El Salvador Profile

... this report are current as of June 1, 2015 (except for the paying taxes indicators, which cover the period January– December 2014). The Doing Business methodology has limitations. Other areas important to business—such as an economy’s proximity to large markets, the quality of its infrastructure ser ...

... this report are current as of June 1, 2015 (except for the paying taxes indicators, which cover the period January– December 2014). The Doing Business methodology has limitations. Other areas important to business—such as an economy’s proximity to large markets, the quality of its infrastructure ser ...

when hedge funds betray a creditor committee`s fiduciary role

... to show profits for their clients.25 Thus, hedge funds are more likely to risk overstepping the law to obtain an edge in achieving sizeable financial returns. Despite the red flags increasingly raised by hedge fund activities,26 this investment vehicle has escaped close government oversight. Hedge f ...

... to show profits for their clients.25 Thus, hedge funds are more likely to risk overstepping the law to obtain an edge in achieving sizeable financial returns. Despite the red flags increasingly raised by hedge fund activities,26 this investment vehicle has escaped close government oversight. Hedge f ...

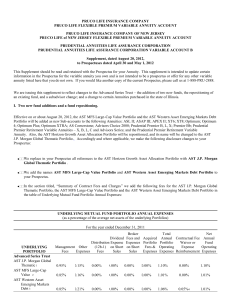

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your contract, please refer to your contract prospectus. The following should be read in conjunction with the Prospectus and should be reta ...

... Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your contract, please refer to your contract prospectus. The following should be read in conjunction with the Prospectus and should be reta ...

Panama - Doing Business

... this report are current as of June 1, 2015 (except for the paying taxes indicators, which cover the period January– December 2014). The Doing Business methodology has limitations. Other areas important to business—such as an economy’s proximity to large markets, the quality of its infrastructure ser ...

... this report are current as of June 1, 2015 (except for the paying taxes indicators, which cover the period January– December 2014). The Doing Business methodology has limitations. Other areas important to business—such as an economy’s proximity to large markets, the quality of its infrastructure ser ...

doing business

... this report are current as of June 1, 2015 (except for the paying taxes indicators, which cover the period January– December 2014). The Doing Business methodology has limitations. Other areas important to business—such as an economy’s proximity to large markets, the quality of its infrastructure ser ...

... this report are current as of June 1, 2015 (except for the paying taxes indicators, which cover the period January– December 2014). The Doing Business methodology has limitations. Other areas important to business—such as an economy’s proximity to large markets, the quality of its infrastructure ser ...

DREYFUS INTERNATIONAL VALUE FUND

... or that derive a significant portion of their revenue or profits from businesses, investments or sales, outside the United States. The Fund typically invests in companies in at least ten foreign countries, and limits its investments in any single company to no more than 5% of its assets at the time ...

... or that derive a significant portion of their revenue or profits from businesses, investments or sales, outside the United States. The Fund typically invests in companies in at least ten foreign countries, and limits its investments in any single company to no more than 5% of its assets at the time ...

Form ADV 2A – Firm Brochure - HD Vest Financial Services

... You should take these considerations into account when deciding which type of account best suits your individual needs. With a commission-based brokerage account (or investments made through HDVIS directly with a product sponsor), HDVIS generally does not have an ongoing fiduciary duty and the prima ...

... You should take these considerations into account when deciding which type of account best suits your individual needs. With a commission-based brokerage account (or investments made through HDVIS directly with a product sponsor), HDVIS generally does not have an ongoing fiduciary duty and the prima ...

The Colors of Investors` Money: The Role of Institutional

... some stock preferences. Foreign institutional investors have a strong bias for firms in the Morgan Stanley Capital International (MSCI) World Index, firms that are cross-listed on a U.S. exchange, and firms that have external visibility through high foreign sales and analyst coverage. Domestic inst ...

... some stock preferences. Foreign institutional investors have a strong bias for firms in the Morgan Stanley Capital International (MSCI) World Index, firms that are cross-listed on a U.S. exchange, and firms that have external visibility through high foreign sales and analyst coverage. Domestic inst ...

The pricing of volatility risk across asset classes

... allows us to entertain the possibility of more than one priced component of stock market volatility. When we price synthetic volatility swaps, it appears that at least one additional volatility factor may be helpful in explaining the cross-section of swap returns. We find that our simple two-factor ...

... allows us to entertain the possibility of more than one priced component of stock market volatility. When we price synthetic volatility swaps, it appears that at least one additional volatility factor may be helpful in explaining the cross-section of swap returns. We find that our simple two-factor ...

Stock Market Liquidity and the Cost of Issuing Equity

... large and robust inverse relationship between the total fees paid to investment banks and the stock market liquidity of the issuing firm. Our finding is robust to each of the seven measures of liquidity we use in our analysis. Further, we show that these results are not only statistically significan ...

... large and robust inverse relationship between the total fees paid to investment banks and the stock market liquidity of the issuing firm. Our finding is robust to each of the seven measures of liquidity we use in our analysis. Further, we show that these results are not only statistically significan ...

Front Cover Page - ICICI Prudential Mutual Fund

... The liquidity of the Scheme‟s investments is inherently restricted by trading volumes in the securities in which it invests. Changes in Government policy in general and changes in tax benefits applicable to mutual funds may impact the returns to Investors in the Scheme. Investors in the Scheme ...

... The liquidity of the Scheme‟s investments is inherently restricted by trading volumes in the securities in which it invests. Changes in Government policy in general and changes in tax benefits applicable to mutual funds may impact the returns to Investors in the Scheme. Investors in the Scheme ...

5.45% Series J Cumulative Preferred Stock

... amended (the “1940 Act”). The Fund’s primary investment objective is to achieve long term growth of capital by investing primarily in a portfolio of equity securities consisting of common stock, preferred stock, convertible or exchangeable securities, and warrants and rights to purchase such securit ...

... amended (the “1940 Act”). The Fund’s primary investment objective is to achieve long term growth of capital by investing primarily in a portfolio of equity securities consisting of common stock, preferred stock, convertible or exchangeable securities, and warrants and rights to purchase such securit ...

Intermarket Technical Analysis

... Industrial Average in their analysis of common stocks. However, I began to notice some interesting correlations with markets outside the commodity field, most notably the bond market, that piqued my interest. The simple observation that commodity prices and bond yields trend in the same direction pr ...

... Industrial Average in their analysis of common stocks. However, I began to notice some interesting correlations with markets outside the commodity field, most notably the bond market, that piqued my interest. The simple observation that commodity prices and bond yields trend in the same direction pr ...

Timing “Smart Beta” Strategies? Of Course! Buy Low, Sell High!

... throughout the finance community.2 For some factors, such as low beta, we show that most or all past performance was revaluation alpha, which could easily reverse from current valuation levels. For smart beta strategies, the picture is a bit better: most established products have respectable structu ...

... throughout the finance community.2 For some factors, such as low beta, we show that most or all past performance was revaluation alpha, which could easily reverse from current valuation levels. For smart beta strategies, the picture is a bit better: most established products have respectable structu ...

Expected Returns on Major Asset Classes

... predictions are anchored on historical experience, financial theories, and observation of prevailing market conditions. In Expected Returns (Ilmanen 2011a), I try to tackle this broad topic in a comprehensive manner. This book offers a more manageable reading experience by adapting four of the centr ...

... predictions are anchored on historical experience, financial theories, and observation of prevailing market conditions. In Expected Returns (Ilmanen 2011a), I try to tackle this broad topic in a comprehensive manner. This book offers a more manageable reading experience by adapting four of the centr ...

Economy Profile - Doing Business

... this report are current as of June 1, 2015 (except for the paying taxes indicators, which cover the period January– December 2014). The Doing Business methodology has limitations. Other areas important to business—such as an economy’s proximity to large markets, the quality of its infrastructure ser ...

... this report are current as of June 1, 2015 (except for the paying taxes indicators, which cover the period January– December 2014). The Doing Business methodology has limitations. Other areas important to business—such as an economy’s proximity to large markets, the quality of its infrastructure ser ...

fao investment centre

... useful insights into performance to date, the relatively short period of existence of ...

... useful insights into performance to date, the relatively short period of existence of ...

Expected Returns on Major Asset Classes

... the equity premium, term and credit premia in fixed income, and the performance of the principal alternative assets (real estate, commodities, hedge funds, and private equity). My 2011 book, to some degree in contrast to this one, argues that by looking beyond asset class allocation, investors can a ...

... the equity premium, term and credit premia in fixed income, and the performance of the principal alternative assets (real estate, commodities, hedge funds, and private equity). My 2011 book, to some degree in contrast to this one, argues that by looking beyond asset class allocation, investors can a ...

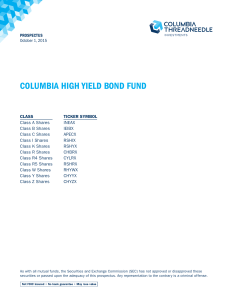

columbia high yield bond fund

... portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most r ...

... portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most r ...

Index Methodology Template w_Cover

... 2.2.1. Long-term Historical Growth Trends........................................................ 14 2.2.2. Return on Equity (ROE) ............................................................................. 15 2.2.3. Current Internal Growth Rate (g) ................................................ ...

... 2.2.1. Long-term Historical Growth Trends........................................................ 14 2.2.2. Return on Equity (ROE) ............................................................................. 15 2.2.3. Current Internal Growth Rate (g) ................................................ ...

Chapter 2 - Motilal Oswal

... organized and regulated exchange rather than being negotiated directly between two parties. Indeed, we may say futures are exchange traded forward contracts. Options An Option is a contract that gives the right, but not an obligation, to buy or sell the underlying on or before a stated date and at a ...

... organized and regulated exchange rather than being negotiated directly between two parties. Indeed, we may say futures are exchange traded forward contracts. Options An Option is a contract that gives the right, but not an obligation, to buy or sell the underlying on or before a stated date and at a ...

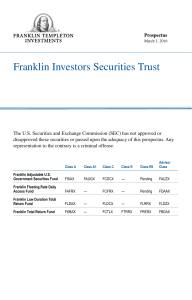

- Franklin Templeton Investments

... comprised of corporate and/or sovereign loans, which may include, among others, senior secured loans, senior unsecured loans, and subordinate corporate loans made to domestic and foreign borrowers, including loans that may be rated below investment grade or equivalent unrated loans. In all types of ...

... comprised of corporate and/or sovereign loans, which may include, among others, senior secured loans, senior unsecured loans, and subordinate corporate loans made to domestic and foreign borrowers, including loans that may be rated below investment grade or equivalent unrated loans. In all types of ...

Mission-Related Investing at the F.B. Heron Foundation

... Understanding the Distinctions Between Mission-Related and Socially Responsible Investing Mission-related investing—a proactive approach in use across asset classes—is often confused with socially responsible investing, which focuses primarily on social screening and proxy activity in public equitie ...

... Understanding the Distinctions Between Mission-Related and Socially Responsible Investing Mission-related investing—a proactive approach in use across asset classes—is often confused with socially responsible investing, which focuses primarily on social screening and proxy activity in public equitie ...

Are Pension Funds too Important to Fail?

... deposits before there are no assets left (Diamond and Dybvig, 1983). A bank run may also cause a perfectly healthy bank to fail. Banks have many illiquid assets, which makes it difficult to retrieve their assets quickly. When there is a run, for example due to rumors, the bank has to liquidate its a ...

... deposits before there are no assets left (Diamond and Dybvig, 1983). A bank run may also cause a perfectly healthy bank to fail. Banks have many illiquid assets, which makes it difficult to retrieve their assets quickly. When there is a run, for example due to rumors, the bank has to liquidate its a ...

CTAs: Shedding light on the black box

... times of acute equity market stress but are importantly noncorrelated rather than uncorrelated to equity markets. Correlations tend to hover close to zero between medium term CTAs and equity markets but they are not significantly negative. We should therefore expect CTAs to perform independently of ...

... times of acute equity market stress but are importantly noncorrelated rather than uncorrelated to equity markets. Correlations tend to hover close to zero between medium term CTAs and equity markets but they are not significantly negative. We should therefore expect CTAs to perform independently of ...