Proposed Rule: Money Market Fund Reform

... SUMMARY: The Securities and Exchange Commission (“Commission” or “SEC”) is proposing two alternatives for amending rules that govern money market mutual funds (or “money market funds”) under the Investment Company Act of 1940. The two alternatives are designed to address money market funds’ suscepti ...

... SUMMARY: The Securities and Exchange Commission (“Commission” or “SEC”) is proposing two alternatives for amending rules that govern money market mutual funds (or “money market funds”) under the Investment Company Act of 1940. The two alternatives are designed to address money market funds’ suscepti ...

ASX Understanding Trading and Investment Warrants

... made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be ...

... made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be ...

printmgr file

... The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. The Fund currently seeks to ...

... The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. The Fund currently seeks to ...

Dynamic Private Investment Pools

... WHAT IS A MUTUAL FUND AND WHAT ARE THE RISKS OF INVESTING IN A MUTUAL FUND? ..... 2 WHAT IS THE MAIN PURPOSE OF A MUTUAL FUND? ................................................................................................. 2 WHAT DO MUTUAL FUNDS INVEST IN? ....................................... ...

... WHAT IS A MUTUAL FUND AND WHAT ARE THE RISKS OF INVESTING IN A MUTUAL FUND? ..... 2 WHAT IS THE MAIN PURPOSE OF A MUTUAL FUND? ................................................................................................. 2 WHAT DO MUTUAL FUNDS INVEST IN? ....................................... ...

Optimal Asset Location and Allocation with Taxable and Tax

... accounts for the asset allocation and location decisions. This is in striking contrast to the traditional approach to financial planning, in which the interaction between the taxable and tax-deferred accounts is largely ignored. The ability to invest on a tax-deferred basis is valuable to investors ...

... accounts for the asset allocation and location decisions. This is in striking contrast to the traditional approach to financial planning, in which the interaction between the taxable and tax-deferred accounts is largely ignored. The ability to invest on a tax-deferred basis is valuable to investors ...

reinet investments sca

... in December of that year, which allowed shareholders to contribute BAT shares to Reinet for shares, Reinet held 84.3 million shares in BAT. The investment in BAT is Reinet’s single largest investment position and is kept under constant review, considering the company’s performance, the industry outl ...

... in December of that year, which allowed shareholders to contribute BAT shares to Reinet for shares, Reinet held 84.3 million shares in BAT. The investment in BAT is Reinet’s single largest investment position and is kept under constant review, considering the company’s performance, the industry outl ...

Form SC 13D/A SJW GROUP - SJW Filed: March 22, 2000 (period

... The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information, except to the extent such damages or losses cannot be limited or excluded ...

... The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information, except to the extent such damages or losses cannot be limited or excluded ...

RBC Funds (Lux) - RBC Global Asset Management

... At the sector level, stocks in the Information Technology, Industrials and Consumer Discretionary sectors had a positive impact on relative performance. Most of the positive stock selection came from securities in China, South Korea and Taiwan. In China, the Fund’s exposure to higher-quality stocks ...

... At the sector level, stocks in the Information Technology, Industrials and Consumer Discretionary sectors had a positive impact on relative performance. Most of the positive stock selection came from securities in China, South Korea and Taiwan. In China, the Fund’s exposure to higher-quality stocks ...

Market Sentiment and Paradigm Shifts in Equity Premium

... the fundamental component and momentum arises as a result. In contrast, during low sentiment period, the rational investor faces no constraints and the price is always adjusted immediately to its fundamental. Hence there is no momentum effect in low sentiment regime. From a broad perspective, this p ...

... the fundamental component and momentum arises as a result. In contrast, during low sentiment period, the rational investor faces no constraints and the price is always adjusted immediately to its fundamental. Hence there is no momentum effect in low sentiment regime. From a broad perspective, this p ...

Does Academic Research Destroy Stock Return Predictability?*

... previous studies produce contradictory messages. As examples, Jegadeesh and Titman (2001) show that the relative returns to high-momentum stocks increased after the publication of their 1993 paper, while Schwert (2003) argues that since the publication of the value and size effects, index funds base ...

... previous studies produce contradictory messages. As examples, Jegadeesh and Titman (2001) show that the relative returns to high-momentum stocks increased after the publication of their 1993 paper, while Schwert (2003) argues that since the publication of the value and size effects, index funds base ...

RFP NO. NM INV-001-FY16 - Public Employees Retirement

... mandate size for such services is between $100-200 million. PERA reserves the right to make a single or multiple source awards to manage the proposed product(s). PERA anticipates that the proposed product(s) under this RFP will be funded with cash. PERA may require the Offeror to transition the port ...

... mandate size for such services is between $100-200 million. PERA reserves the right to make a single or multiple source awards to manage the proposed product(s). PERA anticipates that the proposed product(s) under this RFP will be funded with cash. PERA may require the Offeror to transition the port ...

Do U.S. Firms Have the Best Corporate Governance? A Cross

... outsiders, have higher value. In contrast, firms are not valued more highly when they have a particular board size or when the functions of chairman of the board and CEO are separated. To the extent that adopting better governance is costly for a firm’s insiders, we expect firms to adopt better gov ...

... outsiders, have higher value. In contrast, firms are not valued more highly when they have a particular board size or when the functions of chairman of the board and CEO are separated. To the extent that adopting better governance is costly for a firm’s insiders, we expect firms to adopt better gov ...

Private equity demystified

... We published the first edition of Private Equity Demystified in August 2008. There followed a period of unprecedented financial turmoil. The second edition built on the first edition to reflect the effects of the recession and examined the way in which the banking market changed its approach to priv ...

... We published the first edition of Private Equity Demystified in August 2008. There followed a period of unprecedented financial turmoil. The second edition built on the first edition to reflect the effects of the recession and examined the way in which the banking market changed its approach to priv ...

Low volatility anomaly and mutual fund allocations - Aalto

... allocation decision across asset classes. Baker et al. (2010) discuss that private investors have preference for lottery-like payoffs, and relate the bias to positive skewness in stocks returns, where large positive payoffs are more likely than large negative payoffs. Also Kumar (2009) finds that so ...

... allocation decision across asset classes. Baker et al. (2010) discuss that private investors have preference for lottery-like payoffs, and relate the bias to positive skewness in stocks returns, where large positive payoffs are more likely than large negative payoffs. Also Kumar (2009) finds that so ...

THU VI?N PHÁP LU?T

... issuance and payment conditions, assurance of legitimate rights and benefits of investors and other conditions. 3. Conditions for public offering of fund certificates to the public include: a/ The total value of fund certificates registered for offering is at least VND 50 billion; b/ There are an is ...

... issuance and payment conditions, assurance of legitimate rights and benefits of investors and other conditions. 3. Conditions for public offering of fund certificates to the public include: a/ The total value of fund certificates registered for offering is at least VND 50 billion; b/ There are an is ...

czech republic

... h) current value of a share of an investment fund or a unit certificate of a unit trust shall mean the portion of the equity capital per share or per unit certificate; i) equity capital of a unit trust shall mean internal resources of the unit trust for financing of the assets in the unit trust; j) ...

... h) current value of a share of an investment fund or a unit certificate of a unit trust shall mean the portion of the equity capital per share or per unit certificate; i) equity capital of a unit trust shall mean internal resources of the unit trust for financing of the assets in the unit trust; j) ...

Cross-Sectional Dispersion and Expected Returns

... market portfolio. However, the assumption of full diversification is particularly restrictive and highly unlikely to describe the way in which investors actually construct portfolios, since in reality different investors clearly hold equity portfolios that are different from the market portfolio and ...

... market portfolio. However, the assumption of full diversification is particularly restrictive and highly unlikely to describe the way in which investors actually construct portfolios, since in reality different investors clearly hold equity portfolios that are different from the market portfolio and ...

Long-Short Commodity Investing - EDHEC

... pressure strategies use as signals for asset allocation the positions of commercial traders and non-commercial traders, as reported by the CFTC. To be more specific, the strategies take long positions in liquid backwardated commodities (for which commercial traders were net short and/ or non-commerc ...

... pressure strategies use as signals for asset allocation the positions of commercial traders and non-commercial traders, as reported by the CFTC. To be more specific, the strategies take long positions in liquid backwardated commodities (for which commercial traders were net short and/ or non-commerc ...

Select Risk Profile Portfolios – quarterly investment report

... For the UK, this quarter was still all about Brexit with a vote in parliament that gave the government permission to begin exiting the European Union. Theresa May signed Article 50 at the end of March, as the Scottish National Party demanded a second Scottish independence referendum. Meanwhile, the ...

... For the UK, this quarter was still all about Brexit with a vote in parliament that gave the government permission to begin exiting the European Union. Theresa May signed Article 50 at the end of March, as the Scottish National Party demanded a second Scottish independence referendum. Meanwhile, the ...

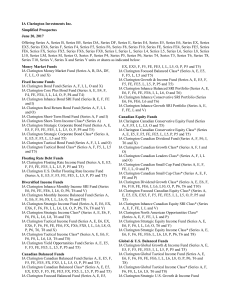

IA Clarington Investments Inc. Simplified Prospectus June 20, 2017

... No securities regulatory authority has expressed an opinion about the merits of the Funds’ securities and it is an offence to claim otherwise. The Funds and the securities of the Funds offered under this Simplified Prospectus are not registered with the United States Securities and Exchange Commissi ...

... No securities regulatory authority has expressed an opinion about the merits of the Funds’ securities and it is an offence to claim otherwise. The Funds and the securities of the Funds offered under this Simplified Prospectus are not registered with the United States Securities and Exchange Commissi ...

Heptagon Fund plc

... being redeemed. Details of any such charge with respect to any Fund will be set out in the relevant Supplement. Where a redemption fee is charged, investors should view an investment in the relevant Fund as medium to long term. INVESTMENT RISKS Investment in the Company carries with it a degree of r ...

... being redeemed. Details of any such charge with respect to any Fund will be set out in the relevant Supplement. Where a redemption fee is charged, investors should view an investment in the relevant Fund as medium to long term. INVESTMENT RISKS Investment in the Company carries with it a degree of r ...

99 COMPANY XYZ LIMITED

... Paul Dobbyn is a Director of Sanlam Qualifying Investors Funds Plc and Sanlam Universal Funds Plc. Paul Dobbyn is also a Director of Sanlam Global Fund of Hedge Funds Plc, which the Directors resolved to place into voluntary liquidation on 7 November 2014. Paul Dobbyn was also a Partner in Maples an ...

... Paul Dobbyn is a Director of Sanlam Qualifying Investors Funds Plc and Sanlam Universal Funds Plc. Paul Dobbyn is also a Director of Sanlam Global Fund of Hedge Funds Plc, which the Directors resolved to place into voluntary liquidation on 7 November 2014. Paul Dobbyn was also a Partner in Maples an ...

Investor Sentiment and the Mean-variance Relation

... that arbitrageurs are likely to be risk averse and to have reasonably short horizons. The authors set up an overlapping generation model with arbitrageurs who hold correct beliefs, and noise traders who hold wrong beliefs. They reach the conclusions that arbitrage is limited and the stock price can ...

... that arbitrageurs are likely to be risk averse and to have reasonably short horizons. The authors set up an overlapping generation model with arbitrageurs who hold correct beliefs, and noise traders who hold wrong beliefs. They reach the conclusions that arbitrage is limited and the stock price can ...

Anno Stolper: The Appeal of Risky Assets

... return, our results hold if fund managers incur positive costs if they are fired.) There is a substantial literature on incentives in funds management.5 Brown et al. (1996), for instance, show empirically that fund managers with a bad relative performance increase risk relative to fund managers with ...

... return, our results hold if fund managers incur positive costs if they are fired.) There is a substantial literature on incentives in funds management.5 Brown et al. (1996), for instance, show empirically that fund managers with a bad relative performance increase risk relative to fund managers with ...