Bendigo Socially Responsible Growth Fund

... • provide comfort that good financial performance needn’t compromise your values ...

... • provide comfort that good financial performance needn’t compromise your values ...

Senior Fund Consultant (m / f) Alternative Investment Funds

... Established 1988, LRI Group is a leading independent investment services company based in Luxembourg. It provides asset managers and investors with nearly three decades of experience in structuring and administration of traditional and alternative investment strategies. In the context of the continu ...

... Established 1988, LRI Group is a leading independent investment services company based in Luxembourg. It provides asset managers and investors with nearly three decades of experience in structuring and administration of traditional and alternative investment strategies. In the context of the continu ...

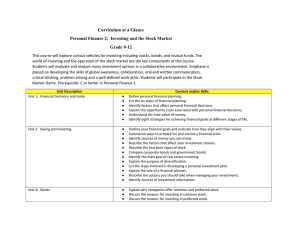

Curriculum at a Glance Personal Finance 2: Investing and the Stock

... Outline your financial goals and evaluate how they align with their values. Summarize ways to prepare for and survive a financial crisis. Identify sources of money you can invest. Describe the factors that affect your investment choices. Describe the two basic types of stock. Compare corporate bonds ...

... Outline your financial goals and evaluate how they align with their values. Summarize ways to prepare for and survive a financial crisis. Identify sources of money you can invest. Describe the factors that affect your investment choices. Describe the two basic types of stock. Compare corporate bonds ...

Sustainable Investments

... ■ Forster clean energy investments to help meet the needs of developing countries in an environmentally responsible way, reduce greenhouse gas emissions and help countries adapt to climate change ...

... ■ Forster clean energy investments to help meet the needs of developing countries in an environmentally responsible way, reduce greenhouse gas emissions and help countries adapt to climate change ...

What annual returns do investors expect?

... investing in GICs, savings accounts and other guaranteed investments ...

... investing in GICs, savings accounts and other guaranteed investments ...

What is Investing? - Undergraduate Investment Society at UCLA

... •Originally used to refer financial instruments secured by an asset. •In modern use, it can refer to all financial instruments regardless of if they are secured. ...

... •Originally used to refer financial instruments secured by an asset. •In modern use, it can refer to all financial instruments regardless of if they are secured. ...

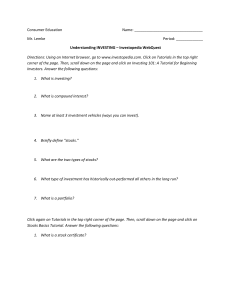

Unit 5 - Understanding Investing WebQuest

... Stocks Basics Tutorial. Answer the following questions: 1. What is a stock certificate? ...

... Stocks Basics Tutorial. Answer the following questions: 1. What is a stock certificate? ...

WisdomTree`s PRACTICE MANAGEMENT SUPPORT PROGRAM

... diversification and more. Our practice management offering continues that tradition. PILLARS OF THE PROGRAM ...

... diversification and more. Our practice management offering continues that tradition. PILLARS OF THE PROGRAM ...

Chapter 9 Sources of Capital

... Identify each of the different financial plans, and evaluate which one would be most beneficial to you at this stage of your life, Explain the difference between Financial Investment and Real Investment and explain which is better for the economy. ...

... Identify each of the different financial plans, and evaluate which one would be most beneficial to you at this stage of your life, Explain the difference between Financial Investment and Real Investment and explain which is better for the economy. ...

verseon - woodfordfunds.com

... VERSEON US-based but UK-listed platform drug development business. Verseon’s proprietary platform uses computerised molecular modelling techniques to engineer novel drugs consistently, reliably, and cost-effectively. It already has an anticoagulation treatment in pre-clinical development with therap ...

... VERSEON US-based but UK-listed platform drug development business. Verseon’s proprietary platform uses computerised molecular modelling techniques to engineer novel drugs consistently, reliably, and cost-effectively. It already has an anticoagulation treatment in pre-clinical development with therap ...

Socially Responsible Investing

... The origins of socially responsible investing date back hundreds of years, and are believed to have stemmed from religious beliefs. In biblical times, it has been noted that Jewish law incorporated aspects of investing, and how to invest in an ethical manner. Generations of religious investors follo ...

... The origins of socially responsible investing date back hundreds of years, and are believed to have stemmed from religious beliefs. In biblical times, it has been noted that Jewish law incorporated aspects of investing, and how to invest in an ethical manner. Generations of religious investors follo ...

ICCR Member Profile: The Church of England Ethical Investment

... an important component of an ethical investment response to climate change, it is not sufficient. We believe that engagement with policy makers is even more important: only policy makers can put the price on carbon that is needed to disincentivise the use of fossil fuels. We do public policy work th ...

... an important component of an ethical investment response to climate change, it is not sufficient. We believe that engagement with policy makers is even more important: only policy makers can put the price on carbon that is needed to disincentivise the use of fossil fuels. We do public policy work th ...

MicroVest announces new CIO and MD Equity

... high caliber candidates. John’s focus on growth and Doug’s attention to our equity business put MicroVest in a great position,” says Gil Crawford, CEO of MicroVest Capital Management, LLC. Mr. Beckham joined MicroVest in June 2016 after nearly 20 years at the Inter-American Investment Corporation (I ...

... high caliber candidates. John’s focus on growth and Doug’s attention to our equity business put MicroVest in a great position,” says Gil Crawford, CEO of MicroVest Capital Management, LLC. Mr. Beckham joined MicroVest in June 2016 after nearly 20 years at the Inter-American Investment Corporation (I ...

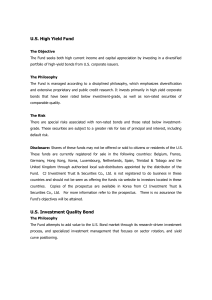

US High Yield Fund

... The Objective The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary ...

... The Objective The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary ...

INVESTMENT OPPORTUNITIES

... you could lose more money. Lower risk usually means lower return. ...

... you could lose more money. Lower risk usually means lower return. ...

Document

... Governance issues are financially material to the longterm performance of their investments then they should take them into account D. If trustees believe that ESG issues are important then they should stop investing in Sports Direct ...

... Governance issues are financially material to the longterm performance of their investments then they should take them into account D. If trustees believe that ESG issues are important then they should stop investing in Sports Direct ...

Saving and Investing on a Shoestring: Finding Money to Save

... Treasury bills, notes and bonds require $1,000 minimum investment ...

... Treasury bills, notes and bonds require $1,000 minimum investment ...

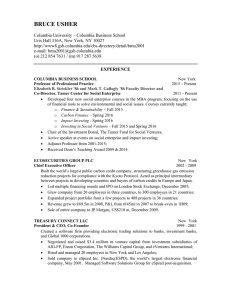

Curriculum Vitae

... Built the world’s largest public carbon credit company, structuring greenhouse gas emission reduction projects for compliance with the Kyoto Protocol. Acted as principal intermediary between projects in developing countries and buyers of carbon credits in Europe and Japan. Led multiple financing r ...

... Built the world’s largest public carbon credit company, structuring greenhouse gas emission reduction projects for compliance with the Kyoto Protocol. Acted as principal intermediary between projects in developing countries and buyers of carbon credits in Europe and Japan. Led multiple financing r ...

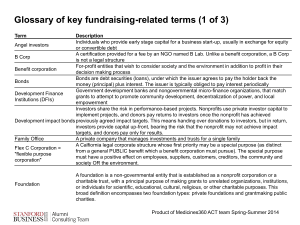

Glossary of Key Fundraising

... types: 1. General Purpose or Operating Support Grants and 2. Program Development or Project Support Grants High impact philanthropy begins with a philanthropist’s personal commitment to making a change in the world and caring enough about a particular issue to remain engaged in the long-term and foc ...

... types: 1. General Purpose or Operating Support Grants and 2. Program Development or Project Support Grants High impact philanthropy begins with a philanthropist’s personal commitment to making a change in the world and caring enough about a particular issue to remain engaged in the long-term and foc ...

Updates to the HealthEquity investment lineup

... mutual funds. You can still keep any current investments you have in these funds, but HealthEquity will no longer monitor their performance. Investment fees in the new lineup are typically lower than before. However, in some cases the newer funds may cost more and provide additional revenue to Healt ...

... mutual funds. You can still keep any current investments you have in these funds, but HealthEquity will no longer monitor their performance. Investment fees in the new lineup are typically lower than before. However, in some cases the newer funds may cost more and provide additional revenue to Healt ...

When investing for any large financial objective, it`s best to start early

... When investing for any large financial objective, it's best to start early and invest often. First, set your goal: Estimate how much you will need to accumulate for each child based on his or her age. Then, develop a plan and stick with it. Consider discussing the following guidelines with your fina ...

... When investing for any large financial objective, it's best to start early and invest often. First, set your goal: Estimate how much you will need to accumulate for each child based on his or her age. Then, develop a plan and stick with it. Consider discussing the following guidelines with your fina ...

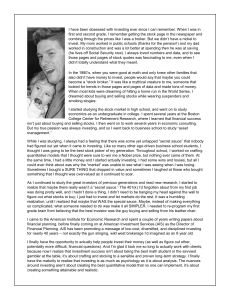

I have been obsessed with investing ever since I can remember

... financial planning, before finally coming on at American Investment Services (AIS) as the Director of Financial Planning. AIS has been promoting a message of low-cost, diversified, and disciplined investing for nearly 40 years – not exactly the gun slinging, wild west brokerage I’d imagined as an 8 ...

... financial planning, before finally coming on at American Investment Services (AIS) as the Director of Financial Planning. AIS has been promoting a message of low-cost, diversified, and disciplined investing for nearly 40 years – not exactly the gun slinging, wild west brokerage I’d imagined as an 8 ...

impact investing “supply” failing to meet demand

... alternatives is outstripping the available supply of such choices for investors, according to a new study awarded the 2016 Moskowitz Prize for Socially Responsible Investing during a special ceremony last night at the 27th annual SRI Conference in Denver. The study found the pinch is most acute in E ...

... alternatives is outstripping the available supply of such choices for investors, according to a new study awarded the 2016 Moskowitz Prize for Socially Responsible Investing during a special ceremony last night at the 27th annual SRI Conference in Denver. The study found the pinch is most acute in E ...

socially responsible investing - Sustainable World Financial Advisors

... Screening involves overlaying qualitative analysis of corporate policies, practices, attitudes, and impacts on the traditional quantitative analysis of profit potential. Qualitative screening helps us to understand corporate character and often helps us identify better-managed companies. A double b ...

... Screening involves overlaying qualitative analysis of corporate policies, practices, attitudes, and impacts on the traditional quantitative analysis of profit potential. Qualitative screening helps us to understand corporate character and often helps us identify better-managed companies. A double b ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.