International finance and the foreign exchange market

... • Factors that cause a currency to depreciate: • A rapid growth of income (relative to trading partners) that stimulates imports relative to exports. • A higher rate of inflation than one's trading partners. • A reduction in domestic real interest rates (relative to rates abroad). ...

... • Factors that cause a currency to depreciate: • A rapid growth of income (relative to trading partners) that stimulates imports relative to exports. • A higher rate of inflation than one's trading partners. • A reduction in domestic real interest rates (relative to rates abroad). ...

Introduction Analysis of the East African Monetary Union

... Analysis of the East African Monetary Union The first obvious implication of a regional central bank is that the member states would lose their autonomy on monetary policy. National central banks will essentially be subsidiaries of the East African Central Bank, limiting unilateral action by member ...

... Analysis of the East African Monetary Union The first obvious implication of a regional central bank is that the member states would lose their autonomy on monetary policy. National central banks will essentially be subsidiaries of the East African Central Bank, limiting unilateral action by member ...

The Federal Reserve`s Role in the Global

... and Bretton Woods,” by Bordo and Owen Humpage, a senior economic advisor at the Federal Reserve Bank of Cleveland. Bretton Woods sought to install a currency adjustment system that would avoid the problems of the 1920s, Bordo said. However, just as the agreement was becoming fully operational, dolla ...

... and Bretton Woods,” by Bordo and Owen Humpage, a senior economic advisor at the Federal Reserve Bank of Cleveland. Bretton Woods sought to install a currency adjustment system that would avoid the problems of the 1920s, Bordo said. However, just as the agreement was becoming fully operational, dolla ...

Talking Points - Austrian Marshall Plan Foundation

... with competing regulatory claims. Only since the Great Depression and the advent of FDIC has a successful nationwide crisis resolution mechanism been in place, at least until the Subprime Crisis ( Nieto and White ( 2013). The Eurozone has also been less successful than the US and other national MUs ...

... with competing regulatory claims. Only since the Great Depression and the advent of FDIC has a successful nationwide crisis resolution mechanism been in place, at least until the Subprime Crisis ( Nieto and White ( 2013). The Eurozone has also been less successful than the US and other national MUs ...

Economic Restructuring and the European Monetary Union

... The relaunch of the European project would not be possible without a new definition of its strategic guidelines, in order to adapt them to the political needs and economic circumstances of the new historical moment. The keys for the economic restructuring were based on two opposite models: the liber ...

... The relaunch of the European project would not be possible without a new definition of its strategic guidelines, in order to adapt them to the political needs and economic circumstances of the new historical moment. The keys for the economic restructuring were based on two opposite models: the liber ...

WORLD ECONOMY Manuel H. Johnson MONETARY POLICY IN AN INTEGRATED

... and rapid flows of financial capital, the timely and accurate compilation and measurement of such financial quantity variables have proven to be difficult and elusive. Current measures of money, particularly narrow transactions balances, have been much less reliable than was earlier the case. In a r ...

... and rapid flows of financial capital, the timely and accurate compilation and measurement of such financial quantity variables have proven to be difficult and elusive. Current measures of money, particularly narrow transactions balances, have been much less reliable than was earlier the case. In a r ...

China, the US, and Currency Issues

... those who call for a fixed exchange rate are right in the short run. And those who call for a floating exchange rate are right in the long run. How long is the short run, you ask? You must understand. China is 8000 years old. So when I say, short run, it could be 100 years.” -- Li Ruogu, Deputy Gove ...

... those who call for a fixed exchange rate are right in the short run. And those who call for a floating exchange rate are right in the long run. How long is the short run, you ask? You must understand. China is 8000 years old. So when I say, short run, it could be 100 years.” -- Li Ruogu, Deputy Gove ...

Multinational-Financial-Management-9th-Edition

... 2.25 Large government budget deficits will a. raise the value of a nation's currency by raising domestic interest rates b. raise the value of a nation's currency by stimulating the domestic economy c. lower the value of a nation's currency by leading to higher inflation d. lower the value of a natio ...

... 2.25 Large government budget deficits will a. raise the value of a nation's currency by raising domestic interest rates b. raise the value of a nation's currency by stimulating the domestic economy c. lower the value of a nation's currency by leading to higher inflation d. lower the value of a natio ...

A simple model of monetary policy and currency crises

... formally assess the relevance and relative importance of these counteracting e!ects, and thereby to contribute to the ongoing debate on the design of monetary policies in an emerging market economy. The uni"ed model we propose in this paper shows that it might not be desirable to implement a tight m ...

... formally assess the relevance and relative importance of these counteracting e!ects, and thereby to contribute to the ongoing debate on the design of monetary policies in an emerging market economy. The uni"ed model we propose in this paper shows that it might not be desirable to implement a tight m ...

real exchange rate

... The real interest rates being paid on foreign assets. The real interest rates being paid on domestic assets. The perceived economic and political risks of holding assets abroad. The government policies that affect foreign ownership of domestic assets. ...

... The real interest rates being paid on foreign assets. The real interest rates being paid on domestic assets. The perceived economic and political risks of holding assets abroad. The government policies that affect foreign ownership of domestic assets. ...

real exchange rate

... The real interest rates being paid on foreign assets. The real interest rates being paid on domestic assets. The perceived economic and political risks of holding assets abroad. The government policies that affect foreign ownership of domestic assets. ...

... The real interest rates being paid on foreign assets. The real interest rates being paid on domestic assets. The perceived economic and political risks of holding assets abroad. The government policies that affect foreign ownership of domestic assets. ...

Chapter Eight: International Solutions to Currency Mismatching?

... monetary system.” Indeed, at the time of its creation, the SDR’s diversification properties were thought to confer on it such an advantage over each of the incumbent reserve currencies that it was regarded as desirable to put some restrictions on the SDR’s use to prevent an excessively rapid switch ...

... monetary system.” Indeed, at the time of its creation, the SDR’s diversification properties were thought to confer on it such an advantage over each of the incumbent reserve currencies that it was regarded as desirable to put some restrictions on the SDR’s use to prevent an excessively rapid switch ...

Set 4 The foreign exchange market

... complete. The plant is to be financed over its economic life of eight years. The borrowing capacity created by this capital expenditure is $1,700,000; the remainder of the plant will be equity financed. Centralia is not well known in the Spanish or international bond market; consequently, it would h ...

... complete. The plant is to be financed over its economic life of eight years. The borrowing capacity created by this capital expenditure is $1,700,000; the remainder of the plant will be equity financed. Centralia is not well known in the Spanish or international bond market; consequently, it would h ...

Lecture 9

... of the IS-LM and AD-AS models for an open economy. • An open economy can have several meanings: – Goods market: trades goods and services – Financial market: allow the flow of investment capital – Factor market: allows the free movement of companies and people ...

... of the IS-LM and AD-AS models for an open economy. • An open economy can have several meanings: – Goods market: trades goods and services – Financial market: allow the flow of investment capital – Factor market: allows the free movement of companies and people ...

On the Stability of Money Demand

... 6 - Glass-Steagall • Banking Act of 1933 separated commercial banks from investment banks, demand deposits from time deposits • Also imposed Regulation Q: no interest paid on demand deposits • Clearly not a free competitive banking system • Nice cartel for banks, but won’t individual banks and othe ...

... 6 - Glass-Steagall • Banking Act of 1933 separated commercial banks from investment banks, demand deposits from time deposits • Also imposed Regulation Q: no interest paid on demand deposits • Clearly not a free competitive banking system • Nice cartel for banks, but won’t individual banks and othe ...

Coping with Asia`s Large Capital Inflows in a Multi

... the last quarter of 2008, • QE2 in late 2010 was the right response to continued US weakness, • and floating rates can accommodate the difference for countries where the problem is now inflation. • Monetary ease is not a beggar-thy-neighbor policy. ...

... the last quarter of 2008, • QE2 in late 2010 was the right response to continued US weakness, • and floating rates can accommodate the difference for countries where the problem is now inflation. • Monetary ease is not a beggar-thy-neighbor policy. ...

Statement on the main directions of the monetary policy of the

... 2017 and in the medium term of the Financial Stability Board (FSB) launched by decree of Mister President of 15 July 2016 provides for such a maneuver. As an important part of this maneuver, the CBA will make critical contribution to effective implementation of the implied macroeconomic stability pr ...

... 2017 and in the medium term of the Financial Stability Board (FSB) launched by decree of Mister President of 15 July 2016 provides for such a maneuver. As an important part of this maneuver, the CBA will make critical contribution to effective implementation of the implied macroeconomic stability pr ...

Chapter 6

... • Stock and bond prices will also be more comparable and there should be more cross-border investing. However, nonEuropean investors may not achieve as much diversification as in the past. ...

... • Stock and bond prices will also be more comparable and there should be more cross-border investing. However, nonEuropean investors may not achieve as much diversification as in the past. ...

JOHANNES KEPLER UNIVERSITÄT DEPARTMENT OF

... Under a fixed exchange rate, the UIP curve effectively disappears. The exchange rate E is fixed. Also, because the domestic country has no control over its monetary policy (since i = i*), the only part that remains of the UIP curve is the point (E (fixed), i*). The contractionary fiscal policy leads ...

... Under a fixed exchange rate, the UIP curve effectively disappears. The exchange rate E is fixed. Also, because the domestic country has no control over its monetary policy (since i = i*), the only part that remains of the UIP curve is the point (E (fixed), i*). The contractionary fiscal policy leads ...

$doc.title

... “contagion” and the actual – as opposed to theoretical – degree of monetary policy autonomy will be greatly reduced.” ...

... “contagion” and the actual – as opposed to theoretical – degree of monetary policy autonomy will be greatly reduced.” ...

Market - e

... From 1924 to the end of WWII, exchange rates were theoretically determined by each currency's value in terms of gold. ...

... From 1924 to the end of WWII, exchange rates were theoretically determined by each currency's value in terms of gold. ...

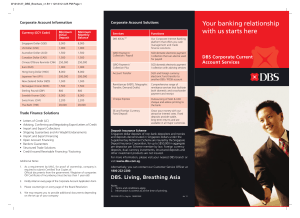

Your banking relationship with us starts here

... For passport / IC, the party certifying cannot be IC / Passport holder Note: All signatures (including authorised signatories’ and directors’ signatures in the board resolution) are to be verified by DBS staff / Notary Public ...

... For passport / IC, the party certifying cannot be IC / Passport holder Note: All signatures (including authorised signatories’ and directors’ signatures in the board resolution) are to be verified by DBS staff / Notary Public ...

Communiqué G20 Leaders Summit – Cannes – 3-4

... continue monitoring the situation and to report publicly on a semi-annual basis. 23. We stand by the Doha Development Agenda (DDA) mandate. However, it is clear that we will not complete the DDA if we continue to conduct negotiations as we have in the past. We recognize the progress achieved so far. ...

... continue monitoring the situation and to report publicly on a semi-annual basis. 23. We stand by the Doha Development Agenda (DDA) mandate. However, it is clear that we will not complete the DDA if we continue to conduct negotiations as we have in the past. We recognize the progress achieved so far. ...

the limits of currencies like Bitcoin

... I mportant: This document is based on public information and may under no circumstances be used or construed as a commitment by Desjardins Group. While the information provided has been determined on the basis of data obtained from sources that are deemed to be reliable, Desjardins Group in no way w ...

... I mportant: This document is based on public information and may under no circumstances be used or construed as a commitment by Desjardins Group. While the information provided has been determined on the basis of data obtained from sources that are deemed to be reliable, Desjardins Group in no way w ...