment that is capable of promoting sustainable development. To respond to this systemic gap, in January 2016 UNCTAD launched an Action Menu on Investment Facilitation. The Action Menu aims to help countries address ground-level obstacles ...

10 Smart Questions Investors Should Be Asking

... Be Asking About Smart Beta (contd.) Disclosures: Investors should carefully consider information contained in the prospectus, including investment objectives, risks, charges and expenses. You can request a prospectus by visiting schwab.com or calling Schwab at 800-435-4000. Please read the prospectu ...

... Be Asking About Smart Beta (contd.) Disclosures: Investors should carefully consider information contained in the prospectus, including investment objectives, risks, charges and expenses. You can request a prospectus by visiting schwab.com or calling Schwab at 800-435-4000. Please read the prospectu ...

2017 1Q LCIV - Todd Asset Management Large Cap Intrinsic Value

... composite was 0.50%. Actual investment advisory fees incurred by clients may vary. The currency used to calculate and express performance is U.S. dollars. All cash reserves and equivalents have been included in the performance. The composite performance has been compared to the following benchmarks. ...

... composite was 0.50%. Actual investment advisory fees incurred by clients may vary. The currency used to calculate and express performance is U.S. dollars. All cash reserves and equivalents have been included in the performance. The composite performance has been compared to the following benchmarks. ...

- Networth Direct

... recommendation on the course of the action to be followed. Readers are strongly advised to verify the contents before taking any investment decision based on this opinion. The above is meant for general reading purpose only and is not meant to serve as a professional guide for the readers. The reade ...

... recommendation on the course of the action to be followed. Readers are strongly advised to verify the contents before taking any investment decision based on this opinion. The above is meant for general reading purpose only and is not meant to serve as a professional guide for the readers. The reade ...

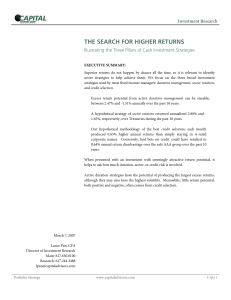

THE SEARCH FOR HIGHER RETURNS

... variance, a finding that is often observed in real life portfolios. The second largest source of over/under performance came from deliberate bets on market sectors. Surprisingly, credit was not as significant a return driver as other two factors. ...

... variance, a finding that is often observed in real life portfolios. The second largest source of over/under performance came from deliberate bets on market sectors. Surprisingly, credit was not as significant a return driver as other two factors. ...

Asset Allocation: A New Look at an Old Theme

... terms of what they bring to your portfolio – Income, Diversification, Growth, or Aggressive Growth. How your portfolio is allocated to each of these categories is directly related to your unique investment objectives -- your return expectations versus your tolerance for risk, among other things. The ...

... terms of what they bring to your portfolio – Income, Diversification, Growth, or Aggressive Growth. How your portfolio is allocated to each of these categories is directly related to your unique investment objectives -- your return expectations versus your tolerance for risk, among other things. The ...

Threadneedle Investments Threadneedle European Smaller

... Past performance is not a guide to future returns. The value of investments and any income from them is not guaranteed and may fall as well as rise and the investor may not get back the original investment. Exchange rate movements could increase or decrease the value of underlying investments/holdin ...

... Past performance is not a guide to future returns. The value of investments and any income from them is not guaranteed and may fall as well as rise and the investor may not get back the original investment. Exchange rate movements could increase or decrease the value of underlying investments/holdin ...

With new “Vaccine Bonds” Japanese Investors will have the

... Every year, 27 million infants are not vaccinated against the most common childhood diseases. As a result, around two to three million children die annually from easily preventable diseases. Many more fall sick, miss school and become part of the vicious cycle that links poor health and lack of educ ...

... Every year, 27 million infants are not vaccinated against the most common childhood diseases. As a result, around two to three million children die annually from easily preventable diseases. Many more fall sick, miss school and become part of the vicious cycle that links poor health and lack of educ ...

View pdf - Egmont Institute

... According to the Commission, the main challenge for Belgium in the field of investment lies in the public sector. Over the years, public investment fell to 1.6% of GDP – almost the lowest percentage of all EU Member States. Since 1980 there has been a decline in public investment. This long period o ...

... According to the Commission, the main challenge for Belgium in the field of investment lies in the public sector. Over the years, public investment fell to 1.6% of GDP – almost the lowest percentage of all EU Member States. Since 1980 there has been a decline in public investment. This long period o ...

Portfolio1 - people.bath.ac.uk

... • The empirical evidence in favour of passive strategies is mixed at best ...

... • The empirical evidence in favour of passive strategies is mixed at best ...

Document

... 1977 Permanent Fund receives its first deposit of constitutionally dedicated oil revenues; $734,000 ...

... 1977 Permanent Fund receives its first deposit of constitutionally dedicated oil revenues; $734,000 ...

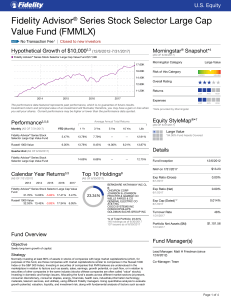

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... Expenses: This Morningstar data point compares the fund's net expense ratio to the net expense ratio of all the other funds within its Morningstar Category grouping. 5. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative ...

... Expenses: This Morningstar data point compares the fund's net expense ratio to the net expense ratio of all the other funds within its Morningstar Category grouping. 5. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative ...

Portfolio Risk and return

... Systematic risk is also called market risk and is the risk inherent in the aggregate market that cannot be solved by diversification. Some common sources of market risk are recessions, wars, interest rates and others that cannot be avoided through a diversified portfolio. Though systematic risk cann ...

... Systematic risk is also called market risk and is the risk inherent in the aggregate market that cannot be solved by diversification. Some common sources of market risk are recessions, wars, interest rates and others that cannot be avoided through a diversified portfolio. Though systematic risk cann ...

TrustSM Target Date Collective Investment Funds

... including up to a 50-year working career and more than 25 years in retirement. Over time, Principal Trust intends to gradually shift the asset allocation targets of each Target Date Fund (other than the Principal Trust Income Fund) to accommodate investors progressing from asset accumulation years t ...

... including up to a 50-year working career and more than 25 years in retirement. Over time, Principal Trust intends to gradually shift the asset allocation targets of each Target Date Fund (other than the Principal Trust Income Fund) to accommodate investors progressing from asset accumulation years t ...

TermPaper_PRES

... Reduce the risk of an individual asset by diversifying the portfolio Select a portfolio of various investments Maximize expected return at fixed level of risk Minimize risk at a fixed amount of expected return Choosing the right combination of stocks ...

... Reduce the risk of an individual asset by diversifying the portfolio Select a portfolio of various investments Maximize expected return at fixed level of risk Minimize risk at a fixed amount of expected return Choosing the right combination of stocks ...

Annexure I

... 2.Providing investors the facility of trading through BSE StAR MF platform for switches in Demat and Non Demat mode and Non Demat transactions in all the open ended schemes of Baroda Pioneer Mutual Fund. Investors may note that currently all the investors of open ended schemes of Baroda Pioneer Mutu ...

... 2.Providing investors the facility of trading through BSE StAR MF platform for switches in Demat and Non Demat mode and Non Demat transactions in all the open ended schemes of Baroda Pioneer Mutual Fund. Investors may note that currently all the investors of open ended schemes of Baroda Pioneer Mutu ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.