International Value Fund - Third Avenue Management

... 7. Relative to the MSCI AC World ex US Index. Active Share is the percentage of a fund’s portfolio that differs from the benchmark index. Past performance is no guarantee of future results; returns include reinvestment of all distributions. The above represents past performance and current performan ...

... 7. Relative to the MSCI AC World ex US Index. Active Share is the percentage of a fund’s portfolio that differs from the benchmark index. Past performance is no guarantee of future results; returns include reinvestment of all distributions. The above represents past performance and current performan ...

Fact Sheet:SPDR DoubleLine Short Duration Total

... so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit spdrs.com for most recent month-end performance. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index. After- ...

... so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit spdrs.com for most recent month-end performance. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index. After- ...

JPMorgan Market Overview

... based on current market conditions. We believe the information provided here is reliable but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suit ...

... based on current market conditions. We believe the information provided here is reliable but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suit ...

corporate governance mandate

... are elected by and are accountable to the shareholders, and takes into account the role of the individual members of management who are appointed by the Board and who are charged with the day to day management of the Corporation. The Board is committed to sound corporate governance practices, which ...

... are elected by and are accountable to the shareholders, and takes into account the role of the individual members of management who are appointed by the Board and who are charged with the day to day management of the Corporation. The Board is committed to sound corporate governance practices, which ...

Calamos Total Return Bond Fund

... lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 2.25%.* Had it ...

... lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 2.25%.* Had it ...

Mutual Funds May 2012

... Very difficult to beat “the market” in any 1 year & even harder to do consistently The only thing you know about the future is the expense ratio. ...

... Very difficult to beat “the market” in any 1 year & even harder to do consistently The only thing you know about the future is the expense ratio. ...

to 30 April 2016 - Allianz Global Investors

... earnings prospects. These include construction and healthcare and selective machinery companies which contributed to performance. On the other hand, exporters whose earnings are sensitive to JPY/ US$ hurt the performance as JPY had appreciated versus the US$. These include automobile and technology ...

... earnings prospects. These include construction and healthcare and selective machinery companies which contributed to performance. On the other hand, exporters whose earnings are sensitive to JPY/ US$ hurt the performance as JPY had appreciated versus the US$. These include automobile and technology ...

1 May 2017 ASX: MVW – VANECK VECTORS AUSTRALIAN

... but don’t know about. ASIC is implementing the new requirements because the disclosure obligations that have existed under the Corporations Act Regulations for over 10 years have failed to achieve their goals of transparent and comparable costs disclosure. This means for over 10 years investors have ...

... but don’t know about. ASIC is implementing the new requirements because the disclosure obligations that have existed under the Corporations Act Regulations for over 10 years have failed to achieve their goals of transparent and comparable costs disclosure. This means for over 10 years investors have ...

Dreyfus Total Emerging Markets Fund

... 1The total return performance figures for Class Y shares of the fund represent the performance of the fund's Class A shares for periods prior to 7/1/13, the inception date for Class Y shares, and the performance of Class Y from that inception date. Performance reflects the applicable class' distribu ...

... 1The total return performance figures for Class Y shares of the fund represent the performance of the fund's Class A shares for periods prior to 7/1/13, the inception date for Class Y shares, and the performance of Class Y from that inception date. Performance reflects the applicable class' distribu ...

Gravitational waves

... hedge funds come on to our platform and manage a sleeve of capital within the structure. Cost, transparency and the ability for the product to fit into their portfolio: these are themes that we see investors prioritise and we focus on to raise capital,” said McCaffery. As the hedge fund industry con ...

... hedge funds come on to our platform and manage a sleeve of capital within the structure. Cost, transparency and the ability for the product to fit into their portfolio: these are themes that we see investors prioritise and we focus on to raise capital,” said McCaffery. As the hedge fund industry con ...

Chapter 17

... Example for Encumbrance Accounting: 1. Assume a purchase order is issued to purchase two sanitation trucks by the City of A.The estimated Cost is $45000 each. 2. The invoice is received for one to the trucks, at an actual cost of $44000. Assume that second truck is backordered. ...

... Example for Encumbrance Accounting: 1. Assume a purchase order is issued to purchase two sanitation trucks by the City of A.The estimated Cost is $45000 each. 2. The invoice is received for one to the trucks, at an actual cost of $44000. Assume that second truck is backordered. ...

managed futures strategy fund

... Mutual Funds involve risk including possible loss of principal. The Fund will invest a percentage of its assets in derivatives, such as commodities, futures and options contracts. The use of such derivatives and the resulting high portfolio turn-over, may expose the Fund to additional risks that it ...

... Mutual Funds involve risk including possible loss of principal. The Fund will invest a percentage of its assets in derivatives, such as commodities, futures and options contracts. The use of such derivatives and the resulting high portfolio turn-over, may expose the Fund to additional risks that it ...

1 The primary investment objective of Fund B is to maximize the

... Each of the Segregated Securities is currently a note issued by Florida East Funding, LLC, Florida West Funding, LLC, Florida Funding I, LLC, and Florida Funding II, LLC (the “Special Purpose Entities”) that holds collateral securities as security for repayment of the Segretated Securities (the “Col ...

... Each of the Segregated Securities is currently a note issued by Florida East Funding, LLC, Florida West Funding, LLC, Florida Funding I, LLC, and Florida Funding II, LLC (the “Special Purpose Entities”) that holds collateral securities as security for repayment of the Segretated Securities (the “Col ...

Performance of Australian superannuation funds

... Diverse outsourcing activities: asset allocation, investment management, custody, legal, actuarial, auditing Non-profit funds: greater outsourcing activities For-profit funds: more frequent outsourcing to related party providers ...

... Diverse outsourcing activities: asset allocation, investment management, custody, legal, actuarial, auditing Non-profit funds: greater outsourcing activities For-profit funds: more frequent outsourcing to related party providers ...

International Bond - American Century Investments

... the fund will decline. The opposite is true when interest rates decline. The fund is classified as nondiversified. Because it is non-diversified, it may hold large positions in a small number of securities. To the extent it maintains such positions; a price change in any one of those securities may ...

... the fund will decline. The opposite is true when interest rates decline. The fund is classified as nondiversified. Because it is non-diversified, it may hold large positions in a small number of securities. To the extent it maintains such positions; a price change in any one of those securities may ...

CLTL - PowerShares Treasury Collateral Portfolio fund in

... CLTL tracks the ICE U.S. Treasury Short Bond Index, providing exposure to a basket of Treasury securities with a maturity of one year or less. Currently, Treasury Bills are one of the most common types of instruments used by institutions as a collateral pledge to cover margin requirements on derivat ...

... CLTL tracks the ICE U.S. Treasury Short Bond Index, providing exposure to a basket of Treasury securities with a maturity of one year or less. Currently, Treasury Bills are one of the most common types of instruments used by institutions as a collateral pledge to cover margin requirements on derivat ...

ASB Investment Funds World Fixed Interest Fund Update

... investment, and there are other risks that are not captured by this rating. The risk indicator is not a guarantee of a fund’s future performance. The risk indicator is based on the returns data for a 5 year period to 31 March 2017. While risk indicators are usually relatively stable, they do shift f ...

... investment, and there are other risks that are not captured by this rating. The risk indicator is not a guarantee of a fund’s future performance. The risk indicator is based on the returns data for a 5 year period to 31 March 2017. While risk indicators are usually relatively stable, they do shift f ...

Action plan - Northumberland County Council

... implement the outcome of DCLG’s consultation on Collaboration, Cost Savings and Efficiencies; follow up work to implement the new LGPS Local Pensions Board; any items referred back to the Pension Fund Panel by the Pension Board; (NEW) consider shared service arrangements with Durham County Council. ...

... implement the outcome of DCLG’s consultation on Collaboration, Cost Savings and Efficiencies; follow up work to implement the new LGPS Local Pensions Board; any items referred back to the Pension Fund Panel by the Pension Board; (NEW) consider shared service arrangements with Durham County Council. ...

Answers to Chapter 1 Questions

... as liabilities while investing in risky, nontradable, and often illiquid loans as assets. As long as an FI is sufficiently large, to gain from diversification and monitoring on the asset side of its balance sheet, its financial claims (it issues as liabilities) are likely to be viewed as liquid and ...

... as liabilities while investing in risky, nontradable, and often illiquid loans as assets. As long as an FI is sufficiently large, to gain from diversification and monitoring on the asset side of its balance sheet, its financial claims (it issues as liabilities) are likely to be viewed as liquid and ...

What is a Mutual Fund?

... What is a Mutual Fund? A mutual fund is a collection of stocks, bonds and other securities owned by a group of investors and managed by a professional investment advisory firm. The investment firm collects money from investors, pools it and invests it. The mutual fund manager, working with a team of ...

... What is a Mutual Fund? A mutual fund is a collection of stocks, bonds and other securities owned by a group of investors and managed by a professional investment advisory firm. The investment firm collects money from investors, pools it and invests it. The mutual fund manager, working with a team of ...

bastion worldwide flexible fund of funds bastion

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

Investment Policy Money Market Funds Rpt

... MMF have preservation of capital and liquidity as their primary objectives and offer the council a combination of high security, instant access to funds, high diversification and good rates of return. The Institutional Money Market Funds Association (IMMFA) is the trade association of the funds the ...

... MMF have preservation of capital and liquidity as their primary objectives and offer the council a combination of high security, instant access to funds, high diversification and good rates of return. The Institutional Money Market Funds Association (IMMFA) is the trade association of the funds the ...

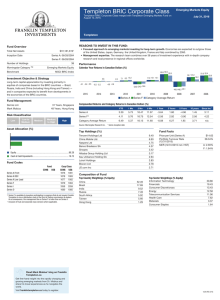

Templeton BRIC Corporate Class Series A

... copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the ...

... copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the ...

Test Presentation Line 2

... 4 pooled funds valued at £630 million (of which £500 million CFB) for UK charities only and 2 pooled funds valued at £30 million (of which £25 million CFB) ...

... 4 pooled funds valued at £630 million (of which £500 million CFB) for UK charities only and 2 pooled funds valued at £30 million (of which £25 million CFB) ...