Green Climate Fund

... 13 new partner institutions on the fourth day of its tenth meeting this week, diversifying beyond the seven entities it accredited at its last meeting in March. This brings the total to 20 accredited entities (AEs). ...

... 13 new partner institutions on the fourth day of its tenth meeting this week, diversifying beyond the seven entities it accredited at its last meeting in March. This brings the total to 20 accredited entities (AEs). ...

Looking to gain from small-cap inefficiencies with active management

... • Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of your investment. • Shares of smaller companies may be more difficult to buy and sell than those of larger companies. This means ...

... • Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of your investment. • Shares of smaller companies may be more difficult to buy and sell than those of larger companies. This means ...

factsheet Neuberger Berman Emerging Market Debt Blend

... The fund mentioned in this document may not be eligible for sale in some countries and it may not be suitable for all types of investor. Shares in the fund may not be offered or sold directly or indirectly into the United States or to U.S. Persons: for further information see the current prospectus. ...

... The fund mentioned in this document may not be eligible for sale in some countries and it may not be suitable for all types of investor. Shares in the fund may not be offered or sold directly or indirectly into the United States or to U.S. Persons: for further information see the current prospectus. ...

james bromiley markets in financial instruments directive ii

... opting up easier than initially anticipated there will still be a process and information requirement from the Administering Authorities. Asset managers representing the IA on this indicated that to make an assessment they may still require evidence of the experience and capacity of the individuals ...

... opting up easier than initially anticipated there will still be a process and information requirement from the Administering Authorities. Asset managers representing the IA on this indicated that to make an assessment they may still require evidence of the experience and capacity of the individuals ...

Aditi Hamlai Mehta 15/ 17 Raghavji Building, 18 A Raghavji Road

... Assistant Manager –Marketing and Corporate Communication Duties and Responsibilities: Developed and executed internal branding solutions Managed production of marketing literature for Investor Education initiatives Worked closely with the PR agency to ensure coverage for key spokespersons in t ...

... Assistant Manager –Marketing and Corporate Communication Duties and Responsibilities: Developed and executed internal branding solutions Managed production of marketing literature for Investor Education initiatives Worked closely with the PR agency to ensure coverage for key spokespersons in t ...

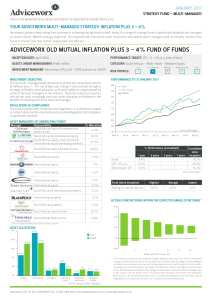

adviceworx old mutual inflation plus 3

... • Additional information on this proposed investment can be obtained, free of charge, from our contact centre. • Fund valuations take place at approximately 16:00 each business day. Purchase and redemption requests must be received by the manager by 14:00 each business day to receive that day’s pr ...

... • Additional information on this proposed investment can be obtained, free of charge, from our contact centre. • Fund valuations take place at approximately 16:00 each business day. Purchase and redemption requests must be received by the manager by 14:00 each business day to receive that day’s pr ...

euro high yield bond fund - Henderson Global Investors

... The Fund may also invest in: ▪ Bonds of any quality from any issuer ▪ Derivatives ▪ Contingent Convertible Bonds ▪ Money market instruments ▪ Bank deposits In choosing investments the manager focuses on identifying the best risk-return prospects within the European high yield corporate bond market. ...

... The Fund may also invest in: ▪ Bonds of any quality from any issuer ▪ Derivatives ▪ Contingent Convertible Bonds ▪ Money market instruments ▪ Bank deposits In choosing investments the manager focuses on identifying the best risk-return prospects within the European high yield corporate bond market. ...

Templeton Developing Markets Trust Fact Sheet

... Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Fund Management: CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. Performance: The fund offers other share classes subject to different fees and exp ...

... Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Fund Management: CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. Performance: The fund offers other share classes subject to different fees and exp ...

GASB Statement No. 54 and Iowa School Districts

... authorized to make assignments and the policy that delegated entity is to follow • Flows: In what order will the resources be used? • Start now with the prior year audit report and determine ...

... authorized to make assignments and the policy that delegated entity is to follow • Flows: In what order will the resources be used? • Start now with the prior year audit report and determine ...

FIN4504c3

... Funds can be sold either Directly by the company Sales force (brokers, insurance agents, and financial planners) Load Funds Sales fee when purchase Fee goes to marketing organization (the company itself or its sales force) selling the shares Fee split between the salesperson and the comp ...

... Funds can be sold either Directly by the company Sales force (brokers, insurance agents, and financial planners) Load Funds Sales fee when purchase Fee goes to marketing organization (the company itself or its sales force) selling the shares Fee split between the salesperson and the comp ...

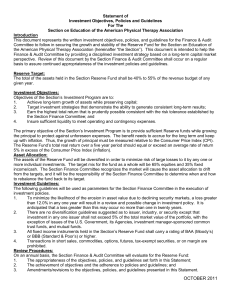

Statement of Investment Objectives, Policies and Guidelines For The

... The assets of the Reserve Fund will be diversified in order to minimize risk of large losses to it by any one or more individual investments. The target mix for the fund as a whole will be 65% equities and 35% fixed income/cash. The Section Finance Committee recognizes the market will cause the asse ...

... The assets of the Reserve Fund will be diversified in order to minimize risk of large losses to it by any one or more individual investments. The target mix for the fund as a whole will be 65% equities and 35% fixed income/cash. The Section Finance Committee recognizes the market will cause the asse ...

KSCVX Cusip Change 12 31 07

... In an effort to enhance operating efficiency and product offerings, the Keeley Funds implemented the following changes to their family of funds effective December 31, 2007. 1 - The Keeley Small Cap Value Fund, Inc. was merged into a newly created series of the Keeley Funds, Inc., the KEELEY Small Ca ...

... In an effort to enhance operating efficiency and product offerings, the Keeley Funds implemented the following changes to their family of funds effective December 31, 2007. 1 - The Keeley Small Cap Value Fund, Inc. was merged into a newly created series of the Keeley Funds, Inc., the KEELEY Small Ca ...

Political uncertainty makes gold great again

... Eck Associates Corporation based in New York, United States. VanEck Vectors ETF Trust ARBN 604 339 808 (the ‘Trust’) is the issuer of shares in the VanEck Vectors Gold Miners ETF (‘US Fund’). The Trust and the US Fund are regulated by US laws which differ from Australian laws. Trading in the US Fund ...

... Eck Associates Corporation based in New York, United States. VanEck Vectors ETF Trust ARBN 604 339 808 (the ‘Trust’) is the issuer of shares in the VanEck Vectors Gold Miners ETF (‘US Fund’). The Trust and the US Fund are regulated by US laws which differ from Australian laws. Trading in the US Fund ...

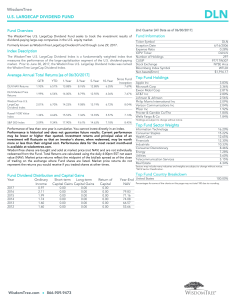

for immediate release

... may be worth more or less than their original cost. Performance does not include the effect of any fees described in the fund’s prospectus (e.g., short-term trading fees) which, if applicable, would lower your total returns. Obtain performance data current to the most recent month-end at www.usfunds ...

... may be worth more or less than their original cost. Performance does not include the effect of any fees described in the fund’s prospectus (e.g., short-term trading fees) which, if applicable, would lower your total returns. Obtain performance data current to the most recent month-end at www.usfunds ...

Counsel Canadian Growth Class Series D

... The Canadian growth equities (80%) investment specialist seeks to identify companies that are changing for the better, and whose underlying fundamentals are improving more rapidly than the overall stock market. They seek to be rewarded by significant upward movements in stock prices that occur over ...

... The Canadian growth equities (80%) investment specialist seeks to identify companies that are changing for the better, and whose underlying fundamentals are improving more rapidly than the overall stock market. They seek to be rewarded by significant upward movements in stock prices that occur over ...

FINANCIAL REPORTING PERFORMANCE GOALS

... The Comprehensive Annual Financial Report will be prepared in conformity with generally accepted governmental accounting principles and financial reporting practices. ...

... The Comprehensive Annual Financial Report will be prepared in conformity with generally accepted governmental accounting principles and financial reporting practices. ...

ZI Barings Developed and Emerging Markets High Yield Bond

... result in the possibility of large and sudden falls in the prices of shares. The shortfalls on cancellation or loss on realisation could be considerable. You could get back nothing at all. You should note that when investing into mirror funds, the charges, expenses and taxation of the underlying fun ...

... result in the possibility of large and sudden falls in the prices of shares. The shortfalls on cancellation or loss on realisation could be considerable. You could get back nothing at all. You should note that when investing into mirror funds, the charges, expenses and taxation of the underlying fun ...

FUND FACTSHEET – JULY 2016 RHB DANA HAZEEM (formerly

... Any issue of units to which the Master Prospectus relates will only be made on receipt of a form of application referred to in the Master Prospectus. For more details, please call 1-800-88-3175 for a copy of the PHS and the Master Prospectus or collect one from any of our branches or authorised dist ...

... Any issue of units to which the Master Prospectus relates will only be made on receipt of a form of application referred to in the Master Prospectus. For more details, please call 1-800-88-3175 for a copy of the PHS and the Master Prospectus or collect one from any of our branches or authorised dist ...

mou 2014-15 negotiation meeting

... Indian Renewable Energy Fund ( 1 Billion US$) : To raise funds to invest in Renewable Energy Projects and associated value chain including equity (Proposed) ...

... Indian Renewable Energy Fund ( 1 Billion US$) : To raise funds to invest in Renewable Energy Projects and associated value chain including equity (Proposed) ...

Order Number: 41512 Running Head: A JOB AT EAST COAST

... The mutual funds are more advantageous that the companies stocks. The mutual stocks have a low level of risk as compared to the stocks. The mutual funds offer divergent options. These options include the dividend payout, growth and dividend reinvestment, (Kirk, 2011). The mutual funds offer vivid as ...

... The mutual funds are more advantageous that the companies stocks. The mutual stocks have a low level of risk as compared to the stocks. The mutual funds offer divergent options. These options include the dividend payout, growth and dividend reinvestment, (Kirk, 2011). The mutual funds offer vivid as ...

Focused Dynamic Growth - American Century Investments

... and share value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains. You should consider the investment objectives, risks, and charges and expenses carefully before you invest. The prospectus or summary prospectus, whi ...

... and share value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains. You should consider the investment objectives, risks, and charges and expenses carefully before you invest. The prospectus or summary prospectus, whi ...

Emerging Market Debt Fund - Standard Life Investments

... proportion of the fund's assets in other bonds, derivatives and/or money market instruments to try to take advantage of opportunities they have identified. Please note the operating currency of the fund is US Dollars, and the base currency is Sterling. The currency risk arising from this difference ...

... proportion of the fund's assets in other bonds, derivatives and/or money market instruments to try to take advantage of opportunities they have identified. Please note the operating currency of the fund is US Dollars, and the base currency is Sterling. The currency risk arising from this difference ...

TIAA-CREF Global Natural Resources Fund

... that are primarily engaged in energy, metals, agriculture and other commodities, as well as related products and services. The Fund's management team focuses on companies of any capitalization size that it believes are resource-rich, have growth potential and trade at attractive valuation levels, re ...

... that are primarily engaged in energy, metals, agriculture and other commodities, as well as related products and services. The Fund's management team focuses on companies of any capitalization size that it believes are resource-rich, have growth potential and trade at attractive valuation levels, re ...

sygnia skeleton worldwide flexible fund

... The total expense ratio (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past year. The TER includes the annual management fees that have been charged (both the fee at benchmark and any performance componen ...

... The total expense ratio (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past year. The TER includes the annual management fees that have been charged (both the fee at benchmark and any performance componen ...